Small Business Payroll Stubs

!Small Business Payroll Stubshttps://checkstubmaker.com/wp-content/uploads/2018/07/small-business-payroll-1-300x200.jpg Small business owners are no stranger...

Jul 02, 2018In the world of financing, securing a loan can often hinge on presenting the right paperwork, particularly with a financial services company like Wells Fargo...

In the world of financing, securing a loan can often hinge on presenting the right paperwork, particularly with a financial services company like Wells Fargo.

If you’re wondering, "Do you need pay stubs to get a loan from Wells Fargo?", the answer is a resounding "Yes!". Providing proof of income is a crucial step and your recent pay stubs play a pivotal role in this loan application process.

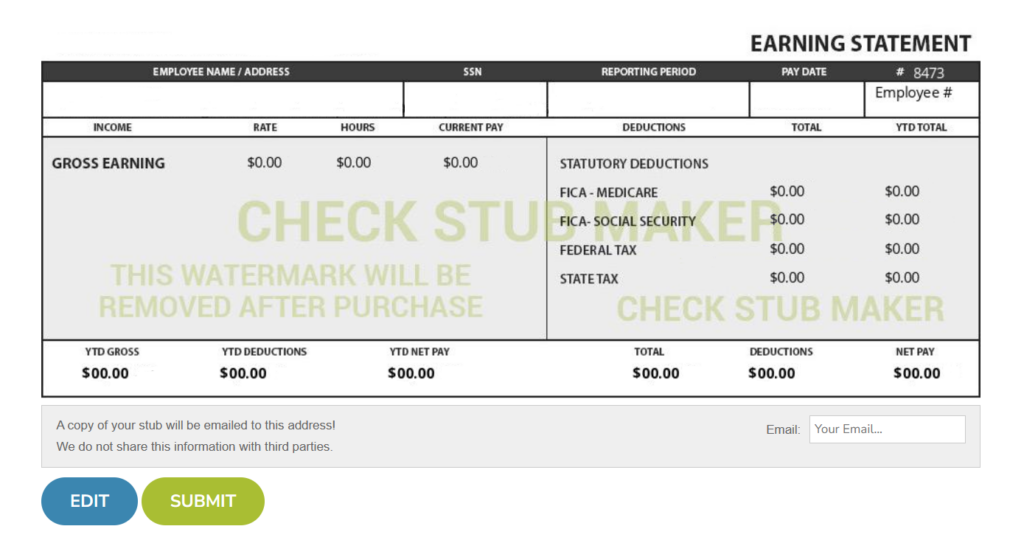

That's where we come in. At Check Stub Maker , our pay stub creator empowers you to generate accurate wage verification swiftly, ensuring your loan application stands out for all the right reasons.

In this article, we'll delve into qualifying for Wells Fargo loans by exploring their various paystub loan types, dissecting their loan terms, and shedding light on their repayment strategies.

Let’s jump in!

What this article covers:

When applying for a loan from Wells Fargo, they typically request your most recent one to two months' worth of pay stubs.

Based on our first-hand experience, these check stubs should detail your gross monthly income and all sources of wages you want Wells Fargo to consider for your loan.

Furthermore, you might need to provide additional copies of any new pay stubs received during the application process so that Wells Fargo has the latest information on your finances.

Submitting multiple recent pay stubs can significantly enhance your credibility with Wells Fargo.

When you make paystubs with us at Check Stub Maker, they serve as vital evidence of your stable earnings and money-related capability, bolstering your loan application.

Wells Fargo personal loans offer flexibility with repayment terms ranging from 12 to 84 months, depending on the loan amount and your creditworthiness. For instance, you can borrow from $3,000 to $100,000, making their loans suitable for various needs.

The application process is relatively straightforward, with most applicants receiving same-day credit decisions, providing quick access to funds if they get approved.

At Check Stub Maker, our team discovered through using this product that our pay stub generator provides accurate proof of income, which is crucial for this type of loan approval.

Now, you can create professional pay stubs swiftly, enhancing your chances of securing a Wells Fargo personal loan.

Based on our observations, Wells Fargo offers various types of personal loans tailored to different needs.

These include:

Our investigation demonstrated that Wells Fargo offers competitive fixed-rate loans with flexible terms, their interest rates typically starting as low as 7.49%.

At Check Stub Maker, we understand the importance of financial flexibility. That’s why our paystub maker ensures accurate earnings documentation, supporting your Wells Fargo loan application process with ease.

Who Is a Wells Fargo Personal Loan Best for?

Who Is a Wells Fargo Personal Loan Best for?Based on our first-hand experience, a Wells Fargo personal loan is best suited for people who want flexible options for various purposes such as:

With generous loan amounts and competitive interest rates, they offer flexibility for diverse needs.

At Check Stub Maker, we understand the importance of accessible lending solutions.

Whether you're a small business owner or an individual requiring proof of wages for loans, you can create check stubs with us to streamline the Wells Fargo loan process.

There are three things you need to do to qualify for a Wells Fargo personal loan.

Our findings show that you must first have an open Wells Fargo account for at least 12 months.

From there, you’ll start by getting a quote online or visiting a branch to assess your eligibility and loan options.

This initial step allows you to understand the loan terms, rates, and potential loan amounts based on your financial situation.

After obtaining a quote, provide all necessary information such as your:

Once you've submitted your application, review the loan details provided by Wells Fargo.

