How Long Does a Business Have to Keep Check Stubs?

When it comes to managing payroll records, one of the most common questions businesses ask is, "How long does a business have to keep check stubs for?"

Jan 30, 2024If you’ve accidentally filed an inaccurate Form 941, Form 941-X is what you need to set things right.As a business owner, the last thing you want to do is ru...

If you’ve accidentally filed an inaccurate Form 941, Form 941-X is what you need to set things right.

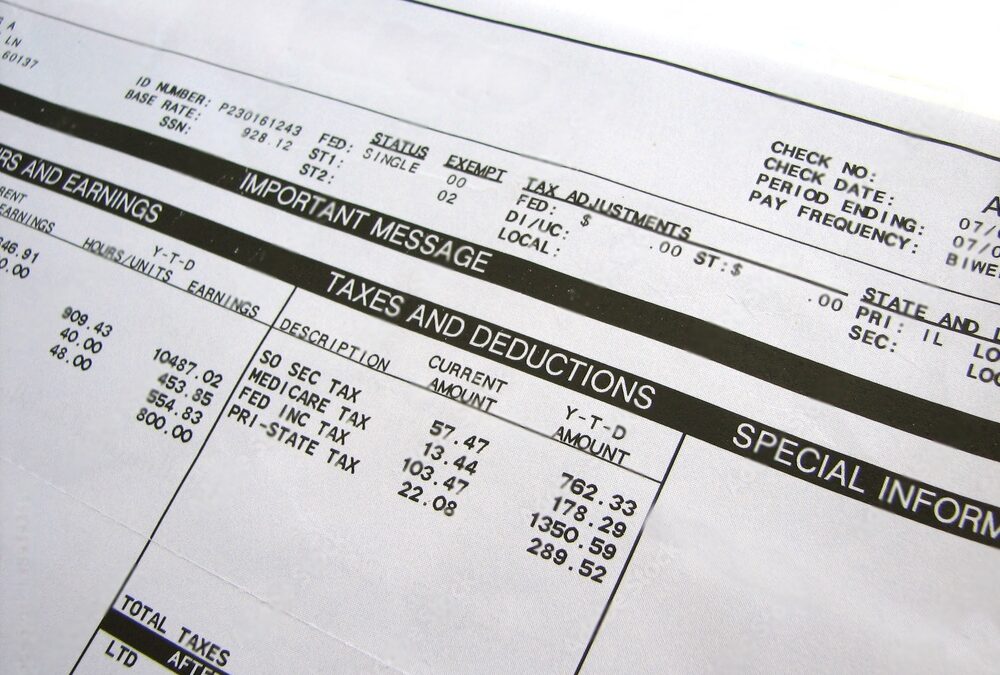

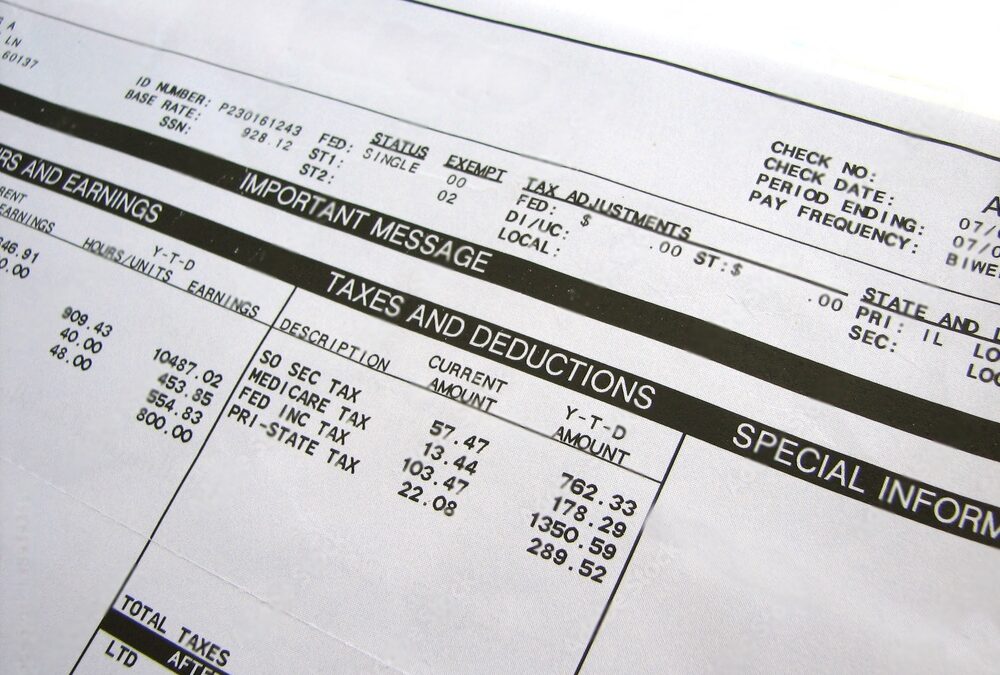

As a business owner, the last thing you want to do is run afoul of the IRS. Unfortunately, with all of the complexity and pressure of filing your taxes, sometimes errors can slip through the cracks. Take for example IRS tax Form 941. As you probably already know, Form 941 is used quarterly to report income taxes, Social Security tax, or Medicare tax withheld from employees’ paychecks, and also allows you (the employer) to pay your portion of Social Security or Medicare tax.

In other words, 941 is an essential part of ensuring that your business’ taxes are being correctly managed and reported. But what happens when you file your Form 941, and only after the fact realize that you made a mistake? That’s where Form 941-X comes in.

Here, we answer your questions about Form 941-X.

941-X is a form that employers may use to make corrections to a previously submitted and filed IRS Form 941. The official name for Form 941-X is Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund, and a separate 941-X must be filed for every individual quarter (you can’t file a single IRS Form 941-X to report on errors from more than a quarter).

Form 941-X may be used to report changes or correct reporting errors related to the following information:

The IRS 941-X form is a supplemental document, designed to provide a clear solution for businesses that may have filed their Form 941 containing incorrect information or other errors. It is not a replacement for the original Form 941. If you’ve forgotten or neglected to file a Form 941, do not file a 941-X in its place. Instead, file the original Form 941.

