Do You Need Pay Stubs for Taxes?

Navigating the maze of tax season can be daunting, especially when you're faced with the burning question: "Do you need pay stubs for taxes?"

Oct 04, 2023The accumulation of debt is a strenuous situation to go through and can sometimes feel like there is no way out. The bills don’t stop getting delivered and t...

The accumulation of debt is a strenuous situation to go through and can sometimes feel like there is no way out. The bills don’t stop getting delivered and the various charges fail to cease. You are probably thinking to yourself, “how am I going to get out of this?” Learning what strategies are effective regarding climbing out of debt can be critical to your financial future. This blog’s goal is to share some key techniques to help you begin to quickly see the various amounts you owe shrink in size. Continue reading to discover seven ways you can pay down your debt.

Sell what you don’t need Selling luxury items that you don’t necessarily need can be a quick way to earn money quickly to apply to your debts. There is a difference between luxury and necessity. We obviously need household items like a refrigerator, bed, computer and Wi-Fi (if you work remotely), and more. Luxury items are items that we do not need but offer entertainment. If you are in deep debt, it would be a good idea to try to sell some items like iPads, video game consoles, laptops, jewelry, designer clothing items, and more.

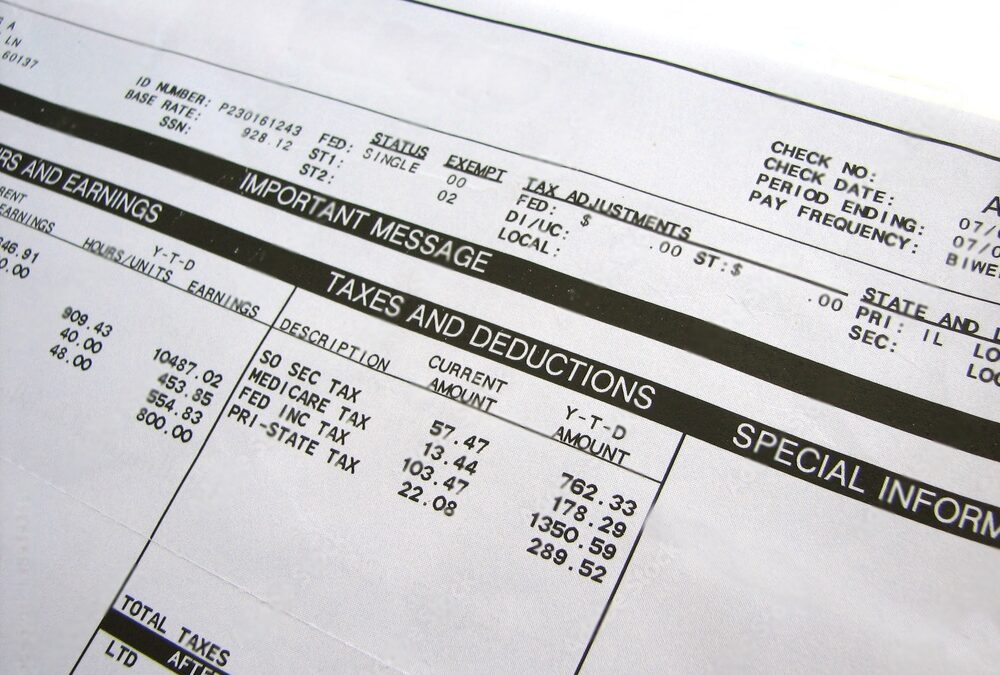

Learn to budget You can start by sitting down and examining on average how much you earn, and how much you spend. Primarily, determine how much you spend on necessities (groceries, rent, utilities, gas), and how much you spend on luxuries (streaming services, eating out, food delivery, clothes). This will help you create a plan to not only gain more debt but also begin to pay it down. If you are self-employed, it is a great idea to generate custom paystubs to help accurately keep track of income and taxes. Then make a spreadsheet or any other program of your choice to clearly outline each month’s earnings, spending, and savings.

You can request lower interest rates Some creditors will be open to negotiations regarding your interest rate. Having a lower interest rate will allow you to pay down your debts in a more timely manner. High-interest rates can make you feel like you’re stuck in the mud. You pay down some debt then the interest rate puts it right back where it was. Get in contact with who you’re indebted to and see if they’d be open to lowering your interest rate.

Pay your bills on time Missing your bill payments will only set you back. The tacked-on interest and penalty fees can detrimentally add further debt to what already feels like a large amount. To ensure this does not happen, set yourself reminders to promptly pay your bills so no further debt is added.

Seek a credit counselor Credit counselors are mostly free and they can help you get on the right track. They can go through your finances with you and maintain a judgment-free zone. They’ll give you important advice to ultimately get you debt free.

Navigating the maze of tax season can be daunting, especially when you're faced with the burning question: "Do you need pay stubs for taxes?"

Oct 04, 2023

Are you wondering 'How do landlords verify pay stubs'? Understanding the verification of pay stubs to ensure that they're not fake is crucial for landlords during the lease agreement process.

Apr 24, 2024

Figuring out how to get pay stubs if you get paid cash is a common concern for many workers in today's gig economy.

Aug 28, 2024