Are you looking through your financial records and wondering, "What is a pay stub?" Simply put, pay stubs are physical or digital documents that accompany your paycheck, offering a detailed breakdown of your earnings and deductions for a specific pay period. In essence, a pay stub is a vital financial document that showcases important details such as your gross pay, taxes withheld, deductions for benefits, and net pay—the amount that lands in your bank account. Understanding your pay stub is crucial because it empowers you with transparency about your earnings and deductions, helping you track your financial progress and ensure accuracy in your paycheck. Meet Check Stub Maker, your trusted partner in the payroll process. We make paystubs that are specialized and accurate to reflect your financial reality. In this blog post, we'll discuss everything pay stub-related and how we can assist you in your financial journey with our customized paycheck stub maker . Let's get started!

What Is A Pay Stub?

A pay stub, often referred to as a paycheck stub or pay advice, stands as a cornerstone in the realm of financial documents, bearing crucial significance for both employees and employers. What type of information should you see when you look at your pay stub ? Your paystub is essentially a digital record that's instrumental in providing a comprehensive breakdown of you, the employee's, earnings and deductions for a specific pay period. Is my check considered a pay stub ? Within its seemingly mundane confines lies the power to illuminate your financial landscape, making it a vital asset in navigating the intricacies of your personal finance and payroll management and the relationship between your check and pay stub. Let's look more specifically at what information you can find inside a typical pay stub, its importance in your financial journey, and the difference between pay stubs and pay checks.

What Information Is On A Pay Stub?

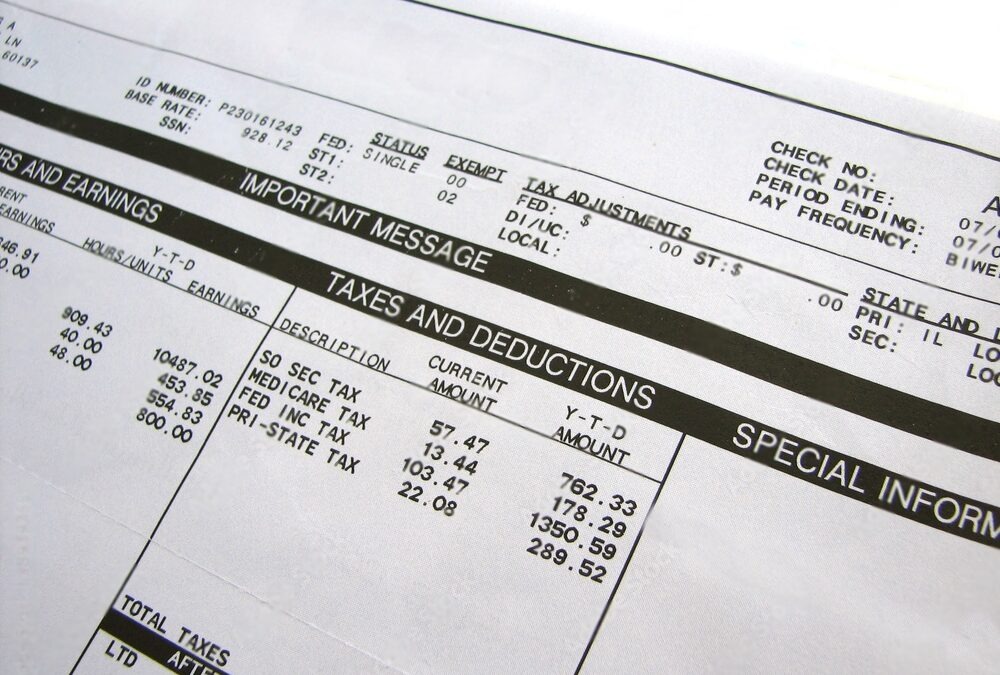

A typical pay stub is a repository of key financial data, serving as a testament to an individual's labor and its associated monetary implications. Here's a closer look at the essential components typically found on a job plus pay stub:

Gross Wages

At the heart of a pay stub lies the notion of gross wages. This figure represents the total earnings an employee has accrued during a specific pay period, prior to any deductions or withholdings. It reflects the raw financial output resulting from one's labor and is often the starting point for assessing your income. For employees, gross wages represent the fruits of their labor—the hard-earned income before any financial commitments or obligations come into play. It's the compensation an employee receives based on their employment agreement, hourly rate, or salary.

