How to Make Pay Stubs for Employees

!How to Make Pay Stubs for Employeeshttps://checkstubmaker.com/wp-content/uploads/2018/10/employee-receives-pay-stub-300x200.jpg For small business owners, d...

Oct 16, 2018A military pay stub, also known as a Leave and Earnings Statement (LES), is a detailed bi-monthly statement for army personnel.

A military pay stub, also known as a Leave and Earnings Statement (LES), is a detailed bi-monthly statement for army personnel. It outlines their pay, entitlements, deductions, and leave balance. It's an essential tool for managing military finances and ensuring that all your payments and deductions are accurate. At Check Stub Maker , our pay stub creator can help you easily generate pay stubs which correctly reflect your army payroll records. In this article, we'll discuss what an LES is, how to get one, and key fields such as entitlements, tax deductions, and Thrift Savings Plan (TSP) details which generally appear on military pay stubs. What this article covers:

A Leave and Earnings Statement (LES) is provided to military personnel twice a month, outlining their pay, entitlements, deductions, leave information, and tax withholdings. Based on our first-hand experience at Check Stub Maker, an LES is the army equivalent of a civilian pay stub, offering a comprehensive breakdown of your income and financial adjustments.

A typical LES features sections like:

Here is an example of what a typical military LES looks like in practice: Example: Military Leave And Earnings Statement ------------------------------- MILITARY LEAVE AND EARNINGS STATEMENT (LES) --------------------------------- Identification: Name: John Doe SSN: XXX-XX-1234 Rank: Sergeant (E-5) Pay Grade: E-5 YTD Earnings: $35,000 Branch: Army Date Of Enlistment: 01-Jan-2015 ----------------------------------------------------------------------------- Entitlements: Basic Pay: $3,000 BAS (Basic Allowance for Subsistence): $400 BAH (Basic Allowance for Housing): $1,200 Special Pay: $150 (Hazardous Duty) ----------------------------------------------------------------------------- Deductions: Federal Tax: $450 FICA-Social Security: $186 FICA-Medicare: $43 State Tax: $50 SGLI (Servicemembers' Group Life Insurance): $25 ----------------------------------------------------------------------------- Leave Information: Leave Balance: 30 days Leave Taken: 5 days Current Leave: 25 days ----------------------------------------------------------------------------- Federal Tax Information: Federal Taxable Wages: $2,900 Federal Tax Withheld YTD: $5,400 FICA Information FICA Taxable Wages: $3,000 FICA Withheld YTD: $2,178 State Tax Information State Taxable Wages: $2,900 State Tax Withheld YTD: $600 ----------------------------------------------------------------------------- Thrift Savings Plan (TSP) Information: TSP Contributions: $300 TSP Loan Repayment: $50 ----------------------------------------------------------------------------- This sample LES provides a clear overview of a typical military pay stub, helping you understand the key sections and their significance.

Similar to an online teacher paystub , service members can access their bi-monthly LES through the MyPay website, which is managed by the Defense Finance and Accounting Service (DFAS) . If you want to know how to get pay stubs as a server in the military, all you need to do is log in with your MyPay credentials. Next, you'll navigate to the "Leave and Earnings Statement" section to view and download your LES. Based on our observations, regularly checking your LES ensures that any potential discrepancies in your payroll are promptly addressed should they arise.

