Do's and Don'ts of Small Business Payroll

!Do’s and Don’ts of Small Business Payrollhttps://checkstubmaker.com/wp-content/uploads/2019/08/small-business-payroll-300x200.jpg Getting paid is the number...

Aug 15, 2019Ever wondered "What is STD on paystub"?

Ever wondered "What is STD on paystub"? “STD” on your pay stub stands for Short-Term Disability insurance. It's a deduction from your earnings that provides income support if you're temporarily unable to work due to injury or illness. At Check Stub Maker, we're experts in all things payroll. Our pay stub creator simplifies the process of decoding your check stubs , so you can understand every aspect of your paycheck. This includes your STD deductions and even DP with state on check stub that concerns health insurance for domestic partners. In this guide, we'll dive deep into Short-Term Disability coverage, exploring how it works, who qualifies, when benefits start, how long it lasts, and how it compares with Long-Term Disability. What this article covers:

Short-Term Disability (STD) insurance is a financial safety net for employees who find themselves temporarily unable to work when they're sick or injured. Based on our first-hand experience, STD typically relates to non-work-related incidents, because injuries which happen at work are usually covered by workers' compensation. When you see "STD" on your check stub , it indicates that a portion of your salary has been allocated to this specific insurance policy.

Essentially, employees pay premiums through regular payroll deductions, which are then pooled to fund the Short-Term Disability insurance program. Our findings show that STD assistance accounts for about 60-70% of an employee's earnings. It's designed to offer substantial monetary support while also encouraging you to return to work as soon as possible.

Full-time employees typically qualify for Short-Term Disability insurance. In certain scenarios, some policies can extend membership to part-time employees after a certain tenure with the company. It's important to note that eligibility doesn't automatically mean you're covered. Most STD policies require employees to opt-in during open enrollment periods or qualifying life events.

STD benefits usually kick in after the elimination period, which is often within 7-14 days. Our investigation demonstrated that this waiting period serves two purposes:

During the elimination period, employees often use their accrued sick leave or paid time off in the meantime. At Check Stub Maker , we always advise our users to familiarize themselves with their company's policies regarding STD assistance and other forms of leave related to their health.

The duration of Short-Term Disability membership generally ranges from 3-6 months, though some policies may extend up to a year. This time frame is designed to cover most temporary disabilities. It's designed to supply you with a financial safety net until the employee can return to work or transition to long-term disability if necessary.

Partial disability benefits work by:

At Check Stub Maker, we've seen how partial disability assistance can offer a smoother transition back to work for many employees. It's a win-win situation, allowing you to ease back into your role while still receiving some monetary support during your recovery period.

Rehabilitation services often work hand-in-hand with partial disability benefits. These services:

Rehabilitation might include physical therapy, occupational therapy, or even job retraining in some cases, depending on the nature of the disability.

Drawing from our experience at Check Stub Maker, Short-Term Disability insurance is designed to assist with temporary conditions, like:

If you're wondering what ‘ LTD meaning on paystub ' means, Long-Term Disability insurance supports more prolonged disabilities in comparison. These are ailments that persist beyond an STD plan's duration, often lasting for several years or even until retirement age. Examples might include:

Another critical distinction is that LTD generally begins after all STD assistance has been utilized. This creates a seamless transition for those whose disabilities extend beyond the conventional STD coverage period for continuous financial support.

The general rule of thumb with Short-Term Disability insurance is that it pays out approximately 60-70% of your gross salary (which is before taxes). For instance, if your gross income is $200,000 and 70% of your paycheck is allocated to your STD healthcare plan, then that amounts to roughly $140,000 paid out to you to assist with a temporary disability.

$200,000 x 0.7 = $140,000### H3 - Is Short-Term Disability Taxable?

The taxation of Short-Term Disability insurance depends largely on how the premiums are paid. For instance, if your STD plan is paid with pre-tax dollars (meaning they're deducted from your paycheck before taxes are calculated), then the assistance you receive will be taxable. On the other hand, if you pay your STD cover with after-tax dollars, the benefits you receive will generally be tax-free.

The following states require employers to give their employees STD membership:

In non-mandatory states, many employers offer voluntary STD programs, allowing employees to opt-in for coverage. At Check Stub Maker, we stay up-to-date with these state-specific regulations so that our paystub generator accurately reflects all required STD calculations and deductions.

Our research indicates that submitting a disability claim typically involves contacting your HR department or insurance provider after submitting the following forms:

We suggest keeping copies of all submitted paperwork, including your paystubs , for your personal records when making a claim.

Mental health conditions like anxiety, depression, or stress are often covered by STD policies. However, you'll need appropriate medical documentation from a healthcare provider to support your claim.

When requesting Short-Term Disability support from your doctor, it's important to have an open and honest discussion about what ails you and how it affects your ability to work. You'll need to ask your doctor to supply detailed medical documentation supporting your need for disability leave. Remember, the more comprehensive the paperwork, the smoother your claim process is likely to be.

