Paystub Generator – Unlock This Game Changing Service for the Self-Employed

Paystubs are arguably one of the most important documents to any business, big or small. But if you’re self-employed, its importance is far greater. It is up...

Aug 23, 2022Welcome to our informative Check Stub Maker guide on non-negotiable pay stubs!

Welcome to our informative Check Stub Maker guide on non-negotiable pay stubs!

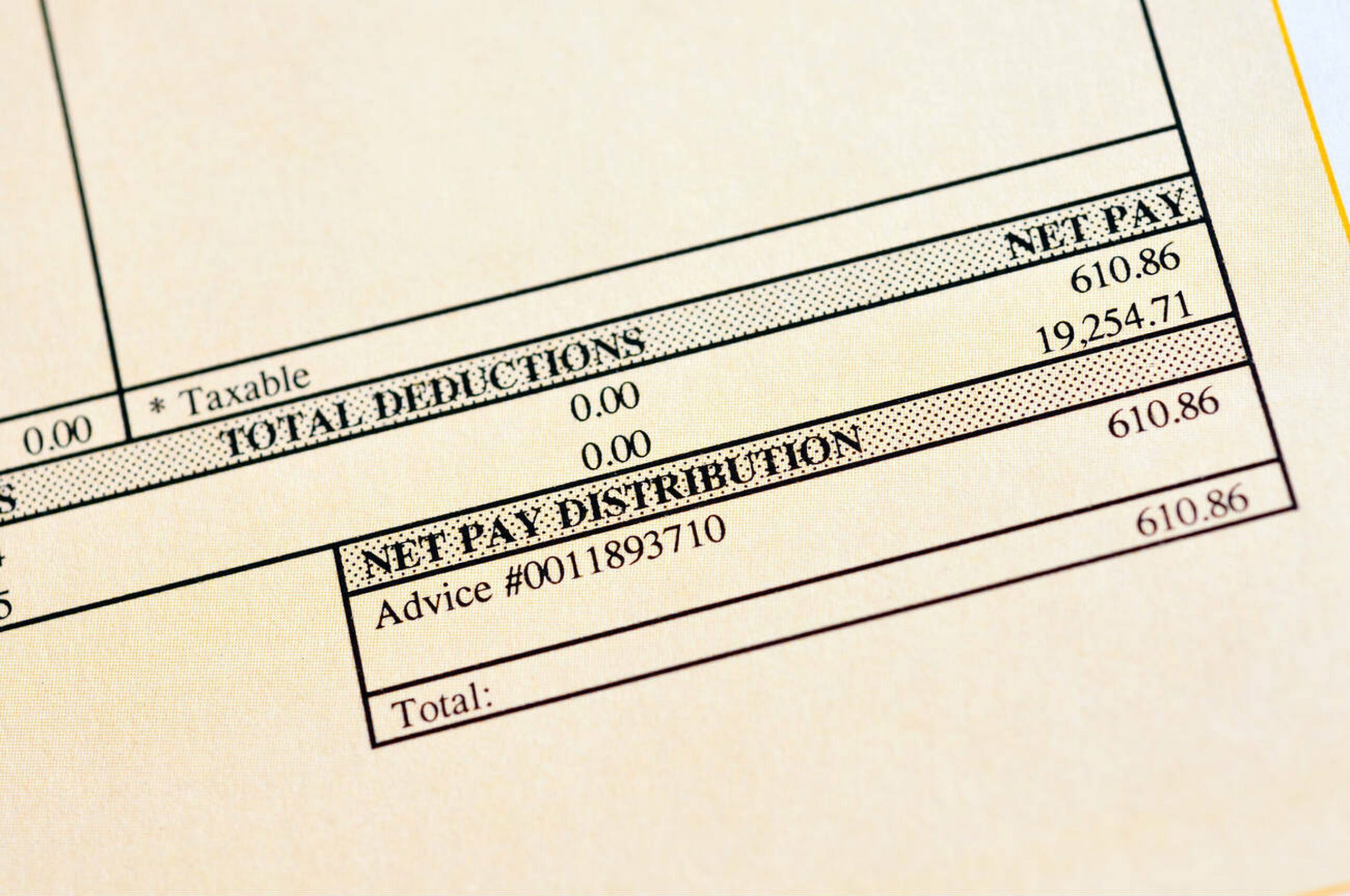

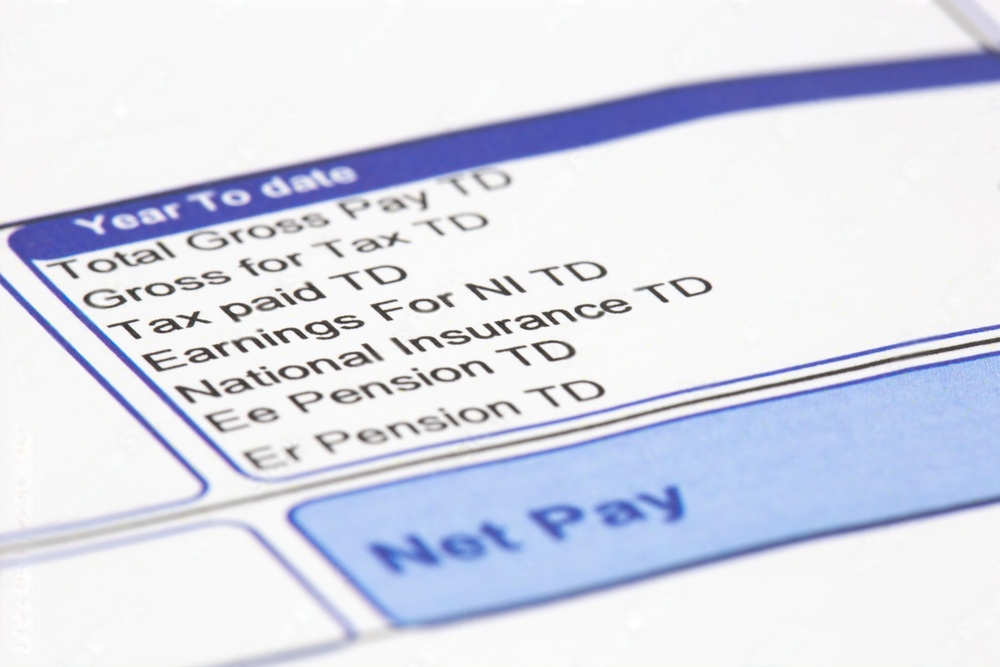

As per our expertise, a non negotiable pay stub provides a comprehensive summary of an employee's earnings, taxes, and deductions but which cannot be cashed or used as a financial instrument.

It's crucial for confirming direct deposit details, loan applications, or verifying income. This document, marked "non-negotiable" to differentiate from actual checks, is integral for payroll transparency.

With our pay stub generator , we simplify your payroll calculations in a matter of minutes.

In this blog post, we'll explain what 'non-negotiable' means, delve into non-negotiable checks and their characteristics, and answer common questions around this pivotal banking paperwork.

Let’s get started!

What this article covers:

When a check stub says "non-negotiable," it means the recipient can't cash or deposit it since it's only meant for record-keeping purposes.

The stub is often paired with a direct deposit setup where employees receive their wages directly into their bank accounts, rather than being issued a physical check.

It guarantees transparency by providing detailed information like gross pay, deductions, and net pay without the risk of being misused for monetary gain by third parties.

Our investigation demonstrated that employers issue non-negotiable stubs to protect against theft and confirm that employees are receiving accurate payments.

In other words, a non-negotiable pay stub verifies your salary or wages via direct deposit, which reduces the chances of fraud and ensures that the correct payment goes to you and not anyone else.

At Check Stub Maker, we work hard so that your paystubs are precise and secure to consistently receive your hard-earned cash.

What Is a Non-Negotiable Check?

What Is a Non-Negotiable Check?A non-negotiable check cannot be exchanged for cash or transferred to another party.

Employers issue these checks when direct deposits are set up, marking them as "non-negotiable" to prevent theft or tampering. For instance, a non-negotiable check can't be cashed if someone other than the intended recipient tries to deposit it.

These checks are issued under strict conditions, serving more as a secure document outlining payment details rather than as a usable check. They offer security by guaranteeing that financial data isn't altered and ensuring that no one can misuse it to gain money fraudulently.

