In the complex landscape of personal finance, answering the question, "What important information is available on a pay stub ?" is paramount. Whats pay stubs? A typical pay stub holds a wealth of vital data, from your gross earnings and deductions to taxes withheld and net pay. It's the blueprint of your financial journey, a snapshot of your hard-earned dollars at work. But deciphering this cryptic document can often feel like navigating a maze. That's where Check Stub Maker, your trusted companion in the payroll labyrinth of making check stubs , comes into play. With our expert guidance, we'll delve deep into the intricacies of pay stubs, demystifying every line and code and showing you what to look for in a generic paystub template in this guide. Let's get started! What this article covers:

What Information Is on a Pay Stub?

As per our expertise, the information you can typically find on a pay stub concerns your:

- Social Security

- Gross wages

- Employee taxes

- Deductions

- Employer contributions

- Employer taxes

- Net pay

A pay stub or data check stub , often regarded as a financial blueprint, is a critical document that casts a spotlight on your financial transactions within a specific pay period. Drawing from our experience, it's an indispensable tool for comprehending your financial landscape, facilitating budgeting, and ensuring that compensation aligns with expectations. In this section, we'll further explore these seven key components of a typical pay stub, shedding light on the critical information it contains and the best way to organize digital paystubs .

Social Security

At the top of the pay stub, you'll find a series of personal identifiers, chief among them being your Social Security number. This unique numerical sequence is the linchpin connecting your earnings to your identity, serving not only as a critical reference for tax purposes but also as a gateway to your future Social Security benefits. Accurate reporting of your earnings via this number ensures that your contributions to the Social Security system are accurately tracked, ultimately impacting the benefits you'll receive in retirement or in the event of disability.

Gross Wages

As you delve deeper into the pay stub, your attention is drawn to the pulsating heart of this financial document—the "Gross Wages" section. Here, in bold and unambiguous figures, lies the sum total of your earnings for the designated pay period. This isn't just your base pay; it encompasses all facets of your compensation. Whether it's the steady rhythm of your regular hourly or salaried pay or the exhilarating crescendo of overtime hours, bonuses, or commissions earned during the pay period, it's all accounted for here. Based on our observations, this grand total reflects the fruits of your labor before the various financial elements come into play.

Employee Taxes

Nestled within the labyrinth of the pay stub are the crucial deductions that shape your pay period. These deductions are akin to the taxes we all must bear, and they are deftly itemized for your scrutiny. The stalwarts of this section often include:

- federal income tax

- state income tax (where applicable)

- FICA taxes (Social Security and Medicare)

Understanding these deductions empowers you to gauge your tax liability, plan your finances, and take control of your fiscal future.

Deductions

Descending further into the pay stub, you encounter the "Deductions" section, a repository of financial adjustments. Here, various items are methodically subtracted from your Gross Wages to calculate your Net Pay. These deductions can be a diverse array, ranging from health insurance premiums that safeguard your well-being to retirement contributions, such as 401(k) or IRA contributions, which lay the foundation for your financial future. Additionally, you may find other voluntary deductions, such as charitable contributions or union dues, that you've authorized. This section not only illustrates the breadth of financial commitments but also underscores the choices you've made to shape your financial well-being.

Employer Contributions

Some pay stubs open a window into a realm of financial benefits that extend beyond your earnings—the "Employer Contributions" section. Here, you may discover the generosity of your employer, often in the form of:

- contributions to retirement plans

- health savings accounts (HSAs)

These contributions are a testament to your employer's commitment to your financial welfare and are, in essence, an integral part of your total compensation package.

Employer Taxes

Directly below the surface, yet no less significant, are the "Employer Taxes." Employers bear a share of the payroll tax burden, contributing to social safety nets such as unemployment insurance and workers' compensation. While these amounts aren't directly subtracted from your paycheck, they play a role in shaping your overall compensation. Understanding these figures illuminates the complex interplay between employee and employer contributions to the broader social and economic landscape.

Net Pay

Finally, as we approach the culmination of the pay stub journey, we arrive at the "Net Pay" section—a revelation of the actual financial reward for your efforts. This figure represents the crisp notes and coins you take home after the intricate dance of earnings, deductions, and contributions has been orchestrated. It's the essence of your compensation, the tangible sum you can budget with, and the foundation for your financial planning. Understanding the information on your pay stub is essential for managing your finances effectively and ensuring accurate compensation. After trying out this product, we can confidently say that our paystub maker helps you efficiently track your earnings, monitor tax withholdings, and make informed decisions about your financial future.

