How Many Pay Stubs Do I Need for a Car?

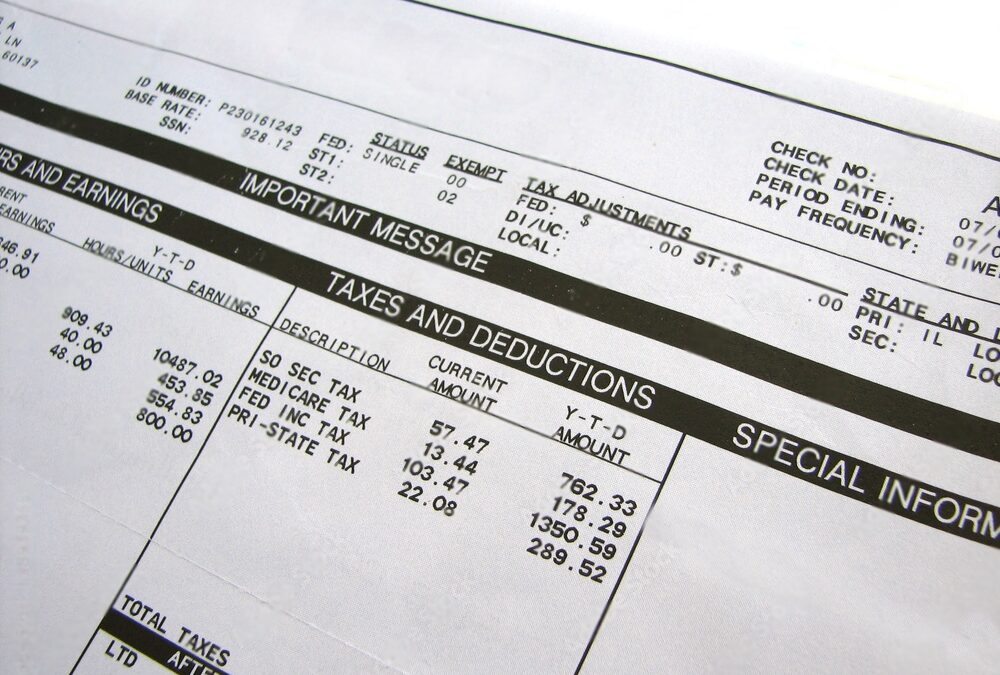

Are you wondering, ‘How many pay stubs do I need for a car?' Generally, you need two to three months of your most recent pay stubs to buy or lease a vehicle.

Jul 02, 2024Are you wondering, ‘is 10 weeks of pay stubs sufficient usda loan?’ Yes, they are! The U.S. Department of Agriculture, or USDA loans for short, demand a reliable employment and income history, which is perfectly showcased by this duration of pay stubs.

Are you wondering, ‘is 10 weeks of pay stubs sufficient usda loan?’ Yes, they are! The U.S. Department of Agriculture, or USDA loans for short, demand a reliable employment and income history, which is perfectly showcased by this duration of pay stubs.

At Check Stub Maker , our pay stub creator ensures you have the necessary documentation, helping you secure that USDA loan with ease.

In this article, we'll delve into the specifics: the number of pay stubs required, the different types of USDA loans available, eligibility criteria, and a step-by-step guide through the application process.

Let's embark on this journey to homeownership together!

What this article covers:

Based on our first-hand experience, lenders require around 2 to 3 months' worth of pay stubs for a USDA paystub loan , which amounts to 8-12 weeks' worth of pay stubs in total.

This timeframe is crucial for establishing a consistent earnings history, a key factor in loan approval. Having this paperwork provides lenders with a clear picture of your monetary stability, increasing the likelihood of approval.

At Check Stub Maker, generating the necessary pay stubs for a USDA loan on our platform is quick and hassle-free, ensuring you seamlessly meet the requirements.

What Is a USDA Loan?

What Is a USDA Loan?A USDA loan, backed by the U.S. Department of Agriculture's Rural Development Program , offers low-to-moderate-income borrowers in eligible rural and suburban areas access to affordable home financing with little or no down payment required.

As per our expertise, eligible applicants must meet specific criteria, including wage limits and property location.

Properties must typically be in designated rural areas to qualify. Eligibility also considers credit history and ability to repay the loan.

USDA loans may be provided by private lenders, such as:

Lenders can give 100% financing and below-market interest rates without taking on undue risk thanks to the USDA’s guarantees and subsidies.

These loans aim to promote homeownership in areas where traditional financing may be challenging. Ideal for first-time homebuyers and those with limited savings, USDA loans often feature competitive interest rates and flexible credit requirements.

At Check Stub Maker, we strive to empower individuals with the monetary tools they need, including accurate check stub generation to support their mortgage applications.

Let’s look at the different types of USDA available to you.

Table: Types Of USDA Loans

**USDA Loan TypeDescriptionUSDA Guaranteed LoansBacked by the USDAProvide lenders with a guarantee against potential loss if the borrower defaultsFavorable terms such as low interest rates and flexible credit requirementsNo down payment requiredAccessible to low-to-moderate-income homebuyers in rural areasUSDA Direct LoansProvided directly by the USDATailored for people or households with low income to purchase homes in eligible rural areas Offer subsidized interest ratesNo down payment requiredBorrowers work directly with USDA representatives throughout the loan processUSDA Home Improvement LoansOffered through the USDA's Rural Housing Repair and Rehabilitation programAssist eligible homeowners in financing necessary repairs, renovations, or improvements to their homes Low-interest financing options so homeowners can enhance the safety, livability, and value of their propertiesEligible improvements include repairs to structural issues, installation of energy-efficient systems, or modifications for accessibility### USDA Guaranteed Loans

USDA Guaranteed Loans are backed by the United States Department of Agriculture (USDA), providing lenders with a guarantee against potential loss in case the borrower defaults.

Our investigation demonstrated that these loans offer favorable terms such as low interest rates and flexible credit requirements, making them accessible to low-to-moderate-wage homebuyers in rural areas.

They don’t require a down payment, making homeownership more achievable for people with limited savings.

USDA Direct Loans, also known as Section 502 Direct Loans, are provided directly by the USDA to low-income individuals or households to purchase homes in eligible rural areas.

Drawing from our experience at Check Stub Maker, we understand that these loans offer subsidized interest rates and often don’t require a down payment. This makes them ideal for those with low earnings and minimal savings.

Borrowers work directly with USDA representatives throughout this loan process, fostering a personalized experience.

USDA Home Improvement Loans, offered through the USDA's Rural Housing Repair and Rehabilitation program, aim to assist eligible homeowners in financing necessary repairs, renovations, or improvements to their homes.

Based on our observations, these loans provide low-interest financing options for qualified applicants. This enables them to enhance the safety, livability, and value of their homes.

Eligible improvements may include:

How to Apply for a USDA Home Loan

How to Apply for a USDA Home LoanHere’s how you can apply for a USDA home loan in six easy steps.

Before starting the application process, you must gather essential paperwork to streamline the process.

Documents typically required include:

Pre-qualification involves providing basic financial information to a lender, who then assesses your eligibility for a USDA loan.

This step gives you an idea of your budget and helps focus your property search on homes within your price range.

Our findings at Check Stub Maker show that pre-qualification can save time and streamline the homebuying process by providing clarity on monetary options.

Once pre-qualified, you first need to make sure that your property is located in a USDA-eligible rural area. Typically, the USDA gives loan approval to areas with a population of 20 thousand people or less.

You can use resources like the USDA's online eligibility map to check this information as well as identify other areas where USDA loans are typically accepted for a broader understanding of the eligibility requirements.

The USDA takes the following factors into consideration when approving a loan:

You must provide all requested information, including your:

Ensure that all your information is up-to-date and accurate to avoid delays in processing. After putting it to the test, we at Check Stub Maker found that attention to detail during the application process is crucial for a smooth approval process.

After submitting your application, the property will undergo an appraisal and inspection to assess its value and condition.

This is done to check whether the property meets USDA requirements for safety and livability. We recommend preparing yourself to potentially cover appraisal and inspection costs.

These steps are essential for guaranteeing that your property meets USDA loan application standards.

Upon completion of the appraisal and inspection, the lender will review your application and make a decision on loan approval. If approved, you and the lender will finalize the loan agreement and complete the closing process.

During closing, you must sign all necessary paperwork and pay any remaining closing costs. Staying organized and responsive during this final stage expedites the closing process and ensures a successful conclusion.

By following these steps and leveraging our expertise, we at Check Stub Maker can provide you with accurate paystubs .

This can help you navigate the USDA home loan application process efficiently to secure financing for your dream home.

USDA loans typically offer lower interest rates compared to conventional loans, making them a more affordable option for eligible borrowers.

Our analysis of this product revealed that USDA loans don’t often need a down payment and have flexible credit score requirements. In contrast, conventional loans usually demand a substantial down payment and higher credit scores from borrowers.

