Keeping Pay Stubs

With springtime comes spring cleaning. As you tackle disorder and perform deep cleaning, you might come across important papers. You might even keep them ins...

Apr 20, 2017Have you ever wondered, "What does TRS stand for on paystub?" Let's clear that up right away.

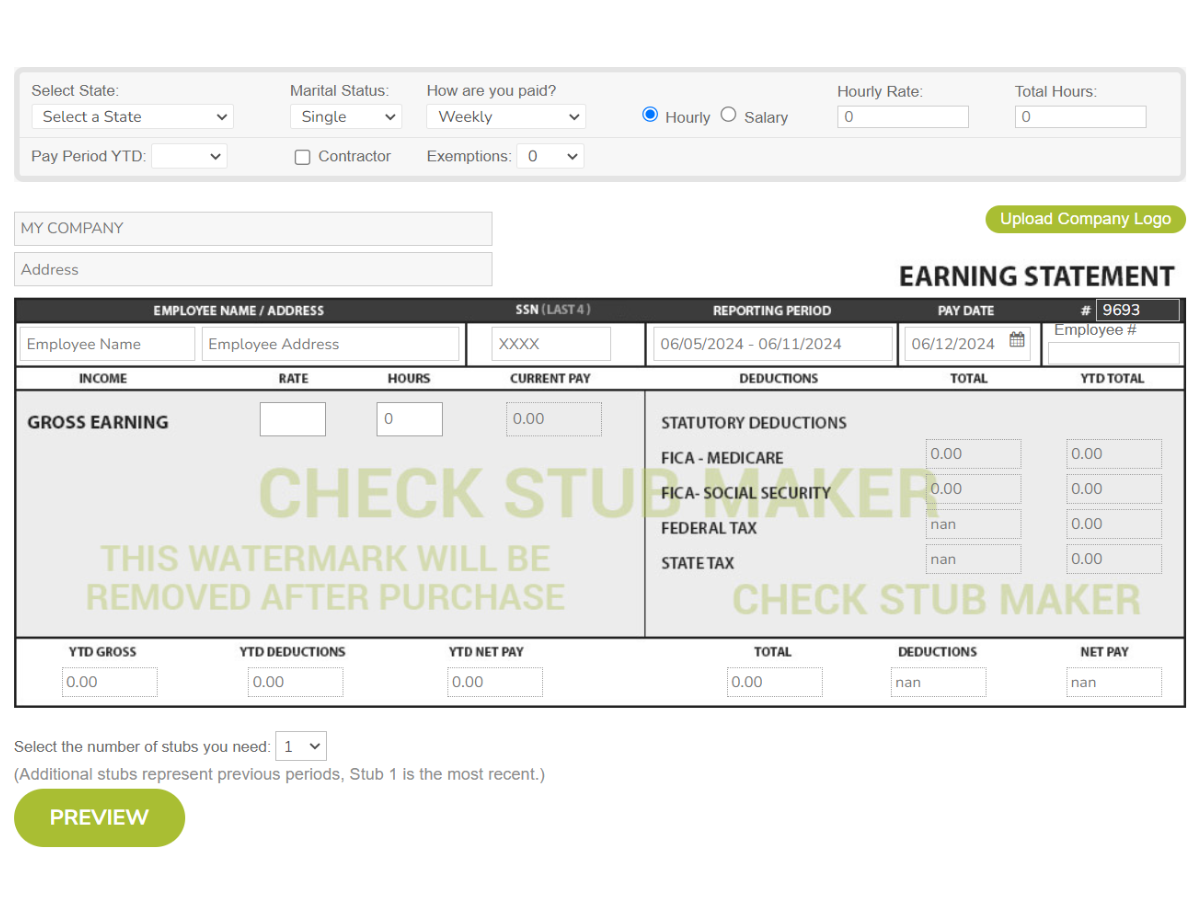

Have you ever wondered, "What does TRS stand for on paystub?" Let's clear that up right away. ‘TRS' on a pay stub is short for the 'Teacher Retirement System'. Essentially, this is a network of state and city-level organizations that collectively administer pensions and retirement accounts for teachers across states in the US. At Check Stub Maker , we're experts in the payroll process and can help you seamlessly decipher the retirement-related deductions on your teacher pay stub with ease using our paystub creator . In this article, we'll dive into the Teacher Retirement System and how it works. We'll explore common TRS deductions, as well as reveal which states offer the best teacher retirement plans. Let's dive in! What this article covers:

The Teacher Retirement System (TRS) is a crucial component of educators' financial futures. It's a pension system designed specifically for teachers and other education professionals working in the U.S. Drawing from our experience, we at Check Stub Maker can say that the TRS provides retirement, disability, and death benefits to employees of public schools, colleges, and universities. Unlike the private sector's 401(k) plans, the TRS is generally a defined plan. This means that retirement perks are calculated based on a formula considering factors like years of service and salary history. The TRS also manages investments to ensure the long-term stability of the pension fund. It's important to note that while TRS is common across the United States, each state typically has its own version with slightly different rules and benefits. This is why you might see variations in TRS acronyms and deductions on paystubs across state lines.

The Teacher Retirement System operates on a contribution-based model, with both employees and employers contributing to the system throughout the teacher's career. Based on our observations at Check Stub Maker, these contributions are usually a percentage of the teacher's salary and are deducted automatically from each paycheck. It's worth noting that the specifics of how the TRS works can vary significantly from state to state. For instance, employees and employers contribute 9% and 0.58% respectively to the Teachers' Retirement System of the State of Illinois . In contrast, the Texas Classroom Teachers Association has a vastly reduced funding structure, with employees and employers located in schooling districts making 0.65% and 1.25% in contributions, respectively. The TRS then invests these contributions to grow the fund over time. When a teacher retires, they receive regular pension payments based on:

One key advantage of the TRS is that it provides a guaranteed income stream in retirement, which can offer peace of mind to educators.

