An Outline of our Net income Calculator

!An Outline of our Net income Calculatorhttps://checkstubmaker.com/wp-content/uploads/2019/08/net-income-calculator-300x200.jpg Have you ever wondered what t...

Aug 29, 2019As tax season approaches, you might be wondering, ‘How do I file my taxes without a W2 or paystub?'

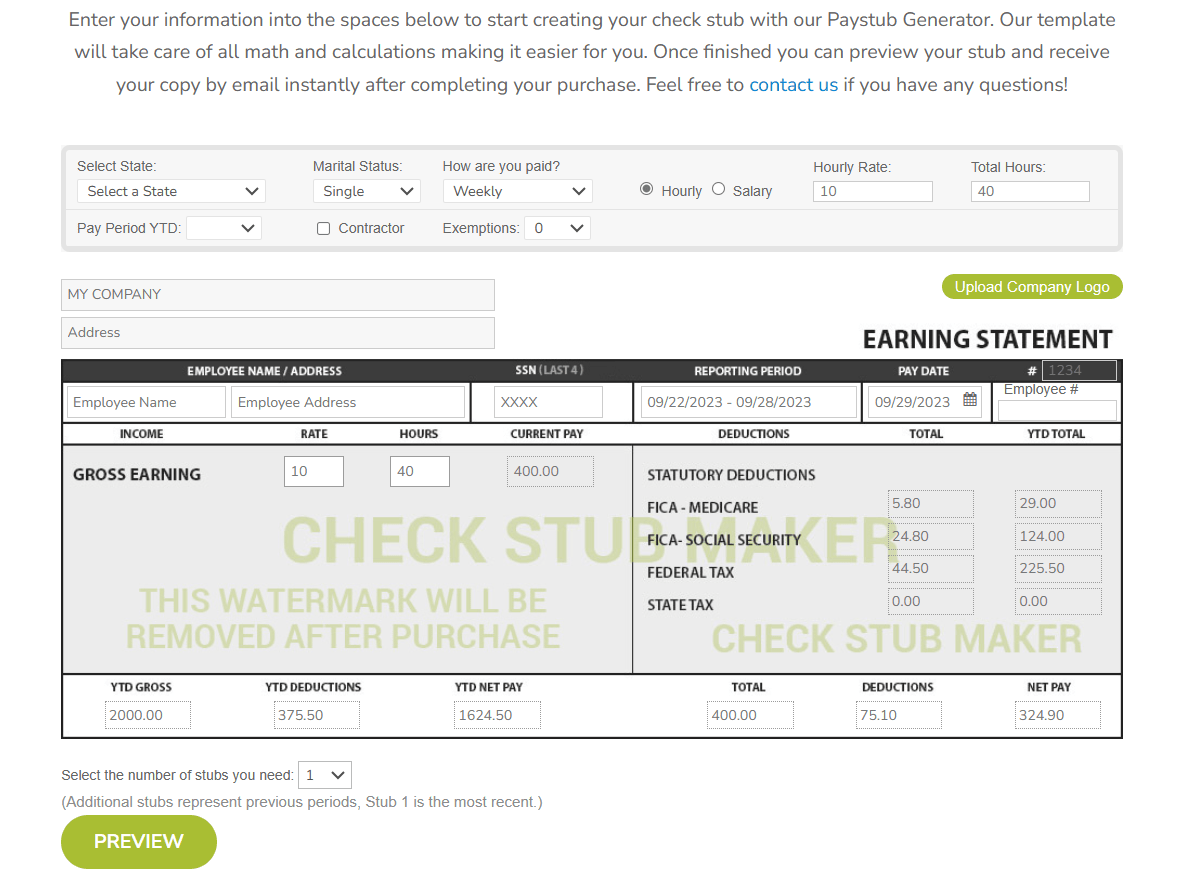

As tax season approaches, you might be wondering, ‘How do I file my taxes without a W2 or paystub?' Based on our firsthand experience, when the W-2 form from the IRS is paired with your paystub, it can be your golden ticket to a stress-free tax filing process. These documents detail your earnings and the taxes withheld, making them essential for accurate submissions. But what if you have no W2 or paystub ? As experts in the payroll realm, we at Check Stub Maker are here to guide you on how to use pay stub for W-2 . In this guide, we'll help you navigate the tax labyrinth with easy steps on what to do in the absence of a W-2 form, so you can do your tax filing timeously and with precision. Let's get started! What this article covers:

Whether you've misplaced your form, didn't receive it, or your employer is no longer in operation, there are alternative methods to ensure you file accurately. In this section, we at Check Stub Maker have outlined four easy steps to show you how to breakdown last pay stub into taxes with no W2 .

Before diving into alternative methods, always try to first obtain the W-2 from your employer. Even if the company is no longer in business, its former payroll provider might be able to provide these forms for you. If you're unable to get a copy from your employer, move on to the next steps.

If you can't get the W-2 from your employer or their payroll provider, your next step should be to contact the IRS at 1-800-829-1040. Provide them with your personal details and your employer's name and address. The IRS might have already received tax information from your employer even if you didn't, and they can help you find a copy of your W-2 in the process.

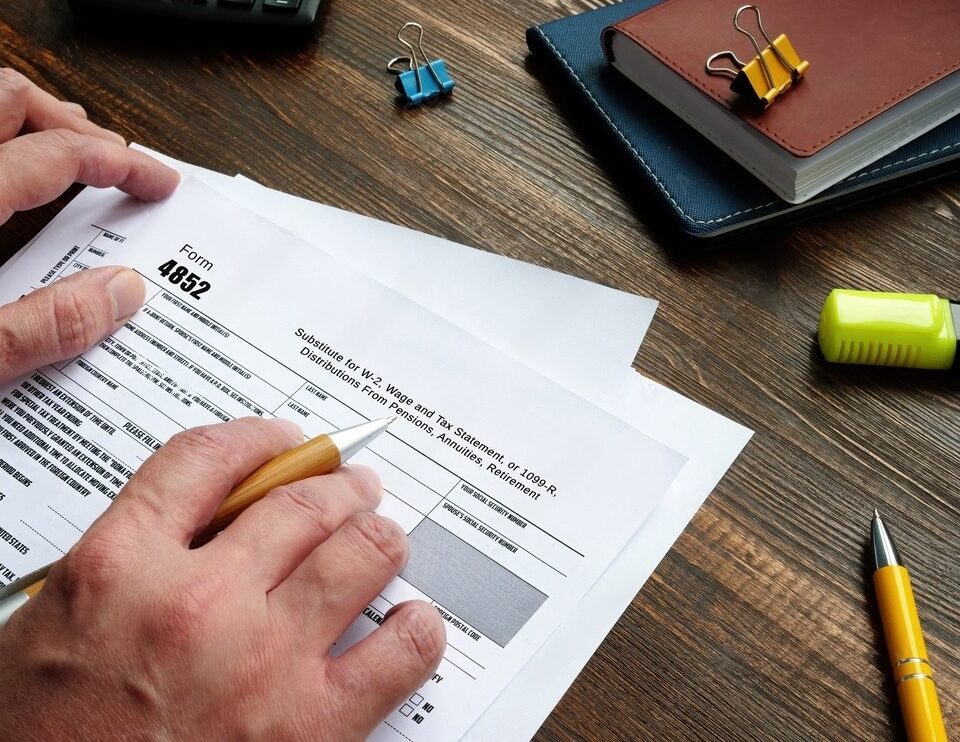

Our findings show that when neither your employer nor the IRS can give you a W-2 form, you can still file your tax return using IRS Form 4852, which serves as a substitute for ‘Form W-2, Wage and Tax Statement'. In this case, you can use your latest check stub from us to fill out this form accurately. Once completed, attach Form 4852 to your 1040 or another appropriate tax form and send it to the IRS.

It's crucial to file your tax return on time, even if you haven't received your W-2. If necessary, you can request an extension from the IRS, but it's essential to be proactive to avoid potential penalties.