Pay Stub Example

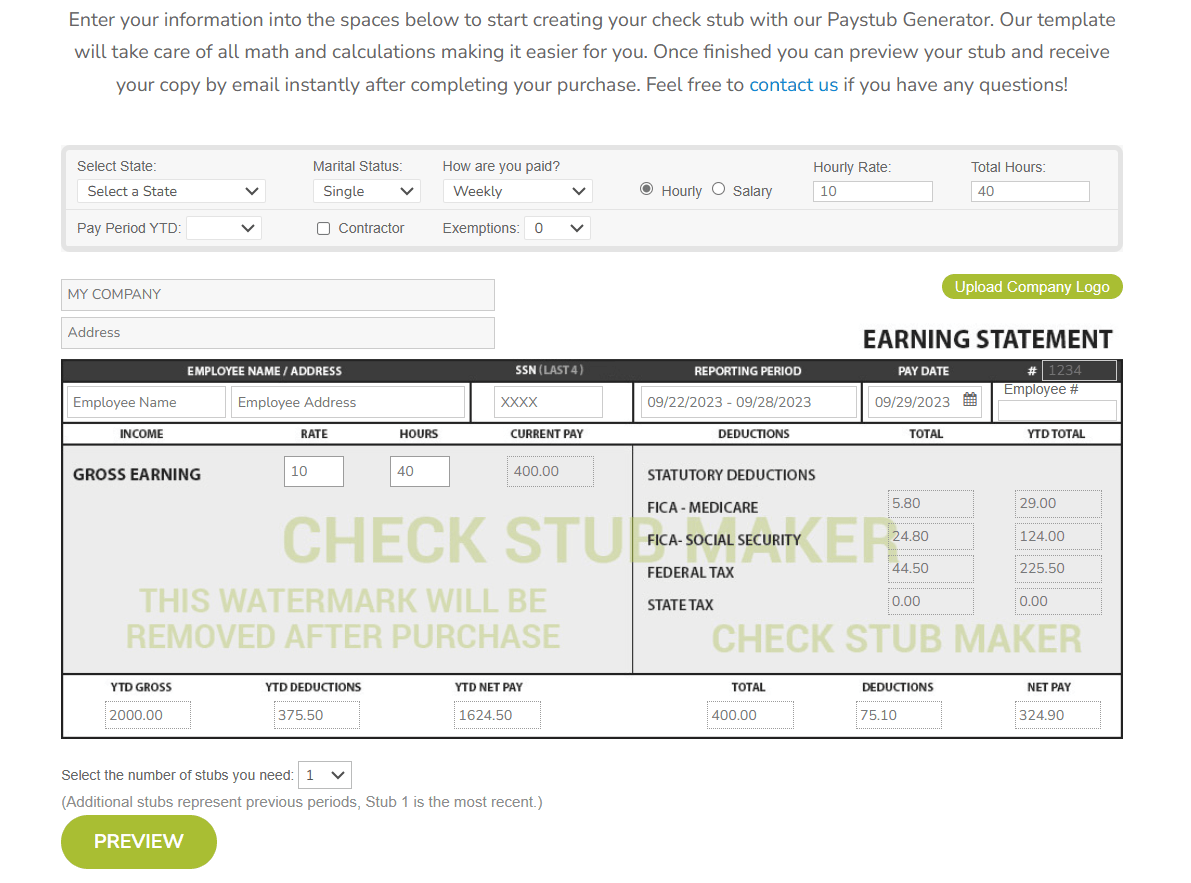

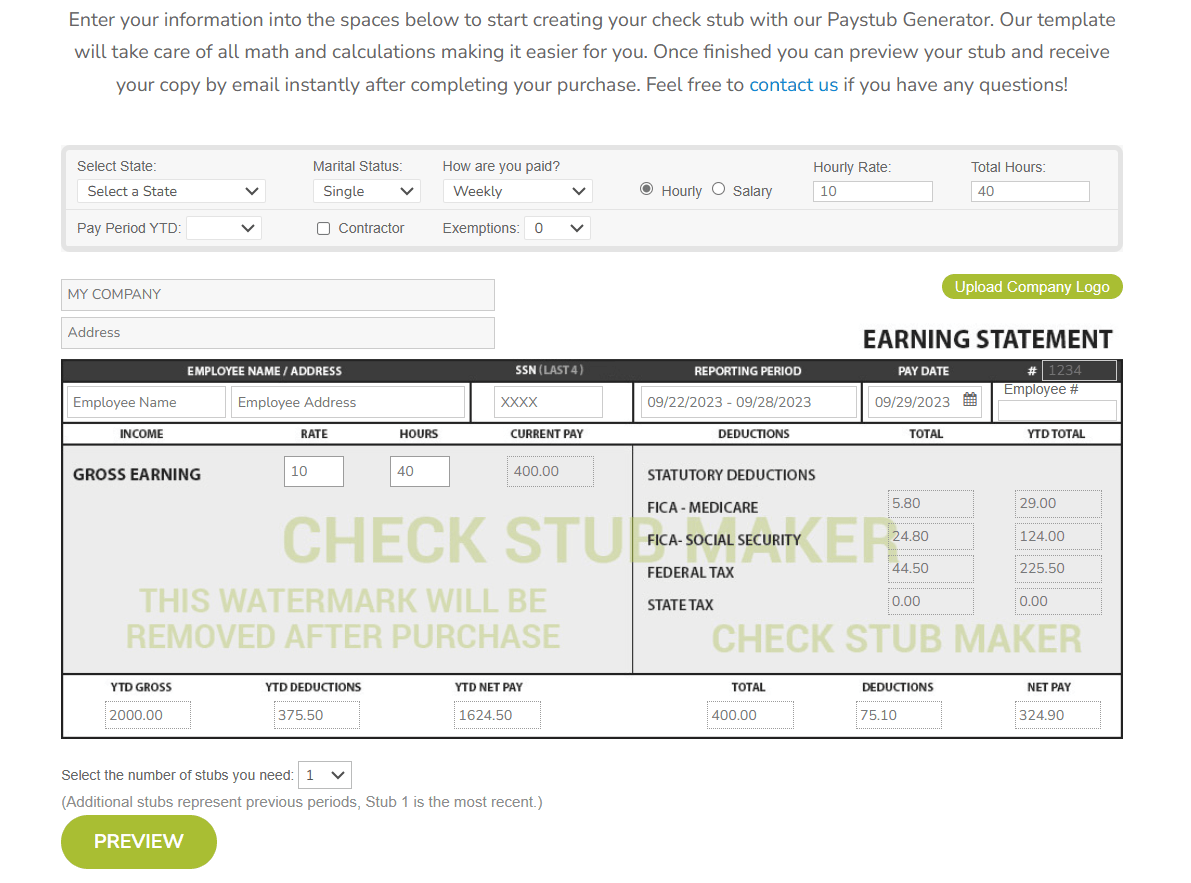

As per our expertise, a pay stub is a crucial document that provides a breakdown of an employee's earnings and deductions for a specific pay period. It not only serves as a record of compensation but also helps employees understand their financial situation. In this section, we'll explore how to create and download a pay stub example using our pay stub creator .

How To Create A Paystub

Creating a pay stub can be done through various methods, including using online pay stub generators. Here's a general guide on how to create a pay stub:

- Choose a Pay Stub Generator: Select a reputable pay stub generator tool, like ours at Check Stub Maker , that can show you ‘ how do I begin make employee check stubs ' that suits your specific needs.

- Input Employee Information: Provide the necessary information, including your name, address, Social Security number, and employment details. Ensure that this information is accurate, as it will be reflected on the pay stub.

- Enter Earnings: Input your gross wages, which include your regular pay, overtime, bonuses, and commissions, if applicable. Our pay stub generator will automatically calculate the total.

- Deductions: Include deductions such as federal and state income taxes, Social Security, and Medicare contributions. Additionally, you can add any voluntary deductions, such as retirement plan contributions or health insurance premiums.

- Employer Contributions: If your employer makes contributions to retirement plans or other benefits, such as imp income pay stub , make sure to include them in the appropriate section of the pay stub.

- Generate the Pay Stub: Once you've entered all the necessary information, you can preview your new stub and make changes wherever necessary. Once you hit “Submit”, we'll email you your detailed pay stub for the specified pay period immediately afterward.

### How To Download A Paystub

### How To Download A Paystub

After creating your pay stub using our online tool, you'll have the option to download it. Here's how to do it:

