In layman’s terms, a pay stub is a document that an employer gives to an employee detailing their earnings (from net pay to deductions) for a particular pay period. It serves as a proof of income docs paystub, and is essential for financial planning and tax purposes.

In this article, we at Check Stub Maker will illustrate the importance of creating templates for check stubs and show you how to make your own monthly pay stubs with our paystub maker in minutes.

Let’s dive in!

What this article covers:

- What Should Monthly Pay Stubs Include?

- Why Do You Need Monthly Pay Stub Templates?

- Create Monthly Pay Stubs Instantly

- Why Choose Check Stub Maker?

- Pay Check Stub for Office FAQs

What Should Monthly Pay Stubs Include?

As per our expertise, there are six key components that should always be included in your w2 and one pay stub on a monthly basis.

Net Pay

Net pay, often referred to as take-home pay, is the amount an employee receives after all deductions are made from their gross pay.

These deductions can include:

- federal and state taxes

- Social Security

- Medicare

- health insurance

- retirement contributions

- any other withholdings

Net pay is a critical component of a pay stub, as it represents the actual earnings you can use for expenses and savings.

Earnings

The earnings section of a pay stub details the total amount an employee earns in a specific pay period.

This includes:

- wages

- salaries

- bonuses

- commissions

- overtime pay

- other forms of compensation

It’s important for this section in your paystubs with Check Stub Maker to be clear and comprehensive, so always ensure that you provide a breakdown of your different types of earnings, including an hourly wage on paystub.

This transparency will help you verify the accuracy of your pay and is crucial for budgeting and tax reporting purposes.

Deductions

Deductions on a pay stub represent the amounts subtracted from an employee’s gross pay. These can be mandatory, such as taxes and Social Security contributions, or voluntary, like retirement plan contributions or health insurance premiums.

Based on our observations, listing these deductions clearly is vital for compliance with labor laws, ensuring transparency, and aiding you in understanding your financial obligations for the year ahead.

Employer Information

Employer information on a pay stub typically includes the company’s name, address, and identification number. This section helps you verify the source of your income and for record-keeping purposes. It also provides essential contact information for any queries related to your employment or pay.

Employee Information

Employee information on a pay stub should include the employee’s name, address, identification number, pay rate, hours worked, and any other relevant details.

This ensures that the pay stub is accurately attributed to the correct individual and provides a record of their compensation, including any additional earnings or deductions.

After putting it to the test, our pay stub generator at Check Stub Maker has a user-friendly interface, helping you input customizable and accurate employee and employer information into your digital paystubs.

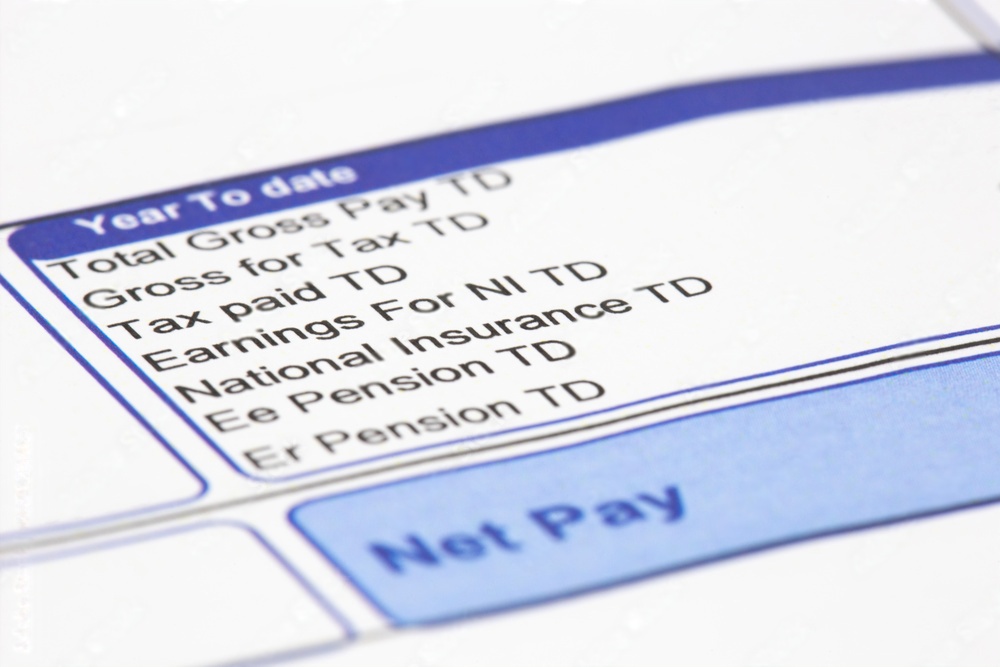

Payment Information

Payment information on a pay stub encompasses details like the:

- payment date

- check number

- payment method

- gross pay

- net pay

- year-to-date

This section is crucial as it provides a comprehensive record of the specific payment made to you, which also prevents year to date is showing up incorrect on paystub from occurring.

