How Many Pay Stubs for Mortgage?

Are you currently thinking of becoming a homeowner? A common question we encounter is "How many pay stubs for mortgage are needed”?

Feb 28, 2024If you've ever wondered, 'Can you use your last check stub to file taxes?' then the answer is yes.

If you've ever wondered, 'Can you use your last check stub to file taxes?' then the answer is yes. A check stub often accompanies your paycheck, detailing your earnings, deductions, and taxes paid. It even holds information about pay stub tax advances . While it's not a tax document per se, in certain situations, it's an excellent source of your financial history to help you better navigate tax season. Dive into our guide and discover the ins and outs of filing your taxes with and without a W2 form using Check Stub Maker's paycheck stub maker . Let's dig in! What this article covers:

While your last pay stub holds key financial details, it's not a complete substitute for the W-2 form. This guide delves into the intricacies of using pay stub for taxes , the importance of the W-2, and steps to take if it's missing. Whether you're considering e-filing or traditional methods, understanding these nuances ensures a smoother tax experience. Let's explore how to effectively use your last pay stub and the precautions to consider.

How do I file my taxes without a W2 or paystub ? You can file your taxes without a W-2, but the process might be more nuanced. While invaluable on its own, your last paycheck stub might occasionally lack some information needed to file a complete tax return. If you file a return with inaccurate or missing information, you might need to file an amended return, which could lead to additional tax preparation fees and delay your refund. That's why it's important to use a W-2 or any other relevant tax forms provided by the IRS, first and foremost.

Employers are required to provide Form W-2 to employees by January 31st. Many employers now offer electronic W-2s which are accessible earlier in the month. If your W-2 is missing, you can contact your employer or the IRS to get the necessary information.

Yes, you can get a W-2 from your employer. If February 1st has passed and you haven't received your W-2, you should contact your employer immediately. Even if the company has closed down, they can usually arrange for W-2s to be sent from their former payroll provider to you. If the company claims to have sent your W-2 but you haven't received it yet, they're obligated to provide a replacement, though they might charge you a nominal fee in some cases.

Yes, you can get a W-2 from the IRS if you don't get one from your employer. The IRS might have received tax information from your employer even if you haven't. After the Social Security Administration processes the W-2 information, they will send it to the IRS on your behalf.

