Save Time, Money and Stress With Check Stub Maker

As a business owner, you understand that the demands of your time and resources are spread very thin. Marketing and growing your expanding business takes up ...

Oct 20, 2016Wondering, ‘Do car dealerships ask for pay stubs?' Yes, car dealerships often request pay stubs to prove income.

Wondering, ‘Do car dealerships ask for pay stubs?' Yes, car dealerships often request pay stubs to prove income. This standard practice ensures that the buyer has sufficient wages to make car payments, subsequently providing proof of employment and financial stability. At Check Stub Maker , we're experts in the payroll process and can help you generate the necessary evidence of salary using our easy pay stub generator . In this article, we'll discuss the pay stub verification process undertaken by car dealerships and explore how they evaluate your earnings without using pay stubs. Discover how our payroll service can help you get a pay stub to buy a car ! What this article covers:

Do car dealerships scan your paystubs ? Yes, car dealerships do scan your pay stubs for the purpose of substantiating income. As per our expertise at Check Stub Maker, dealerships often check your pay stubs by contacting your employer to directly confirm your employment details. This is done to ensure that the information on your pay stub matches your actual employment status. Additionally, dealerships might use online verification services to validate the authenticity of your pay stubs. They may even cross-check them with other financial documents you provide, such as bank statements or tax returns. Ultimately, this protects the dealership from fraudulent activities and proves that buyers are financially stable, which substantiates your good standing as a borrower.

If you're wondering, ‘ How many pay stubs do I need to finance a car ?' dealerships typically require two to three recent paystubs when you're buying a car. While this is a standard practice for confirming your current earnings, some dealerships might ask for more pay stubs according to their specific policies. Based on our observations, dealerships can even request up to six months' worth of pay stubs to get a comprehensive view of your financial stability. Moreover, some instances occur where dealerships request extra pay stubs after you've completed the transaction and taken your vehicle home. If you refuse to supply this additional paperwork, you can potentially lose the car you've secured with the initial loan. Providing additional documentation, like bank statements, can also be beneficial and sometimes necessary to support your salary claims.

The importance of pay stubs in car loans is indisputable for a number of reasons:

These practices help with fostering a trustworthy relationship between the buyer and the dealership for a smoother car purchasing process. All you often need to do at this stage in the process is bring or email paystub to a dealer . At Check Stub Maker, we help you create pay stubs that are accurate and professional to meet these loan application requirements.

Can a car dealership verify employment without pay stubs ? A car can be financed without pay stubs by using other forms of income proof instead, such as bank statements, to finance a car. Lenders may also accept documents like benefit statements or pension slips. Additionally, self-employed individuals can provide tax returns (like IRS Form 1099 , for instance) or create pay stubs online with us at Check Stub Maker. After putting it to the test, our easy-to-use pay stub creator helps you make precise payroll paperwork, offering you sufficient evidence of earnings for your car loan needs. By utilizing these alternative wage verification methods, you can still secure financing for a vehicle without conventional pay stubs.

Car dealerships check non-traditional income in a variety of ways:

