After working overtime for several grueling hours, have you ever wondered, "What is EWW on a paystub?" ‘EWW' stands for Extended Work Week, a term used to describe additional hours worked beyond the standard workweek. It's typically used to denote overtime pay so employees receive fair compensation that's due for any extra hours they've worked. At Check Stub Maker , we can help you understand the ins and outs of EWW and how much remuneration you should receive on your paystubs . In this blog, we'll explore the concept of Extended Work Week pay, its processes, how rates are calculated, and how employees receive this unique workplace benefit.

What Is Extended Work Week (EWW) Pay for Employees?

Extended Work Week (EWW) pay gives employees specific remuneration for hours worked beyond their regular schedule. Based on our first-hand experience, EWW pay often includes overtime rates, which are higher than standard hourly wages. This pay structure can include bonuses or incentives for additional work as well. The primary purpose of EWW pay on check stubs is to recognize and reward employees for their added effort, helping maintain professional morale and productivity during busy work weeks. EWW pay is an essential aspect of fair compensation, especially in industries where extended hours are common. It acknowledges the value of an employee's time and effort beyond their standard work hours. Moreover, it provides a financial incentive for those who put in extra time to meet deadlines or handle increased workloads.

Who Qualifies For EWW?

You must first be exempt under the Fair Labor Standards Act (FLSA) to qualify for EWW. Our findings at Check Stub Maker show that the following people are exempt in this context and most likely have EWW eligibility if they:

- work as full-time employees

- receive consistent salaries

- perform executive, administrative, or professional duties

It's important to note that the classification of exempt and nonexempt employees varies according to job duties, salary level, and other factors. For example, non-exempt employees are generally employees who get paid $7.25 per hour according to FLSA. While they're entitled to standard overtime pay for hours worked beyond 40 in a workweek, they may not necessarily receive EWW.

When Does EWW Start?

EWW starts when an employee works beyond the standard 40-hour workweek. Usually, this is calculated on a weekly basis, with any hours beyond the regular schedule considered as EWW. However, the exact point at which EWW begins can vary depending on company policies and industry standards. Some organizations might have different thresholds for EWW, especially in industries with non-traditional work schedules or for employees with flexible work arrangements.

How Are EWW Rates Calculated?

The general EWW rate is 1.5 times the standard hourly wage, which is consistent with standard overtime pay regulations. While 1.5 times the regular rate is common, some organizations might offer different rates for EWW. For instance, their rates might be increased for weekend or holiday work to compensate for the inconvenience of working during typically off-peak hours. Our analysis of this product revealed that a pay stub generator like ours at Check Stub Maker simplifies EWW calculations. Our digital payroll tool automatically calculates EWW earnings based on the employee's regular pay rate and the number of extended hours worked.

How Do Employees Receive EWW Pay?

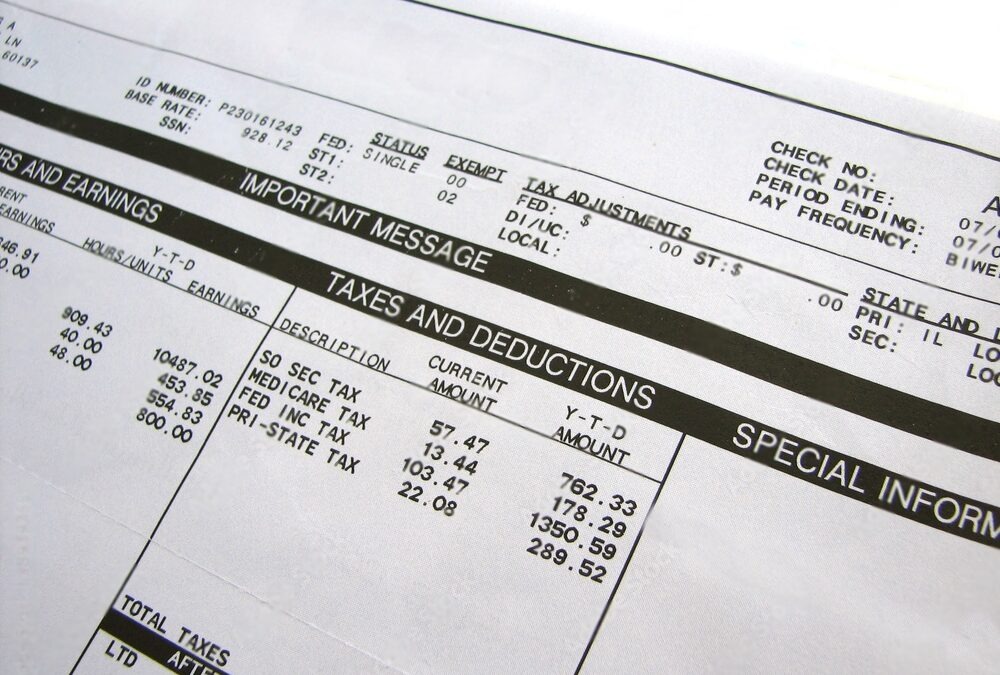

EWW pay is usually included in your regular paycheck. It's itemized separately on your check stub for clarity, allowing you to see exactly how your EWW pay was calculated by your employer. As per our expertise, we at Check Stub Maker ensure that our paystub maker itemizes EWW pay clearly. This makes it easy for employees to check their remuneration and for employers to maintain precise and transparent payroll records. When reviewing your pay stubs, you might notice other items like MIP payment on pay stub , which could indicate a Member Investment Plan for retirement. This is separate from EWW pay but is another important element on your pay stub concerning receiving specific benefits from your employer.

Conclusion

In this blog post, we discovered that an Extended Work Week on a pay stub is essential for precise payroll management. It guarantees that employees are fairly compensated for their extra work, maintaining job satisfaction and productivity. Using tools like our pay stub creator simplifies this process, making it easier for both employers and employees to track and understand compensation that goes beyond the regular work week. If you're looking for an easy way to generate clear, detailed pay stubs that include EWW and other critical financial information, why not give us at Check Stub Maker a try? We make recording overtime and reaping the benefits a breeze for businesses of all sizes. If you want to learn more, why not check out these articles below: