How Long to Keep Pay Stubs

!The Importance of Keeping Your Pay Stubshttps://checkstubmaker.com/wp-content/uploads/2018/08/keeping-your-pay-stubs-300x200.jpg Perhaps you have on occasio...

Aug 20, 2018Curious about ‘What is RSU offset on paystub'? Restricted Stock Units, or RSUs for short, are company shares given to employees as part of their compensation.

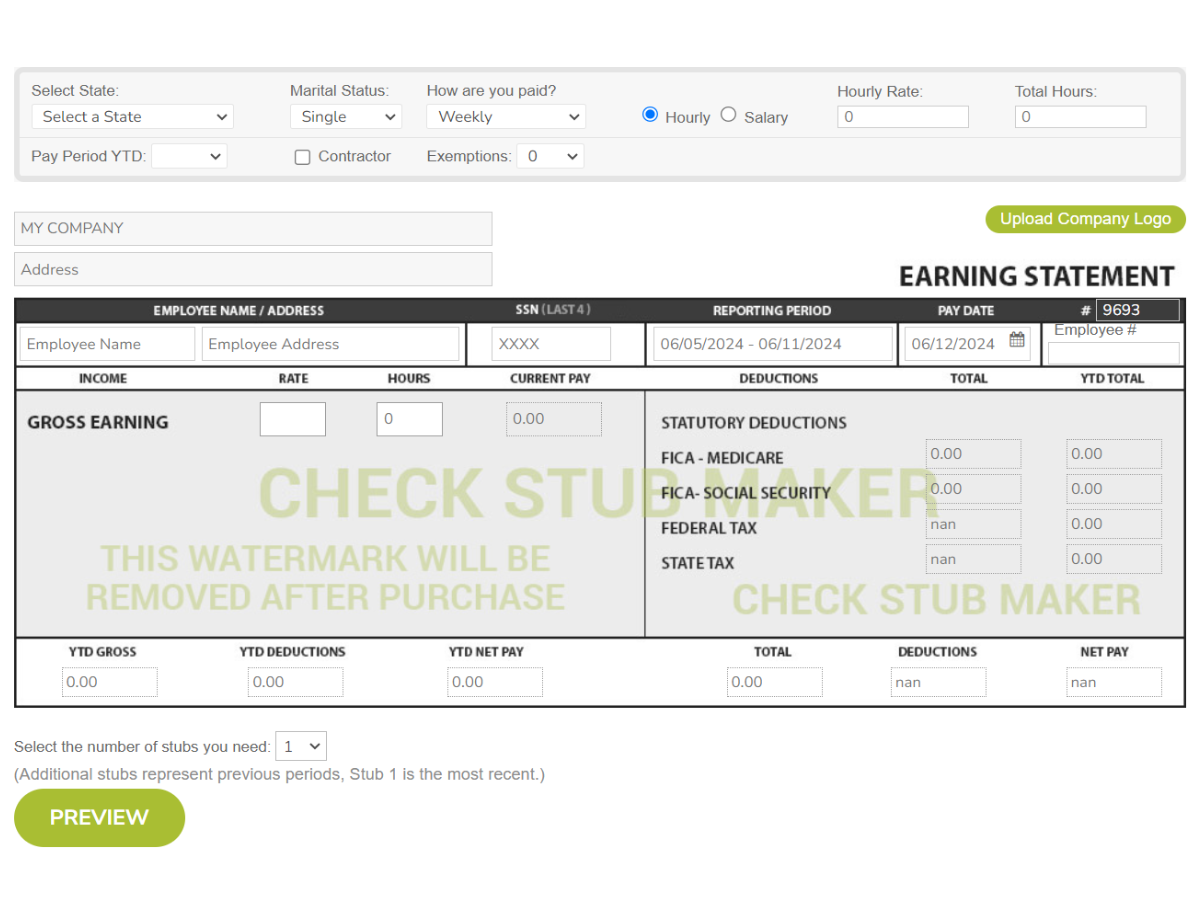

Curious about ‘What is RSU offset on paystub'? Restricted Stock Units, or RSUs for short, are company shares given to employees as part of their compensation. In this context, the RSU offset makes adjustments to employee payments to account for these stock units, which is ultimately reflected on your check stubs . At Check Stub Maker, we're experts in the payroll process and can help you understand your RSU deductions and refunds with our easy-to-use paystub maker . In this article, we'll cover what RSUs are, how they work, the different types and vesting schedules, as well as their pros and cons. Let's dive in! What this article covers:

An RSU, or Restricted Stock Unit, is a company stock granted to employees as part of their remuneration package. They're used as an incentive to retain professional talent, aligning employee interests with the organization's performance.

