How to Get Paystubs From a Job If You Get Paper Checks

Wondering how to get paystubs from a job if you get paper checks?

Aug 28, 2024Are you entering tax season and wondering, ‘Which deduction from your paystub is paid back later?'

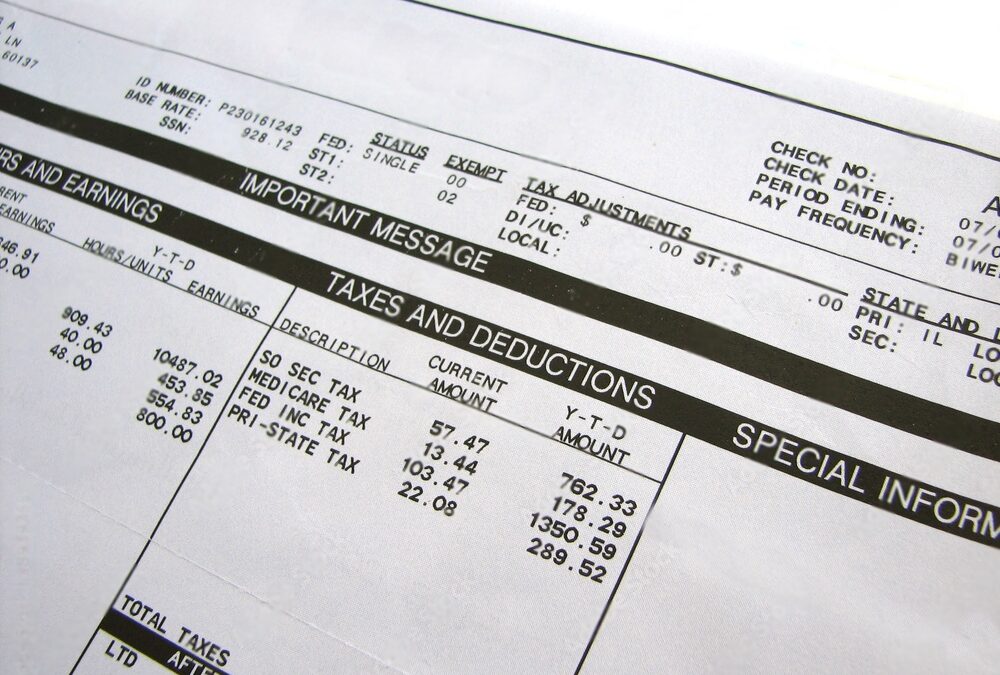

Are you entering tax season and wondering, ‘Which deduction from your paystub is paid back later?' Based on our first-hand experience at Check Stub Maker , deductions like Social Security, Federal Income Tax, State Income Tax, and Local Government Tax are often refundable. Wondering how? Our pay stub generator can illuminate these standard pay stub sections payroll accounting for you! In this article, we'll delve into these various deductions that could find their way back into your pocket once you've filed your taxes. From understanding which taxes offer repayment opportunities to unraveling the process of overpayment and refunds, we're your payroll partners, guiding you every step of the way. What this article covers:

Let's explore some common deductions and their potential for repayment by the IRS: Table: Common Deductions That Can Be Refunded

DeductionDescriptionExampleSocial Security- Created by the Social Security Administration

Federal program providing income for retired and disabled individuals

Overpayment due to multiple employments

Federal Income Tax- Tax levied by the federal government on income within its jurisdiction

State Income Tax- Tax levied by state governments on income earned within their jurisdiction

Local Government Tax- Tax levied by local governments to fund services such as education and roads

Like a Medicare deduction on paystub , Social Security deductions are withheld from your paycheck to fund retirement benefits, disability insurance, and survivor benefits. Based on our observations, if you overpay your Social Security taxes, you could be eligible for a refund during tax filing season.

A FIT deduction on paystub is withheld based on your income level and filing status. If you overpay your federal income taxes throughout the year, you can receive a refund when you file your tax return. This may include any excess amounts previously withheld from your paychecks.

Which is an example of a mandatory deduction on a pay stub ? Similar to federal income tax, state income tax deductions are mandatory and withheld from your pay based on your state's tax rates. If you overpay your state income taxes, you may also receive a refund when you file your state tax return. Our findings show that this could potentially include any excess amounts withheld from your paychecks.

