Securing a car loan without a conventional car loan paystub is feasible with the right approach. In this context, a no pay stub car dealership loan is possible through proving your residency and establishing your creditworthiness, which can significantly increase your chances of approval. At Check Stub Maker , we offer digital pay stubs to help you prove your earnings when traditional documentation isn't available with our user-friendly pay stub creator . In this article, we'll outline ways to get car loans that don't require income verification and explain how these unconventional loan applications generally work. What this article covers:

How Do You Qualify for a Car Loan Without Income Verification?

Based on our first-hand experience, you can qualify for a car loan without a purchase or ‘ lease trade based on pay stubs ' solution by proving your creditworthiness and residency, as well as selecting a reputable lender. At Check Stub Maker, we'll guide you through these processes.

1. Prove Your Residence

You can use utility bills or lease agreements as evidence to prove your residence. Our research indicates that providing a consistent residence history ultimately aids with loan approval. By showing you have a permanent residence, lenders are more likely to see you as a reliable borrower.

2. Demonstrate Your Creditworthiness

As per our expertise, a good credit score can offset the lack of traditional pay stubs. To achieve and maintain a good credit score, we suggest managing your debts responsibly and making timely payments. Regularly checking and improving your credit report is also essential. According to Business Insider , you can obtain free credit reports annually from the three major credit bureaus (Equifax, Experian, and TransUnion). This can help you keep track of your credit status and make necessary improvements. If you need assistance in generating pay stubs to bolster your credit report, we at Check Stub Maker can help with our user-friendly paystub maker .

3. Choose A Lender

When looking for a car loan without proof of earnings, utilize lenders that specifically offer no-income verification loans. In this context, local credit unions or online lenders are often more flexible and understanding of your unique transactions compared to traditional banks. It's important to compare loan terms and interest rates from different lenders to help you get the best deal. By using alternative documentation and following these tips, you can improve your chances of approval. Whether you need to make paystubs or simply want guidance on the process, we at Check Stub Maker are here to help you every step of the way.

How to Get a No Income Verification Car Loan

Through our practical knowledge, there are numerous no-income verification car loans available, such as "Buy Here, Pay Here" dealerships, borrowing from friends or family, or using home equity loans. Let's take a closer look at these unique auto financing solutions.

Local Buy Here, Pay Here Lots

Buy Here, Pay Here (BHPH) dealerships generally offer in-house financing, which means they don't rely on traditional income confirmation methods. They often cater to customers with less-than-perfect credit or those who can't provide standard wage paperwork. However, it's important to note that higher interest rates may apply at these dealerships, so it's crucial to read the terms carefully before committing to a loan. Additionally, make sure that you select a dealership which reports your payments to one of the three main credit bureaus. Utilizing a BHPH dealership can help improve your credit score over time, making it easier to secure better loan options in the future.

Borrow From Friends Or Family

Another viable option is to borrow money from friends or family. Our findings show that personal loans from trusted sources can be highly advantageous, as they often come with lower or no interest rates, as well as more generous repayment terms. However, it's essential to establish clear terms and repayment plans to avoid potential conflicts. Consider formalizing the loan with a written agreement so both parties are on the same page. This approach not only provides monetary support but also strengthens trust and relationships with lenders you have a personal relationship with. At Check Stub Maker, we believe in transparent and clear communication, whether you're working with professional lenders or personal connections. We can show you how to make legit check stubs to get a car loan as a sound alternative in this scenario.

Home Equity Loan

A home equity loan (HEL) is another option for securing a car loan without salary confirmation. By using your home equity as collateral, you can access funds for purchasing a vehicle. While these loans generally offer lower interest rates compared to other unsecured loans, it's important to be mindful of the potential pitfalls. For instance, if you don't make repayments on time, you run the risk of potentially losing your home. That's why we suggest having a solid repayment plan in place before opting for this type of loan. At Check Stub Maker, we understand the challenges of securing a car loan without conventional income proof. Our analysis of this product revealed that our digital paystubs can also assist in proving your earnings when traditional documentation isn't available. This further supports your loan application with a car salesman asking for pay stub .

What Sources of Income Do Lenders Accept?

Drawing from our experience, lenders may accept various alternative sources of wages when evaluating a car loan application. These can include:

- Social Security benefits

- investment income

- rental income

Providing comprehensive paperwork of all salary sources is pivotal to strengthen your car loan application. By ensuring you have detailed records of your earnings, you can present a strong case to potential lenders and improve your likelihood of securing an auto loan. At Check Stub Maker, we can help you create pay stubs that effectively supplement your verification needs.

Do You Need to Show Paycheck Stubs to Get a Car Loan?

You don't necessarily need two pay stubs car approval to secure a loan of this nature. Alternative proof of income, such as bank statements, are also acceptable in this scenario. However, if you're wondering ‘ Do car dealerships scan your paystubs ?', our team discovered through using this product that our check stubs can serve as reliable evidence of wages with dealerships who specifically make this request. Whatever option you choose, it's important to maintain organized financial records to present to lenders. At Check Stub Maker, we offer user-friendly digital solutions to help you record your salary accurately and efficiently.

Can Loan Companies Look at Your Bank Account?

How do car lenders verify pay stubs and other forms of wages? Aside from checking your earnings on pay stubs, car lenders may also review your bank statements to assess your overall monetary stability. Regular deposits and a healthy balance can positively influence loan approval. We recommend avoiding significant overdrafts or large unexplained transactions before applying for an auto loan. At Check Stub Maker, our services can help you generate reliable pay stubs, giving you the proper paperwork to present to lenders. By keeping your finances in good standing, you enhance your credibility and improve your chances of securing a car loan.

Can You Be Denied for a Car Loan After Pre-Approval?

Yes, a car loan can be denied after the pre-approval stage if there are adverse changes in your financial situation or creditworthiness that affect your ability to make repayment. Our investigation at Check Stub Maker demonstrated that it's important to keep communication open with your lender and promptly address any changes that arise during the loan application process. By staying proactive and transparent with your lender, you can improve your chances of securing and maintaining your car loan approval.

Conclusion

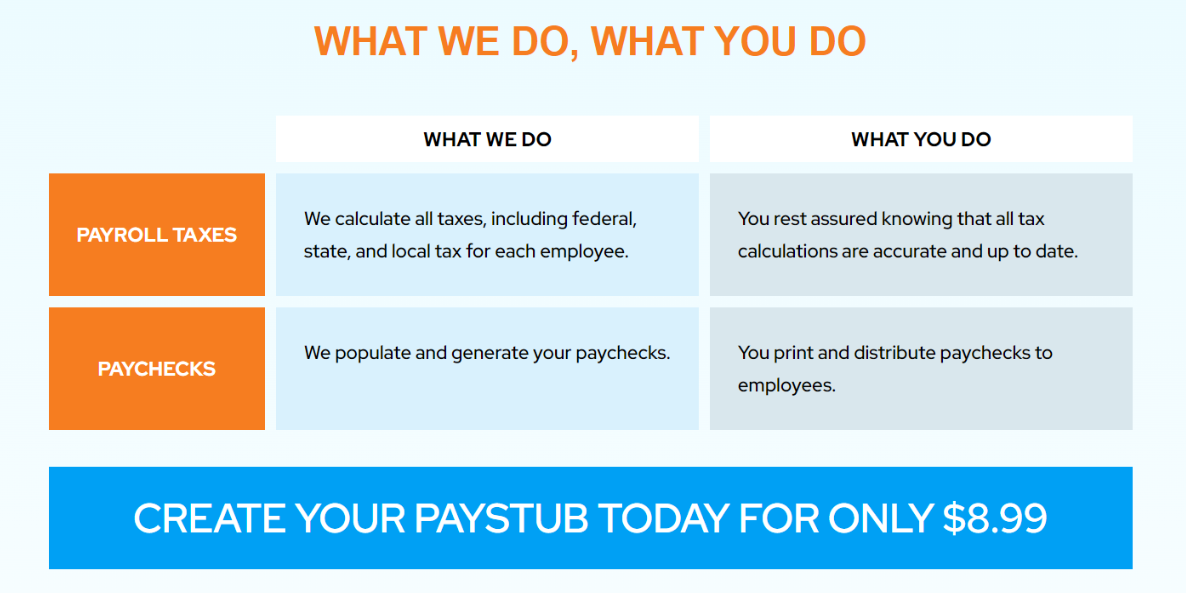

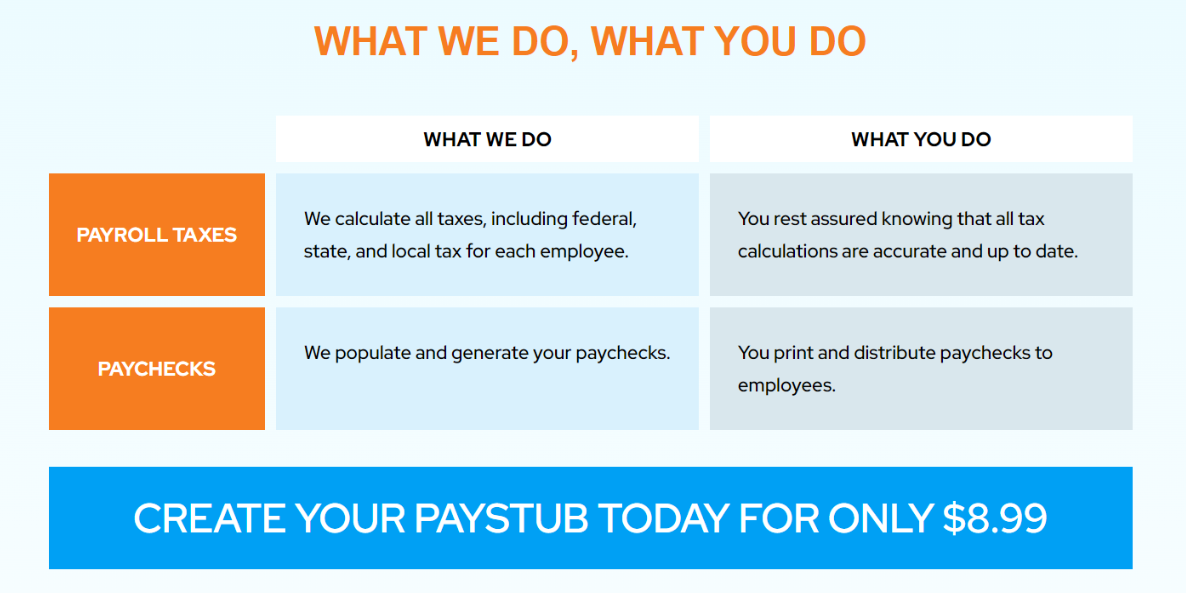

In this article, we navigated through the concept of a no pay stub car dealership and discovered that this option is possible with proper documentation and planning. With our digital service, we offer reliable digital pay stubs, aiding in efficient earnings confirmation time and time again. So, what are you waiting for? Simplify your payroll needs with our user-friendly pay stub generator , ensuring precision and compliance. Try out Check Stub Maker now and experience hassle-free income verification first-hand! Did our blog meet your needs? You might also find our other guides helpful: