Check Stub Maker Makes the Season Bright

!Check Stub Maker Makes the Season Brighthttps://checkstubmaker.com/wp-content/uploads/2016/12/checkstub-maker-holiday-season-300x200.jpg Amid the lights and...

Dec 16, 2016In the realm of payroll, it's imperative that you understand the significance of the 'fit deduction on paystub' for both employers and employees.

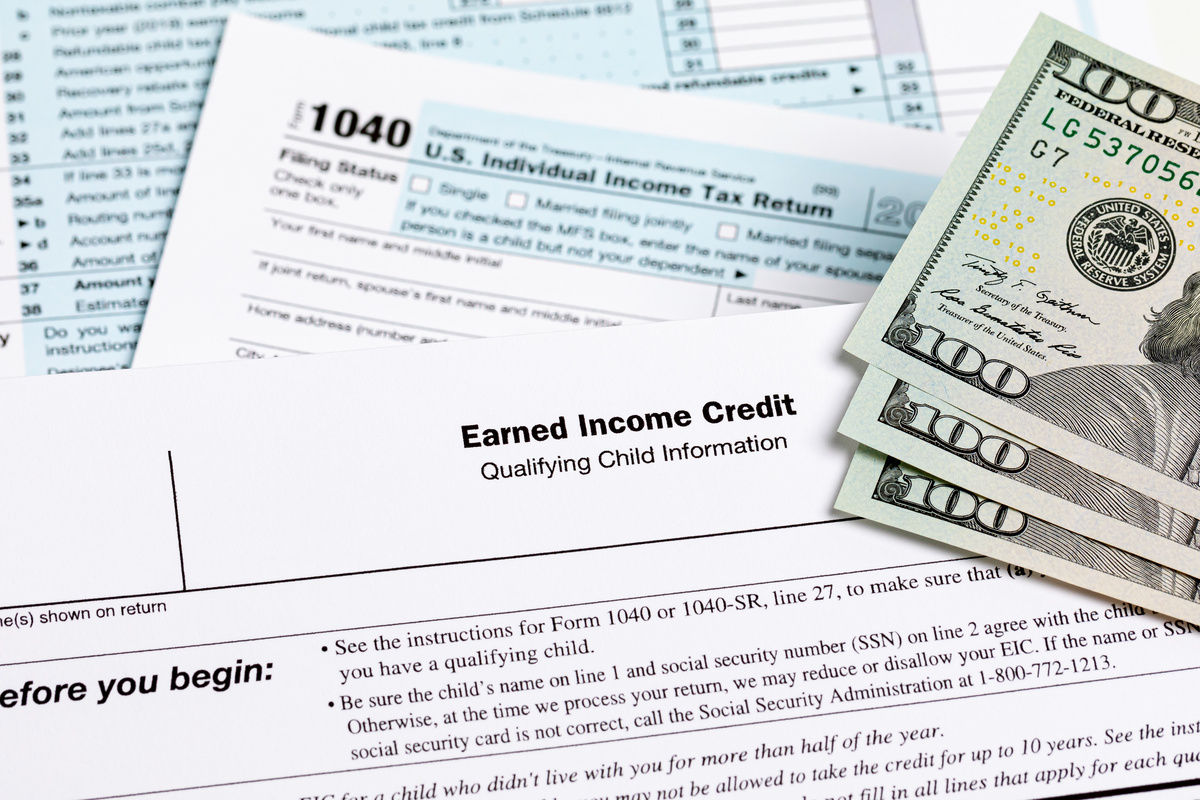

In the realm of payroll, it's imperative that you understand the significance of the 'fit deduction on paystub' for both employers and employees. Federal Income Tax (FIT) is crucial for funding national initiatives, and its proper deduction ensures compliance and financial responsibility for all US taxpayers. At Check Stub Maker , our expertise in payroll processes empowers us to assist you in accurately recording these deductions using our pay stub generator. In our upcoming article, we'll delve into the intricacies of FIT pay stub tax deductions, its importance, and the implications of withholdings for taxpayers. We'll cover the various types of FIT taxable wages and elucidate how FIT is calculated, providing comprehensive insights for employers and employees alike. What this article covers:

What is an example of a mandatory deduction on a pay stub ? This would be the Federal Income Tax, or ‘FIT' for short. Unlike a choice deduction on paystub , FIT is imposed by the federal government on taxable income. This tax is crucial for funding national services, such as:

With our paystub generator , we ensure proper recording of FIT deductions on pay stubs using our professional calculation tools.

A common deduction on a person's pay stub would be Federal Income Tax (FIT) withholding. This is the amount deducted from an employee's paycheck by their employer to cover their federal income tax obligations. Based on our first-hand experience, FIT is calculated based on various factors, including:

This withholding is vital for ensuring that people meet their obligatory tax liabilities throughout the year. With us at Check Stub Maker, you can efficiently record your FIT withholdings on pay stubs, ensuring compliance and transparency for both employers and employees.

The amount of Federal Income Tax (FIT) varies based on factors like income level, filing status, and claimed allowances on the W-4 form. There are typically seven brackets of FIT rate percentages taken out of US citizens' paychecks:

Based on our observations, the FIT rate is progressive, meaning that higher income levels incur higher tax rates.

Through our practical knowledge, employers use IRS withholding tables to determine the amount to withhold from each paycheck. These tables incorporate tax brackets, standard deductions, and exemptions to calculate the correct withholding amount.

Our investigation demonstrated that US citizens who generally earn in the range of 0$ - $25,000 get 10% taken out of their paycheck for the FIT rate. At the other end of the spectrum, taxpayers who usually earn $600,000 and higher are subject to the 37% FIT tax rate. These specific paystubs shows income under abt span across single filers and households containing married couples filing jointly and separately. After putting it to the test, our check stubs are created using an intuitive interface and built-in calculator so that employers consistently deduct the correct FIT percentage from their employees' paychecks.

Let's consider an employee with a certain taxable income of $50,000 per year and a filing status of single with no dependents. Based on IRS withholding tables, the FIT might be calculated as follows:

The resulting amount is the FIT to be withheld from the employee's paycheck (between 12%-22%), which is reflected in our paystubs at Check Stub Maker.

Examples of FIT taxable wages include salaries, wages, bonuses, commissions, and tips. Additionally, other forms of compensation such as sick pay, vacation pay, and certain fringe benefits may also be subject to FIT.

Understanding the 'fit deduction on paystub' is crucial for navigating taxes. In this guide, we've covered the significance of Federal Income Tax (FIT), its implications on earnings, and examples of FIT taxable wages. Now's the time to simplify your payroll process with us at Check Stub Maker . Try our user-friendly pay stub creator for accurate calculations and hassle-free tax management today! If you want to learn more, why not check out these articles below:

!Check Stub Maker Makes the Season Brighthttps://checkstubmaker.com/wp-content/uploads/2016/12/checkstub-maker-holiday-season-300x200.jpg Amid the lights and...

Dec 16, 2016

Your business is just as good as your team. It is critical to put together a hiring process that makes your team of employees an asset to your company, not a...

Nov 17, 2022

If you're new to payroll processes, you may be thinking about check stubs meaning and wondering, “What do check stubs look like?” This is a common question for many employees and employers alike.

Oct 04, 2024