Check Stubs Meaning

Have you ever wondered about the ‘check stubs meaning' in your payroll documents?

Oct 04, 2024In today's financial world, one of the most reliable and widely accepted forms of income verification is presenting 3 months of pay stubs.

In today's financial world, one of the most reliable and widely accepted forms of income verification is presenting 3 months of pay stubs. From the start of the year to your end of year pay stubs , these documents serve as a concrete record of your earnings and deductions, providing a transparent view of your financial stability without dates wrong on pay stub so you can do anything from renting an apartment to purchasing a car. In this article, we at Check Stub Maker will explore different financial situations where you might need to prepare 3 months of pay stubs as proof of your income and what to do if you don't have paystubs to meet your financial obligations. Let's dive in! What this article covers:

There are a number of people and institutions who might request three months' worth of pay stubs as proof of income from you.

When it comes to renting an apartment, landlords typically require proof of income to ensure that potential tenants can afford the rent. This is where pay stubs come into play. Drawing from our experience, we discovered that most landlords ask for two to three months' worth of pay stubs in order to verify that you, the tenant, have a stable income source and can consistently pay rent. These paystubs should ideally be from the same employer, reflecting your current income status and a clock number on pay stub . In cases where a tenant has recently changed jobs, it might be necessary to provide an explanation along with the pay stubs from your new employer to your prospective landlord.

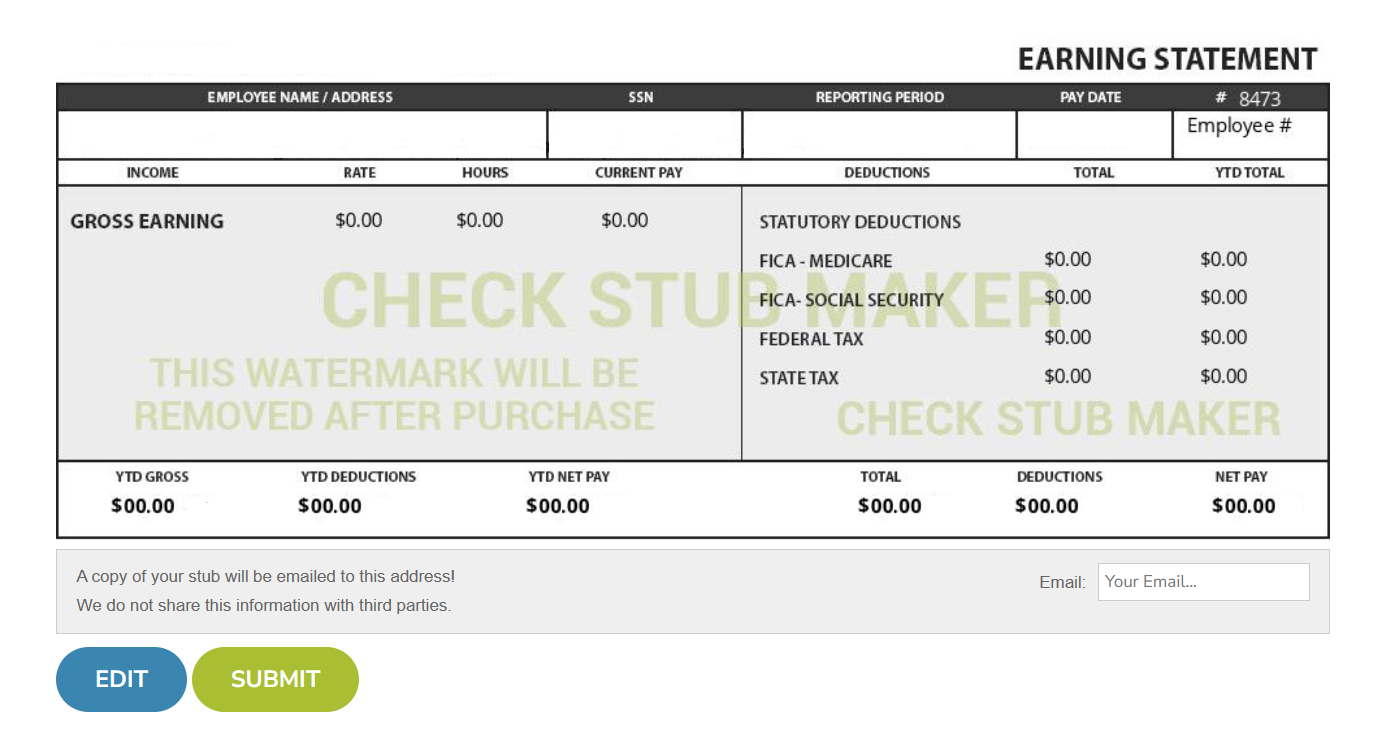

For self-employed individuals, a traditional pay stub online record might not be readily available. That's why we recommend using a paystub creator , like Check Stub Maker, to create your own pay stubs. Not only will it reflect your income and deductions accurately, but it will also provide a standardized and credible form of income proof, which is essential for various financial transactions.

When purchasing a vehicle, automobile dealerships often require proof of income to ensure that the buyer can afford the car payments. Pay stubs serve as a reliable form of income verification in this scenario. By presenting recent pay stubs, you can demonstrate your financial capability to make regular payments, which is a crucial factor in the approval process for auto loans.

As per our expertise, mortgage lenders typically require recent pay stubs, often the last two to three months, to show income verification as part of the loan application process. With these pay stubs, lenders can assess the borrower's ability to repay the mortgage loan. For those who don't have traditional pay stubs, using our digital payroll service at Check Stub Maker to make paystubs can be an invaluable tool.

In some cases, you may need to verify your income for social security purposes. Pay stubs can be used to demonstrate income levels, which might be necessary for various social security benefits or programs. This is particularly relevant if you're employed and receiving or applying for social security benefits.

Our findings show that investors often need to prove their income for various financial activities, such as securing loans for investment purposes. Pay stubs provide a clear and official record of your income, which gives lenders confidence in your ability to repay a loan. For investors who may not have a traditional employer or who need to view pay stubs from closed business , generating check stubs through Check Stub Maker can provide the necessary documentation in a format that's widely accepted and trusted in the payroll industry.

If you don't have three months worth of paystubs or don't know how to get two months of pay stubs for one reason or another, don't despair. There are still other forms of income verification you can use to meet your financial obligations as per usual.

A proof of income letter, often issued by an employer, is a formal document that illustrates an employee's income and employment details. This letter typically includes information about the employee's:

Our team discovered through using this document that it's a valuable tool for freelancers or contractors who often don't get regular pay stubs for the work they do.

An offer letter from an employer can also serve as proof of income, particularly if you've recently secured employment and haven't received your first paycheck yet. This letter usually outlines the terms of employment, which include your:

It's a useful document for demonstrating future income, especially in scenarios where immediate income verification is required, such as securing a rental agreement or a bank loan.

Tax returns provide a comprehensive overview of your income sources over the previous year, including wages, dividends, and interest. For the self-employed, tax returns are often the most reliable form of income verification simply because they consolidate various income streams into one official document. Our team at Check Stub Maker recognizes the significance of tax returns in income verification processes and advises our clients on how to effectively use them.

Retirement earnings, such as pension distributions or annuity payments, are crucial for retirees needing to verify their income. These earnings are documented through statements from retirement funds or annuity providers, detailing the amount and frequency of payments. For many retirees, our findings show that these documents are essential in proving their financial stability, especially when applying for loans, housing, or other financial services. While pay stubs are a common and effective way to verify income, there are other forms of documentation that can serve the same purpose. From proof of income letters to tax returns, each type of document caters to different individual circumstances. At Check Stub Maker, we're committed to helping our clients navigate through these options, ensuring they can effectively demonstrate their financial stability in various situations. For those who need assistance in generating accurate and professional pay stubs in three-month increments, our pay stub generator is always available to provide reliable and efficient service.

Now, let's look at some frequently asked questions related to proof of income documents over a period of three months and how we at Check Stub Maker can assist you in your financial journey.

Proof of income is a document or set of documents that verifies your earnings. It's essential for various financial transactions, like renting an apartment, applying for a loan, or purchasing a vehicle. Based on our first hand experience, common forms of proof of income are:

After trying out this product, we discovered that our specialized check stubs maker serves as reliable proof of income, especially if you don't have traditional forms of income documentation at your disposal.

One effective method of proving income from cash payments is to deposit your cash earnings into a bank account regularly and use your bank statements as proof. Alternatively, creating pay stubs using a pay stub creator like ours at Check Stub Maker can provide a professional and organized way to document your cash earnings. This method is particularly useful for freelancers, independent contractors, and tip-based workers.

If you're currently unemployed, proving income can involve showing any unemployment benefits you're receiving. Based on our observations, documents such as benefit statements from the unemployment office can serve as adequate proof of income. Additionally, the following documents can also be used to demonstrate financial stability during periods of unemployment:

To obtain proof of unemployment income, you can request a benefits statement from the unemployment office, which will detail the amount and duration of the benefits you're receiving. Our research indicates that it's an official document that can be used in various financial transactions to prove that you have some form of income, even while unemployed.

You can create proof of income by using a pay stub generator, like the one we offer at Check Stub Maker. Whether you're self-employed, work on a freelance basis, or receive cash payments, our pay stub generator can help you produce professional and accurate pay stubs over three months that have the correct paystub date range . Simply enter your income details into our user-friendly platform, preview it for any potential errors, and then hit ‘Submit'. After that, it will generate a pay stub that can be used as a valid proof of income for various financial purposes.

Throughout this article, we've explored the importance of having 3 months of pay stubs as proof of income in various financial situations. And whenever you're in doubt, we at Check Stub Maker are here to assist you in generating accurate and professional pay stubs with ease. So why not try our paystub generator today? It's a simple, reliable, and affordable solution for all your income verification needs, from renting an apartment to securing a bank loan. Give yourself the financial freedom you deserve with Check Stub Maker! If you want to learn more, why not check out these articles below:

Have you ever wondered about the ‘check stubs meaning' in your payroll documents?

Oct 04, 2024

As small businesses and self-employed individuals, keeping payroll accurate and timely is a top priority. The solution? Electronic Pay Stubs. At Check Stub M...

Aug 14, 2023

Ever wondered, "Is it illegal to keep check stubs from the employee when they have direct deposit?"

Oct 31, 2023