Can You File Taxes If You Have All of Your Pay Stubs?

Ever wondered, "Can you file taxes if you have all of your pay stubs?" The answer is yes, but with a few caveats.

Oct 04, 2023Are you looking at your payroll paperwork and wondering, ‘Do checks count as pay stubs?'

Are you looking at your payroll paperwork and wondering, ‘Do checks count as pay stubs?' The short answer is no, they don't. As per our expertise, checks and pay stubs serve different purposes in the payroll process. While a paycheck states your total earnings for a pay period, a pay stub provides a detailed breakdown of your income. This includes deductions, contributions, overtime, and net pay after taxes. At Check Stub Maker , we're experts in money matters and can help you understand the role which checks and pay stubs play in your finances. In this blog post, we'll explore the relationship between checks and pay stubs in depth by examining the differences between the two, and break down what information you can find on each payment-related document. What this article covers:

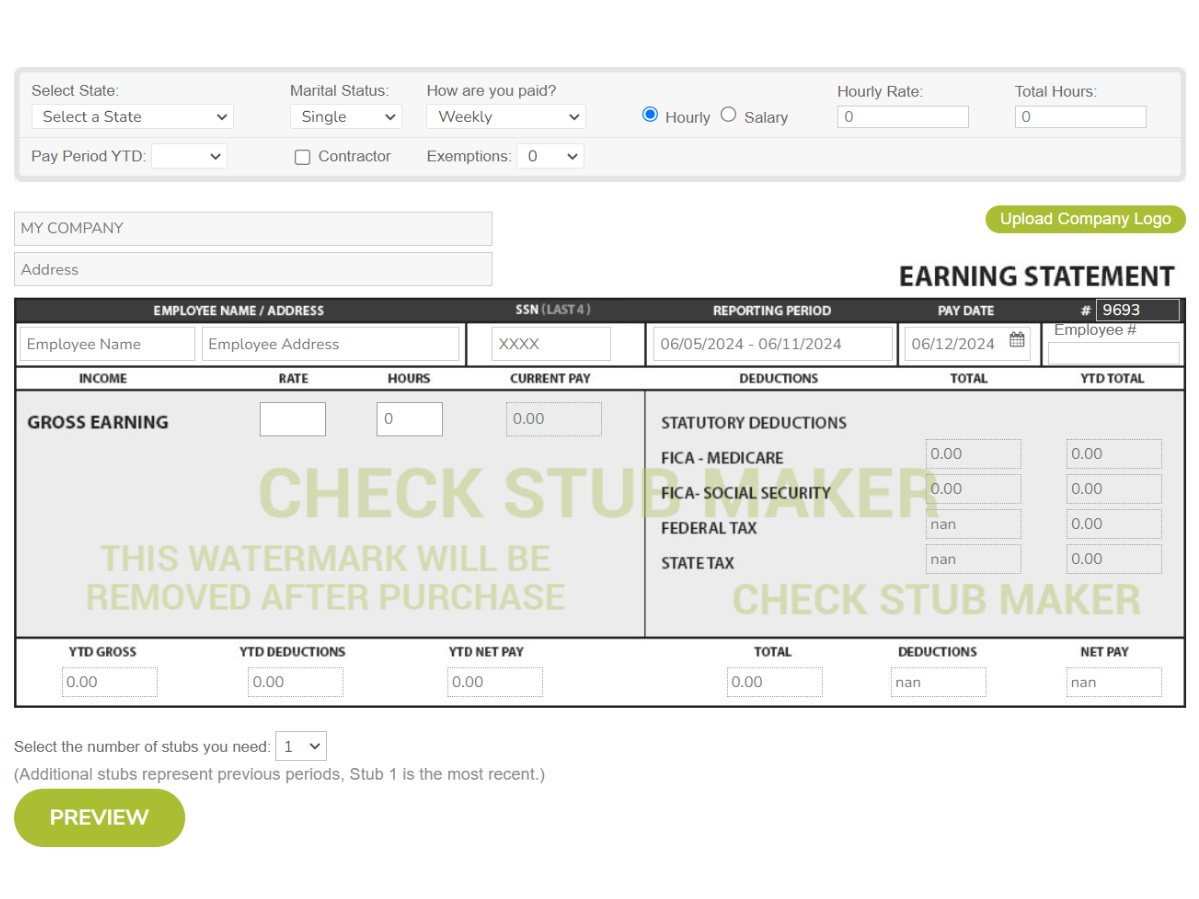

As mentioned, checks and pay stubs are distinct documents with different purposes. While both are related to your professional compensation, they serve separate functions in the payroll process. A check, or paycheck, is a physical or electronic payment issued by your employer for your work during a specific pay period, comprising the total amount you've earned minus any deductions. Drawing from our experience, a pay stub, also known as a payslip, a check stub , or earnings statement, goes beyond a traditional paycheck. In this regard, it gives you a detailed breakdown of your income and deductions during a specific pay period, whether it's hourly, weekly, bi-weekly, or monthly.  what do you put as employer address on paystub when you work online

what do you put as employer address on paystub when you work online

To further clarify the difference between a check vs check stub , let's examine what information you can typically find in each set of paperwork.

A paycheck generally includes:

While a paycheck supplies essential information for a particular payment, it doesn't offer the detailed breakdown of your tax-related data that a pay stub does. You'll soon see the difference when you create pay stubs with us at Check Stub Maker.