Through our practical knowledge at Check Stub Maker, we found that non-negotiable checks are essential for confirming direct deposit transactions and providing accurate information of your transactions. This is also the case for our check stubs .

Non-negotiable checks often include clear markings like "VOID" or "NON-NEGOTIABLE" to indicate that they can't be cashed. Additionally, they typically contain payroll data like earnings and deductions for direct deposit verification.

Our findings show that the purpose of these non-negotiable check characteristics is to ensure that funds are only accessible to the designated recipient while offering a reliable record of payment for the sender.

As such, these documents guarantee precise payroll processing by providing comprehensive details without monetary value, thus preventing unauthorized endorsements.

Non-Negotiable on Paystubs FAQ

Non-Negotiable on Paystubs FAQOther non-negotiable documents include:

Based on our observations at Check Stub Maker, the primary function of this paperwork ensures accurate banking activities and prevents unauthorized transfers. This is key for businesses needing secure transactions and thorough record-keeping processes.

A negotiable instrument is a financial document guaranteeing payment to the holder.

Examples of negotiable instruments which are legally binding include:

They offer the flexibility to be endorsed and transferred between parties like cash. Their transferability ensures liquidity, providing quick access to funds for the holder.

Our research indicates that negotiable instruments are crucial for commercial transactions and follow specific legal requirements under the Uniform Commercial Code .

Conclusion

ConclusionIn this blog post, we highlighted how a non negotiable pay stub clarifies your payroll transactions while preventing unauthorized use.

With our user-friendly paystub generator , you can simplify payroll by quickly calculating accurate deductions and creating secure, compliant pay stubs.

So, what are you waiting for?

Try out Check Stub Maker now, and we’ll help you focus on what matters most: growing your business with our reliable and secure pay stub site .

And that’s not negotiable.

If you want to learn more, why not check out these articles below:

Paystubs are arguably one of the most important documents to any business, big or small. But if you’re self-employed, its importance is far greater. It is up...

Aug 23, 2022

Welcome to our guide on pay stub information. From your gross pay to your deductions, your pay stub is a concise and accurate reflection of your financial journey.

Feb 28, 2024

!Small Business Online Payroll Stubshttps://checkstubmaker.com/wp-content/uploads/2018/10/small-business-payroll-stubs-300x200.jpg Small business is the back...

Oct 16, 2018