If your LLC is looking to change your default tax classification, then the IRS requires you to fill out a Form 8832. Here’s everything you need to know about Form 8832 instructions and where to file a Form 8832.

What is Form 8832?

Businesses use Form 8832, also called the Entity Classification Election, to change their tax classification. These classifications include C-corporation, partnership, or sole proprietor. The most common use of a Form 8832 is to have your LLC be taxed as a C-corporation. Changing your tax status could potentially save you tax money every year.

Businesses use Form 8832, also called the Entity Classification Election, to change their tax classification. These classifications include C-corporation, partnership, or sole proprietor. The most common use of a Form 8832 is to have your LLC be taxed as a C-corporation. Changing your tax status could potentially save you tax money every year.

Single-member LLCs are automatically taxed as a sole proprietor, while multiple-member LLCs are automatically taxed as a partnership. Different entity types are classified in different ways, so changing your tax classification could lower your taxes.

A similar form is the Form 2553. This form is used for LLCs or corporations that want to be classified as S-corps. Stick to using a Form 8832 if you want your LLC to be taxed as a C-corp, partnership, or sole proprietor.

Who is Eligible to Make an 8832 Election?

U.S.-based LLCs and partnerships are eligible to file for an 8832 election, along with certain foreign entities. Make sure you are making a decision that will last since businesses can only change their tax classification every five years.

Sole proprietors aren’t able to file a Form 8832, and corporations aren’t eligible unless they are an LLC that previously changed to a corporation status and wishes to change their classification again.

What is the Deadline to File Form 8832?

Although there is no deadline for filing Form 8832, it’s important to be strategic about when you want your new tax classification to take place. Your new

classification cannot take effect more than 75 days before or 12 months after filing the election.

How do I File Form 8832?

Completing Form 8832 takes only 17 minutes according to an IRS estimation. Follow along with these Form 8832 instructions.

Before getting started, make sure that you’ve filed articles of incorporation with your Secretary of State if you want to be taxed as a corporation.

You’ll also need to have the following information handy:

- Business name

- Business address

- Business phone number

- Employer identification number (EIN)

- Owner name and Employer Identification Number (EIN) or Social Security number

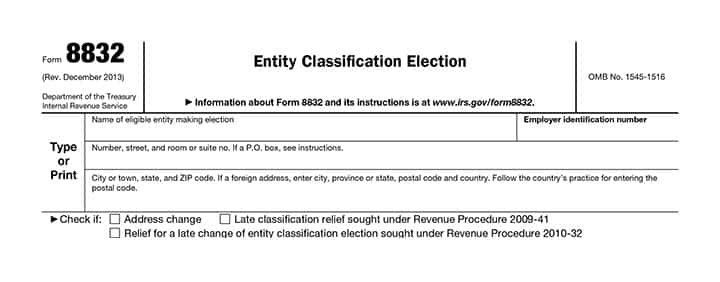

Step 1: Complete Your Business Information

You can find Form 8832 on the IRS website.

The first section will include your basic business information, such as the name, Employer Identification Number (EIN), and address. Check the boxes if:

- Address change: You’ve changed your address since applying for an EIN or since filing your most recent tax return

- Late classification relief sought under Revenue Procedure 2009-41: You’ve researched late classification relief and know that you need to file your classification late.

- Relief for a late change of entity classification election sought under Revenue Procedure 2010-32: You’ve researched late election relief and know that you need to check this box.

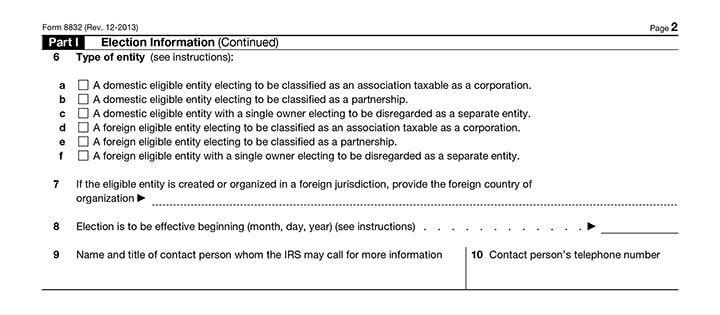

Step 2: Choose Your Type of Election

Part I, election information, will ask questions about your tax status election. Line 1 determines if you are filing to change your classification for the first time or if you’ve changed your status before. If you check box a, then go straight to line 3. If you check box b, then answer lines 2a and 2b about your previous elections.