Deductions

Deductions on a pay stub encompass a broad spectrum of financial commitments and responsibilities. These are the various withholdings and ltd imputed income on paystub derived from an employee's paycheck, ranging from contributions to retirement plans and health insurance premiums to deductions for other benefit-related expenses. Our research indicates that deductions play a pivotal role in shaping your net income, as they directly reduce your overall earnings displayed in the gross wages section. These deductions may be related to:

- contributions to employer-sponsored retirement plans such as a 401(k) or 403(b)

- health insurance premiums

- dental and vision insurance

- contributions to flexible spending accounts (FSAs) for healthcare or dependent care.

Additionally, deductions may encompass contributions to other benefit programs, such as life insurance or employee stock purchase plans.

Taxes

The tax section of a pay stub offers insight into the fiscal obligations you must fulfill. Pay stubs meticulously detail the various taxes that have been withheld from your earnings, ensuring compliance with federal and state tax regulations. Common tax withholdings are:

- Federal Income Tax: The amount of your income that the federal government withholds to pay for federal income tax obligations.

- State Income Tax: Depending on the state of residence and applicable tax laws, a portion of an your income may be withheld to satisfy state income tax obligations.

- Social Security Tax: A percentage of your income is allocated to fund the Social Security program, providing financial support for you during retirement or in the event of disability.

- Medicare Tax: Medicare tax contributions are also deducted from your income to fund the Medicare program, which provides healthcare coverage for individuals aged 65 and older.

What Are Pay Stubs Used For?

Through our practical knowledge, our pay stubs serve a multitude of practical purposes for both employees and employers in the realm of learning about creating a custom paystub , and beyond, such as:

Proof Of Income

When seeking financial services such as loans, mortgages, or apartment rentals, you often need to furnish proof of a stable income source. Pay stubs serve as a tangible and credible record of earnings, demonstrating an individual's capacity to meet financial obligations.

Budgeting Purposes

For employees, pay stubs are invaluable tools for effective budgeting. By providing a clear breakdown of earnings, deductions, and net income, pay stubs empower you to assess your financial health, allocate resources wisely, and make informed financial decisions.

Tax Filing

Pay stubs play a pivotal role during the annual tax-filing process. They offer you a detailed record of their income and tax withholdings, simplifying the task of calculating tax liability and ensuring accurate and timely tax filings. Having access to pay stubs can significantly expedite the process and minimize the chances of errors.

Why Are Pay Stubs Important?

Based on our first hand experience, the importance of pay stubs transcends the realm of mere financial documentation. They can also offer you the following benefits:

It Offers Transparency

For employees, pay stubs epitomize transparency in compensation. They offer a comprehensive breakdown of how earnings are calculated and the precise deductions that are applied. This transparency fosters trust between employers and employees, ensuring that compensation is fair and accurate.

It Offers Compliance

Employers rely on pay stubs to maintain compliance with labor laws and tax regulations. Accurate pay stubs aren't just a legal requirement in many jurisdictions but also a crucial means of reducing the risk of legal issues or disputes related to compensation.

