Wondering how to find annual income on paystub? All you have to do is check the 'summary' section of your paystubs to see a breakdown of your annual income, including earnings and deductions. At Check Stub Maker , we're experts in the payroll process and we're here to help you navigate this important financial information. In this guide, we'll explore what annual income is, why it's important to calculate, and how to determine your yearly earnings from your pay stubs. We'll cover methods for calculating wages before and after taxes, as well as how to estimate annual income from your hourly wages. Let's dive in! What this article covers:

What Is Annual Income?

Annual income refers to the total amount of money you earn in a year from all sources, including your:

- salary or wages

- bonuses

- commissions

- any other forms of compensation

It's a crucial figure that provides a comprehensive view of your financial situation over a 12-month period. When looking at your check stub , you might see references to your gross yearly income on check stub , which represents your total earnings before any deductions are made.

Why Is It Helpful To Calculate Your Annual Income?

Our findings at Check Stub Maker show that people who regularly track their annual salary are better equipped to make informed financial decisions and plan for their future. Knowing your annual wages helps you create realistic budgets, set savings goals, and understand your tax obligations. It's also crucial when applying for loans, mortgages, or rental agreements, as many financial institutions and landlords use this figure to assess your ability to meet payment obligations. Moreover, deciphering your annual income allows you to negotiate salary increases effectively and evaluate job offers by comparing total compensation packages. With our trusted pay stub creator , you can do these essential calculations in a matter of minutes.

How to Calculate Annual Income From Pay Stubs

To calculate your annual income, you'll need to look at various factors such as your:

- gross pay

- net pay

- taxes

- deductions

How To Calculate Annual Income After Taxes And Deductions

The amount of earnings you actually take home after taxes and deductions is known as your net annual wages. To calculate your annual salary after taxes and deductions, look at the 'net pay', ‘net annual income', or 'take-home pay' figure on your pay stub. This represents your earnings after all deductions have been made. Next, multiply this number by the amount of pay periods in a year to get your net annual income. For instance, if your net pay is $1,500 per bi-weekly paycheck, your net annual earnings would be $39,000.

$1,500 (bi-weekly gross pay after deductions) x 26 (number of bi-weekly pay periods) = $39,000 (net annual income)

How To Calculate Annual Income Before Taxes

As per our expertise at Check Stub Maker, calculating your annual wages before taxes, also known as ‘gross annual income', is essential for figuring out your true earning potential and for tax planning purposes. To calculate your annual earnings before taxes, locate the 'gross pay' or 'total earnings' figure on your pay stub. This amount represents your earnings before any deductions are taken out. Next, multiply your gross pay (before deductions) by the number of pay periods in a year. For example, if your gross pay is $3,000 per monthly paycheck, your gross annual income would be $36,000.

$3,000 (monthly pay before deductions) x 12 (number of monthly pay periods) = $32,000 (gross annual income)It's important to note that this method provides an estimated pay stub calculation of your annual wages, which doesn't account for potential variations in pay throughout the year, such as bonuses or overtime.

How To Calculate Annual Income From Hourly Wages

If you're an hourly worker, calculating your annual income requires this important step. Through our practical knowledge, we at Check Stub Maker have developed a simple method to help hourly workers estimate their annual wages accurately. Start by multiplying your hourly rate by the number of hours you work per week. Then, multiply this figure by 52 (the number of weeks in a year). For example, if you earn $15 per hour and work 40 hours per week, your annual income would be $31,200.

$15 x 40 (hourly wages and rates per week) x 52 (number of weekly pay periods) = $31,200Remember that this method provides an estimate and doesn't account for overtime, holidays, or unpaid time off. For a more precise figure, you may need to adjust based on your specific work schedule and any variations in hours throughout the year.