- Save as a PDF: Our pay stub generator allows you to save the pay stub as a PDF file. Simply click the "Download" or "Save" button and choose the PDF format.

- Choose Storage Location: Specify where you want to save the PDF file on your computer or device. This could be your local storage or a cloud-based service like Google Drive or Dropbox.

- Access Anytime: Once downloaded, your pay stub will be available for future reference. You can print it or share it digitally as needed, whether for tax purposes, loan applications, or proof of income.

Creating and downloading a pay stub is a straightforward process, thanks to online pay stub generators like Check Stub Maker. Our analysis of this product revealed that it allows both employers and employees to maintain accurate records of earnings and deductions, promoting transparency and financial accountability.

Conclusion

In this guide, we've unveiled the essential components of a pay stub and answered the question, ‘Shat important information is available on a pay stub?'. Your typical pay stub is more than just numbers; it's a financial roadmap, encompassing everything from gross wages to taxes, deductions, and net pay. But remember, deciphering these details can sometimes be like solving a puzzle. That's where Check Stub Maker shines as your trusted guide in the intricate world of payroll. What is a job plus pay stub ? Based on our first-hand experience, we can simplify the process for both businesses and individuals and with how you make paystubs that are job-related on our user-friendly digital platform, ensuring that they're accurate and understandable. So, why not give us a try? You can rely on Check Stub Maker's user-friendly pay stub creator and experience the convenience of accurate, well-structured income documentation that puts you in control of your financial journey. Did you find the blog helpful? If so, consider checking out other guides:

### How To Download A Paystub

### How To Download A Paystub