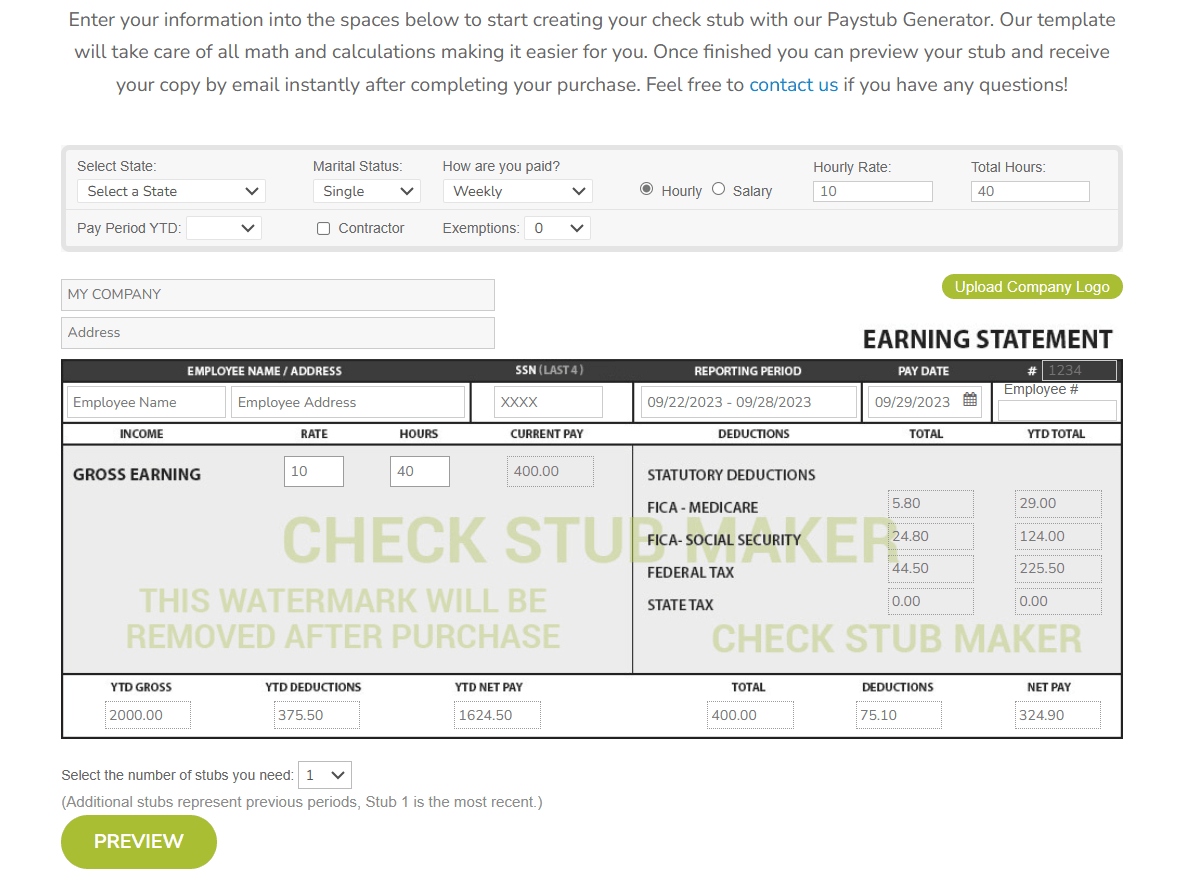

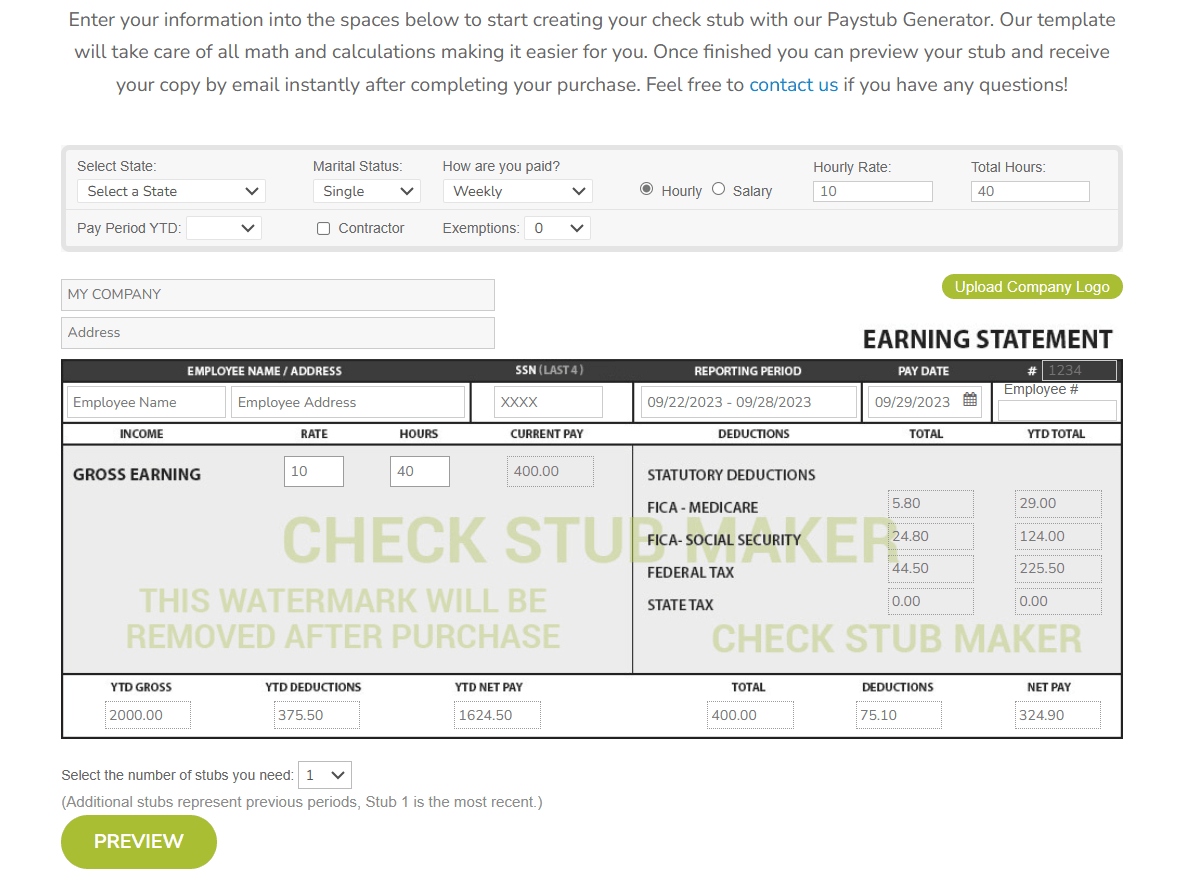

How Do I Get Pay Stubs?

The process of obtaining pay stubs is typically straightforward for employees. Employers issue pay stubs as a standard part of the payroll process, ensuring that you receive documentation of your earnings and deductions for each pay period. In the modern digital age, many employers provide electronic pay stubs through secure online portals like us at Check Stub Maker . As an employee, our digital platform allows you to conveniently access and review your pay information from anywhere with an internet connection. If you haven't had a chance to download it from our instantaneous email, you can also contact us to help you retrieve your past pay stubs for reference or tax purposes whenever you need it. For employees who prefer physical copies, employers may also provide printed pay stubs along with the paycheck, allowing you to retain a tangible record of your earnings.

Is The Pay Stub The Same As A Paycheck?

No, a pay stub and a paycheck are distinct elements of the compensation process, each serving its own unique purpose. Let's look at their key differences in more detail.