An RSU offset is a payroll adjustment that reflects the value of these specific company restricted stock units, ensuring accurate reporting of remuneration on pay stubs. This helps employees make sense of their total earnings, including stock units. When employers prepare clear RSU offsets, they prevent payment discrepancies, offering transparency and precision with employee compensation. At Check Stub Maker, we specialize in making these calculations simple yet comprehensive for your financial needs when you create paystubs on our user-friendly platform.

RSUs are given to employees as part of their compensation package (which is similar to a retirement MIP payment on pay stub ), with benefits granted after meeting specific conditions. These requirements are set by the employer and typically involve either a time-based or performance-based vesting schedule. Based on our observations at Check Stub Maker, employees must stay with the organization for a set period or meet performance targets to gain ownership of the RSUs. Once vested, RSUs can be sold or held like regular stocks, providing you with financial perks linked to your company's achievements.

RSUs can vary based on the conditions set by the company. The main types include:

Vesting schedules determine when employees gain ownership of their RSUs. As per our expertise, there are three primary types of RSU vesting schedules:

RSUs have several advantages and disadvantages. RSUs align employee goals with the business' achievements, providing long-term incentives that are tied to the company's accomplishments. They also offer potential for substantial financial gains if the company performs well. However, RSUs don't come with voting rights until they're vested, and they may have tax implications. Moreover, the taxation of RSUs can be complex, involving ordinary income tax when vested and capital gains tax when sold.

Let's consider an employee who receives 100 RSUs which vest over four years. Each year, 25 RSUs vest and become fully owned by the employee.

100 (RSUs) ÷ 4 (years) = 25 vested RSUsThe value of these RSUs depends on the company's stock performance. If the stock price increases, the employee stands to gain significantly. Conversely, if the stock price decreases, the value of the RSUs will be lower. At Check Stub Maker , our pay stub generator is designed to make this process simple and clear, providing you with the tools you need to interpret the value of your RSUs effectively.

Drawing from our experience at Check Stub Maker, RSUs aren't taxed twice, but they do have specific tax implications. When RSUs vest, they're taxed as ordinary income. This means that the value of the RSUs at the time of vesting is included in your taxable earnings for that year. Later, if you decide to sell the vested RSUs, you may be subject to capital gains tax on any increase in the stock's value - from the time of vesting to the time of sale. Proper management of RSUs can optimize tax outcomes. That's why our team is here to help you navigate these complexities and ensure accurate payroll consolidation on your check stub .

Yes, RSU income does appear on your W-2 form. In this regard, our findings show that RSU earnings are typically reported as part of an employee's total compensation, which is crucial for tax reporting and compliance. This means that the value of the RSUs at the time they vest is included in the W-2 form.

If you leave your employer before the RSUs vest, the unvested RSUs are forfeited, causing you to lose any potential stock that hasn't met the vesting conditions. However, any RSUs that have already vested beforehand will remain yours. At Check Stub Maker, we understand that managing vesting schedules is nuanced. That's why our paystub creator is designed to help you keep track of your remuneration with the utmost precision, even when your employment situation changes.

RSUs represent actual shares that are granted to employees. In contrast, an ESPP on paystub , or an Employee Stock Purchase Plan for short, gives employees the right to buy shares at a set price, known as the exercise price. Unlike RSUs, stock options require an EE purchase on pay stub , meaning it's the employee's prerogative to invest in their company. In contrast, RSUs don't have a purchase price like regular stock, automatically converting to stock once vested. Overall, both RSUs and stock options have different tax treatments and vesting schedules, which can affect their value and the timing of their benefits.

In this article, we revealed how Restricted Stock Units and their compensation based on your relationship with your employer is reflected on your pay stub. We simplify this process with our easy-to-use paystub generator . It's tailored for small businesses and self-employed individuals needing precise payroll solutions to keep track of their professional assets. Ready to streamline your finances? Try our services today and experience at Check Stub Maker for the ultimate experience in stock tracking and more. If you want to learn more, why not check out these articles below:

!The Importance of Keeping Your Pay Stubshttps://checkstubmaker.com/wp-content/uploads/2018/08/keeping-your-pay-stubs-300x200.jpg Perhaps you have on occasio...

Aug 20, 2018

Wondering how to calculate yearly income tax off pay stub when tax is not taken out?

Oct 04, 2024

Have you ever wondered, "So pay stubs appear the day before people are paid" and why that's the case?

Dec 06, 2023