Which Deduction on a Pay Stub Is Optional?

At Check Stub Maker, we understand the importance of optimizing finances. Today, let's delve into a crucial question: "Which deduction on a pay stub is optional?"

Mar 25, 2024Managing payroll can be time-consuming and daunting for many small business owners. However, understanding the ins and outs of paystubs is essential to ensur...

Managing payroll can be time-consuming and daunting for many small business owners. However, understanding the ins and outs of paystubs is essential to ensuring smooth operations, financial transparency, and compliance with legal requirements.

Utilizing an online paystub generator can help save time, reduce errors, and streamline payroll processes for a small business.

This blog will explore the importance of understanding paystubs and the benefits of using an online paystub generator for small businesses.

The Basics of a Paystub

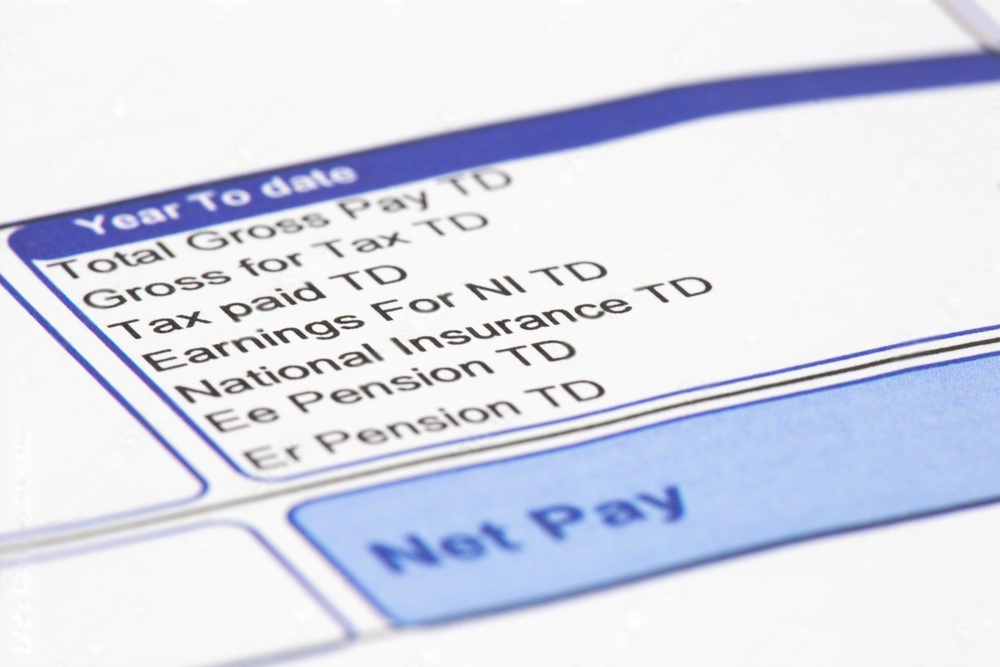

A paystub is a document that provides a detailed breakdown of an employee's earnings and deductions for a specific pay period. It records wages, taxes, and other contributions and deductions, such as social security, health benefits, and retirement savings. Paystubs are essential for several reasons:

1. Legal Compliance: Providing paystubs to employees is a legal requirement in many states. Employers need to maintain accurate records of their employees' wages and working hours to ensure they comply with labor laws, including minimum wage and overtime.

2. Financial Transparency: Paystubs help maintain clear communication between employers and employees about wages, deductions, and benefits, ensuring that both parties understand the breakdown of an employee's compensation package.

3. Proof of Income: Employees often require paystubs as proof of income for various purposes, such as applying for loans, renting an apartment, or obtaining certain government benefits.

Benefits of Using an Online Paystub Generator for Small Businesses

Online paystub generators offer several advantages over traditional, paper-based payroll systems. Here are some of the main reasons why small businesses should consider making the switch:

Time and Cost Savings – Managing payroll can be a time-consuming aspect of running a small business, especially if you're still creating paystubs manually. Online paystub generators automate the process and allow you to quickly input employee information, calculate taxes and deductions, and generate accurate paystubs in minutes. This frees up valuable time and resources, which can be redirected to more critical business functions.

Reduced Errors – Manually calculating payroll can be prone to human error, which can result in inaccuracies, overpayments, or underpayments, and potential legal issues. Using an online paystub generator can help minimize these errors by automating calculations, and ensuring that your employees receive the correct compensation.

Accessibility and Convenience – With an online paystub generator, employers and employees can access paystubs anytime and from anywhere with an internet connection. This convenience also makes it easy to share paystubs with employees through email or a secure online portal, eliminating the need for physical delivery or mailing.

Customization and Branding – Many online paystub generators offer customization options that allow you to create paystubs that align with your business's branding and visual identity, providing a more professional appearance.

Make the Switch Today

Understanding paystubs is critical for small businesses to maintain legal compliance, promote financial transparency, and foster trust between employers and employees. Utilizing an online paystub generator can help streamline payroll management, save time and resources, and reduce errors, significantly benefiting a small business's overall operations.

Making the switch to an online paystub generator is a simple yet effective step toward modernizing your business and enhancing efficiency.

Check Stub Maker | The #1 Online Paystub Generator

At Check Stub Maker, we understand the importance of optimizing finances. Today, let's delve into a crucial question: "Which deduction on a pay stub is optional?"

Mar 25, 2024

What is flex credit on pay stub? Come on a journey with us as we unpack what this concept means, the most common flexible work benefits, and how they appear on your pay stub. Let's dive in!

Aug 31, 2023

Are you in the middle of a business or personal transaction and wondering ‘Why is it important for a person to examine their pay stub information?'

Apr 24, 2024