Conclusion

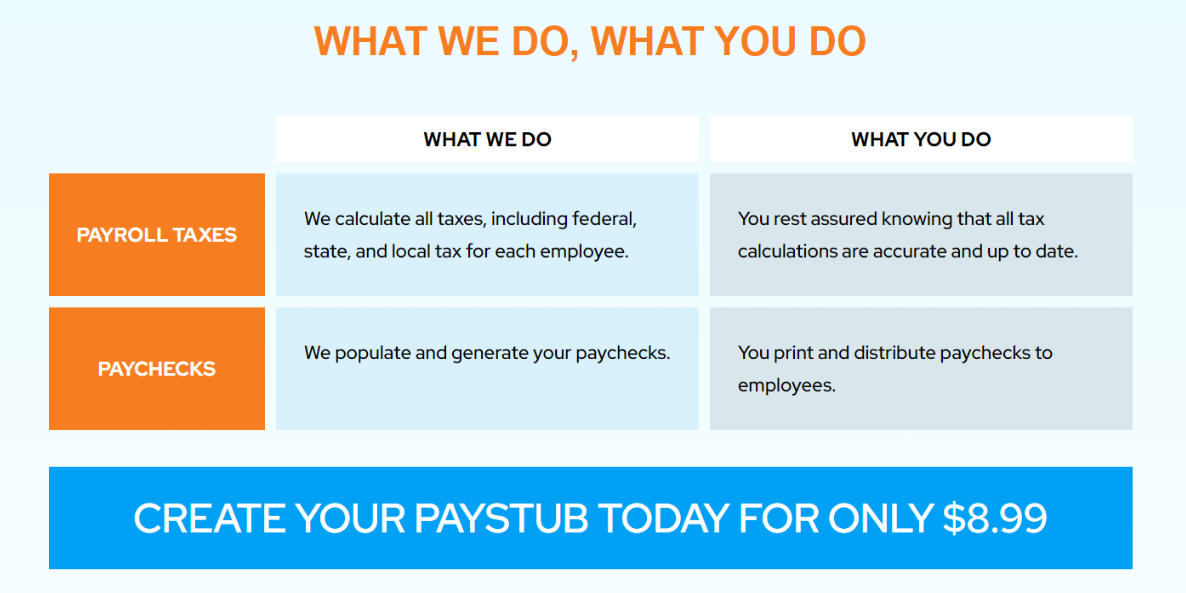

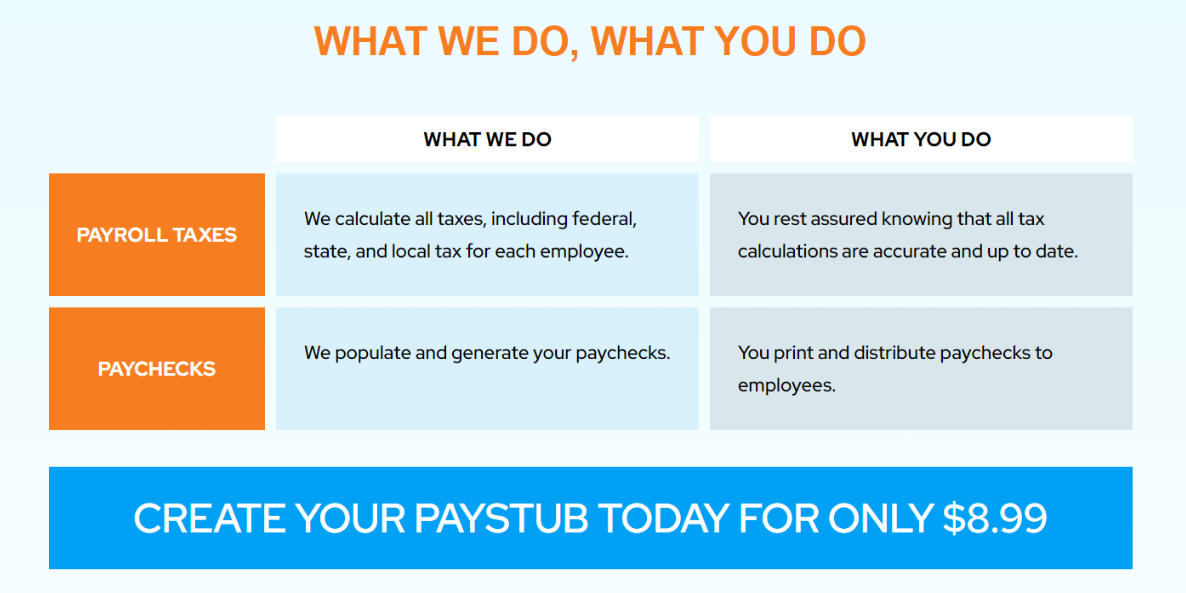

In this guide, we discovered that understanding how to find annual income on paystub is crucial for effective financial planning. We also explored the concept of annual earnings, its importance, and various methods to calculate it from your pay stubs. Need help creating accurate pay stubs for your small business? Try our user-friendly pay stub generator at Check Stub Maker . We make payroll management a breeze, ensuring you always have the financial information you need at your fingertips. If you want to learn more, why not check out these articles below: