A common query we encounter from our users is, “Can you make your pay stub higher to apply for loan?” Understanding the significance of accurate proof of earnings is crucial in these situations.

As per our expertise, using fake pay stubs or financial paperwork for loans is fraudulent and illegal, which can result in hefty fines and other unwanted legal repercussions.

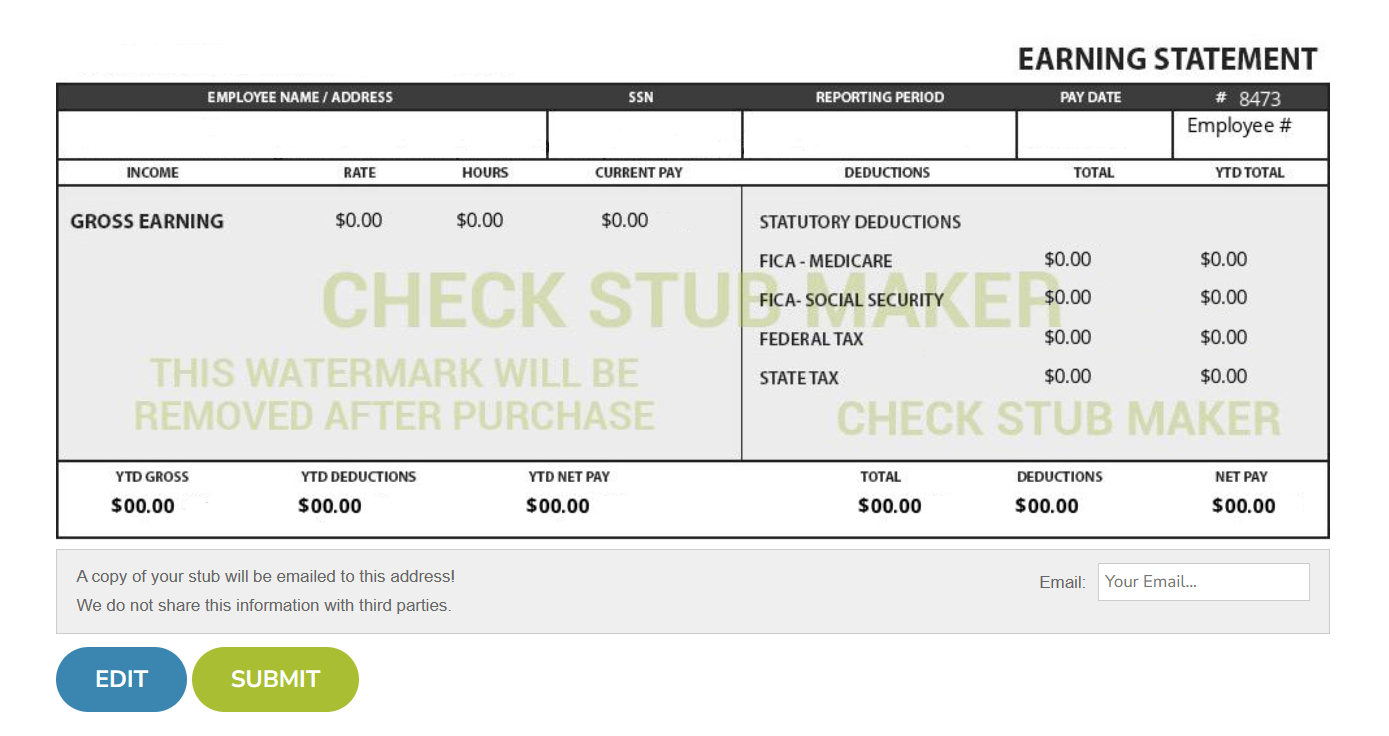

At Check Stub Maker, we’re experts in the payroll process, ready to guide you safely through creating genuine pay stubs with our pay stub creator.

In this article, we’ll delve into whether enhancing your pay stub for loan applications is advisable, the importance of honest income reporting, and the potential repercussions of submitting falsified documents.

What this article covers:

- What Happens If Someone Lies on a Personal Loan Application?

- Can You Get a Loan Without Pay Stubs?

- Documents You Can Provide Instead of a Pay Stub

- What Is The Easiest Loan to Get Approved for?

- Personal Loan Alternatives

- What Is The Purpose of Proving My Income?

- Loans Without Pay Stub FAQ

What Happens If Someone Lies on a Personal Loan Application?

Lying on a personal loan application can often lead to loan rejection and legal consequences in most cases. When applying for personal loans, honesty isn’t just a virtue; it’s a necessity.

