"Can I use my paystubs to file taxes?” It's a question many of us have pondered at the end of the fiscal year. The short answer is ‘not directly', as paystubs aren't official tax documents when it comes to how to enter W2 info from last check stub . However, they can be incredibly useful in verifying income and ensuring accuracy when preparing your tax return. At Check Stub Maker , we're your guiding light in the payroll process. With unparalleled expertise in payroll intricacies, we're here to demystify the process, helping you harness the power of your paystubs for a smoother tax filing experience. Dive into our tax filing guide and relevant IRS documents, like your W-2 and 4852, and discover how to make the most of your earnings records with your paystubs!

Using Pay Stub for Taxes

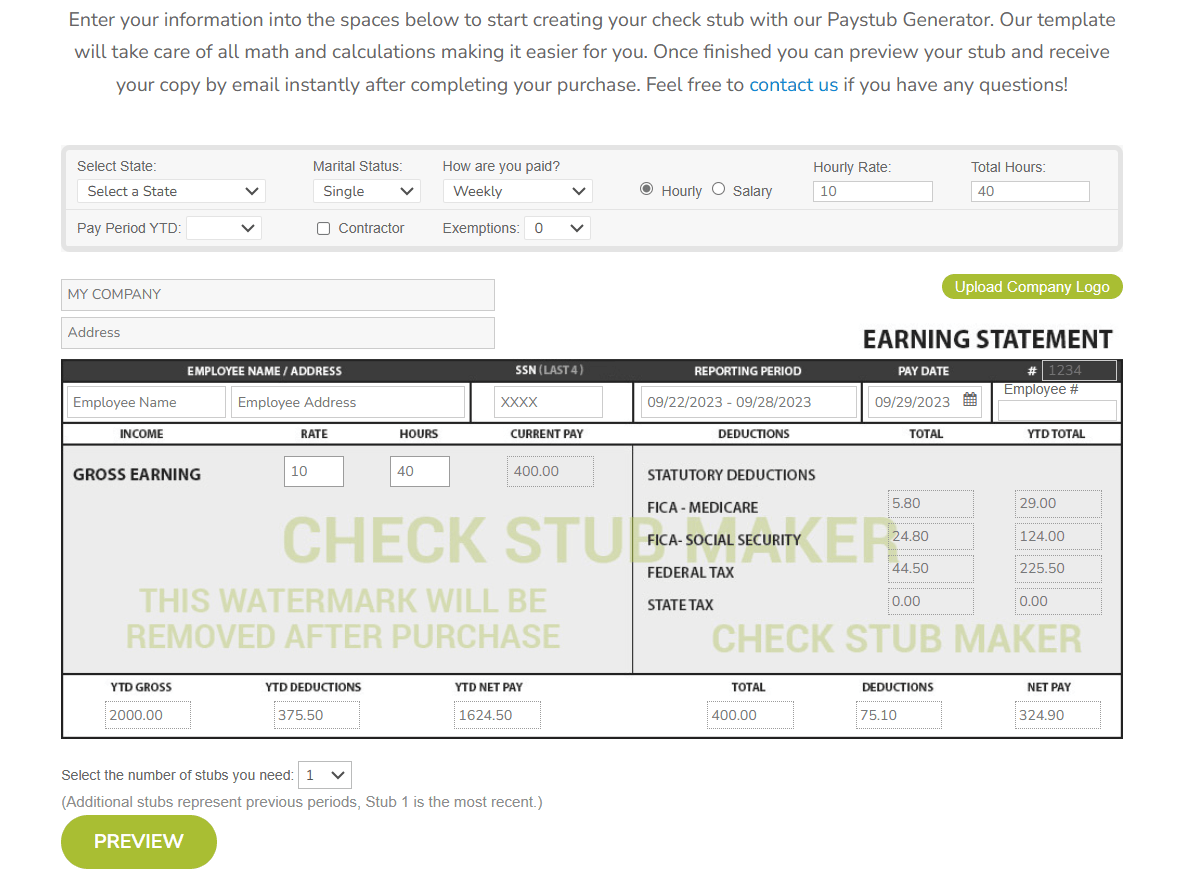

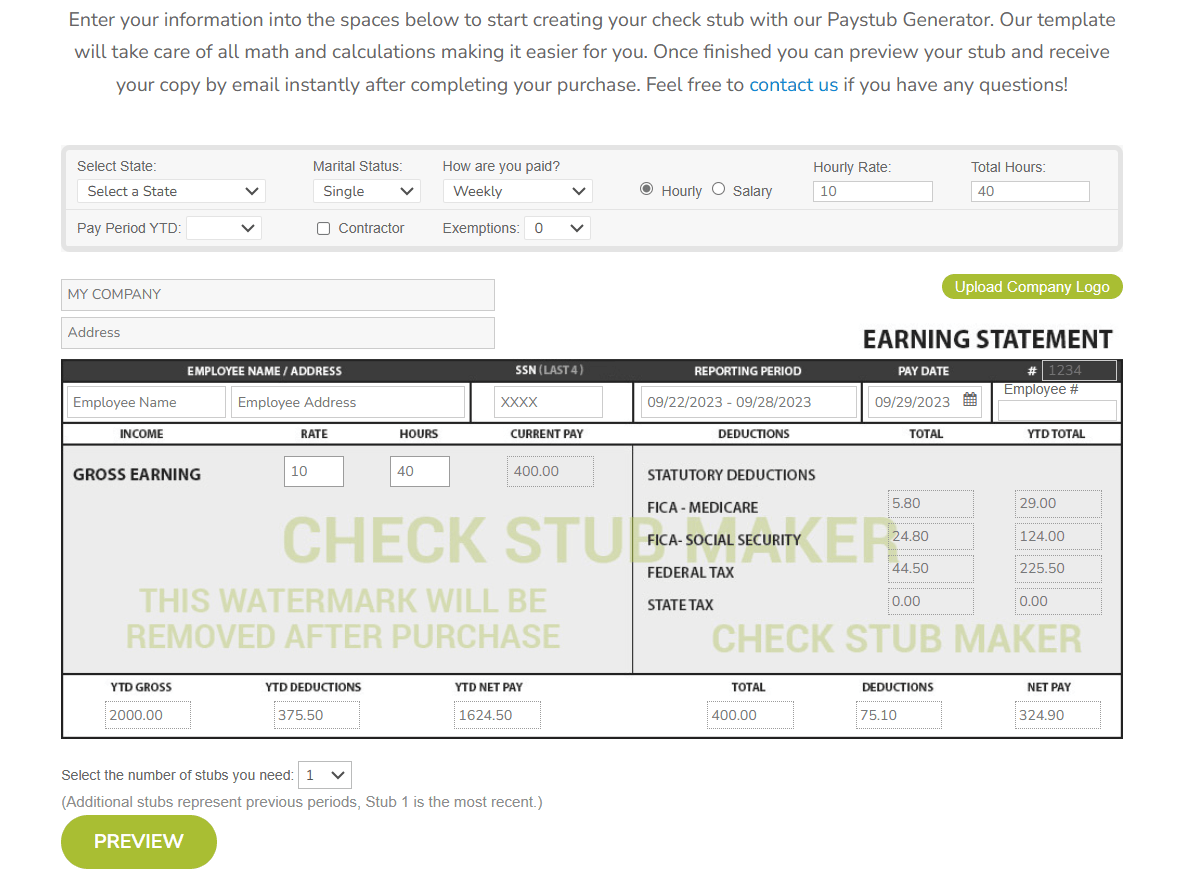

Every year, as the tax season approaches, you might find yourself scrambling to gather the necessary documents to ensure a smooth filing process. We determined through our tests that one of the most common dilemmas faced is whether you can file with paystub no W2. This is where tools like Check Stub Maker's pay stub generator come into play, offering a streamlined and accurate way to manage and understand your earnings records.

