Can You Rent to Own at Rent a Center Without a Check Stub?

Are you thinking of renting products and wondering ‘Can you rent to own at Rent A Center without a check stub?'

Feb 28, 2024Ever stared at your pay stub and wondered, ‘What is GL50 on pay stub?' GL50 refers to Group Term Life GTL insurance, which will serve you and your colleagues...

Ever stared at your pay stub and wondered, ‘What is GL50 on pay stub?' GL50 refers to Group Term Life (GTL) insurance, which will serve you and your colleagues well should a fatal accident occur at your workplace. Without further ado, let's explore just what a GL50 code means on your paystub and the tax implications it can have for your earnings. What this article covers:

GL50 is on your pay stub because it's the earning code that represents the taxable benefit of your Group Term Life insurance. Through our practical knowledge, it's calculated based on factors like your age, annual earnings, and the benefit amount, be it 1x, 1.5x, or 2x your salary.

GL50 is essentially the taxable benefit of your Group Term Life (GTL) insurance and a reflection of the value your employer places on your well-being. It's a way to quantify the additional income you're technically receiving in insurance coverage beyond the tax-free threshold.

The calculations for GL50 aren't pulled out of thin air. As per our expertise, it's meticulously determined, and factors such as your age play a crucial role because insurance costs rise as we age. Your annual earnings are also pivotal, especially if your GTL insurance is a multiple of your salary, such as 1x, 1.5x, or even 2x. The combination of these factors determines the value of the insurance benefit you receive and, consequently, the taxable amount that GL50 represents.

As stated above, Group Term Life (GTL) insurance is a type of life insurance coverage offered to a group of people at the same company, typically under a single policy. Here's a deeper dive into GTL deductions:

GTL insurance is often temporary, covering employees for the term of their employment or a specified duration. It doesn't build cash value like whole life insurance but serves as a protective shield during the employee's tenure.

One of the primary reasons GTL is popular among employers is its cost-effectiveness. Since it's a group policy, the premiums are generally lower than individual policies, making it an attractive benefit to offer employees.

Some employers offer employees the option to purchase additional GTL coverage at their own expense. This allows employees to enhance their coverage based on their individual needs.

Based on our firsthand experience, some GTL policies offer employees the option to convert their group policy into an individual policy upon leaving the company. This ensures continuity of coverage, which is especially beneficial for those who find it challenging to secure personal coverage due to age or health conditions.

As per our expertise, GTL deductions can be taxable, tax-free, or a combination of both.