Common Lies On A Loan Application

Common deceptions include:

- overstating income

- underreporting debts

- fabricating employment history

While it might seem harmless to tweak numbers to secure better loan terms, these are still fraudulent acts.

Drawing from our experience, misrepresenting your economic status doesn’t just affect the application’s outcome but also your financial integrity and future borrowing capabilities.

Criminal Consequences

The repercussions of lying on a loan application extend beyond mere rejection; legal actions can be taken against you, which could lead to fines or even jail time in rare scenarios.

In the realm of finance, trust is paramount. As such, maintaining accountability in all documentation is crucial for long-term economic health and legal compliance.

That’s why we emphasize the importance of accurate information, especially when it concerns financial matters on our check stubs.

We at Check Stub Maker are here to help you stay on the right side of the law when applying for a loan.

Can You Get A Loan Without Pay Stubs?

Through our practical knowledge, you can get certain loans without pay stubs.

While lenders typically require proof of income to assess your ability to repay the loan, alternative documentation such as bank statements, tax returns, or letters from employers can sometimes be used to verify earnings.

It’s essential to communicate openly with lenders about your situation and provide any financial paperwork available to support your application.

Remember, honesty is key in money matters to maintain trust and credibility.

Documents You Can Provide Instead Of A Pay Stub

At Check Stub Maker, we understand that not everyone has access to traditional pay stubs, especially freelancers, entrepreneurs, or those in between jobs.

However, there’s alternative paperwork you can provide to prove your economic stability and wages when applying for loans or other financial services.

Table: Other Types Of Income Verification Documents For Loans

| Other Types Of Income Verification Documents | Examples |

| Loan Application |

|

| Personal Identification |

|

| Proof Of Address |

|

| Proof Of Income |

|

Loan Application

To start the process, a completed loan application is essential. This form typically requires your personal information, a history of your work experience, and financial details.

Ensure that all this information is accurate and up-to-date to avoid any discrepancies that could affect your loan approval.

Personal Identification

Valid personal identification is crucial. In most cases, this can be a driver’s license, passport, or state ID, which are acceptable for a loan.

Based on our first-hand experience, lenders use this paperwork to verify your identity and prevent fraud. We recommend checking that whatever form of identity you use is current and clearly legible.

Proof Of Address

You’ll also need to provide proof of address, which can be located on a utility bill, lease agreement, or mortgage statement that’s in your name. This document should be recent, typically within the last few months, to confirm your current residence.

Proof Of Income

While traditional pay stubs are a common form of income verification, there are alternatives if you don’t have them:

- Bank Statements: These can show consistent wage deposits into your account. Lenders may request several months’ worth of statements to verify regular earnings.

- Tax Returns: Tax returns can serve as proof of annual income, especially for self-employed individuals. Lenders will usually request the last two years of returns.

- Letters From Employers: If you’re employed but don’t receive traditional pay stubs, a letter from your employer stating your salary and the nature of your employment can suffice in this context.

- 1099 Form: For freelancers and contractors, using IRS Form 1099 from the previous year can demonstrate income received from your clients.

Remember, the key to a successful loan application is providing clear, accurate, and verifiable paperwork as proof of your financial journey.

You can create pay stubs at Check Stub Maker, helping you maintain transparency and integrity throughout the process to build trust with lenders and increase your chances of approval.

What Is The Easiest Loan to Get Approved for?

Based on our expert payroll insights, payday loans and personal installment loans are often considered the easiest types to get approved for.

These generally require minimal paperwork and can be more accessible to people with less-than-perfect credit scores.

However, it’s crucial to approach them with caution due to their potentially high interest rates and fees. We recommend thoroughly researching and considering all loan options at your disposal so you understand the terms and conditions before proceeding.

At Check Stub Maker, we subscribe to the notion that a well-informed decision is an important step towards economic health and stability.

Personal Loan Alternatives

Here are some alternatives to personal loans that might suit different financial needs and situations:

Table: Alternatives To Personal Loans

| Alternatives To Personal Loans | Description | Pros | Cons |

| Credit Cards |

|

|

|

| Cash Advances |

|

|

|

| Home Equity Loans (HELOCs) |

|

|

|

| Pawn Shop Loans |

|

|

|

Credit Cards

Credit cards can be a flexible alternative to personal loans, offering the convenience of use for various purchases and potentially lower interest rates compared to high-interest loans.

Based on our observations, some credit cards also offer:

- rewards programs

- ashback

- introductory 0% APR periods

However, it’s essential to manage your card usage responsibly to avoid costly interest debt accumulation.