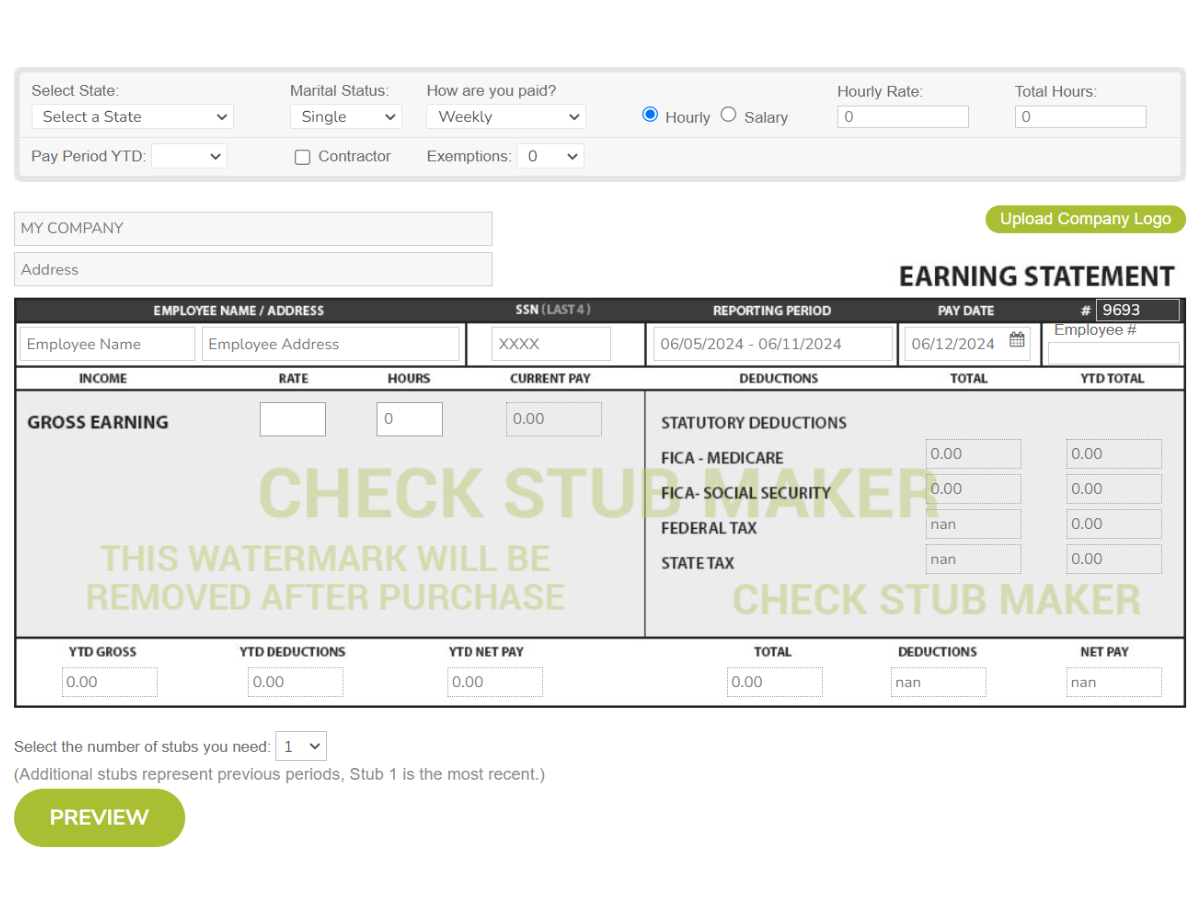

If you're wondering how to make legit check stubs to get a car loan , our services at Check Stub Maker help you make paystubs to present the necessary financial evidence for your car loan that stands up against evaluation.

Car dealerships utilize comprehensive evaluation criteria when deciding on auto loans. This includes assessing the credit score and credit history of the buyer to determine their reliability in repaying loans. They also consider the down payment amount and the trade-in value of the car, which impacts the loan amount and terms.

Additionally, dealerships assess the buyer's overall financial stability and debt-to-income ratio (DTI) to ensure they can manage the monthly car payments. These factors are also pivotal when trying to obtain a no pay stub auto loan . At Check Stub Maker, we help you create accurate pay stubs and financial documents that support these evaluations, making the auto loan process more efficient.

In this blog post, we answered the question, ‘Do car dealerships ask for pay stubs?' and discussed the importance of providing precise and verifiable income proof. Pay stubs, along with other sources of earnings, are pivotal for getting car financing. For an easy and reliable way to generate professional pay stubs, you can always trust us. Our paycheck stub maker simplifies your payroll needs, ensuring you have the necessary paperwork for your financial transactions. Visit Check Stub Maker today to secure your auto financing with confidence! Did our blog meet your needs? You might also find our other guides helpful:

As a business owner, you understand that the demands of your time and resources are spread very thin. Marketing and growing your expanding business takes up ...

Oct 20, 2016

Whether you’re a small business owner or just curious to know what the IRS form 2553 is, you’re at the right place.What is form 2553? -------------------!Wha...

Apr 02, 2021

What Is Proof of Income?------------------------!How to Show Proof of Income Without Pay Stubshttps://checkstubmaker.com/wp-content/uploads/2020/05/61-ways-t...

May 27, 2020