What Is RSU Offset on Paystub?

Curious about ‘What is RSU offset on paystub'? Restricted Stock Units, or RSUs for short, are company shares given to employees as part of their compensation.

Aug 01, 2024Have you ever faced the headache of an absent pay stub?

Have you ever faced the headache of an absent pay stub?

At Check Stub Maker , we understand how crucial every pay stub is for maintaining accurate financial records. That's why we offer a reliable missing paystub calculator that simplifies the recreation of any lost documents.

Whether you’re an employer who needs to reconstruct a pay stub or an employee seeking to verify your income details, our tools make the process effortless.

In this guide, we'll walk you through how to calculate a missing pay stub, covering everything from filling in employee details to generating a replacement pay stub. With our comprehensive pay stub creator , we can save you time, ensuring accuracy and compliance with your tax obligations.

Let's get started on guaranteeing that your payroll is never incomplete again.

What this article covers:

Let’s look at how you can calculate the value of a missing pay stub based on your existing payroll documentation.

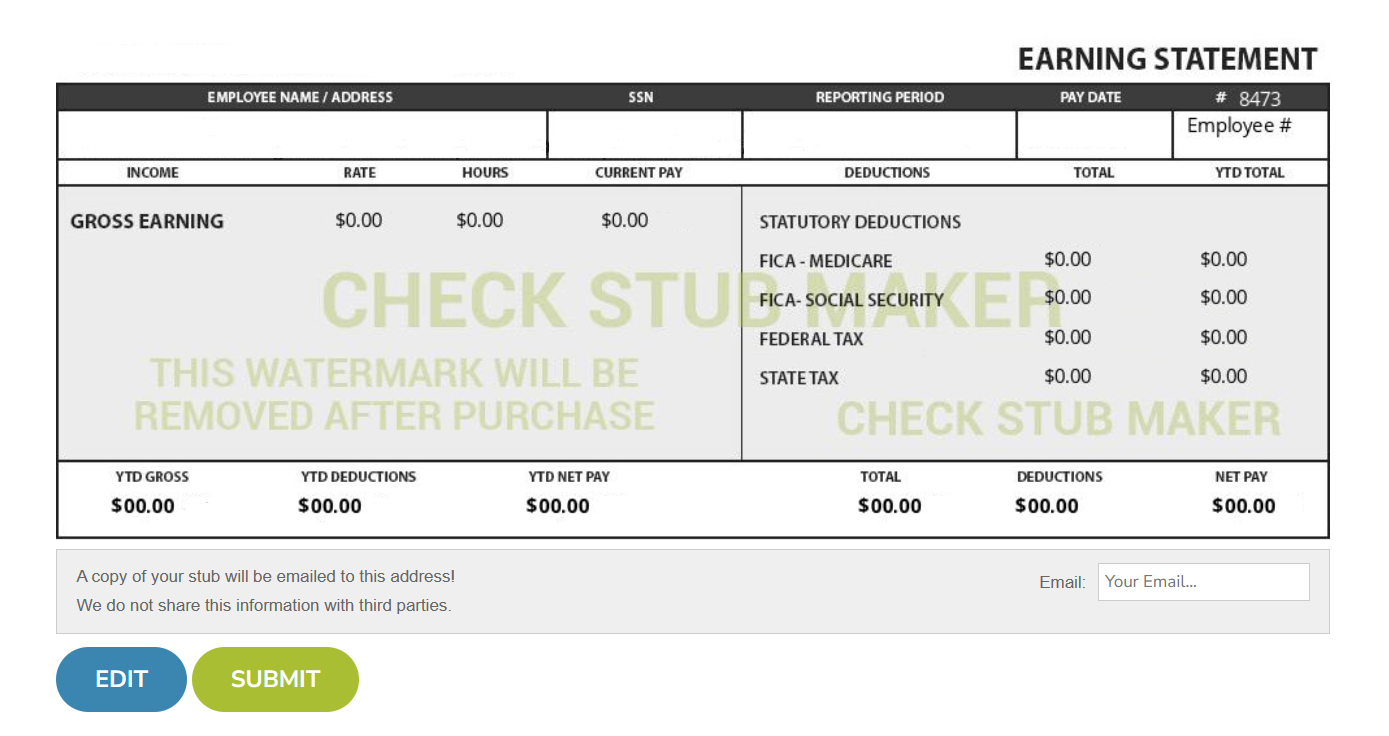

At Check Stub Maker, you’ll start the process of recreating a missing pay stub by navigating to our paystub maker page.