Cash Advances

Cash advances are short-term loans provided by credit card issuers, allowing cardholders to withdraw a certain amount of money.

They can be a quick source of funds, but they normally come with high fees and interest rates. As such, they should be considered a last resort due to their costly terms.

Home Equity Loans Or Home Equity Lines Of Credit

If you own a home, you might consider a home equity loan or a home equity line of credit (HELOC).

They use your home as collateral and may offer lower interest rates than unsecured personal loans or credit cards.

However, it’s crucial to remember that failing to repay can put you at risk of losing your home, so they should be used with extreme caution.

Pawn Shop Loans

Pawn shop loans provide immediate cash in exchange for valuable items as collateral. They don’t require a credit check, making them accessible to those with poor or no credit.

However, our findings show that the interest rates can be costly, and if it isn’t repaid, the pawn shop can sell your item. Therefore, this option should be used only when confident you can repay the loan promptly.

Each of these alternatives has its pros and cons, and what works best will depend on your individual financial situation and needs.

At Check Stub Maker, we encourage you to consider all your options carefully and choose the one that best fits your economic strategy and goals.

Whenever you’re in doubt about loan requirements, our pay stub generator can help you quickly create detailed and accurate pay stubs in minutes to verify your earnings and support your application.

What Is the Purpose of Proving My Income?

The purpose of proving your income isn’t just about showing how much you earn; it’s about demonstrating your monetary stability and reliability with loans.

Debt To Income Ratio (DTI)

Your Debt To Income Ratio (DTI) is a key factor lenders use to assess your ability to manage monthly payments and repay borrowed money.

Through our trial and error, we discovered that it compares your total monthly debt payments to your gross monthly income, which provides a clear picture of your financial health.

A lower DTI indicates a good balance between debt and wages, making you a more attractive loan candidate.

Payment to Income Ratio (PTI)

A Payment To Income Ratio (PTI) is particularly important for auto loans. It measures the percentage of your monthly earnings that would ultimately go towards your car payment.

Lenders use this ratio to determine if the proposed car payment is manageable within your budget. A lower PTI means a lesser financial burden, increasing your chances of approval.

And you can find detailed breakdowns of your income on our digital paystubs at Check Stub Maker.

Understanding these ratios can help you better prepare for loan applications and manage your money effectively.

Loans Without Pay Stub FAQ

Why Do You Need A Check Stub For Loans?

A check stub is crucial for a loan as it provides verifiable evidence of your wages and employment, helping lenders assess your ability to repay them.

Based on our first-hand experience at Check Stub Maker, loans with paystubs reflect your financial trustworthiness, which is critical in the approval process.

Do You Need Pay Stubs To Buy A House?

When buying a house, pay stubs are typically required to prove your earnings and employment status.

However, alternative documentation like bank statements or tax returns may be accepted, especially for self-employed individuals who don’t have pay stubs or people opting for DSCR loans.

After putting it to the test, our paystub maker is an essential payroll tool for small business and self-employed people which can show you how to make a pay stub for a loan.

How Many Pay Stubs Do I Need For A Car Loan?

Generally, you should provide the most recent two to three months’ worth of pay stubs to secure a car loan.

This helps lenders determine your Payment to Income Ratio (PTI) and ensure that the car payments are manageable within your specific budget.

Understanding these requirements for an auto loan pay stub can help streamline your application process and improve your chances of approval.

Conclusion

In wrapping up, we’ve explored the critical role of genuine proof of income and the risks of falsifying documents. Remember, honesty is always the best policy in financial dealings.

If you’re looking to create paystubs that are accurate, professional, and reflect your true earnings, why not give our digital platform a try?

Visit us at Check Stub Maker now and ensure that your payroll paperwork is in tip-top shape for your next loan application.

If you want to learn more, why not check out these articles below:

- How Does Child Support Appear on Pay Stub

- Does It Take 3 Pay Stubs to Get a Loan

- Medicare Deduction on Paystub

- Fit Deduction on Paystub

- What Do Workers Compensation Deductions Show Up as on Paystub?

- Which Deduction From Your Paystub Is Paid Back Later?

- Which Deduction on a Pay Stub Is Optional?

- A Common Deduction on a Person’s Pay Stub Would Be

- How Change in Number of Deductions Affect My Paystub

- How Many Pay Stubs for Mortgage?

- A Paystub Generator That Will Save Your Small Business Time & Money

- How Do Apartments Verify Pay Stubs?

- Can Landlord Ask for Pay Stub?

- Is a Pay Stub Proof of Residency?

- Closing on House and Don’t Have Pay Stubs in Time for Closing