There is frequently a flurry of paperwork during tax season, with the W-2 form being one of the most important. But what happens when you don't have this essential document? The process might seem intimidating, but with the right resources and guidance, you can navigate this challenge. With our state-of-the-art online paystub generator , Check Stub Maker stands as a beacon, offering an accurate check stub file for those in this predicament. Let's delve deeper into some frequently asked questions to shed light on this topic.

The W-2 form is an official IRS document that employers use to report the annual wages of their employees and the amount of taxes withheld from their paychecks. This form provides a clear breakdown of an individual's earnings and tax deductions, making it a cornerstone for accurate tax filing. Without it, determining your tax obligations can be a complex task.

Every employee who has had any form of tax—federal, state, or other—deducted from their wages during the year can receive a W-2 from their employer. This form isn't just for full-time employees; part-time workers, seasonal staff, and others who have taxes withheld can also receive this document.

Absolutely! Employers are legally bound to furnish their employees with W-2 forms. If, for some reason, you haven't received yours by early February, it's prudent to reach out to your employer or the HR department. There could be simple reasons, like a change in your address, that might have caused a delay.

Yes, the IRS can be a fallback option. If your employer is unresponsive or unable to provide a W-2, you can call the IRS helpline at 1-800-829-1040. After verifying your identity, they can send you a copy of the W-2 if they've received one from your employer.

By law, employers are supposed to send W-2 forms to their employees by January 31st. Depending on mail services, if your employer adheres to this deadline, you should have it in hand by early February.

Based on our observations, not having a W-2 doesn't mean you're exempt from filing taxes. You can use IRS Form 4852 as an alternative, which acts as a substitute for the W-2. If you're unsure about your earnings, Check Stub Maker's paystub generator is a fantastic tool to help you estimate your income and various deductions and contributions, ensuring you don't miss out on any pivotal financial details.

Certainly! Especially in situations where your employer has ceased operations, the payroll service provider they used might still have your records. In this instance, they can generate and provide you with the necessary tax forms.

If your employer has gone out of business by the time you're ready to file your taxes, try reaching out to your former company's last known payroll service provider. If this avenue doesn't yield results, you can use Form 4852 from the IRS as it's designed to be a stand-in for the W-2 in such scenarios.

In mergers and acquisitions, the acquiring company assumes responsibility for all assets and liabilities, including employee records. In this instance, they should be able to provide you with your W-2. If there's any confusion, their HR department can guide you to the right place.

If you prefer the traditional method of mailing your tax returns, attaching your W-2 is crucial. If you don't have it, ensure you include Form 4852 as its replacement. Always try to mail your tax forms ahead of time, wherever possible, in case there are unforeseen delays with the postal service.

Unfortunately, no. The IRS doesn't provide automatic extensions based on the non-receipt of a W-2. If you foresee a delay in filing, it's best to proactively request an extension. While the absence of a W-2 can be stressful, there are clear pathways to ensure you file your taxes correctly. Tools like our pay stub creator can be a lifesaver, offering a streamlined way of using last pay stub to estimate taxes . With the right resources, tax season can be a breeze, even without the W-2.

Navigating the tax maze without a W-2 or paystub might have seemed daunting, but as you've seen in our guide, there are clear steps and tools available, like filing taxes with ein and pay stubs . At the heart of these solutions is us - Check Stub Maker. Our unwavering commitment to both businesses and individuals ensures that the complexities of payroll are simplified, as we can help you make paystubs and so much more - like getting a tax advance with pay stub . If you're aiming to make your tax season hassle-free, why not lean on our expertise? Everyone appreciates a helping hand with getting an estimate tax looking at paystub . Use our paycheck stub maker today, and let us be your guiding star in the payroll realm! Did you find the blog helpful? If so, consider checking out other guides:

!An Outline of our Net income Calculatorhttps://checkstubmaker.com/wp-content/uploads/2019/08/net-income-calculator-300x200.jpg Have you ever wondered what t...

Aug 29, 2019

If you're wondering how to make legit check stubs to get a car loan, utilizing a certified pay stub creator like ours at Check Stub Maker ensures that your pay stubs meet legal and professional standards.

Jul 02, 2024

Being critical to an employer’s success, employee engagement is essentially the emotional connection an employee does or does not have with their work. It ca...

Sep 26, 2022