How Long Should You Keep Pay Stubs Before Shredding?

When it comes to managing financial records, a common question arises: "How long should you keep pay stubs before shredding them?"

Jan 30, 2024Are you in the middle of a business or personal transaction and wondering ‘Why is it important for a person to examine their pay stub information?'

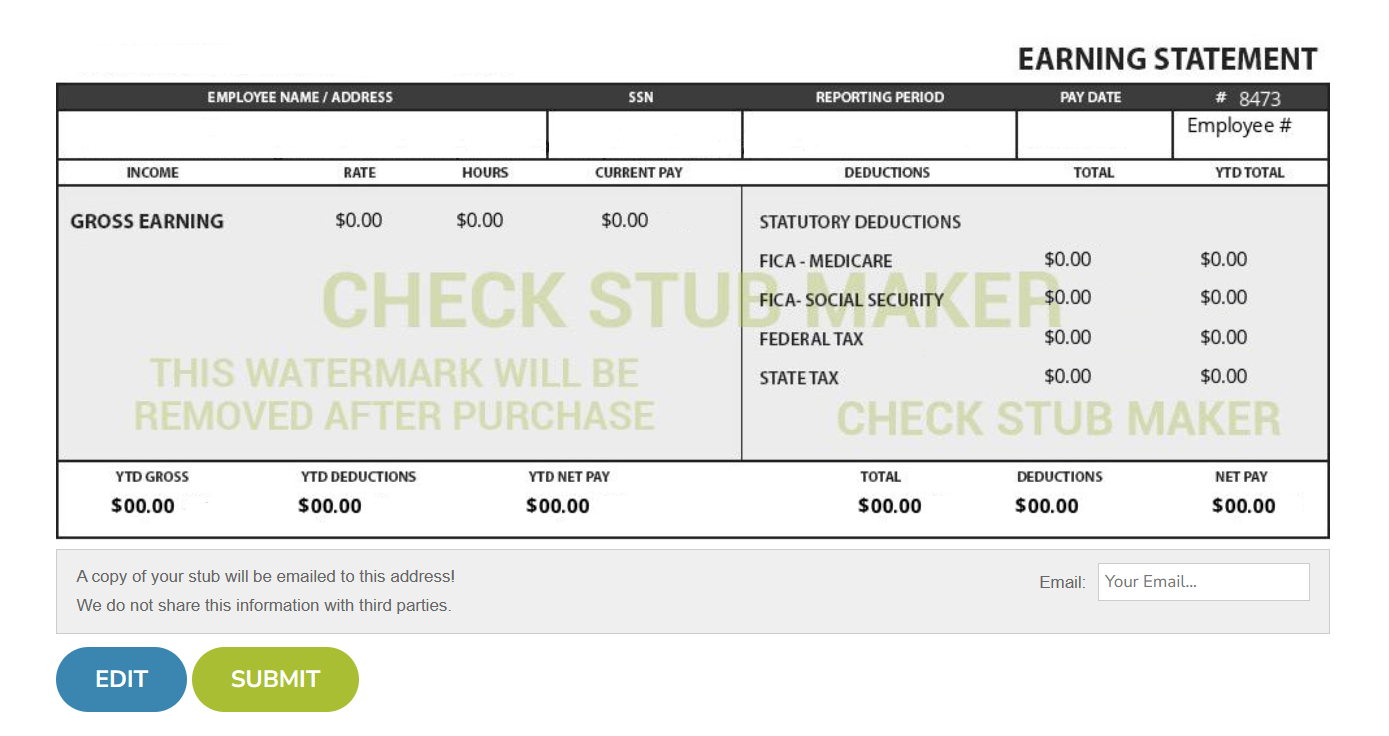

Are you in the middle of a business or personal transaction and wondering ‘Why is it important for a person to examine their pay stub information?' Whether using a pay stub as proof of address or as a pay stub form of ID , they offer a comprehensive breakdown of your earnings, taxes, deductions, and contributions. They empower you to track your financial progress and ensure accuracy in all your payments. In this article, we at Check Stub Maker will delve into the importance of examining pay stubs. From providing fair compensation to identifying errors, we'll uncover why examining them is vital for your monetary well-being.

There are a number of reasons why it's crucial to read and understand your pay stub.

It helps you grasp your gross pay by providing a detailed breakdown of your earnings before any deductions are made. Based on our first-hand experience, this allows you to comprehend your total income, encompassing elements like regular wages, bonuses, or overtime pay.

Pay stubs from us at Check Stub Maker serve as a tool for tracking taxes withheld, ensuring transparency and consistency in your tax obligations. Our team discovered through using this product that our pay stub generator plays a significant role in tax filing preparation by calculating and curating documentation necessary for accurate tax filing.

Your pay stub provides clarity on when you received payment for your work, allowing you to track your wages accordingly. Understanding the pay period dates helps you know when to expect your payments and align your financial planning with your income schedule.

Whether you need a pay stub for credit card , applying for a loan or a rental property, or you're trying to receive government benefits, this important payroll document gives a clearer picture of your income. It showcases your economic stability and capability to fulfill financial obligations, giving lenders and institutions confidence in your ability to repay debts and maintain an acceptable credit score.

With the information gleaned from your pay stub, you can create and maintain a budget and plan for future financial goals. Our investigation at Check Stub Maker demonstrated that this can help you make informed decisions about your spending habits and savings strategy.

Having precise records of your deductions simplifies the tax filing process and aids in compliance with tax regulations. Additionally, your pay stub serves as evidence of your income, which may be required when filing taxes or applying for loans, mortgages, or government benefits. By keeping track of your pay stubs, you can accurately report your wages to tax authorities and other relevant parties, reducing the risk of errors or discrepancies in your tax filings.

For freelancers and self-employed individuals, organizing and retaining pay stubs is essential for:

By maintaining precise records through pay stubs, you can streamline your monetary management processes and demonstrate earning consistency to potential clients or lenders.

Pay stubs provide transparency regarding employer-paid perks, such as:

Based on our observations, these perks are often included in the total compensation package but which might not be explicitly outlined in employment contracts. When you create pay stubs with us at Check Stub Maker, you can review and understand the value of these work-related benefits. This way, you as an employee receive the agreed-upon compensation and that you follow state legislation to the letter as an employer. Additionally, pay stubs enable employees to:

This added step fosters trust and transparency in the employment relationship and ultimately promotes employee satisfaction and retention.

In this article, we've explored the vital importance of examining your pay stub information. From aiding budgeting to clarifying employer-paid benefits, understanding this payroll document ensures monetary clarity and boosts morale in the workplace. Whether you want pay stubs for your employees or just need a pay stub for getting an ID for your personal applications, we're here to help any way we can. Now, take control of your money and make informed decisions by utilizing our services at Check Stub Maker . Our user-friendly paystub generator is the first step towards financial empowerment in the long run. If you want to learn more, why not check out these articles below:

When it comes to managing financial records, a common question arises: "How long should you keep pay stubs before shredding them?"

Jan 30, 2024

Being a strong leader can be a difficult role to navigate. You don’t want to come off as too bossy yet you don’t want to be perceived as a pushover. Managing...

Mar 14, 2023

What does AWD NC on my check stub mean? Good question.

Aug 31, 2023