That means carefully examining the terms, fees, and conditions associated with the loan. This step allows you to confirm that the loan aligns with your budgeting goals and obligations.

At Check Stub Maker, we understand the importance of transparent and accessible services. After trying out this product, our paystub creator simplifies the documentation process, offering accuracy and efficiency in managing your finances when under review.

How Much Can I Apply for?

How Much Can I Apply for?As per our expertise, Wells Fargo offers flexible loan amounts going as high as $100,000.

This broad range allows borrowers to select the loan amount that best suits their needs, whether it's for consolidating debt, covering major expenses, or funding special purchases.

Wells Fargo typically takes between one to three business days to approve a personal loan application, provided all required documentation is submitted accurately and promptly.

However, approval times may vary based on individual circumstances and the complexity of the application.

Borrowers with good to excellent credit scores (about 700 and up) generally have a higher chance of approval for a loan from Wells Fargo.

Additionally, the following attributes can improve your chances of qualifying for a Wells Fargo personal loan:

At Check Stub Maker, our pay stub platform empowers you to streamline the payroll documentation process, providing accurate pay stubs tailored to your needs with loan applications.

To apply for a Wells Fargo personal loan, you can follow these steps:

After your loan is approved, you’ll proceed to the closing process. During this phase, you’ll review and sign the loan agreement documents, confirming your acceptance of the loan terms and conditions.

Once all documentation is finalized, the loan funds will be disbursed to your designated account, allowing you to use them according to your financial needs.

### How Long Does It Take To Receive My Funds?

### How Long Does It Take To Receive My Funds?

Our research at Check Stub Maker indicates that most consumers can receive same-day credit decisions, getting prompt access to funds. However, the exact time may vary based on your specific application.

Here's how you can manage your loan payments effectively:

Wells Fargo calculates your monthly payment based on several factors, including the:

To do this, they use an amortization formula to determine a fixed monthly payment amount that covers both principal and interest over the loan term.

As indicated by our tests at Check Stub Maker, the portion of your monthly payment allocated to interest decreases over time as you pay down the principal amount of the loan.

Initially, a larger portion of your payment goes towards interest, but as the principal decreases, more of your payment is applied to reduce the principal balance.

The amount of interest you pay changes each month because the interest is calculated based on the remaining principal balance of the loan.

As you make payments and reduce the principal balance, the interest is calculated on the remaining balance, resulting in a decrease in the interest portion of your monthly payment over time.

Wells Fargo may offer options to change your loan due date, depending on your specific circumstances.

We recommend that you contact Wells Fargo’s customer service team telephonically at 1-800-956-4442 or via email at onlinefeedback@wellsfargoadvisors.com to inquire about changing your due date and exploring available options.

### Can I Make Extra Payments Or Pay Off My Personal Loan Early?

### Can I Make Extra Payments Or Pay Off My Personal Loan Early?

Through our practical knowledge, you can make extra payments or pay off your personal loan early without incurring prepayment penalties with Wells Fargo. This strategy can help you save on interest and pay off your debt sooner.

With our paycheck stub maker , we at Check Stub Maker provide user-friendly solutions to simplify your payroll tasks and support your future loan repayment efforts.

To qualify for an interest rate (relationship) discount, you typically need to have an eligible Wells Fargo checking account and maintain a specified balance.

Through our trial and error, we discovered that this discount is offered to customers who have a strong relationship with Wells Fargo, which can result in lower interest rates on personal loans.

A hard credit inquiry occurs when a lender checks your credit report as part of the loan application process, which can impact your credit score.

On the other hand, a soft credit inquiry may be conducted for pre-qualification purposes or background checks, which doesn’t affect your credit score.

When you make a payment on your Wells Fargo personal loan, it’s typically applied first to any outstanding fees or charges.

After that, it goes to accrued interest, and finally to the principal balance of the loan. Our findings show that this payment allocation helps reduce the overall loan balance over time.

If you miss a payment or make a late payment on your Wells Fargo personal loan, it can negatively impact your credit score and result in late fees or penalties.

Additionally, late payments may lead to increased interest rates or other adverse effects on your loan terms.

It's essential to make payments on time to maintain a positive credit history and avoid additional money-related burdens.

At Check Stub Maker, we prioritize transparency and reliability in providing paystubs that streamline and promote financial management, making you a trustworthy candidate for Wells Fargo loan applications.

Understanding "Do you need pay stubs to get a loan Wells Fargo?" is crucial for navigating loan processes effectively. We've covered qualifying for Wells Fargo loans, loan types, terms, and repayment methods.

Now, you can streamline your financial journey with ease by using our user-friendly paystub creator . Let's simplify your payroll management and empower your monetary decisions.

Try our services at Check Stub Maker today and experience the convenience firsthand!

If you want to learn more, why not check out these articles below:

!Small Business Payroll Stubshttps://checkstubmaker.com/wp-content/uploads/2018/07/small-business-payroll-1-300x200.jpg Small business owners are no stranger...

Jul 02, 2018

!How to Void a Check?https://checkstubmaker.com/wp-content/uploads/2021/04/pexels-cytonn-photography-955389-1-300x200.jpg Using paper checks has become less ...

Apr 02, 2021

In the world of business transactions, proving where you live is crucial, particularly with a bank asking for paystub. That's where proving where you live comes in. But the question arises: do pay stubs count as proof of address?

Apr 24, 2024