Figuring out ‘how to calculate W2 wages from paystub’ is crucial for accurate tax reporting and financial planning.

This guide will cover the detailed process of calculating W-2 wages, including how to ascertain gross income, adjust for various deductions, remove non-taxable income, compute yearly taxes, and tally total W-2 income.

We'll also explore an example of a W-2 calculation, its importance, as well as the differences between a W-2 and a pay stub.

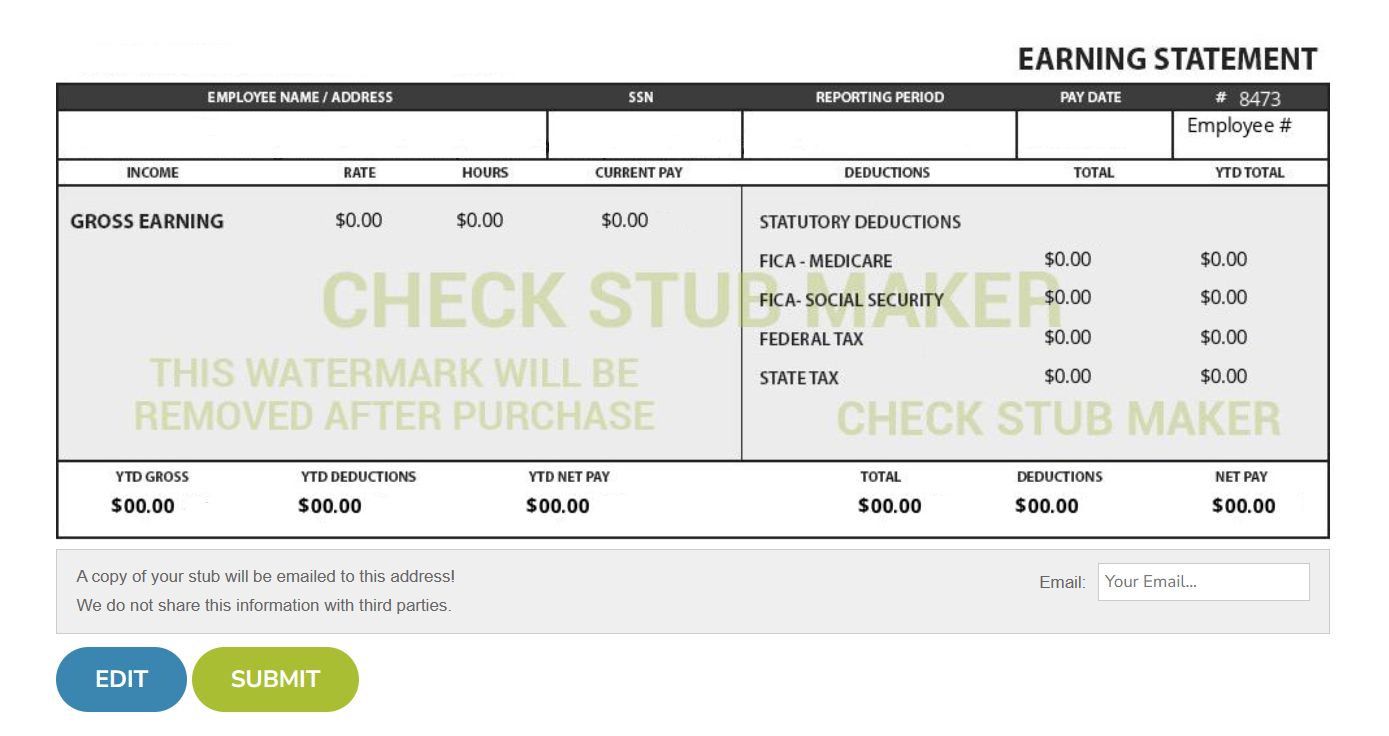

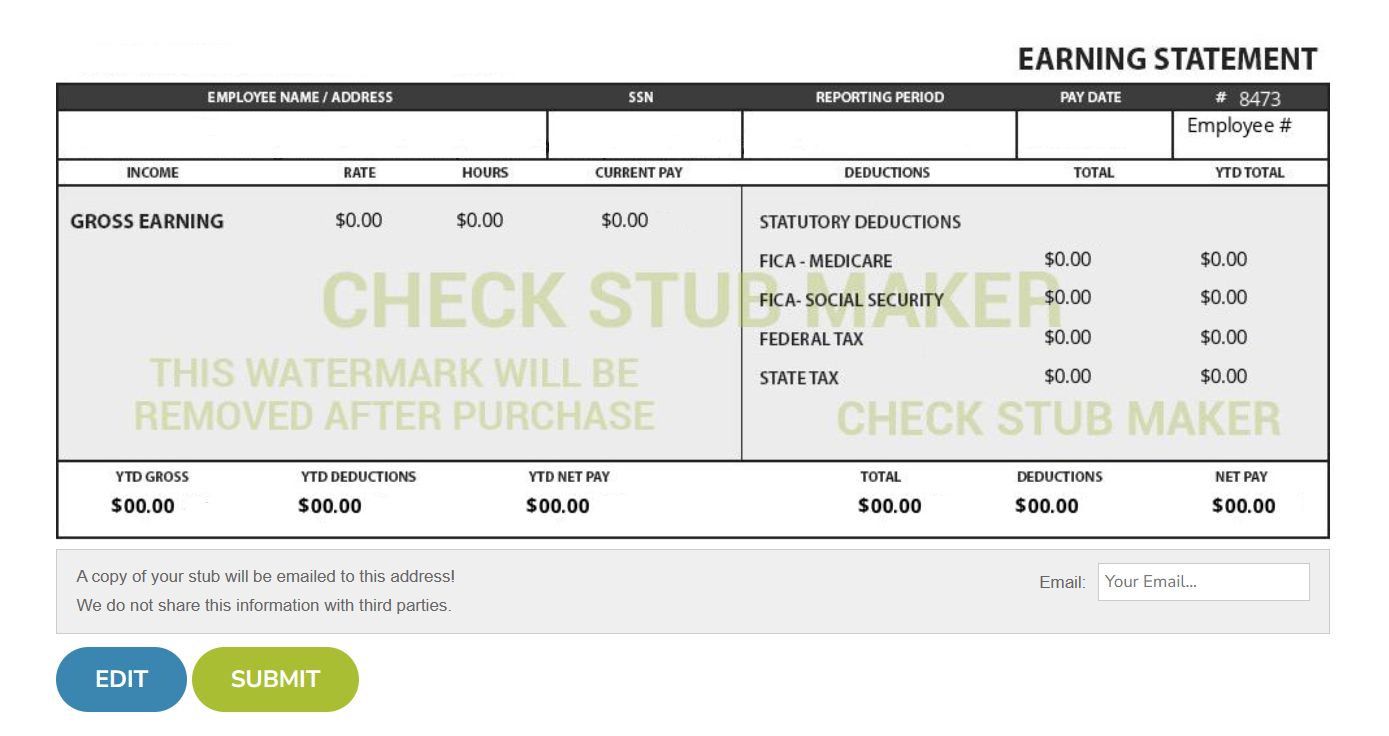

With our trusted pay stub deductions calculator at Check Stub Maker , you’ll learn exactly how to determine W-2 earnings by understanding the steps involved in translating pay stub details into W-2 form figures.

Let’s dive into the details and simplify your end-of-year payroll reporting.

What this article covers:

How Do You Calculate W-2 Wages From a Paystub?

The first step involves identifying the total gross income on the pay stub, including all forms of compensation such as:

- hourly wages

- salaries

- bonuses

- overtime pay

Next, it's important to adjust for any taxable and non-taxable adjustments. This means accounting for benefits and reimbursements that can affect taxable income.

Lastly, you should always confirm the final taxable wage amount listed on the pay stub with what will be reported in Box 1 of your W-2. This figure should represent your pay after deductions but before tax withholdings.

From learning how to how to calculate AGI from paystub and calculating W-2 wages from a pay stub, they’re all vital for precise tax reporting and payroll management.

At Check Stub Maker, our paystub maker simplifies this verification process, ensuring that all your pay stub particulars are correct and up-to-date.

1. Calculate Gross Income

Calculating gross income involves totaling all earnings listed on the pay stub, which includes:

- regular pay

- overtime

- any bonuses

- miscellaneous income (tips, commissions, or other wages)

If you earn a salary, it's crucial to multiply the annual salary as reported on your pay stub by the number of pay periods per year. This method ensures that the gross income reflects your total wages before any deductions.