Additionally, it’s used for verifying accurate payments, tracking income for tax purposes, and serving as proof of income for various financial transactions you do throughout the year.

Why Do You Need Monthly Pay Stub Templates?

After conducting experiments with it, we found that creating and utilizing a monthly pay stub template ensures consistency, accuracy, and compliance with legal requirements.

These templates help standardize the format of pay stubs, making it easier for both employers and employees to understand and manage them.

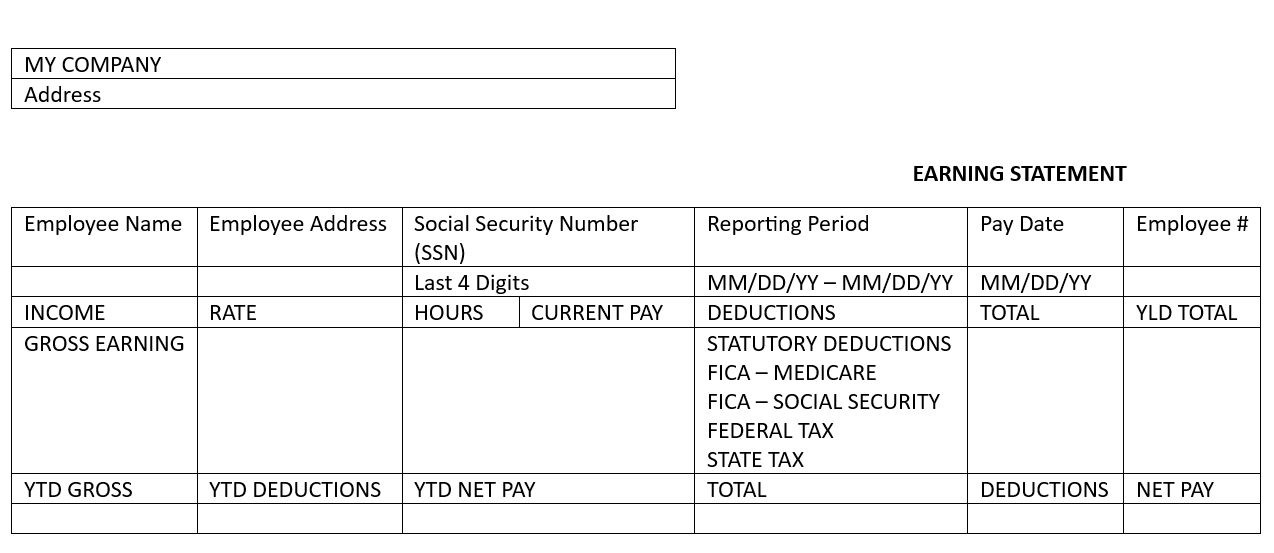

Pay Stub Template

Here is a basic monthly pay stub template by us at Check Stub Maker that you can use and customize for your needs. This template is designed to be simple, easy to understand, and covers all the essential elements of a pay stub.

Monthly Paystub Template By Check Stub Maker

[Your Company Name]

[Company Address]

[City, State, Zip]

Employee Information

- Name: [Employee Name]

- Address: [Employee Address]

- Social Security Number: [Employee SSN]

- Employee ID: [Employee ID Number]

Pay Period: [Start Date] to [End Date]

Pay Date: [Date]

Earnings

- Hourly Rate: $ [Rate]

- Hours Worked: [Hours]

- Gross Pay: $ [Gross Pay]

- Year to Date Gross: $ [YTD Gross]

Deductions

- Federal Tax: $ [Amount]

- State Tax: $ [Amount]

- Social Security Tax: $ [Amount]

- Other Deductions: $ [Amount]

- Total Deductions: $ [Total Deductions]

- Year to Date Deductions: $ [YTD Deductions]

Net Pay

- Total Net Pay: $ [Net Pay]

- Year to Date Net: $ [YTD Net]

Our findings show that a well-structured pay stub not only ensures compliance with legal requirements but also provides clarity and transparency for your employees regarding their earnings (even when the paystub shows advance) and deductions.