Form 941-X is fairly straightforward and does not require a significant amount of information. Before you begin to fill out form 941-X, be sure that the following details are in order:

The IRS provides detailed instructions for filling out Form 941-X. Here, we offer an abbreviated checklist:

The mailing address for submitting your Form 941-X depends on what state (if any) your principal place of business is located in. Click here to see where the IRS needs you to send the form.

Although there are many forms and tax documents that can be filed electronically, the 941-X is unfortunately not one of them. You will need to print out the completed 941-X and send it through the mail. This is because the IRS does not currently have the capacity to accept and process electronically-submitted 941-X forms, though this may change in the future.

Generally, Form 941-X must be filed within 3 years from the date you filed your original return, or 2 years from the date you paid the tax (whichever date is later).

Everyone makes mistakes. And thankfully, if those mistakes extend to an already filed IRS Form 941, you have the opportunity to correct them before they can cause any real harm. Filling out a Form 941-X is a relatively quick and painless process, and can help ensure that your business remains compliant and above-board with the IRS. After all, when it comes to earnings and taxes, accuracy is always essential. Optimize your paystub accuracy and ensure that your numbers are where they’re supposed to be — click here , and see what Check Stub Maker can do for you!

When it comes to managing payroll records, one of the most common questions businesses ask is, "How long does a business have to keep check stubs for?"

Jan 30, 2024

As more companies turn to digital solutions to streamline their processes, learning ‘how to create pay stubs for my business’ is extremely relevant in the fa...

Feb 23, 2023

Are you working in a restaurant and wondering how to get a pay stub as a waitress? Waitresses typically rely on tips and often get paid in cash, making it crucial to track their earnings accurately.

Jul 02, 2024