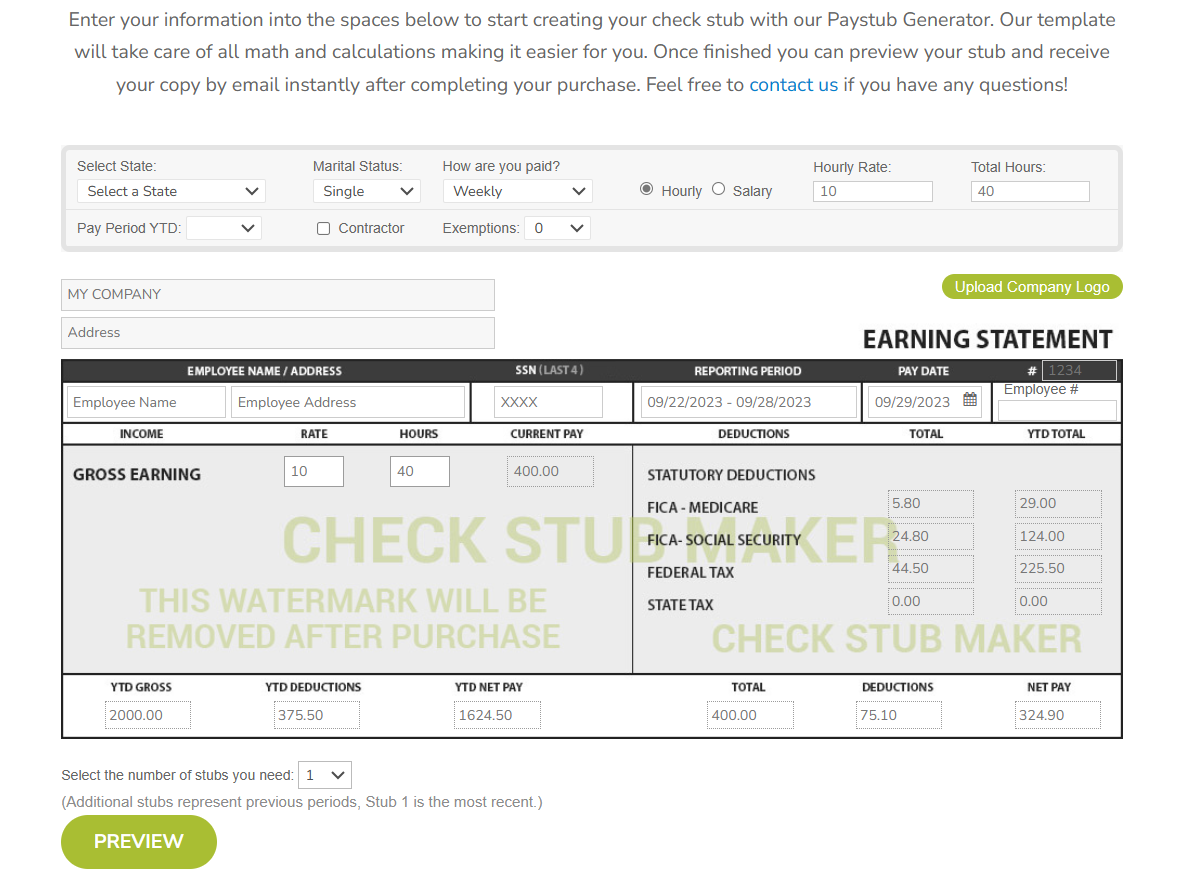

After making your pay stub with Check Stub Maker, it will often contain most of the information required to file your taxes. This includes:

If you're filing online (e-filing), you can use your check stub information, but there are certain conditions to meet. If you can't get your W-2, you can use IRS Form 4852 instead, which you can complete using your last pay stub. Always ensure the information is accurate to avoid penalties. While it's possible to file taxes with your last pay stub, it's always best to use your W-2 if available. If there are discrepancies after filing with your pay stub, you might need to file an amended tax return.

Navigating tax season can be complex, especially when missing essential documents like the W-2. However, with tools like our paystub generator , learning how to file taxes with paystub becomes a breeze, efficiently aiding in your tax filing process. But do you need pay stubs for taxes and still have to work out the process on your own? The answer is a resounding ‘no'. As your go-to expert in the payroll process, we at Check Stub Maker are here to guide you on leveraging that last check stub to your tax advantage. Let's look at some of the most common questions we get asked about the tax filing process and how your last pay stub curated by us can simplify the process for you.

As per our expertise, our paycheck stub maker allows you to select from all U.S. states, ensuring accurate calculation of state taxes. This feature ensures that your generated pay stub reflects precise state tax deductions, making it a reliable document for reference.

If your employer claims to have dispatched your W-2 but you haven't received it, it's essential to follow up on the matter. Employers are obligated to provide a replacement, possibly for a nominal fee. Through our trial and error, we discovered that any pay stub we produce can act as a temporary reference until you receive your W-2.

While the W-2 is the standard form for reporting wages, there are situations where you might use IRS Form 4852 as a substitute instead. If you're missing your W-2, Check Stub Maker offers a seamless way to generate accurate check stubs , so you can fill out this form, ensuring you provide the IRS with accurate income and tax information.

Learning how to do your taxes with a check stub is less daunting when you're armed with the right tools and knowledge. Our research indicates that using your last check stub to file your taxes, with or without a W-2 from the IRS, is indeed possible, but it's essential to ensure accuracy during every stage of the process. Check Stub Maker is your trusted advance paycheck stub calculator in the payroll process. Whether you're a business or an individual, our commitment is to simplify and demystify the world of pay stubs and taxes for you. Curious about making your tax journey and other payroll processes smoother, like how to figure out tax return with last pay stub ? Then use Check Stub Maker's paycheck stub maker today to make your tax filing easier for a smoother financial journey.If you want to learn more, why not check out these articles below:

Are you currently thinking of becoming a homeowner? A common question we encounter is "How many pay stubs for mortgage are needed”?

Feb 28, 2024

Are you working in the Education industry and wondering, ‘How can I get a copy of my pay stub if I am a teacher?'

Jul 02, 2024

When examining a pay stub, you might be wondering, ‘What does overtime look like on a pay stub?', especially in end of year pay stubs. Overtime, typically earned by working more than the standard 40-hour workweek, has its own unique way of showing up on pay stubs.

Dec 06, 2023