Ensuring that you sum up all earnings before any deductions, along with learning how to calculate pay stub with tips and to it , is key to getting the correct gross income figure.

Our check stubs maker carefully factors in these variables to provide a comprehensive and precise calculation.

2. Look At Other Deductions

Based on our observations, key deductions when calculating W-2 wages from a pay stub include:

- contributions to retirement accounts

- health savings accounts

- union dues

- uniform expenses

- transportation or parking benefits

- other pre-tax benefits or job-related expenses

These pre-tax deductions reduce the gross income before tax calculations. That’s why it's important to subtract these amounts to arrive at an accurate taxable income figure.

These deductions can significantly lower taxable income and must be included in your calculations.

In this context, your pay stubs help you check these contributions to ensure they’re accounted for correctly in your calculations.

At Check Stub Maker, our paystub generator automatically identifies and subtracts these deductions, simplifying the payroll process for you.

### 3. Remove Non-Taxable Income

### 3. Remove Non-Taxable Income

Removing non-taxable income from the pay stub is a vital step in ensuring that the W-2 reflects the correct taxable wages.

Our research indicates that typical examples of non-taxable income are:

- employer reimbursements for travel or meals

- health insurance premiums and life insurance premiums that are paid pre-tax

- educational assistance and adoption assistance benefits with certain exemptions

- disability insurance payouts paid by the employer categorized as non-taxable

- other work-related expenses

These shouldn’t be included in the taxable income calculations since they’re exempt.

These amounts significantly reduce the gross income that will be reported on the W-2. Using our paystub creator can help you subtract these benefits to avoid overestimating your taxable income.

4. Calculate Yearly Taxes

Our findings show that calculating your annual taxes involves totaling all federal, state, and local tax withholdings as displayed on your pay stub is essential.

This step ensures that these withholdings match the tax amounts that will eventually appear on your final W-2 document.

Knowing how to calculate Medicare wages from paystub as well as using a Social Security wages from paystub calculator is also important. These taxes are levied at flat rates on your income up to a certain limit.

Additionally, checking for any additional state-specific taxes that might have been withheld throughout the year is vital. This is especially significant if there were any mid-year adjustments or changes in filing status (such as getting married or changing jobs) that could impact your overall tax responsibility.

At Check Stub Maker, we automate this process, verifying the accuracy of all tax withholdings to ensure that your W-2 forms reflect the correct tax amounts.

5. Calculate Total W-2 Earnings

The final step in calculating W-2 wages from a pay stub is to aggregate all taxable wages after accounting for all deductions and exclusions.

This means adding up all taxable wages to determine the final W-2 earnings figure. This practice ensures that your taxable wages are thoroughly accounted for and correctly reported.

Confirming that the total wages figure matches the year-to-date earnings reported at the end of your last pay stub for the year is crucial. Through our trial and error, we discovered that this prevents discrepancies in the reported taxable income, ensuring the continuity of your financial records.

Additionally, using any year-end bonuses or adjustments included on the final pay stub is essential for ensuring complete accuracy. We recommend incorporating these adjustments into the final calculation to reflect your true annual earnings.

Additionally, using any year-end bonuses or adjustments included on the final pay stub is essential for ensuring complete accuracy. We recommend incorporating these adjustments into the final calculation to reflect your true annual earnings.

This step, along with double-checking against the Social Security wage base for precise reporting on your tax forms, confirms the integrity of the W-2 forms you prepare.

From showing you how to calculate a missing paystub or using existing pay stubs to calculate your W-2, we at Check Stub Maker are payroll experts you can consistently trust.

What Is an Example of a W-2 Wage Calculation?

Let’s consider a scenario where an employee earns a gross income of $50,000 annually and needs to do a W-2 wage calculation.

Based on our first-hand experience at Check Stub Maker, the initial step involves subtracting any pre-tax contributions, such as $5,000 for retirement and $1,000 for health premiums. This will lower their taxable income to $44,000.

$50,000 (employee’s gross income) - $6,000 (retirement and health insurance premiums) = $44,000If the employee also receives $3,000 in non-taxable reimbursements and has $2,000 in other deductions, their taxable income further adjusts to $39,000.