For more detailed and customizable templates, you can explore our digital paystub generator to make your monthly paystubs reflect the accuracy of your financial records and the uniqueness of your brand.

Create Monthly Pay Stubs Instantly

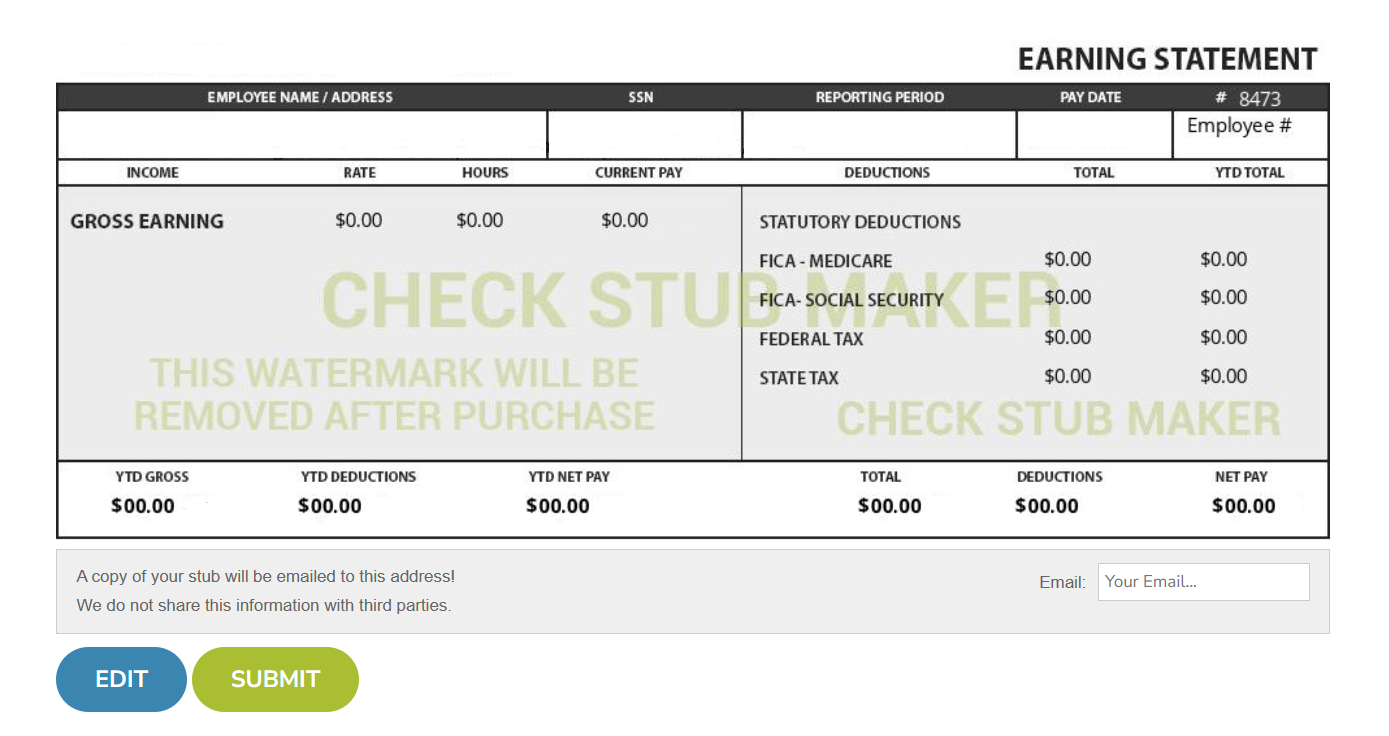

Now that you understand the basic format and importance of a paystub template, let’s look at how you can make your own monthly paystubs online with Check Stub Maker.

1. Fill In Your Information

At Check Stub Maker, our easy-to-use platform allows you to create monthly pay stubs in minutes. Simply enter your information, including employee details, pay rate, and hours worked.

Drawing from our experience, whether you earn salaried or hourly wages, our paystub creator is designed to accommodate various payment structures, ensuring that all your relevant financial data is captured accurately.