Line 3 asks if your business has more than one owner. If so, go to line 5 and provide the name of the parent corporation and the EIN. If you answer line 3 saying that you have only one owner, go to line 4 and provide the name and identifying number of the owner.

Line 6 is where you will declare the type of entity you wish to become. Check the box that applies to your business and the classification you wish to obtain. If your business is a foreign entity, list your country on line 7. On line 8, enter the date that you want your new tax classification to become effective. Remember that you can’t enter a date more than 75 days before or 12 months after the filing date. If you don’t fill out this line, the classification will become effective on the day you file the form.

On lines 9 and 10, provide the name, title, and phone number of a person in your business that the IRS can contact for more information.

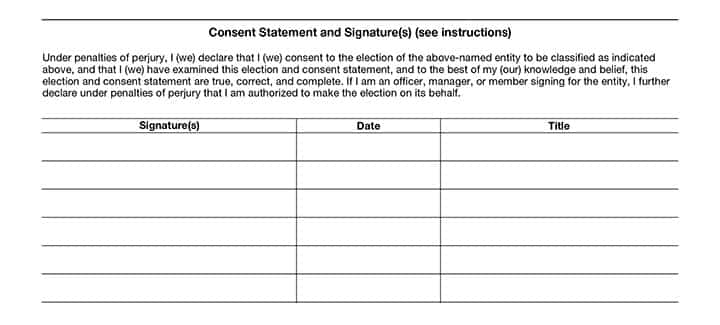

In the signatures section, make sure to have authorized signatures from a business owner, manager, or officer of the business. If the election is going to go into effect before the date you file the form, then it also needs to be signed by anyone who was an owner during the effective period.

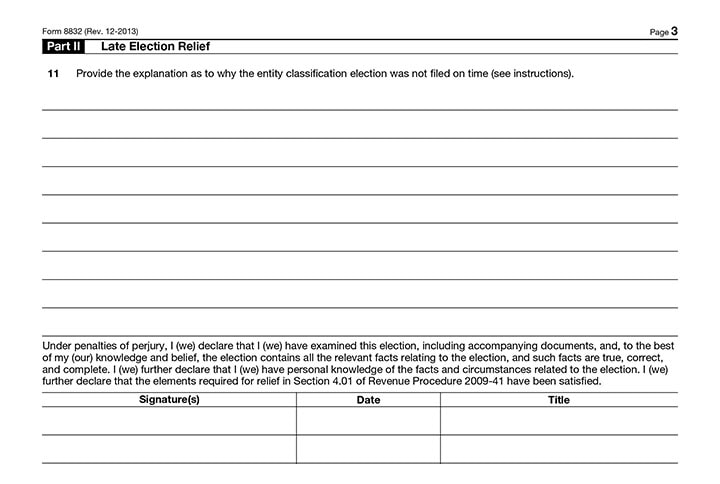

Step 3: Complete Late Election Relief if Needed

Part II, late election relief, only needs to be completed if you’re applying for your tax election more than 75 days after you want your election to begin. To be eligible for late election relief, four requirements must apply:

- Your previous Form 8832 was denied because it was filed late

- The federal tax deadline has not passed for the current year, or you are currently up to date on all federal tax filings

- You have reasonable cause for not filing Form 8832 on time

- Your requested effective date is less than three years and 75 days from the filing date

If all these requirements are met, then explain the delay on line 11. This section also needs to be signed by an authorized representative of your business and each affected person. Anyone who signs must have personal knowledge of the information described on line 11.

Step 4: Where to File Form 8832

Once you’ve completed the form, mail it to the appropriate address. Your Form 8832 mailing address will depend on where your business is located.

| Businesses located in: | Will mail their form to the following Internal Revenue Service Center address: |

| Connecticut, Delaware, District of Columbia, Florida, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Vermont, Virginia, West Virginia, Wisconsin | Cincinnati, OH 45999 |

| Alabama, Alaska, Arizona, Arkansas, California, Colorado, Georgia, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Tennessee, Texas, Utah, Washington, Wyoming | Ogden, UT 84201 |

| A foreign country or U.S. possession | Ogden, UT 84201-0023 |

Note. Also attach a copy to the entity’s federal income tax return for the tax year of the election.

Conclusion

By filing Form 8832, you’re helping your business find the tax classification that will be most beneficial for your bottom line. Once the election is submitted, the IRS will notify you of acceptance within 60 days.