$44,000 (employee’s gross income after removing pre-tax contributions) - $5,000 (non-taxable reimbursements and other deductions) = $39,000From this adjusted taxable income, federal, state taxes, and other withholdings must be subtracted to align with the W-2 reported earnings.

Actual calculations might vary based on additional factors like specific tax credits or other state-specific deductions.

This scenario gives a clear view of how deductions and adjustments impact the final taxable income, ensuring compliance with IRS regulations.

What Is the Importance of a W-2 Wage Calculation?

Our investigation demonstrated that accurate calculations are critical for several reasons:

- Filing Correct Tax Returns: Correct filing personal income taxes can help you determine tax refunds or amounts owed. Moreover, correct W-2 wage calculations contribute to correct Social Security and Medicare contributions, which directly affect your future benefits.

- Ensuring IRS-Compliance: Filing the correct taxes can help you avoid penalties from the IRS for underreporting income.

- Maintaining Legal And Financial Standing: Having accuracy in these W-2 calculations taken from your pay stub can help you maintain legal and financial integrity in all your transactions.

- Enhancing Eligibility For Transactions: For lenders and creditors, these W-2 pay stub calculations provide a clear financial picture for loans or credit applications.

What's the Difference Between a W-2 and a Paystub?

What's the Difference Between a W-2 and a Paystub?

As per our expertise, a pay stub provides detailed information about each paycheck, which includes gross pay, deductions, and net pay per pay period. It serves as an immediate record of payment details for each pay cycle.

Conversely, the W-2 form summarizes the year’s total earnings, taxes withheld, and final taxable income, and is primarily used for annual tax filing purposes. The W-2 is essential for both the employer and the IRS to confirm an employee’s annual wages and tax liabilities.

While pay stubs from us at Check Stub Maker show pre-tax deductions and net pay, the W-2 reflects the income after such deductions have been applied, which becomes critical for precise tax reporting.

This includes additional tax information not typically detailed in each pay stub, such as:

- federal taxes withheld

- state taxes withheld

Understanding these differences helps employees verify the accuracy of their reported earnings and deductions over the course of a year.

How to Fill in a W-2 Using a Pay Stub FAQs

Why Is The Gross Amount On Your End-Of-Year Pay Stub Different From The Amount On Your W-2?

Based on our first-hand experience, discrepancies between the gross amount on your end-of-year pay stub and the amount on your W-2 typically arise from the following scenarios:

- non-taxable deductions and employer contributions that aren’t reflected in the gross total of the pay stub

- seasonal bonuses or corrections made after the last pay period

- payroll processing errors or changes in tax laws throughout the year

Can I Use A Self-Employment Ledger To Calculate The W-2 Wages?

While a self-employment ledger can help estimate taxable income for setting aside estimated tax payments, it differs significantly from W-2 calculations.

Drawing from our experience at Check Stub Maker, a self-employment ledger lacks specific withholding information, which is crucial for W-2 forms. Instead of a ledger, we recommend that self-employed individuals use IRS Form 1040 to report their earnings and expenses on tax returns.

Distinctions between the two are vital for understanding the different financial documentation needs of employed versus self-employed individuals.

Conclusion

As we’ve explored throughout this guide, learning how to calculate W2 wages from a pay stub is essential for accurate tax filing and a clear understanding of your financial status.

We take pride in offering payroll tools that simplify these calculations, ensuring you can confidently manage payroll and tax reporting.

If you're seeking reliable and efficient payroll solutions, we invite you to try out our pay stub generator today. It’s designed to make your payroll experience smoother and more precise, helping you save time and reduce errors.

So, what are you waiting for?

Visit us at Check Stub Maker now and discover how effortlessly we can enhance your payroll processes in time for tax season.

Did our blog meet your needs? You might also find our other guides helpful:

### 3. Remove Non-Taxable Income

### 3. Remove Non-Taxable Income Additionally, using any year-end bonuses or adjustments included on the final pay stub is essential for ensuring complete accuracy. We recommend incorporating these adjustments into the final calculation to reflect your true annual earnings.

Additionally, using any year-end bonuses or adjustments included on the final pay stub is essential for ensuring complete accuracy. We recommend incorporating these adjustments into the final calculation to reflect your true annual earnings. What's the Difference Between a W-2 and a Paystub?

What's the Difference Between a W-2 and a Paystub?