3 Months of Pay Stubs

In today's financial world, one of the most reliable and widely accepted forms of income verification is presenting 3 months of pay stubs.

Dec 06, 2023You may be getting ready for tax season and wondering, “What is EIT on paystub?” In layman's terms, “EIT” stands for Earned Income Tax, a local tax collected from employees.

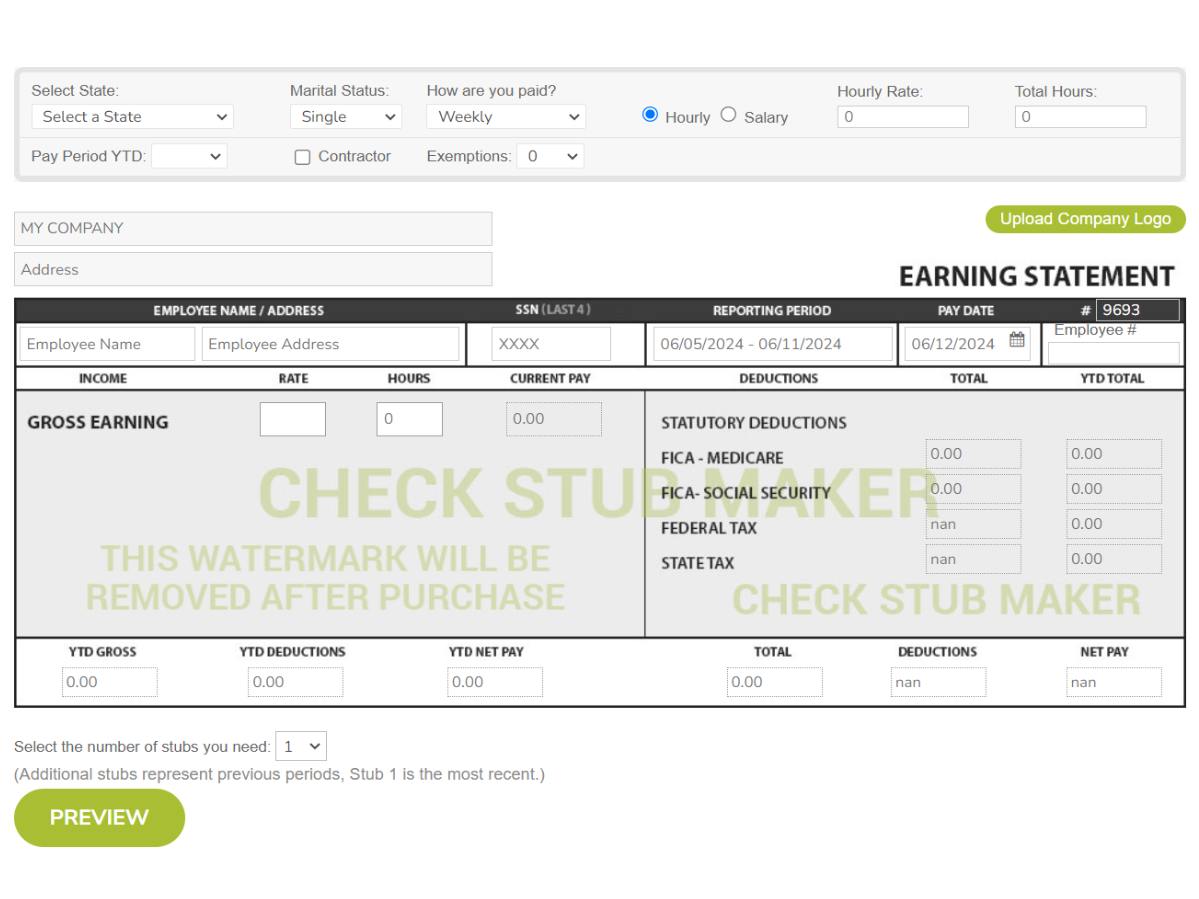

You may be getting ready for tax season and wondering, “What is EIT on paystub?” In layman's terms, “EIT” stands for Earned Income Tax, a local tax collected from employees. It appears on your pay stubs to show the amount withheld by your employer for tax purposes, such as funding local municipalities and schools. At Check Stub Maker , our paystub maker is a simple solution, helping small businesses and self-employed individuals determine how their earnings are affected by local taxes. In this article, we'll explore what Earned Income Tax is, how it works, and EIT withholding requirements for yourself and your employees. Let's jump in! What this article covers:

