Paystub Loan

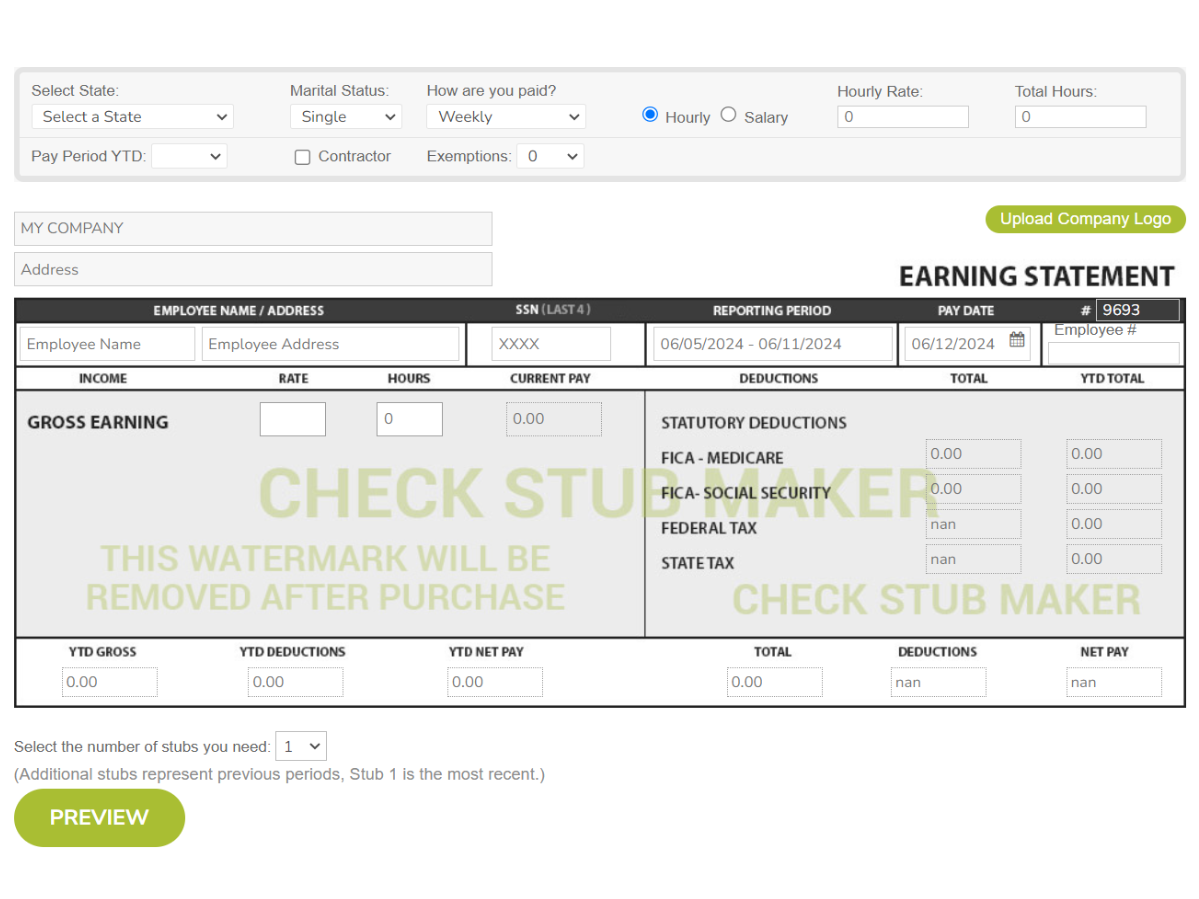

At Check Stub Maker, we understand the urgency of financial needs, like your rent being due before payday. That's why we're here to guide you through the process of securing a paystub loan quickly and safely.

Jun 06, 2024In a nutshell, an Income Driven Repayment (IDR) program is designed to help you better handle your student loan debts through a regulated monthly payment plan.

In a nutshell, an Income Driven Repayment (IDR) program is designed to help you better handle your student loan debts through a regulated monthly payment plan. Our research indicates that these monthly IDR payments formulated under the Public Service Loan Forgiveness (PSLF) program are typically calculated according to your salary and family size. Overall, these programs are designed to make student loan repayment more manageable by adjusting your monthly payments according to your particular financial situation. In this comprehensive guide, we at Check Stub Maker will explore what IDR plans are, how they work, the types of plans available, and the factors that influence payment percentages using an efficient calculator for pay stub like our paystub creator . What this article covers:

An Income-Driven Repayment (IDR) plan is a federal student loan repayment option that adjusts your monthly payment based on your wages and the size of your family. Based on our observations at Check Stub Maker, IDR plans are designed to make student loan repayment more affordable for borrowers who may be struggling with their current payment amounts. IDR plans usually cap your monthly payment at a percentage of your discretionary income. Essentially, this is the difference between your salary and a percentage of the federal poverty guideline for your family size and location. This approach ensures that your loan payments remain proportional to your earnings, potentially lowering your monthly obligation compared to standard repayment plans. Let's say you're calculating student loan repayments for the Saving On A Valuable Education (SAVE) Plan with the following details:

The first thing you need to do is find the poverty guideline. For a family of 3, the 2024 federal poverty guideline is $24,860. Next, you need to use the formula for calculating your discretionary income, which looks like this:

Discretionary Income = Annual Income - 225% Of Poverty GuidelineBased on the information above, you wouldn't be required to make a repayment to SAVE due to having a low discretionary income, which amounts to $0 in this context. This is because your annual income ($50,000) is below the federal poverty guideline, which is $55,935.