Based on our observations, many insurers allow you to increase your Short-Term Disability (STD) coverage during specific times. This includes open enrollment periods or qualifying life events like:

However, increased coverage might incur higher premiums, so it's essential to carefully consider the additional cost against the potential advantages. Additionally, some insurers may need evidence of insurability or request a medical exam to approve increased protection.

The core difference between volunteer and noncontributory STD lies in funding, with voluntary STD being employee-funded. Conversely, noncontributory STD is paid for by your employer, which can be reflected as ‘ med ER on paystub '. Moreover, noncontributory STD may be mandatory for all eligible employees.

Having both Short-Term Disability (STD) and Long-Term Disability (LTD) insurance can afford you comprehensive protection against loss of wages due to disability. STD offers immediate monetary needs for short-term conditions, usually up to half a year. LTD, on the other hand, kicks in after STD assistance is complete, supplying ongoing support for several years or until the age of retirement with prolonged disabilities. This dual coverage strategy keeps you protected during both the initial phase of disability and any extended recovery period, giving you peace of mind and financial security.

The Family and Medical Leave Act (FMLA) is different from STD, providing unpaid leave for medical and family reasons without losing your livelihood for up to 12 weeks. In contrast, STD offers paid assistance during temporary disability periods, giving you income replacement for several months instead of job stability. Additionally, while FMLA guarantees that you can return to your job post-leave, STD ensures you have financial support during your absence. We at Check Stub Maker suggest utilizing both options to supply extensive coverage which addresses both your monetary and work security.

In this guide, we discovered that Short-Term Disability (STD) insurance is a critical component of employee benefits. It provides financial security during temporary periods of disability while you're unable to work. With our pay stub generator , we simplify managing STD deductions, ensuring quick payroll processing that's consistently accurate for small businesses and self-employed individuals. Ready to simplify your pay stub mechanisms? Try out our digital services at Check Stub Maker today and get the short-term disability coverage you deserve to improve your health! If you want to learn more, why not check out these articles below:

!Do’s and Don’ts of Small Business Payrollhttps://checkstubmaker.com/wp-content/uploads/2019/08/small-business-payroll-300x200.jpg Getting paid is the number...

Aug 15, 2019

!The Difference in Making a Pay Stub as an Employee vs. a Contractorhttps://checkstubmaker.com/wp-content/uploads/2018/11/employee-contractor-300x200.jpg If ...

Nov 30, 2018

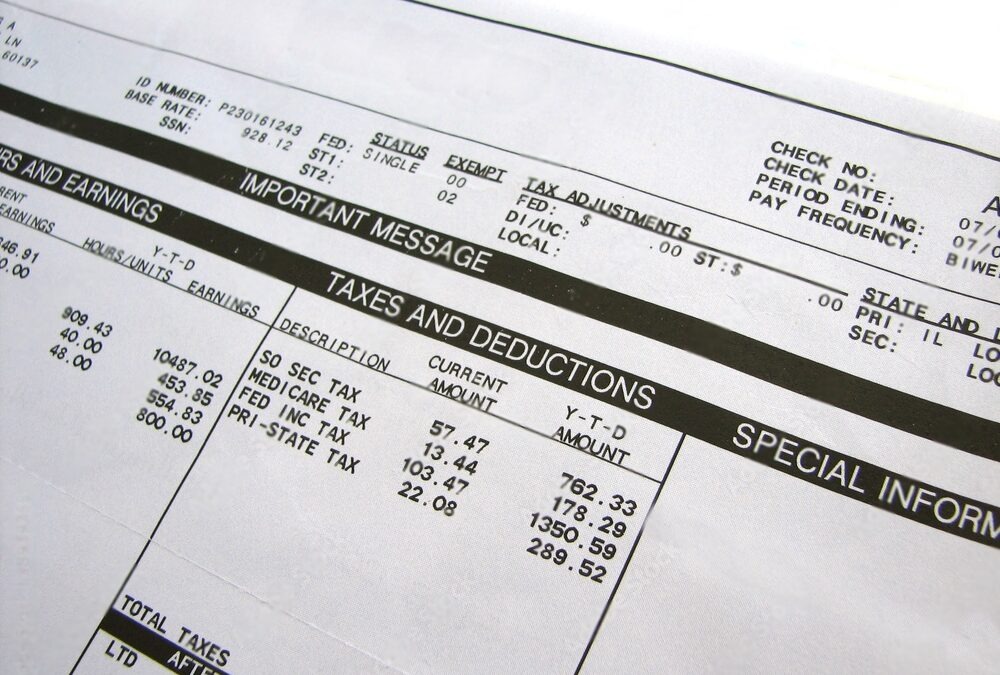

Are you looking through your financial records and wondering, "What is a pay stub?" Simply put, pay stubs are physical or digital documents that accompany your paycheck, offering a detailed breakdown of your earnings and deductions for a specific pay period.

Oct 04, 2023