How to Access Pay Stubs If Your Not a Best Buy Employee Anymore

If you're pondering over how to access pay stubs if you're not a Best Buy employee anymore, there's no need to scratch your head in confusion anymore.

Oct 31, 2023Navigating the maze of tax season can be daunting, especially when you're faced with the burning question: "Do you need pay stubs for taxes?"

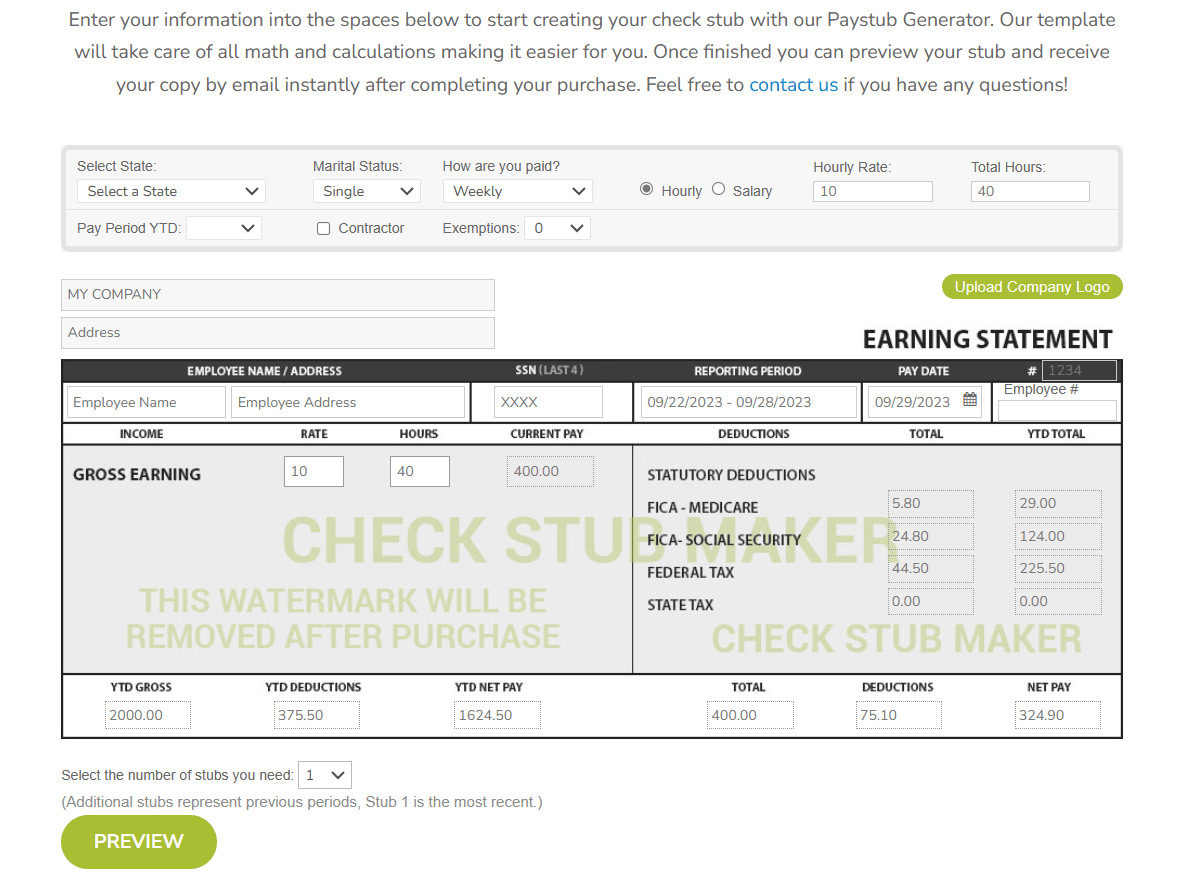

Navigating the maze of tax season can be daunting, especially when you're faced with the burning question: "Do you need pay stubs for taxes?" The simple answer is ‘yes'. Pay stubs provide a detailed breakdown of your earnings, deductions, and taxes paid throughout the year, making them invaluable when it's time to square up with the taxman. But what if you're missing a stub or two? With our state-of-the-art pay stub creator , we at Check Stub Maker ensure you're never left scrambling during tax season. Whether you're a seasoned tax pro or a newbie, we're here to guide you every step of the way with how to use last paystub to input tax information . Dive in, and let's demystify the world of pay stubs and taxes together! What this article covers:

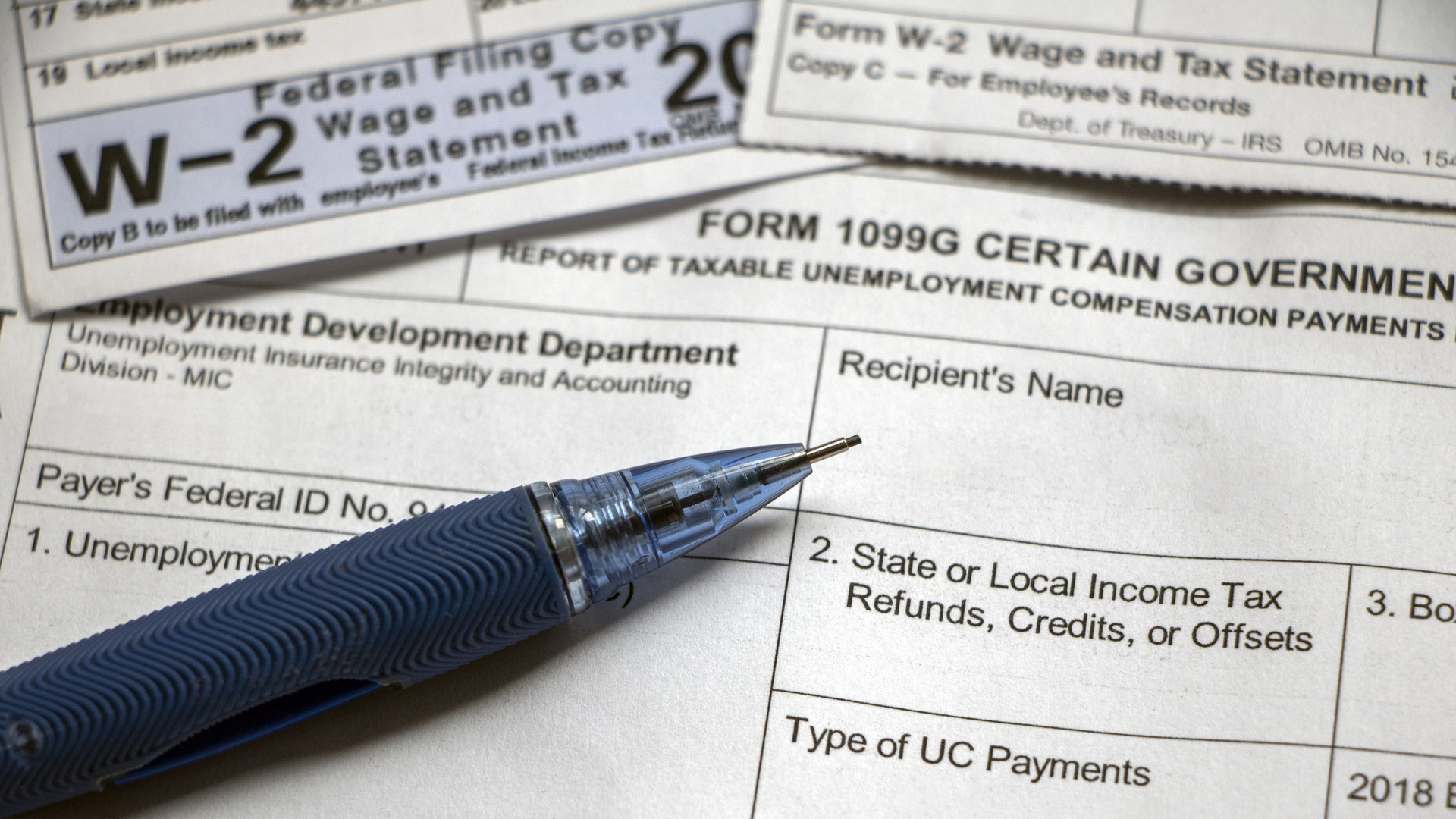

Tax season can be a stressful time, especially if you're missing crucial documents and wondering, ‘ how to estimate my taxes with final pay stub ?'. While the W-2 form is the standard document for tax filing, there are instances where you might find yourself without it. In such cases, your last pay stub can be very helpful.