Additionally, USDA loans cater to low-to-moderate-income borrowers in rural areas, while conventional loans are available to a broader range of borrowers. Despite these advantages, USDA loans may have stricter property eligibility criteria, which some borrowers might find challenging.

Overall, USDA loans provide a compelling alternative for qualified individuals seeking homeownership with favorable terms.

When you create pay stubs with us at Check Stub Maker, we help you put your best forward with your USDA loans. You can generate quick and precise pay stubs in minutes that verify all your critical banking information.

USDA Loans FAQs

USDA Loans FAQsUSDA home loans have wage limits based on the area's median income and which vary depending on the location and the size of the household.

Lower-income households, especially those in rural areas, are more likely to meet the income requirements, so long as their earnings are 15% or less than the area’s median income.

USDA loans may take slightly longer to close compared to conventional home loans from the Federal Housing Administration (FHA) or Veteran Affairs (VA) .

Through our trial and error, we discovered that the processing time can vary depending on factors such as the:

While USDA loans involve additional steps, such as property eligibility assessments, they typically close within a reasonable timeframe.

We recommend that you engage in proactive communication with the lender by ensuring that all necessary documentation is provided promptly to help expedite the closing process.

Borrowers with existing USDA loans may be eligible for cash-out refinancing.

Cash-out refinancing allows borrowers to access equity in their homes by refinancing for a higher loan amount than the current mortgage balance.

This additional cash can be used for various purposes, such as:

However, cash-out refinancing is subject to USDA guidelines and borrower qualification requirements. Borrowers should consult with a USDA-approved lender first to determine their eligibility and explore available options.

The maximum loan size for USDA mortgages is determined by several factors, including your earnings, debts, and the property's appraised value.

Through our practical knowledge at Check Stub Maker, we've learned that USDA loans don’t have a strict maximum loan amount like conventional loans.

Instead, eligibility is based on the borrower's ability to repay the loan, considering factors such as their:

Yes, borrowers can receive gifts or have the seller pay for closing costs with a USDA loan.

These loans allow borrowers to receive gifts from:

Sellers can also contribute towards closing costs through a seller concession. However, the total amount of closing costs paid by the seller cannot exceed the actual closing costs.

Drawing from our experience at Check Stub Maker, these options can help borrowers minimize their out-of-pocket expenses when purchasing a home with a USDA loan.

USDA loans cannot be used to finance vacation homes, investment properties, or working farms as they’re intended for primary residences in eligible rural areas.

Attempting to use a USDA loan for ineligible purposes may result in loan denial and potential consequences.

People who have recently returned to work or are self-employed may be eligible for USDA loans.

Our investigation at Check Stub Maker demonstrated that USDA loans consider various wage sources, including:

However, self-employed individuals in particular may need to provide additional paperwork, such as tax returns and profit-and-loss statements, to verify their income stability.

After trying out this product, our pay stub generator is an excellent tool for helping the self-employed create check stubs quickly and accurately to help them qualify for a USDA loan.

The USDA loan program is meant for financing home purchases, repairs, improvements, accessibility and energy-efficiency upgrades for homes located in eligible rural areas.

If your home isn’t eligible for a USDA loan in this regard, we recommend exploring alternative financing options from other government programs specifically tailored to your renovation needs to fund home improvement projects.

### Can A Non-Citizen Qualify For A USDA Loan?

### Can A Non-Citizen Qualify For A USDA Loan?

Non-citizens may qualify for USDA loans if they meet the program's eligibility requirements.

Our research indicates that eligible non-citizens include:

If you fall into this category and want to apply for a USDA loan, you must provide documentation to verify your immigration status and eligibility to reside in the United States.

In this article, we unraveled the mysteries surrounding USDA loans, shedding light on their purpose, eligibility criteria, and the application process to address the question, "Is 10 weeks of pay stubs sufficient for a USDA loan?"

Now equipped with this knowledge, it's time to streamline your USDA loan applications effortlessly.

Visit us at Check Stub Maker now and let's save you valuable time and effort with our user-friendly paystub maker !

If you want to learn more, why not check out these articles below:

Are you wondering, ‘How many pay stubs do I need for a car?' Generally, you need two to three months of your most recent pay stubs to buy or lease a vehicle.

Jul 02, 2024

An employee pay stub is a document that accompanies a paycheck, detailing the specifics of an employee's earnings.

Jan 30, 2024

Wondering ‘Can a person transfer H1B to another employer with one pay stubs'? H1B visas are vital for foreign nationals working in the United States, showcasing the significance of seamless employment changes.

Apr 24, 2024