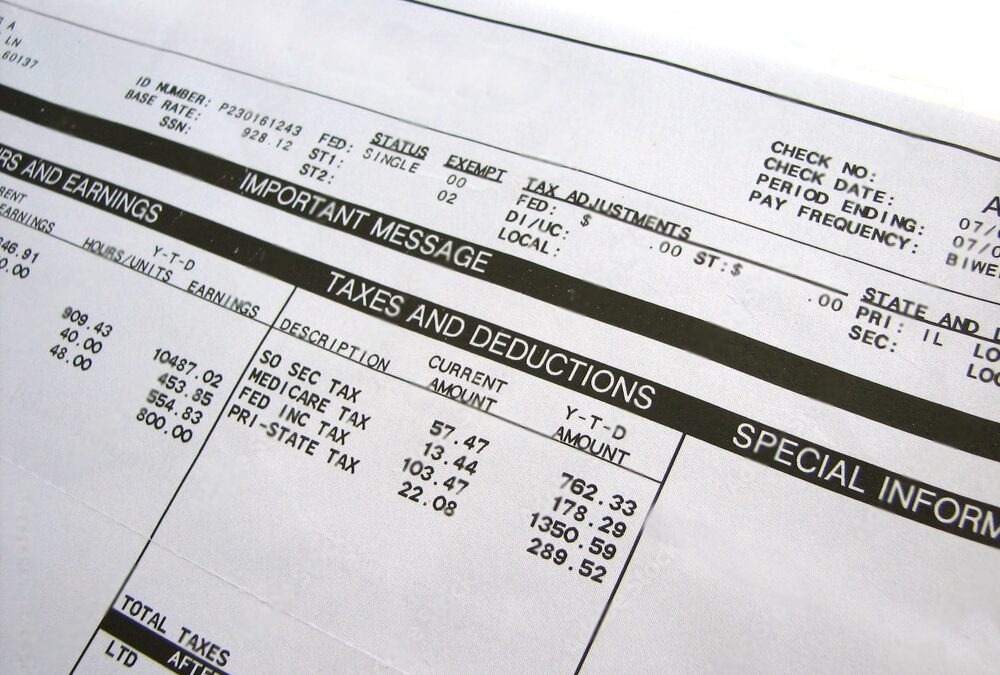

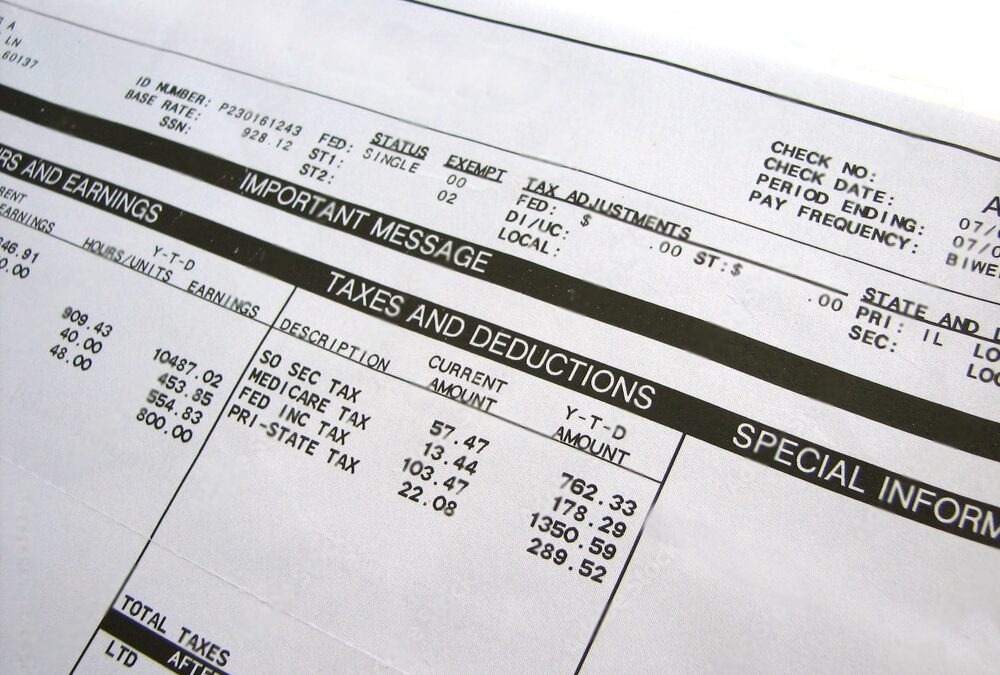

Through our practical knowledge, a pay stub is much more comprehensive than a paycheck. A conventional pay stub looks like this, containing pertinent information about:

Understanding the check stubs meaning is crucial for both employers and employees. For employers, the Fair Labor Standards Act (FLSA) merely stipulates that they maintain detailed payroll records for their employees, which often takes the form of pay stubs in many U.S. states. For employees, pay stubs serve as vital records for verifying accurate compensation, tracking deductions, and for utilization in monetary transactions like loan applications. At Check Stub Maker, we've found that while paychecks supply the direct means of payment, our paystubs offer the pertinent transparency and detail necessary for proper financial management and tax compliance.

In this blog post, we revealed that checks and pay stubs, while related, ultimately serve different purposes in the payroll process. While a paycheck summarizes your total salary, a pay stub breaks down every aspect of your compensation, from contributions to take-home pay after taxes. Now that you know the difference between this vital financial paperwork, why not try our user-friendly pay stub generator for your small to medium-sized businesses? At Check Stub Maker , we help you provide all the necessary information to your employees on their well-deserved earnings. Did our blog meet your needs? You might also find our other guides helpful:

Ever wondered, "Can you file taxes if you have all of your pay stubs?" The answer is yes, but with a few caveats.

Oct 04, 2023

Have you ever glanced at your paystub p and wondered, ‘Why would I have extra paid time off hours on my pay stub?' This can be a pleasant surprise, but it's important to understand why this is the case.

Dec 06, 2023

Talk of digital transformation seems to be everywhere these days, but what does it mean to go digital? When you want to watch a movie, you can do it online. ...

Jun 20, 2017