How to Get Paystubs From a Job If You Get Paper Checks

Wondering how to get paystubs from a job if you get paper checks?

Aug 28, 2024Work paystubs are an essential component of every business's financial system. From tiny mom-and-pop stores to bustling startups, everyone uses them to track...

Work paystubs are an essential component of every business's financial system. From tiny mom-and-pop stores to bustling startups, everyone uses them to track payroll accurately. So, what is a work paystub?

According to our research at Check Stub Maker, it's an essential document that records an employee's earnings for a specific period. It plays a crucial role in maintaining financial transparency and ensuring business success.

In our experience, many small businesses and self-employed operators often struggle to understand and use paystubs effectively. The numbers and jargon may seem overwhelming, but fear not; this guide aims to simplify work paystubs by breaking them down into understandable terms and explaining their importance in everyday business operations.

Remember, as experts in the field, we at Check Stub Maker are here to help you navigate the world of work paystubs confidently and competently. Let's begin this journey to smoother payroll!

What this article covers:

Work paystubs aren’t simply jumbles of numbers and information; they hold the key to effective payroll management. At its most basic, a work paystub is a document detailing the pay an employee receives for a specified pay period. It's given out with their paycheck, which is why you might often hear the term pay stubs when getting a check.

Work paystubs, often referred to as pay stubs when getting a check, are documents detailing the pay an employee receives for a specified pay period. They’re essential tools for effective payroll management.

In the digital age, the concept of paystubs has evolved. Instead of physical documents, electronic pay stubs are gaining popularity. They’re easier to generate, distribute, and store, providing the same information in a more accessible and sustainable format.

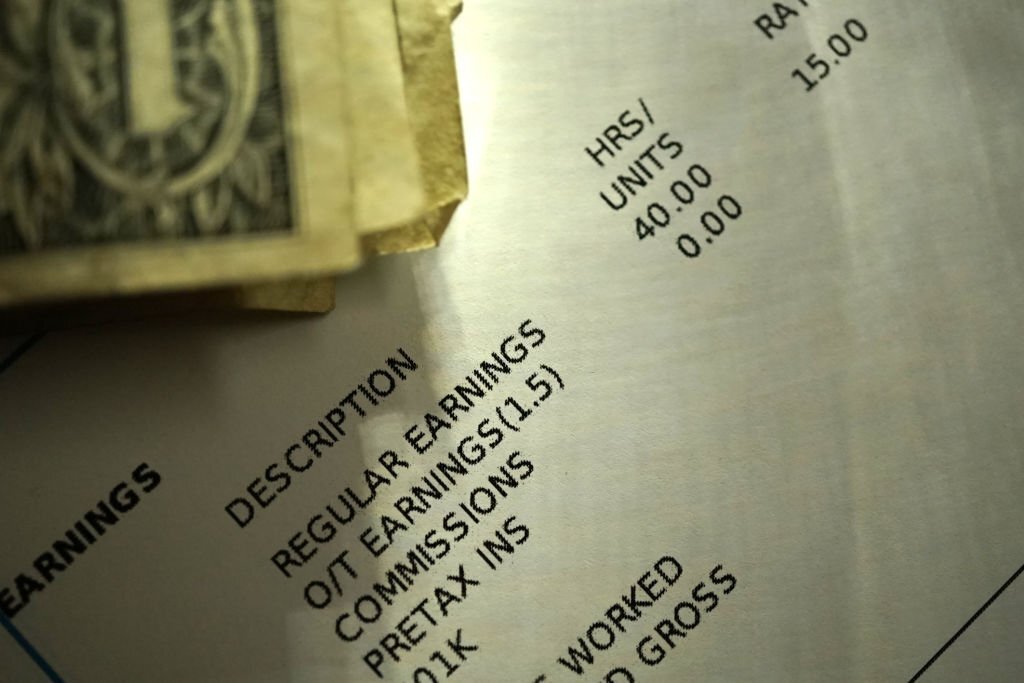

A typical paystub provides a detailed breakdown of an employee's earnings, deductions, and net pay. It includes the income from regular hours worked, overtime, bonuses, and other sources. Deductions can include taxes, healthcare, and retirement contributions. The net pay is the final take-home amount after all deductions.

### The Art of Calculating Manual Paycheck Stubs

### The Art of Calculating Manual Paycheck Stubs

To calculate manual paycheck stubs , you need to understand the process. It involves adding up all the income for the pay period, subtracting the various deductions, and arriving at the net income. While it may sound straightforward, it can be complicated, especially when dealing with various income streams, tax rates, and other deductions. But don't worry! At Check Stub Maker, we have plenty of experience to help simplify this process for you.

Analyzing a pay stub is a skill of paramount importance for small businesses and self-employed individuals. It's not enough to know how much to pay your employees or how much you've earned; you need to understand where that money is going. When you can analyze a pay stub effectively, you can make informed decisions about tax obligations, and employee benefits, and managing cash flow.

Understanding what pay stubs look like is equally important. A pay stub should include details about gross pay, deductions, and net pay, as well as personal information about the employee and the pay period. It might seem overwhelming at first glance, but each section has a specific purpose that contributes to the overall understanding of an employee's or your own earnings.

For many small businesses and self-employed individuals, the ability to create check stubs can be a game changer. Having a consistent and professional pay stub not only simplifies payroll management but also enhances credibility. Whether you're hiring your first employee or growing your team, providing accurate and timely pay stubs showcases your business's professionalism.