Some localities impose taxes that are deducted from your paycheck. If you overpay these particular government taxes, you may be eligible for a refund depending on local tax laws and regulations. For instance, the IRS stipulates that you can possibly get a deduction on certain local property taxes up to $10,000 for married couples filing taxes jointly or $5,000 for separate filing. Understanding these deductions and their potential for getting paid back to you is crucial for managing your finances effectively. At Check Stub Maker, we're here to assist you in deciphering your paystub and maximizing your refund outcomes. Our team discovered through using this product that our pay stub creator provides clear breakdowns of your deductions, empowering you to make informed decisions.

Pay stub tax deduction codes represent various deductions withheld from employees' wages. As per our expertise, these codes indicate the purpose of each deduction, such as taxes, insurance premiums, retirement contributions, or other benefits. Understanding these codes is crucial for comprehending paycheck details and ensuring accuracy in payroll records. At Check Stub Maker, we recognize the importance of clarity in paycheck stubs. By creating accurate check stubs with us, we empower our users to decipher their earnings and deductions effortlessly. This knowledge enables you to track your finances effectively and make informed decisions about budgeting and spending.

An overpayment on taxes occurs when an individual pays more in taxes than they owe to the government. Our investigation demonstrated that this can happen due to various reasons, such as:

When someone pays more than they're supposed to with their taxes, they're often entitled to receive a refund of the excess amount.

According to IRS regulations, taxpayers can request a refund by filing an amended tax return or by claiming the overpayment on their next tax return. Additionally, if the excess payment is due to excess withholding from wages, taxpayers can adjust their withholding amounts to prevent future overpayments. Understanding these guidelines is essential to ensure you know how to change withholding on paystub so you can receive any refunds you're owed and manage your money efficiently.

Understanding wage deductions is crucial for managing personal finances effectively and ensuring accurate tax filings.

Our research indicates that wage deductions occur when an employee receives more wages than they're entitled to, which leads to an overpayment. Some examples include:

If you receive more than you're owed in wages and need to pay it back in the current tax year, we at Check Stub Maker can assist with our paystub maker . After putting it to the test, it knows how to do correct income calculations, helping you pay the precise repayment amount.

Correctly reporting the repayment of current year wages on tax returns ensures compliance with IRS regulations and prevents potential penalties. For instance, if an employee receives a repayment for excess state income tax deductions, they must report the amount when next filing their taxes to adjust their taxable income appropriately.

Understanding deductions helps employers recognize and address overpayments in subsequent tax years, which minimizes financial strain. Based on our expertise, paying the money back is necessary to rectify these excess payments. This involves:

Accurate reporting of overpayments and repayments in subsequent years avoids tax discrepancies and possible audits from the IRS.

Properly reporting overpayments and repayments in subsequent years on tax returns ensures precise filings and compliance with tax laws. Here's what you need to do to initialize the repayment process:

Awareness of wage deductions aids in identifying overpayments and repayments from prior tax years. The best ways to pay the money back includes:

Understanding deductions helps you rectify errors from previous years, potentially leading to refunds or adjustments in your subsequent tax filings.

Proper repayment and reporting helps avoid penalties and ensures the correct treatment of prior year repayments. Understanding wage deductions empowers you to:

Ultimately, doing these steps will contribute to your financial well-being and peace of mind.

To prevent tax overpayments, we at Check Stub Maker recommend that you review your withholding allowances regularly by:

Frequently checking your pay stubs and tax documents ensures consistency between reported income and withheld taxes, avoiding potential excess payments and optimizing your monetary management.

Understanding which deductions from your paystub are paid back later is crucial for managing your money effectively. We've explored various types of deductions that can be reimbursed later and discussed the concepts of overpayment and repayment on certain taxes. If you want accurate pay stubs that are hassle-free, then why not give our services at Check Stub Maker a try? Use our paystub creator today and let us simplify your payroll process. With us, you'll have peace of mind knowing your finances (like a retirement account that is sometimes a deduction on a paystub ) are in good hands. If you want to learn more, why not check out these articles below:

Wondering how to get paystubs from a job if you get paper checks?

Aug 28, 2024

While the topic of getting severance pay after terminating a professional relationship can be sensitive for some, it's important to ask the question, "What does severance mean on paystub?". This is to ensure the requirements have been met and to understand how your compensation and benefits appear on your paystub. Let's dive in.

Aug 31, 2023

Embarking on a new job journey often brings with it a mix of excitement and uncertainty, especially when it comes to discussing financial matters.

Dec 27, 2023