How To File Taxes With Your Last Pay Stub

As per our expertise, your pay stub provides a detailed breakdown of your earnings, deductions, and net pay for a specific pay period. It's an important preview of your financial earnings and can be a handy tool for budgeting or verifying income. But when it comes to taxes, is it sufficient? While it's tempting to use your final pay stub of the year alone to get a head start on tax preparations, it's crucial to understand its limitations. The truth is that your pay stub isn't an official tax document. Instead, the IRS recognizes the W-2 form as the definitive record of your annual earnings and the taxes withheld from those earnings. Why is there a discrepancy between the pay stub and the W-2? Several factors can cause differences:

- Tax-Deferred Contributions: Contributions to retirement accounts like 401(k)s or 403(b)s reduce your taxable income. These contributions might be reflected on your pay stub but are excluded from the taxable wages on your W-2.

- Pre-Tax Deductions: Premiums for health, dental, or vision insurance, taken from your paycheck before taxes, can also cause differences between the gross wages on your pay stub and the taxable wages on your W-2.

- Other Taxable Benefits: Some benefits, like employer-provided life insurance over $50,000, are considered taxable. Your employer adds these to your W-2, but they might not be evident on your pay stub.

#### Can You File Taxes Without A W-2?

#### Can You File Taxes Without A W-2?

Yes, you can technically file your taxes without a W-2 form, but it comes with certain conditions. The W-2 is more than just a document; it's a comprehensive record of your annual earnings and the taxes withheld. With it, you're equipped to navigate the tax filing process confidently, ensuring that all details align perfectly. This precision minimizes the chances of discrepancies, ensuring a smoother experience with the IRS. While a paystub provides detailed and accurate information about your earnings and can help you estimate federal tax based on pay stub , the W-2 offers a complete yearly overview. Should you notice any differences between your pay stub and the W-2, the IRS has provisions like Form 1040X to help you make necessary adjustments. It's a straightforward process, but having the W-2 from the start can streamline things even more. So, while the idea of filing early without a W-2 sounds appealing, having the W-2 in hand ensures a seamless and efficient tax filing journey.

Can You Use Any Other IRS Forms?

Yes, you can use another IRS form, such as Form 4852, to file your taxes in case you don't have the W-2 for a number of reasons. If the calendar flips to February 14th and your W-2 is still nowhere in sight, the IRS has a backup plan in the form of Form 4852, otherwise known as "Substitute for Form W-2, Wage and Tax Statement." This form is designed to be a stand-in for the W-2, allowing taxpayers to move forward with their tax filing. To fill out Form 4852, you'll need to estimate your annual wages and tax withholdings. This is where your final check stub of the year, especially one generated from reliable sources like Check Stub Maker, becomes a crucial reference. It provides a detailed breakdown of your earnings, helping you make an informed estimation. However, it's essential to approach Form 4852 with caution. Based on our observations, estimations, by nature, can vary from actual figures. When your W-2 eventually arrives, and if it showcases different numbers than your estimates, then you'll need to make corrections. This involves filing an amended return to rectify any discrepancies, ensuring you're in full compliance with tax regulations. So, while alternate forms of tax filing exist for contingencies, the W-2 remains the preferred choice for a hassle-free tax season.

Conclusion

Can you use final pay stub file taxes? You can up to a point, because paystubs offer a pivotal glimpse into your earnings, benefits, and deductions. With that said, you should always pair your pay stub with a W-2 form or its backup 4852 form to play it safe while filing your taxes for the year, as these IRS-approved forms contain a detailed picture of your financial history during a specific pay period. Lucky for you, we at Check Stub Maker have expertise in the payroll realm and are committed to simplifying the process for both businesses and individuals alike with our detailed check stub maker online solution. That way, you'll always have detailed and accurate financial records on our state-of-the-art platform and consistently come prepared to file your taxes with your W-2 or Form 4852 every year. So, as your tax filing deadline approaches, why not give yourself a head start? Try out our dynamic pay stub creator today and ensure that tax season isn't taxing in the least. If you want to learn more, why not check out these articles below:

#### Can You File Taxes Without A W-2?

#### Can You File Taxes Without A W-2?