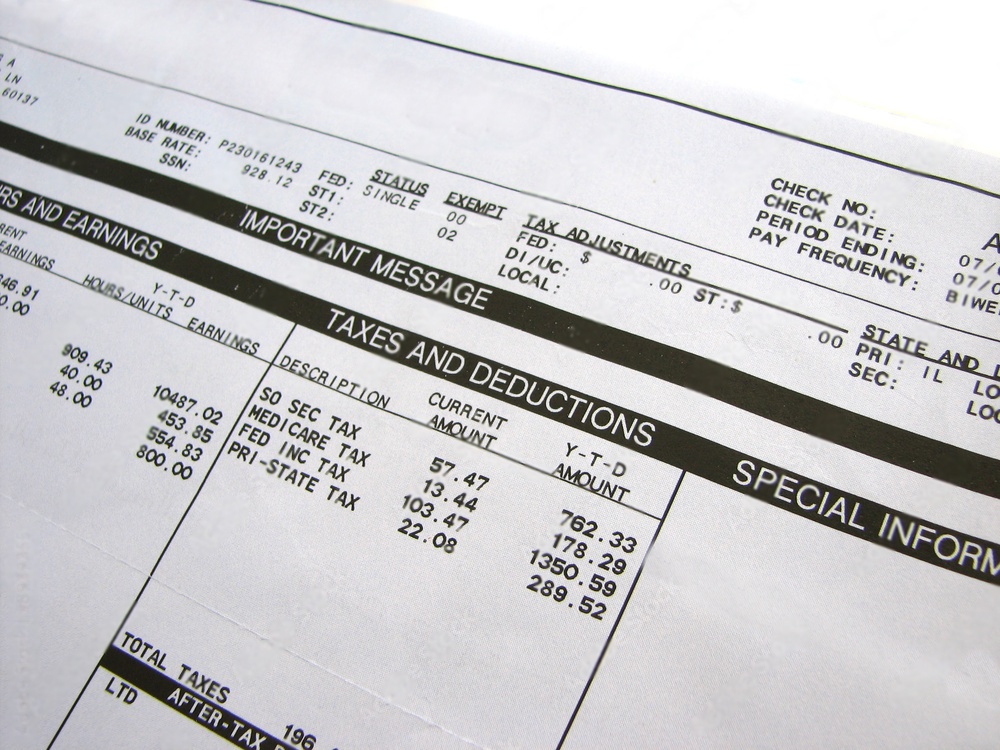

The IRS has set guidelines on the tax-free threshold when it comes to GTL insurance. They provides a table (often called the Uniform Premium Table ) that determines the cost per $1,000 of GL50 protection based on age brackets. This table helps calculate the taxable amount for GTL coverage over $50,000. This means that premiums for coverage up to $50,000 that an employer provides are tax-free for the employee. This means that if your employer provides you with GTL insurance with a death benefit of $50,000 or less, you won't see any additional taxable income related to this benefit on your pay stub.

Here's where things get a tad more intricate. If the coverage exceeds that $50,000 benchmark, the premiums paid by the employer for the excess coverage become taxable income for the employee. This doesn't mean the entire premium becomes taxable, just the portion corresponding to the coverage amount over $50,000.

Understanding the tax implications of GTL and other deductions on your pay stub is crucial. Some employee deductions and benefits might be pre-tax (like contributions to a Health Savings Account), reducing your taxable income, while others are post-tax, like union dues. Drawing from our experience, it helps employees plan better for tax season, avoiding unpleasant surprises. After all, no one likes to be caught off guard, especially regarding finances. While GTL insurance is a fantastic benefit, knowing its tax implications is essential. Being informed means you can make the best decisions for your financial health and be prepared when Uncle Sam comes calling.

Here are a few more frequently asked questions on the mysteries of GL50 and how it relates to your pay stub.

No, not everyone has ‘GL50' on their pay stubs. Only employees with GTL insurance coverage exceeding the $50,000 tax-free threshold will typically see the GL50 code on their pay stubs.

Yes, you can reduce or remove the GL50 amount from your pay stub because the GL50 amount is directly tied to your GTL insurance coverage. If you want to reduce or remove the taxable benefit, you also need to adjust your GTL coverage, usually by reducing it to the tax-free threshold or below. However, we strongly recommend consulting with your HR department before making any changes.

If you've left your job, the appearance of a GL50 or lack thereof on your final pay stub will depend on your employer's policy and how they handle final paychecks. If you had GTL insurance with them and the taxable benefit had yet to be fully accounted for in your previous pay stubs, it might appear on your final one.

Yes, the GL50 amount can impact your annual tax returns. Since GL50 represents a taxable benefit, it can influence your overall taxable income for the year, so always keep this amount in mind while preparing your tax returns.

Understanding GL50 is important for several reasons. Being informed about all aspects of your pay, including codes like GL50, empowers you to make informed financial decisions. It ensures you know your complete compensation package, not just your base salary.

To recap, Group Term Life (GTL) is customized life insurance for multiple people, typically co-workers at the same company, and typically lasts until the termination of the work contracts of everyone on the same GTL policy. It's referred to as ‘GL50' and appears as a cost subtraction or tax-related added income on paystubs. That's why we at Check Stub Maker prioritize your payroll, ensuring you're constantly in the loop about your earnings and deductions, and everything else that appears on your paystub. With a sprinkle of knowledge and the right tools, you can be in the driver's seat of your finances and even create paystubs right at home. Try our check stub maker online today and give yourself financial clarity and peace of mind! If you want to learn more, why not check out these articles below:

Are you thinking of renting products and wondering ‘Can you rent to own at Rent A Center without a check stub?'

Feb 28, 2024

Have you ever wondered, "What is Hospit on my paystub?" Many employees encounter this term and find themselves puzzled.

Aug 28, 2024

‘Imputed income on paystub' might sound like a financial enigma, but it's a crucial concept with tangible implications.

Oct 04, 2023