The calculation of your IDR monthly payment is influenced by several factors:

Figuring out how to calculate taxable wages from paystub is essential for accurate IDR calculations. Each Income-Driven Repayment (IDR) plan calculates payments differently, generally as a percentage of your discretionary earnings. The percentage and repayment terms vary by plan, affecting how much you owe monthly. For instance, our findings at Check Stub Maker show that the SAVE plan often results in the lowest monthly payments for most borrowers. This is due to its significant reduction in payment percentages from 10% down to 5% in 2024, making it the most feasible student loan repayment program overall.

Your family size and location directly affect how your discretionary income is calculated for IDR plans. In this context, your discretionary earnings are determined by subtracting 150-225% of the federal poverty guideline for your family size and location from your adjusted gross income. In layman's terms, the larger your family, the lower your monthly payments under an IDR plan will be, as more wages are shielded based on these poverty guidelines.

If you're married and file taxes jointly, your spouse's income is typically included in your IDR payment calculation. However, if you file separately, most IDR plans will only consider your earnings alone. This difference can greatly impact the monthly payment reflected on your check stub .

If your spouse also has federal student loans, this may affect your payment calculation and determine your approximate federal withholding from paystub under certain IDR plans if you file taxes jointly. This can result in prorated payments based on the combined student loan debt and discretionary income, potentially lowering your payment amount. With that said, should you file separately, only your salary will be considered under most IDR plans, which can further impact your monthly payment.

In layman's terms, IDRs work by helping you consistently pay off your student loan debts every month. As years go by and your finances and lifestyle steadily changes, your repayments get adjusted alongside these circumstances.

Drawing from our experience at Check Stub Maker, IDR plans work by recalculating your monthly student loan payment each year based on your updated wages and family information. This annual recertification process ensures that your payment amount reflected on your check stubs remains appropriate for your current financial situation. Knowing how to calculate your taxable earnings on paystub is crucial for this repayment process.

To be eligible for most IDR plans, you must have Partial Financial Hardship (PFH) . PFH occurs when the monthly payment you would be required to pay on your eligible federal student loans under a 10-year Standard Repayment Plan is higher than the monthly payment you would be required to pay under a conventional IDR plan.

The payment amount under an IDR plan is typically a percentage of your discretionary income reflected on your check stubs . It often ranges from 10% to 20%, depending on the specific repayment plan. Our investigation demonstrated that this percentage is applied to a significant portion of your wages, as determined by the federal poverty guideline. Knowing how to find YTD income on check stub can be helpful in your student loan repayment calculations.

To apply for an IDR plan, you'll need to submit an application through the Federal Student Aid website or your loan servicer. You'll be required to provide information about your:

Through our practical knowledge at Check Stub Maker, using your recent paystubs can help accurately calculate your current salary for the application.

While IDR plans can lower your monthly payments for student loan debts, they may also extend your repayment term. This potentially increases the total amount you'll pay over time due to accruing interest. Additionally, you'll need to recertify your wages and the size of your family every year. This can potentially be an administrative burden, particularly if there aren't any changes to your earnings.

There are several types of IDR plans available, each with its own calculation method and eligibility requirements:

The Saving On A Valuable Education (SAVE) plan replaced the Revised Pay As You Earn (REPAYE) plan. Generally speaking, it calculates payments for undergraduate and postgraduate studies as 5-10% of your discretionary income. As such, this plan often results in lower monthly payments when compared to other IDR options.

The Pay As You Earn (PAYE) Repayment Plan also calculates payments as 10% of your discretionary earnings. But unlike other IDRs, it caps the payment at the 10-year Standard Repayment Plan amount. This plan is usually available to newer borrowers experiencing significant financial hardship.

An Income-Based Repayment (IBR) Plan calculates payments at 10% of your discretionary income for borrowers who took loans on or after July 1, 2014, and at 15% for earlier borrowers. Like PAYE, it also caps payments at the 10-year Standard Repayment Plan amount. The IBR plan also offers loan forgiveness after 20 to 25 years, depending on when you borrowed.

The Income-Contingent Repayment (ICR) Plan calculates your monthly payment as the lesser of 20% of your discretionary earnings. Generally, these payments are non-taxable and automatically added to your gross wages. Alternatively, it calculates the amount you would pay on a fixed 12-year repayment plan, which is adjusted based on your salary. At Check Stub Maker, we can help you create pay stubs that reflect your student loan debt repayments correctly.

Annual renewal is crucial for maintaining precise IDR payments. You must recertify your wages and family size each year to ensure your payment remains appropriate for your current financial situation.

If you fail to renew your IDR plan by the annual deadline, your payment may revert to the standard 10-year repayment amount. Based on our first-hand experience at Check Stub Maker, this could be considerably higher than your IDR payment. Additionally, any unpaid interest may capitalize, increasing your overall loan balance owed.

In this guide, we revealed that the monthly payments for the Income-Driven Repayment (IDR)program are calculated based on factors like salary, the size of your family, and the specific plan you choose. Understanding how these payments are determined can help you better manage your student loan debt repayment. We take great pride in showing you how to make paystubs that are accurate and can be used for IDR calculations. So, what are you waiting for? Visit us at Check Stub Maker now and create professional, detailed pay stubs for your small to medium-sized business or self-employed needs to further your education! If you want to learn more, why not check out these articles below:

At Check Stub Maker, we understand the urgency of financial needs, like your rent being due before payday. That's why we're here to guide you through the process of securing a paystub loan quickly and safely.

Jun 06, 2024

Have you ever wondered, "What is PAC on my paystub?" You're not alone.

Aug 01, 2024

!Why Should You Use Check Stub Maker Softwarehttps://checkstubmaker.com/wp-content/uploads/2018/08/check-stub-maker-software-min-300x200.jpg For business own...

Aug 20, 2018