Earned Income Tax (EIT) is a tax on wages, salaries, and other earnings. It's typically levied by local governments to support community services. As per our expertise at Check Stub Maker, we've found that clear documentation of EIT on paystubs simplifies tax filing for both employers and employees. It aids with compliance and ensures that local services are consistently and adequately funded.

Like a retirement annuity MIP payment on pay stub , employers must also withhold EIT from employees' wages to comply with local tax laws. The amount withheld depends on local tax rates and the employee's earnings. For instance, employers in Pennsylvania must generally withhold 3% of their employees' salary for local EIT if their worksites are located in the state. Therefore, if an employee earns $200,000 annually, then roughly $6,000 will go to local EIT. This process includes:

Liability for EIT is based on the employee's place of residence and work location. Employers must use local tax codes to calculate the correct tax amount. For example, employers in Pennsylvania will compare the employee's Total Resident EIT Rate with the Non-Resident EIT Rate of the work municipality to determine the higher rate to withhold. Afterwards, they must report and remit these taxes quarterly and annually to the pertinent local tax authority. With automated tools like ours at Check Stub Maker, we make calculating EIT seamless. After trying out this product, we found that our paystub generator ensures consistently precise and efficient EIT calculations to determine your employees' tax responsibility.

If multiple locations are used for a business enterprise, the employer should determine the primary work location of the employee, then prorate the EIT accordingly. Based on our first-hand experience, employers must document the time spent at each location to ensure correct tax calculations.

For businesses operating in multiple districts, employers can register with a centralized local tax collection agency to consolidate their filing for Local Income Tax (LIT). Automated payroll solutions like ours at Check Stub Maker streamline the remittance process when you make paystubs with us. This helps businesses with managing their local tax obligations and remaining compliant across numerous locations.

Through our practical knowledge at Check Stub Maker, Political Subdivision (PSD) codes identify local tax jurisdictions which are essential for accurate LIT section 32 withholding calculations on their check stubs . Each PSD code corresponds to a specific EIT rate, determining the amount withheld from employees' wages. For example, the PSD code for Philadelphia is ‘510101', and it has a higher EIT rate compared to suburban areas in Pennsylvania. Employers must use the correct PSD code based on the employee's residence and work location. For instance, the PSD code ‘230303' applies to employees in Concord Township located within the state of Ohio, which affects their EIT rate.

Employers need to register for LIT withholdings by filling out forms containing details about their business details and employees with local tax authorities. This involves:

Employees earning less than $12,000 annually are exempt from Local Services Tax (LST) . By properly documenting exemptions, employers can avoid unnecessary tax withholdings. This ensures that their employees aren't overtaxed and that their company remains compliant with local tax laws.

In this article, we discovered that understanding EIT on pay stubs is crucial for both employers and employees. Wherever you run your business from, we offer an easy-to-use paystub maker to consistently manage your earned income tax calculations. So, what are you waiting for? Simplify your company's payroll process in any locale by experiencing the convenience and accuracy of our digital solutions at Check Stub Maker ! If you want to learn more, why not check out these articles below:

In today's financial world, one of the most reliable and widely accepted forms of income verification is presenting 3 months of pay stubs.

Dec 06, 2023

As a business, it is always important to set goals. In doing so, you will most likely discover that it is not always so easy to see those goals accomplished....

Feb 09, 2023

As more companies turn to digital solutions to streamline their processes, learning ‘how to create pay stubs for my business’ is extremely relevant in the fa...

Feb 23, 2023