2. Preview Your Document

Once you’ve entered your information, our system generates a preview of your pay stub. This step is crucial as it allows you to review and confirm the accuracy of all the details before finalizing the document and clicking ‘Submit’.

Our commitment to precision ensures that your pay stubs reflect the correct earnings, taxes, and deductions, providing you with a reliable record of your financial transactions at all times.

3. Check Your Email

After confirming the details, your pay stub is ready. From there, we send the finalized document directly to your email, ensuring swift and secure delivery.

This process not only saves time but also provides a convenient way for you to store and access your financial records digitally.

Why Choose Check Stub Maker?

There are several reasons why you should choose our digital paystub generator for your payroll needs.

Are Paystub Generators Effective In Making Paystubs?

Paystub generators, like CheckStub Maker, are essential tools in today’s digital age for good reason.

After trying out this product, we found that our digital payroll platform provides a quick and accurate way to produce pay stubs.

This is particularly vital for:

- income verification

- tax purposes

- personal financial management

The pay stubs you create with us contain comprehensive details about your earnings and deductions, making them indispensable for various financial and legal purposes.

Why Choose Our Online Paystub Generator?

Our online pay stub generator stands out for two key reasons:

- Our system is designed with user-friendliness in mind, making it accessible to everyone, regardless of their technical expertise.

- Our system ensures that all your financial calculations are precise, reflecting the latest tax rates and legal requirements.

Moreover, we pride ourselves on offering a diverse range of features and support for a variety of pay structures, ensuring that our service caters to a wide range of users, from small business owners to freelancers.

Pay Check Stub for Office FAQs

Now, let’s look at some of the most common questions related to monthly paystub types and how they’re similar and different from other equally important payroll documents.

What Are The Different Types Of Paystubs?

Based on our first hand experience at CheckStub Maker, the most common types of paystubs include:

- Standard Paystub: Ideal for regular employees, it details gross pay, net pay, taxes, and other deductions.

- Contractor Paystub: Tailored for freelancers or contractors, focusing on gross earnings without standard deductions.

- Commission-Based Paystub: For those earning primarily through commissions, this paystub type highlights commission amounts and any additional earnings.

- Overtime Paystub: Specifically designed for employees who work overtime, showing regular and overtime hours separately.

Each type serves a unique purpose, ensuring that all financial details are accurately represented for different employment scenarios.

What Is The Difference Between A Pay Stub And A Paycheck?

Through our practical knowledge, a paycheck is the actual check issued to an employee for their wages, making it either a physical or electronic means of transferring payment for work done.

On the other hand, paystubs, like the ones we make at Check Stub Maker, are documents that accompany a paycheck, providing detailed information about the earnings and deductions for that pay period.

In short, the paycheck is the actual payment, while the pay stub serves as a record of the payment details actualized by the paycheck.

What Is The Difference Between A Pay Stub And An Invoice?

A pay stub is a record of a payment made to an employee that details their earnings, taxes, and other deductions.

Conversely, an invoice is a request for payment. Through our trial and error, we discovered that businesses or independent contractors typically use invoices to bill clients for services rendered or goods delivered.

To sum up, while a pay stub reflects income received, an invoice represents income that is owed to a person or business.

Conclusion

In this article, we explored the essential aspects of monthly pay stubs, their importance, and how we at CheckStub Maker can simplify the process of creating accurate and professional pay stubs.

We’re more than just a paystub generator. We’re a reliable partner in managing your payroll needs, offering accuracy, convenience, and versatility. Whether you’re an employer or an employee, our service is designed to meet your needs and exceed your expectations.

So, don’t wait—visit CheckStub Maker today and take the first step towards streamlined payroll management every month!

If you want to learn more, why not check out these articles below:

- How to Generate Backdated Pay Stubs

- How Do I Get My W2 If Company Closed and Don’t Have Pay Check Stub

- 3 Paystubs in One Month

- Last Pay Stub Pay Date or Ending Date

- Paystub for Bi-Monthly Payroll Example

- Pay Stub Premium

- Period End Date on Paystub

- Standard Hours Increased on My Pay Stub

- What Important Information Is Available on a Pay Stub?

- What Is a Pay Stub?

- Imputed Income on Paystub

- What Is a Paycheck Stub?

- Pay Stub for Self Employed

- How to Show Pay Stubs When Self Employed

- If I Own a Business Do I Get Pay Stubs