Let's not forget that issuing work paystubs isn’t just a matter of professionalism—it's often a legal requirement. These documents are crucial for record keeping, providing proof of income and employment, ensuring compliance with labor laws, and simplifying tax filings.

In short, work paystubs play a key role in the smooth operation of small businesses and self-employed ventures. From understanding the nuances of analyzing a pay stub to knowing what pay stubs look like and being able to make a check stub , mastering these skills can greatly contribute to your business's success. And at Check Stub Maker, we're here to help you along the way.

Navigating the payroll process can often be a complex task, especially for small businesses and self-employed individuals. However, work paystubs can play a significant role in simplifying this process. Understanding the difference between a check stub or pay stub and leveraging them effectively can lead to smoother payroll management.

The terms 'check stub' and 'pay stub' are often used interchangeably. Both represent a document given to an employee to outline the details of their pay for a particular period. Whether you prefer to use the term 'check stub' or 'pay stub', the important thing is to understand its purpose and use it effectively.

Paystubs are more than just a record of payment; they're a tool for transparency, compliance, and communication. They help in ensuring accuracy in calculating pay, taxes, and other deductions. Plus, they serve as a vital communication tool between you and your employees, clearly detailing how their pay is calculated.

### Creating a Seamless Payroll Process with Paystubs

### Creating a Seamless Payroll Process with Paystubs

An organized payroll system is crucial to maintaining happy and motivated employees. Regular, accurate paystubs not only ensure that employees are paid correctly and on time, but they also help in resolving any disputes that may arise regarding pay. The trust that comes from this transparency can boost morale and productivity.

Here at Check Stub Maker, we understand the intricacies involved in payroll management. Our services are designed to make it easy for you to generate accurate and professional paystubs, ensuring a smooth payroll process.

In summary, work paystubs are an integral part of a well-functioning payroll system. They simplify the complex process, ensure transparency, and foster a trusting work environment. Whether you call it a check stub or pay stub, it's a small document with a huge impact.

In the world of financial transactions and applications, proof of income is often required. Work paystubs serve as one of the most reliable proofs of income. Whether you’re an employee applying for a loan, or a small business owner seeking credit, a well-documented paystub can make the process much easier.

When it comes to proving your income, nothing speaks louder than a well-documented paystub. It provides a detailed breakdown of your earnings, helping lending institutions understand your financial health better. For small business owners and self-employed individuals, it becomes even more important as it is often the primary proof of their income.

When applying for loans or leases, institutions often require evidence of steady income. In these scenarios, a series of recent paystubs can be the key to unlocking these financial resources. It offers a snapshot of your regular income and shows your financial stability and ability to fulfill your financial obligations.

Work paystubs not only showcase your income but also ensure accuracy and transparency. It's a document that shows you’re earning what you claim to earn, so it’s a powerful tool when you're seeking to secure a loan, rent an apartment, or finance a vehicle.

At Check Stub Maker, we're here to help you make the most of your paystubs. We ensure they’re detailed and professional, making them an ideal proof of income for any situation. Our expertise in the field allows us to guide you on how to best use your work paystubs to meet your financial goals.

Check Stub Maker: Your Reliable Partner in Paystub Generation

Check Stub Maker: Your Reliable Partner in Paystub GenerationIn today's complex financial landscape, having a dependable partner to help with payroll management can make a significant difference for small businesses and self-employed individuals. Check Stub Maker is a reliable partner, offering an intuitive and user-friendly paystub creator to simplify your payroll process.

At Check Stub Maker, we understand the challenges you face when managing payroll. That's why we've developed our paystub creator , a tool that provides a simple solution to your complex payroll needs. With a few clicks, you can generate a detailed and professional paystub, ensuring your employees have a clear understanding of their earnings and deductions.

The use of a check stub creator not only simplifies the payroll process but also offers several other benefits. It saves time, reduces the chances of human error, and ensures consistency across all your paystubs. Additionally, it allows you to keep track of payroll records, making tax time easier and ensuring you're always prepared for any financial audits.

When you trust Check Stub Maker as your paystub and check stub creator, you’re partnering with a team of experts committed to making your payroll process as straightforward as possible. We stay up-to-date with the latest payroll laws and regulations to ensure our tool provides the most accurate and compliant paystubs.

Check Stub Maker isn’t just a tool; it's a support system for your business. We offer resources and customer support to ensure you're never alone in your payroll journey. We understand that every business is unique, and our tool is designed to accommodate a variety of payroll needs.

In a nutshell, work paystubs are more than just a record of wages paid. They serve as a communication tool between employers and employees, proof of income for financial transactions, and an essential element in maintaining accurate payroll records.

At Check Stub Maker, we recognize the value and necessity of accurate, reliable, and professional paystubs. That's why we've developed our intuitive paystub generator. It's designed to simplify the process of paystub generation, saving you time, reducing errors, and providing the help you need to make a check stub.

But we don't stop at providing a great tool. We partner with you on your payroll journey, offering resources and customer support to make the process as smooth as possible.

At Check Stub Maker, we're committed to ensuring your payroll process is seamless, simple, and efficient. Here's to a simplified payroll process and the power of well-crafted work paystubs!

Did our blog meet your needs? You might also find our other guides helpful:

Wondering how to get paystubs from a job if you get paper checks?

Aug 28, 2024

Wondering how to calculate yearly income tax off pay stub when tax is not taken out?

Oct 04, 2024

!Paperless Pay: What is the Law?https://checkstubmaker.com/wp-content/uploads/2018/09/paperless-pay-min-300x200.jpg One of the great things about technology ...

Sep 21, 2018