If you're eager to get your tax refund as soon as possible, you might be tempted to file your taxes using the information on your last paycheck stub. However, it's essential to note that your last paycheck stub usually provides just a snapshot of your annual earnings. It could be missing some vital information required for a full tax return. If you're unable to obtain a W-2 from your employer, there are steps you can take. For instance, if your W-2 doesn't arrive by February, the IRS can assist you in obtaining the tax form from your employer or relevant financial institutions. This way, you can file your taxes using details from your last pay stub, such as:

Yes, you can use other IRS forms if you're unable to get your hands on a W-2 in time. In this situation, Form 4852 serves as a stand-in for the W-2 and is acceptable even if your employer's W-2 is late or inaccurate. To file taxes with your last check stub , you'll need Form 4852, which should be filled out with the utmost care to avoid errors and potential penalties. This form requires details like your wages, tips, and various tax deductions. Once completed, Form 4852 should be sent (physically or electronically) alongside your other tax documents.

Navigating the intricacies of tax documentation can be a challenge. Our findings show that one of the most common documents that comes into play is the pay stub. But what exactly is a pay stub, and how does it fit into the broader context of tax filing and income verification? Let's delve into the frequently asked questions about how to use pay stub to estimate taxes .

Your employer will provide you with a pay stub that lists your earnings for a specific pay period. It typically includes information about your gross wages, deductions, taxes, and net pay. It serves as a record of your income and is often used as proof of earnings.

As per our expertise, a pay stub typically contains the following information:

Pay stubs are primarily used as proof of income and can show you how to do your taxes with a check stub . They can be required in various situations, including:

### Why Are Pay Stubs Important?

### Why Are Pay Stubs Important?

Our investigation demonstrated that pay stubs are important because they provide a detailed record of your earnings and deductions and can help you use your last check stub too file taxes . They also ensure that employees are paid correctly and can be used to verify income for various financial transactions.

It's advisable to keep pay stubs for at least a year. At the beginning of the year, when you file your taxes, your last pay stub can be useful, especially if there are discrepancies with your W-2 form. If you're transitioning to digital records, ensure you have backups and consider shredding physical copies after scanning to keep your financial information private and secure.

While federal law doesn't mandate employers to provide pay stubs, doing so ensures transparency in the payroll process. Based on our firsthand experience, it allows employees to understand their earnings and deductions better and provides a record that can be used for various financial purposes.

If you don't have a pay stub, you can use alternative proof of income documents like bank statements or tax returns. In some cases, if you've misplaced your check stubs , you can use online tools like Check Stub Maker to generate them.

If you lose a pay stub, first check if you have a digital copy saved. If not, contact your employer's HR or payroll department to request a duplicate. Alternatively, online platforms like Check Stub Maker can help you recreate a pay stub if needed.

In wrapping up, the age-old question, "Do you need pay stubs for taxes?" gets a resounding "Yes!" These handy documents not only provide a clear snapshot of your earnings and deductions but also play a pivotal role in ensuring a smooth tax filing process and helping you with filing taxes with last paycheck stub . With a deep-rooted commitment to clarity and precision, we at Check Stub Maker have been simplifying payroll intricacies for both businesses and individuals alike with our trusty paystub maker for years. We ensure that you're not just filing taxes but doing so with the utmost accuracy. So why not give Check Stub Maker a whirl? Dive in, explore our services to help you make simple check stubs , and let us be your guiding star in the world of taxes. If you want to learn more, why not check out these articles below:

If you're pondering over how to access pay stubs if you're not a Best Buy employee anymore, there's no need to scratch your head in confusion anymore.

Oct 31, 2023

There are many reasons why you might need to prove your address - from opening a bank account to renting an apartment. So, you might be wondering, ‘Is a pay stub proof of residency?'.

Feb 28, 2024

!What Taxes Are Taken out of My Paycheck?https://checkstubmaker.com/wp-content/uploads/2019/06/Paycheck-Taxes-Taken-Out-300x200.jpg Receiving your paycheck c...

Jun 06, 2019