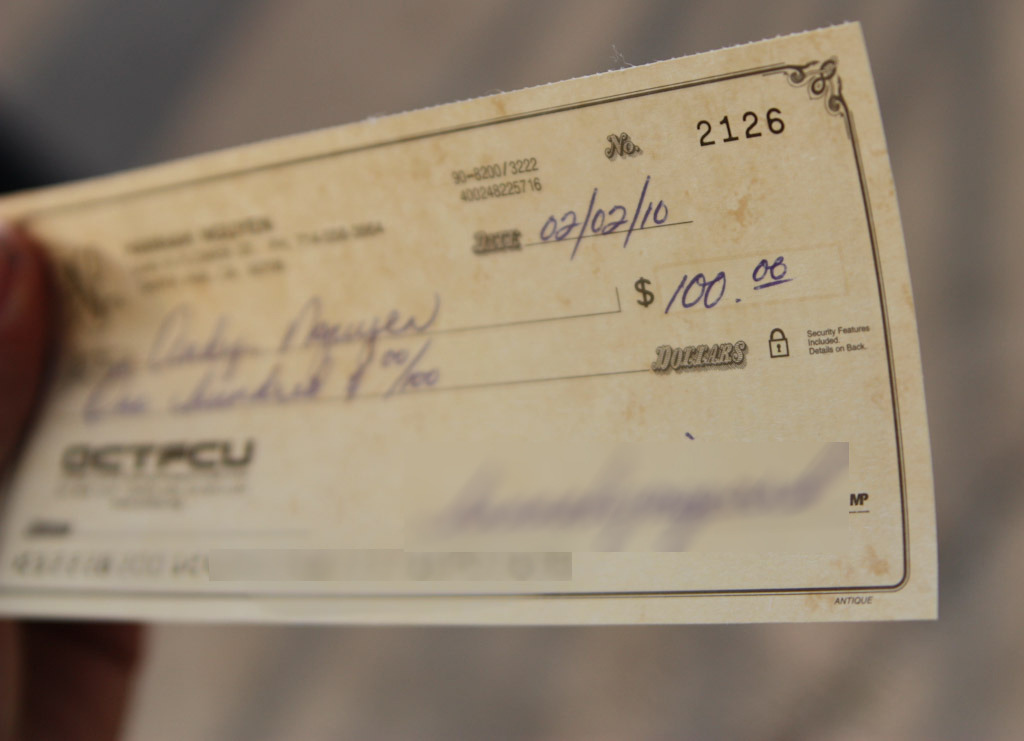

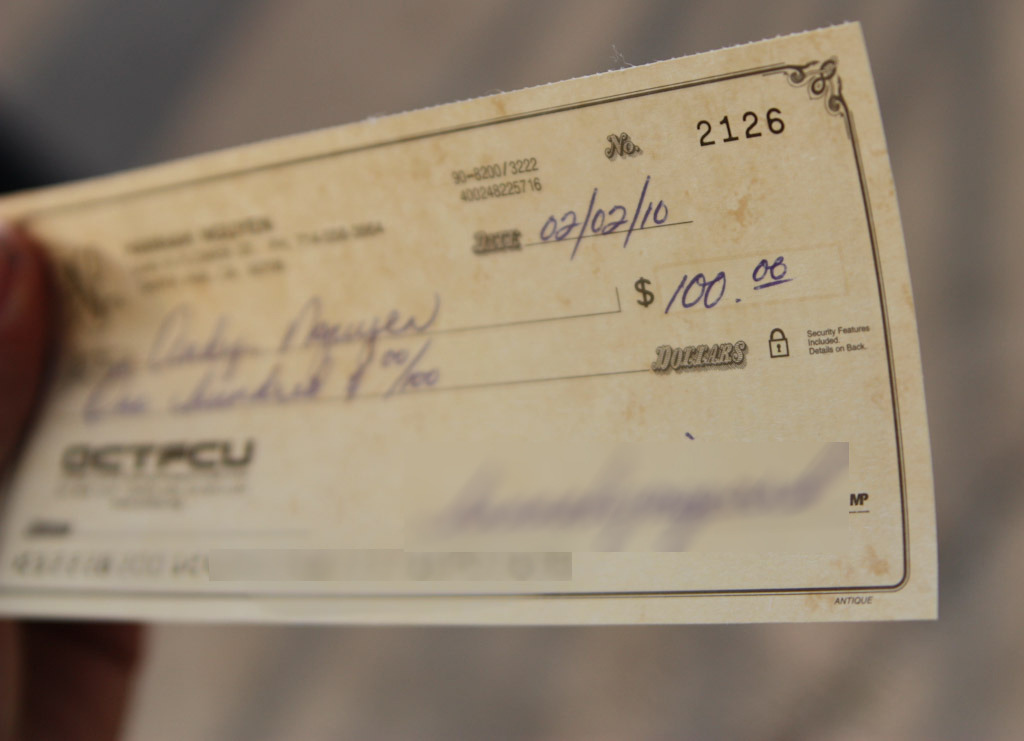

Paycheck

A paycheck is the actual payment issued to an employee, representing the financial compensation for their work. Paychecks can take the form of physical checks or direct deposits into your bank account. The paycheck is the tangible manifestation of your earnings.

Pay Stub

In contrast, a pay stub is a supplementary document accompanying the paycheck. It details the intricate breakdown of an employee's earnings, deductions, and taxes for the specific pay period. While the paycheck provides the funds, the pay stub offers the financial transparency and detailed information that you need to understand and manage your compensation effectively. In short, a pay stub isn't the payment itself but rather the invaluable record that empowers you and businesses with financial insight to ensure compliance and facilitate essential financial tasks such as budgeting and tax filing.

Conclusion

In this blog post, we've unraveled the mysteries of what a pay stub is, delving into its vital role in financial clarity. From gross wages to deductions and taxes, it's the key to understanding your earnings and financial obligations. When it comes to pay stubs, Check Stub Maker stands as your knowledgeable and trusted partner. But don't just take our word for it; take the leap and create your accurate pay stubs with our trusted paystub generator today. Create free fillable pdf pay checkstubs that accurately reflect your financial history, and embark on a journey of financial empowerment with us! Did you find the blog helpful? If so, consider checking out other guides: