A Quick Guide to Small Business Tools

!A Quick Guide to Small Business Toolshttps://checkstubmaker.com/wp-content/uploads/2019/09/small-business-tools-300x200.jpg Starting your own business can b...

Sep 27, 2019A common query we encounter from our users is, "Can you make your pay stub higher to apply for loan?" Understanding the significance of accurate proof of earnings is crucial in these situations.

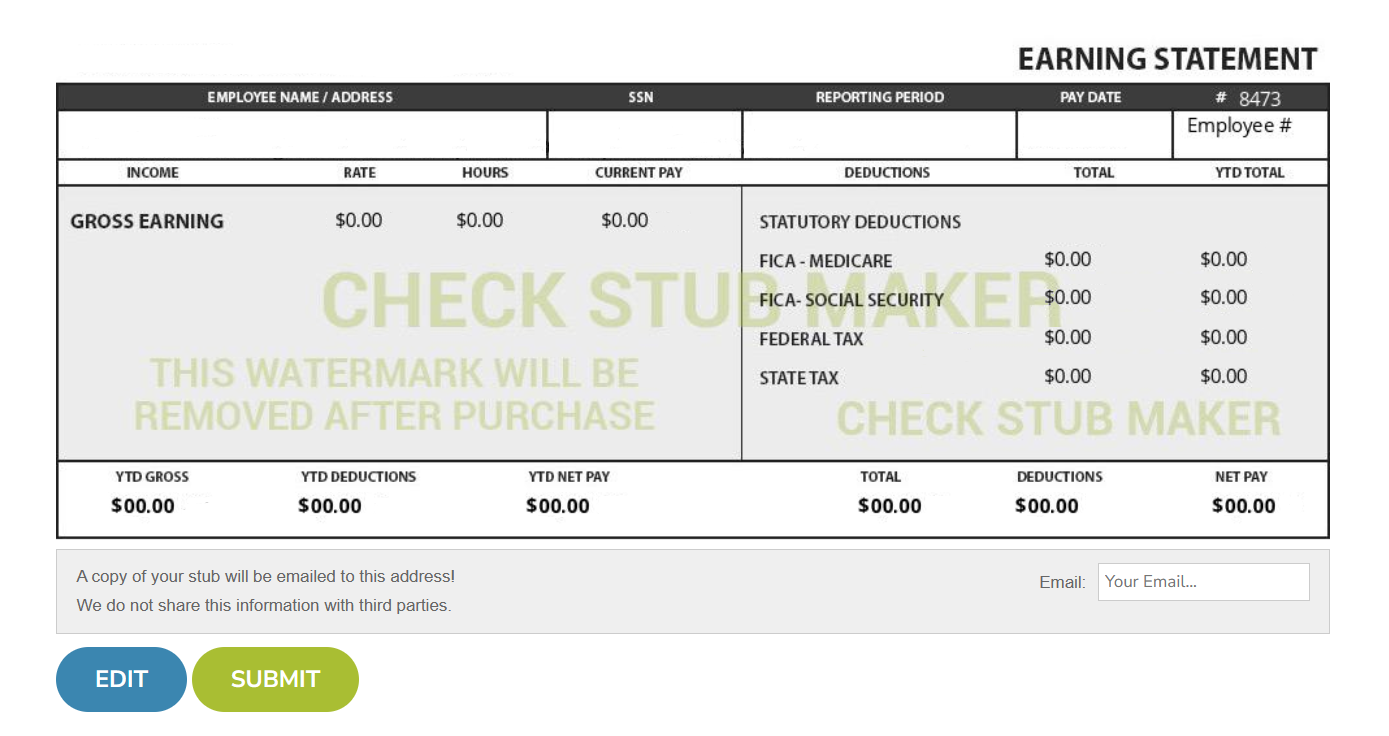

A common query we encounter from our users is, "Can you make your pay stub higher to apply for loan?" Understanding the significance of accurate proof of earnings is crucial in these situations. As per our expertise, using fake pay stubs or financial paperwork for loans is fraudulent and illegal, which can result in hefty fines and other unwanted legal repercussions. At Check Stub Maker , we're experts in the payroll process, ready to guide you safely through creating genuine pay stubs with our pay stub creator . In this article, we'll delve into whether enhancing your pay stub for loan applications is advisable, the importance of honest income reporting, and the potential repercussions of submitting falsified documents. What this article covers:

Lying on a personal loan application can often lead to loan rejection and legal consequences in most cases. When applying for personal loans, honesty isn't just a virtue; it's a necessity.

Common deceptions include:

While it might seem harmless to tweak numbers to secure better loan terms, these are still fraudulent acts. Drawing from our experience, misrepresenting your economic status doesn't just affect the application's outcome but also your financial integrity and future borrowing capabilities.

The repercussions of lying on a loan application extend beyond mere rejection; legal actions can be taken against you, which could lead to fines or even jail time in rare scenarios. In the realm of finance, trust is paramount. As such, maintaining accountability in all documentation is crucial for long-term economic health and legal compliance. That's why we emphasize the importance of accurate information, especially when it concerns financial matters on our check stubs . We at Check Stub Maker are here to help you stay on the right side of the law when applying for a loan.

Through our practical knowledge, you can get certain loans without pay stubs. While lenders typically require proof of income to assess your ability to repay the loan, alternative documentation such as bank statements, tax returns, or letters from employers can sometimes be used to verify earnings. It's essential to communicate openly with lenders about your situation and provide any financial paperwork available to support your application. Remember, honesty is key in money matters to maintain trust and credibility.

At Check Stub Maker, we understand that not everyone has access to traditional pay stubs, especially freelancers, entrepreneurs, or those in between jobs. However, there's alternative paperwork you can provide to prove your economic stability and wages when applying for loans or other financial services.

Table: Other Types Of Income Verification Documents For Loans

Other Types Of Income Verification DocumentsExamplesLoan Application- Completed application form with personal, employment, and financial information

Personal Identification- Driver's license

Proof Of Address- Utility bills

Proof Of Income- Bank statements

To start the process, a completed loan application is essential. This form typically requires your personal information, a history of your work experience, and financial details. Ensure that all this information is accurate and up-to-date to avoid any discrepancies that could affect your loan approval.

Valid personal identification is crucial. In most cases, this can be a driver's license, passport, or state ID, which are acceptable for a loan. Based on our first-hand experience, lenders use this paperwork to verify your identity and prevent fraud. We recommend checking that whatever form of identity you use is current and clearly legible.

You'll also need to provide proof of address, which can be located on a utility bill, lease agreement, or mortgage statement that's in your name. This document should be recent, typically within the last few months, to confirm your current residence.

While traditional pay stubs are a common form of income verification, there are alternatives if you don't have them:

Remember, the key to a successful loan application is providing clear, accurate, and verifiable paperwork as proof of your financial journey. You can create pay stubs at Check Stub Maker, helping you maintain transparency and integrity throughout the process to build trust with lenders and increase your chances of approval.

Based on our expert payroll insights, payday loans and personal installment loans are often considered the easiest types to get approved for. These generally require minimal paperwork and can be more accessible to people with less-than-perfect credit scores. However, it's crucial to approach them with caution due to their potentially high interest rates and fees. We recommend thoroughly researching and considering all loan options at your disposal so you understand the terms and conditions before proceeding. At Check Stub Maker, we subscribe to the notion that a well-informed decision is an important step towards economic health and stability.

Here are some alternatives to personal loans that might suit different financial needs and situations: Table: Alternatives To Personal Loans

Alternatives To Personal LoansDescriptionProsConsCredit Cards- Used for purchases or cash withdrawals

Flexible spending

Potential rewards

Possible 0% APR introductory rates

High-interest rates if not managed properly

Can lead to debt accumulation

Cash Advances- Short-term loans from credit card issuers

Allows withdrawal of cash up to a certain limit

Quick access to money

No collateral required

Costly fees and interest rates

Increases debt burden

Home Equity Loans (HELOCs)- Loans or credit lines secured against the equity of your home

Lower interest rates compared to unsecured loans

Large loan amounts are possible

Risk of losing your home if you default

Requires home equity

Pawn Shop Loans- Short-term loans in exchange for an item of value, which serves as collateral

No credit check required

Access to immediate funds

High-interest rates

Risk of losing collateral if you can't repay the loan

Credit cards can be a flexible alternative to personal loans, offering the convenience of use for various purchases and potentially lower interest rates compared to high-interest loans. Based on our observations, some credit cards also offer:

However, it's essential to manage your card usage responsibly to avoid costly interest debt accumulation.

Cash advances are short-term loans provided by credit card issuers, allowing cardholders to withdraw a certain amount of money. They can be a quick source of funds, but they normally come with high fees and interest rates. As such, they should be considered a last resort due to their costly terms.

If you own a home, you might consider a home equity loan or a home equity line of credit (HELOC). They use your home as collateral and may offer lower interest rates than unsecured personal loans or credit cards. However, it's crucial to remember that failing to repay can put you at risk of losing your home, so they should be used with extreme caution.

Pawn shop loans provide immediate cash in exchange for valuable items as collateral. They don't require a credit check, making them accessible to those with poor or no credit. However, our findings show that the interest rates can be costly, and if it isn't repaid, the pawn shop can sell your item. Therefore, this option should be used only when confident you can repay the loan promptly. Each of these alternatives has its pros and cons, and what works best will depend on your individual financial situation and needs. At Check Stub Maker , we encourage you to consider all your options carefully and choose the one that best fits your economic strategy and goals. Whenever you're in doubt about loan requirements, our pay stub generator can help you quickly create detailed and accurate pay stubs in minutes to verify your earnings and support your application.

The purpose of proving your income isn't just about showing how much you earn; it's about demonstrating your monetary stability and reliability with loans.

Your Debt To Income Ratio (DTI) is a key factor lenders use to assess your ability to manage monthly payments and repay borrowed money. Through our trial and error, we discovered that it compares your total monthly debt payments to your gross monthly income, which provides a clear picture of your financial health. A lower DTI indicates a good balance between debt and wages, making you a more attractive loan candidate.

A Payment To Income Ratio (PTI) is particularly important for auto loans. It measures the percentage of your monthly earnings that would ultimately go towards your car payment. Lenders use this ratio to determine if the proposed car payment is manageable within your budget. A lower PTI means a lesser financial burden, increasing your chances of approval. And you can find detailed breakdowns of your income on our digital paystubs at Check Stub Maker. Understanding these ratios can help you better prepare for loan applications and manage your money effectively.

A check stub is crucial for a loan as it provides verifiable evidence of your wages and employment, helping lenders assess your ability to repay them. Based on our first-hand experience at Check Stub Maker, loans with paystubs reflect your financial trustworthiness, which is critical in the approval process.

When buying a house, pay stubs are typically required to prove your earnings and employment status. However, alternative documentation like bank statements or tax returns may be accepted, especially for self-employed individuals who don't have pay stubs or people opting for DSCR loans. After putting it to the test, our paystub maker is an essential payroll tool for small business and self-employed people which can show you how to make a pay stub for a loan .

Generally, you should provide the most recent two to three months' worth of pay stubs to secure a car loan. This helps lenders determine your Payment to Income Ratio (PTI) and ensure that the car payments are manageable within your specific budget. Understanding these requirements for an auto loan pay stub can help streamline your application process and improve your chances of approval.

In wrapping up, we've explored the critical role of genuine proof of income and the risks of falsifying documents. Remember, honesty is always the best policy in financial dealings. If you're looking to create paystubs that are accurate, professional, and reflect your true earnings, why not give our digital platform a try? Visit us at Check Stub Maker now and ensure that your payroll paperwork is in tip-top shape for your next loan application. If you want to learn more, why not check out these articles below:

!A Quick Guide to Small Business Toolshttps://checkstubmaker.com/wp-content/uploads/2019/09/small-business-tools-300x200.jpg Starting your own business can b...

Sep 27, 2019

Time is money and money is time when it comes to your business. Today, employers are accounting for and calculating every expense so that can squeeze the mos...

Mar 09, 2015

!Deductions – What Are They and What’s Their Purpose?https://checkstubmaker.com/wp-content/uploads/2022/09/Deductions-300x201.jpg https://checkstubmaker.com/...

Jul 13, 2022