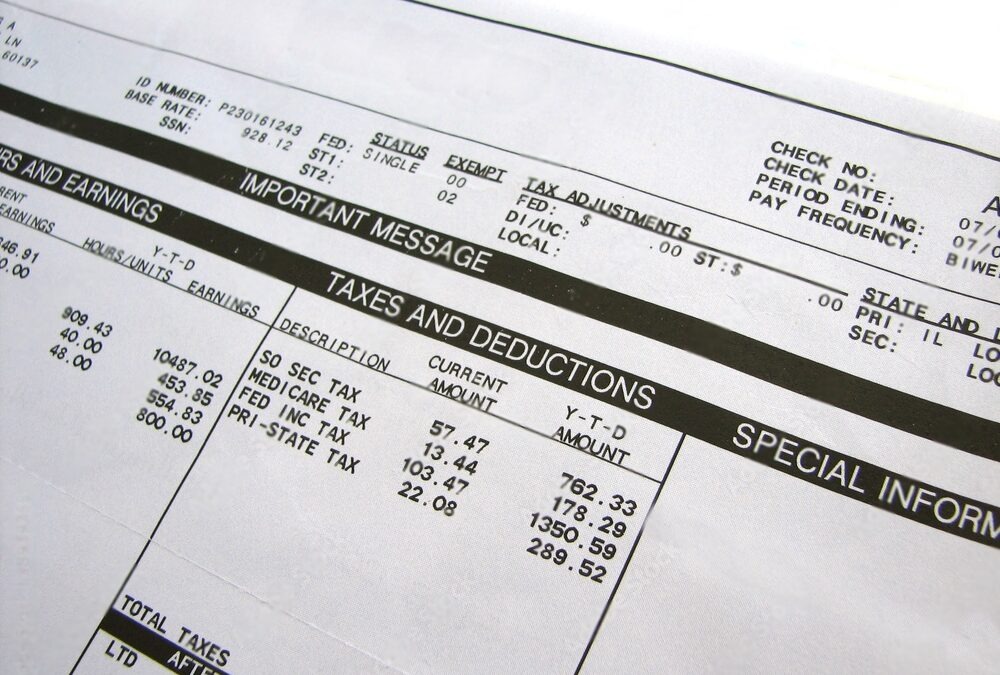

When examining your check stub , you'll likely notice two main types of TRS deductions related to your retirement annuities and health insurance contributions.

The retirement portion is the core of your TRS deduction. This is the money that goes directly into your pension fund. The exact percentage can vary according to each state, but it's typically between 6% and 9% of your gross wages. Our findings at Check Stub Maker show that this deduction is often tax-deferred, meaning you don't pay income tax on this portion of your salary until you withdraw it in retirement. This is generally the case in states like New York.

Many TRS plans also include a healthcare component. In states like Massachusetts, this deduction goes towards funding health benefits for retired teachers. It's important to note that this portion is usually non-refundable. Even if you leave the teaching profession before you're eligible for retirement, you typically can't reclaim these contributions. The health insurance portion is generally a smaller percentage of your income compared to the retirement portion. For instance, in the schooling district of Pflugerville in Texas, the TRS deductions for healthcare is only 0.65% of an employee's paycheck. With that said, this health insurance portion still plays a crucial role in ensuring that retired educators have access to affordable healthcare. At Check Stub Maker, we can help you decipher and track your healthcare gains and deductions with our user-friendly paystub maker .

Our investigation demonstrated that the states with the best teacher retirement plans are currently South Carolina, Tennessee, South Dakota, Oregon, and Michigan. These states stand out for various reasons, including the:

However, it's important to remember that the "best" plan for retirement can vary depending on additional factors like your career stage, salary, and annuity goals.

In many states, teachers become eligible for full retirement gains between the ages of 60 and 65, often with a minimum of 5 years to a maximum of 30 years of service. Some systems also offer early retirement options, usually around age 55, though these may come with reduced benefits. As per our expertise at Check Stub Maker, we've noticed that many teachers aim to retire in their early 60s. This balances the desire for a long retirement in order to maximize their pension gains. However, factors like job satisfaction, health, and financial readiness can influence this decision significantly. It's worth noting that some teachers choose to work beyond the minimum retirement age, either to increase their pension benefits or simply because they enjoy their work. The flexibility of the teaching profession can also allow for partial retirement options in some cases.

In this article, we discovered that ‘TRS' stands for the ‘Teacher Retirement System' on paystubs. We also explored how the TRS works, its most common deductions and typical retirement ages for educators. Understanding these aspects of the TRS can help teachers make informed decisions about their financial futures. If you run an educational institution and need help with your payroll processes, why not try our pay stub generator at Check Stub Maker right now? It's designed to make your life easier, ensuring accuracy for payments made to your institution's most prized assets - your teachers. If you want to learn more, why not check out these articles below:

With springtime comes spring cleaning. As you tackle disorder and perform deep cleaning, you might come across important papers. You might even keep them ins...

Apr 20, 2017

Are you looking through your financial records and wondering, "What is a pay stub?" Simply put, pay stubs are physical or digital documents that accompany your paycheck, offering a detailed breakdown of your earnings and deductions for a specific pay period.

Oct 04, 2023

With the new year here comes new resolutions that promise improvements in different areas of life. Often, people strive to better their health, habits, and r...

Jan 05, 2023