Next, you’ll gather comprehensive employee details, such as their:

As per our expertise, this allows us to tailor the pay stub to reflect specific role-related allowances or deductions, ensuring each pay stub we generate is as organized and accurate as the original.

This meticulous approach to detail guarantees that all your subsequent calculations are based on correct data, minimizing potential errors in payroll and tax reporting. It also supports adherence and employee satisfaction by providing clear and precise earnings statements.

Through our practical knowledge, we know that correctly reconstructing pay information is key to generating a reliable pay stub.

This includes entering the employee’s:

Our Check Stub Maker calculator also factors in any previous pay adjustments that might affect the current pay period.

By using our comprehensive approach, you can replicate the original document as closely as possible while also showing you how to calculate taxes on pay stub to maintain continuity in banking records.

### 3. Input Any Additional Pay

### 3. Input Any Additional Pay

When reconstructing a missing pay stub, it’s important to account for all sources of income.

Our investigation demonstrated that including details like commissions, tips, and other gratuities is essential. This guarantees the completeness of the pay stub, reflecting the total earnings precisely for the given period.

You should also add any allowances for travel, meals, or housing that were part of the employee’s compensation package during the pay period in question. This includes recording miscellaneous income such as severance pay or awards.

At Check Stub Maker, we ensure that every dollar is accounted for, providing a full and fair representation of an employee’s wages.

Recording the employee’s withholding status from their W-4 form with precision is the first step in calculating the correct federal tax withholding.

After putting it to the test, our paystub generator then applies the current IRS tax tables to compute your federal income tax, alongside Social Security and Medicare taxes.

By showing you how to calculate Medicare wages from paystub as well as using a Social Security wages from paystub calculator , we guarantee that each deduction is calculated with precision.

Ultimately, this will reflect the correct tax obligations based on the employee's earnings and filing status.

### 5. Fill In The State Tax Information

### 5. Fill In The State Tax Information

State taxes can vary widely, and our research indicates that it's crucial to input state-specific tax details accurately.

This includes:

State-specific unemployment insurance contributions should also be considered in this instance.

After trying out this product, our check stub calculator automatically adjusts to account for these variables, offering employers and employees peace of mind that the reconstructed pay stub adheres with relevant tax laws.

After all the data is inputted and verified, the final step in our process is to generate the new pay stub.

Our findings show that using advanced online pay stub generators like ours simplifies this process, automating calculations and formatting to produce a precise and professional-looking payroll document.

Before finalizing, we offer the option to check the pay stub one more time using our ‘Preview’ feature, allowing corrections and adjustments as needed.

Once everything is confirmed as correct, your pay stub is ready to be downloaded and distributed, ensuring that you maintain complete and compliant payroll records.

Managing employee payments in-house can seem daunting, but with tools like Check Stub Maker, it’s a straightforward and manageable task.

Through our trial and error, we discovered that our easy-to-use platform allows anyone to quickly create customized pay stubs in minutes - and all without the need for complex financial software.

From learning vital calculations like how to calculate your adjusted gross income from pay stub and the like, our DIY tools are accessible and cost-effective. This offers accuracy and adherence with federal and state regulations by automatically calculating deductions and taxes.

Our hands-on approach to digital payroll not only saves businesses money but also empowers them to take full control of their finances.

Conclusion

ConclusionIn this guide, we looked at how you can make use of a missing paystub calculator to retrieve your invaluable paperwork.

We pride ourselves on offering reliable and efficient financial solutions that meet the needs of both small businesses and self-employed users.

Our expertise ensures that every pay stub generated is accounted for and accurate, helping to maintain employee satisfaction and legal conformity.

If you're looking for a way to simplify your employee payments, avoid errors, and guarantee compliance, why not try our services at Check Stub Maker today?

Use our pay stub generator now to seamlessly recreate any missing documents and manage your entire payroll with ease.

If you want to learn more, why not check out these articles below:

Curious about ‘What is RSU offset on paystub'? Restricted Stock Units, or RSUs for short, are company shares given to employees as part of their compensation.

Aug 01, 2024

They’re inconvenient, frustrating, and can feel unfair. Nonsufficient fund fees and overdraft fees can hit you when you least expect it. Typically, they occu...

Oct 06, 2022

!High-Quality and Professional Check Stub Makerhttps://checkstubmaker.com/wp-content/uploads/2018/12/professional-checkstub-300x200.jpg If you are looking to...

Dec 19, 2018