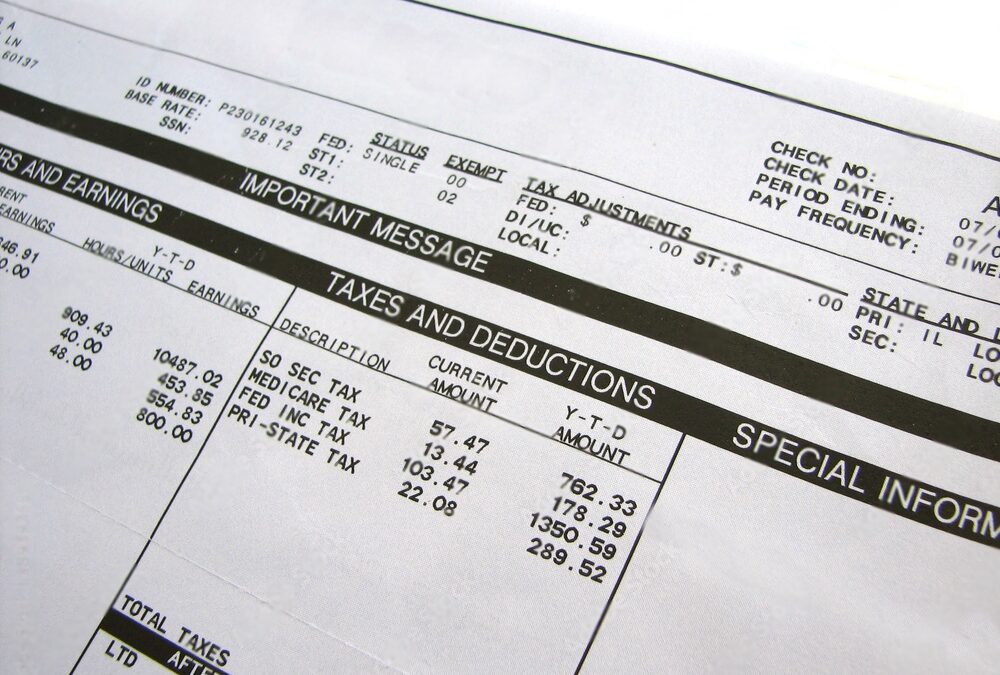

Let's look at how to read a Defense Finance and Accounting Service pay stub section by section.

These fields include personal and professional identification details such as your:

These sections detail various types of pay and allowances on a military disability pay stub and the like. This includes aspects such as your:

As per our expertise in payroll services, these deductions are often sub-categorized into taxes, insurance premiums, and retirement contributions for army personnel. Understanding these fields helps you identify your net income and money-related obligations when you make paystubs with us at Check Stub Maker.

This section provides data on leave balances, including accrued leave and leave taken. Our research indicates that it helps track available leave days and any adjustments made to leave balances, helping you make the most of your earned time off from military duty.

These fields provide a helpful snapshot of your tax obligations and withholdings for the pay period. These fields show elements such as:

This is vital for understanding federal tax responsibilities and planning accordingly when service members get paid twice a month and receive their military check stubs .

This section details your Social Security and Medicare contributions. Our investigation demonstrated that this includes the amounts deducted for FICA taxes. This ensures contributions towards future benefits, which is important for your long-term financial planning.

This section deals with your:

These fields cover any additional pay details that weren't included in the earlier sections. Through our practical knowledge, it can include:

When you create pay stubs with us at Check Stub Maker, our intuitive digital platform can accurately calculate your additional income within minutes.

This section outlines your contributions to the Thrift Savings Plan (TSP) , the military's retirement savings program. Drawing from our experience, it also includes:

By understanding each section and what it entails, you can manage your finances more effectively and ensure all your payroll data is correct and up to date.

Understanding your military pay stub, particularly the Leave and Earnings Statement (LES), is essential for effective financial management. At Check Stub Maker , we can simplify and enhance your army paperwork, including that for an OPM pay stub and more, giving you quick and accurate results every time. So, what are you waiting for? Use our pay stub generator now to make your payroll process infinitely easier! Did our blog meet your needs? You might also find our other guides helpful:

!How to Make Pay Stubs for Employeeshttps://checkstubmaker.com/wp-content/uploads/2018/10/employee-receives-pay-stub-300x200.jpg For small business owners, d...

Oct 16, 2018

Do you need pay stubs to buy a car? Yes, you do!

Jul 02, 2024

When you receive a paystub p, it's packed with important financial information, but understanding all the details can be a challenge. One common question is, "What does advice date mean on a pay stub?"

Dec 06, 2023