Fit Deduction on Paystub

In the realm of payroll, it's imperative that you understand the significance of the 'fit deduction on paystub' for both employers and employees.

Mar 25, 2024You might be thinking about budgeting for a rainy day and wondering, “What is annuity on a check stub?”

You might be thinking about budgeting for a rainy day and wondering, “What is annuity on a check stub?” An ‘annuity' is essentially a retirement savings plan purchased by an employer for their employee. It represents a portion of the employee's pay which is set aside for a specific retirement account. A typical example of an annuity is a 403(b) tax-sheltered annuity (TSA) plan. In this guide, we at Check Stub Maker will explore different types of annuities, including immediate and deferred options. We'll also explain what a TSA plan is, and guide employers through how exactly they and their employees can participate in an IRS 403(b). Let's get started! What this article covers:

An annuity is a financial product that offers a steady stream of income to an individual, which is generally used for retirement planning. Annuities are contracts between someone and an insurance company. In this business transaction, you make payments (either in a lump sum or over a period of time) in exchange for regular payouts in the future. Annuities accumulate funds over the years, either through contributions or investment growth. From there, the money is distributed back to the annuity owner in a series of payments. Depending on the type of annuity that's chosen, these payments can start immediately or be deferred to a later date. When you see an annuity on your check stub , it usually indicates that a portion of your salary is being allocated to a tax-advantaged retirement account, such as a 403(b) plan. This contribution is often made with pre-tax dollars, which can reduce your taxable earnings for the year.

Drawing from our experience, annuities come in various forms, comprising part of your basic wages reflected as nml on pay stub . The five primary types are:

The two main categories we'll discuss in greater detail are immediate and deferred annuities. Let's take a closer look at each:

An immediate annuity begins paying out to the payee on their paystubs shortly after the initial investment is made by them. This type of annuity is often purchased with a lump sum payment. It's ideal for people nearing retirement or those who have already retired and need a steady income stream right away. As per our expertise at Check Stub Maker, we've found that immediate annuities can provide a sense of financial security for retirees. This is because they supply guaranteed earnings for a specific period or for the remainder of the annuity owner's life.

A deferred annuity, on the other hand, allows the invested funds to grow over time before the payout phase begins. This type of annuity is generally chosen by people who are still in their working years and want to build up their retirement savings. Deferred annuities can be further divided into fixed, variable, and indexed annuities:

At Check Stub Maker , we've observed that deferred annuities can be an effective way to supplement other retirement savings programs, such as 401(k)s or Individual Retirement Accounts (IRAs).

A Tax-Sheltered Annuity (TSA), also known as a 403(b) plan, is governed by section 403(b) of the Internal Revenue Code . In essence, it's a retirement savings plan supplied by public schools and certain tax-exempt organizations, such as:

Our findings at Check Stub Maker show that TSAs are designed to offer employees of these organizations a tax-advantaged way to save for retirement. The term "tax-sheltered" refers to the fact that contributions to these plans are made with pre-tax dollars, reducing the employee's taxable salary for the year. Additionally, the earnings on these investments grow tax-deferred until they're eventually withdrawn by the retiree. When you see an annuity listed on your check stub from a qualifying employer, it's likely referring to contributions made to a TSA plan. These contributions are automatically deducted from your paycheck and invested into said retirement plan on your behalf.

Employers looking to offer a 403(b) TSA plan to their employees must follow specific steps for compliance with IRS regulations. Here's a breakdown of the process:

The first step for employers participating in a 403(b) TSA plan is to adopt a written program. This document should outline all the necessary terms and conditions, such as:

Regular updates to the written program are necessary to reflect any changes in IRS regulations or organizational policies. This can achieve ongoing compliance as well as the TSA plan's overall success and legality.

Once the written program is in place, employers must establish annuity contracts or custodial accounts for each employee who participates in the 403(b) plan. Annuity contracts provide a structured payout system for employees upon retirement to achieve a steady income stream. Alternatively, custodial accounts supply investment options through mutual funds, allowing employees to choose how their retirement savings are invested. These accounts will hold the contributed funds and any subsequent wages until the retiree makes a withdrawal. The selection of annuity providers or custodial account managers is a critical decision for employers. That's why it's important to choose insurance companies that offer diverse investment options and demonstrate reliable financial management.

Employers must obtain a separate Employer Identification Number (EIN) specifically for the 403(b) plan. This number is distinct from the general business EIN and is required for all IRS communications and filings related to the TSA plan. An EIN is essential for maintaining the tax-sheltered status of the TSA plan. This is done to ensure that all contributions and distributions are correctly reported to the IRS. The EIN is used in various tax documents and reports, including annual filings that detail the money-related activities of the 403(b) plan.

Employers are responsible for informing eligible employees about the 403(b) plan. This includes supplying them with all the necessary paperwork, such as the:

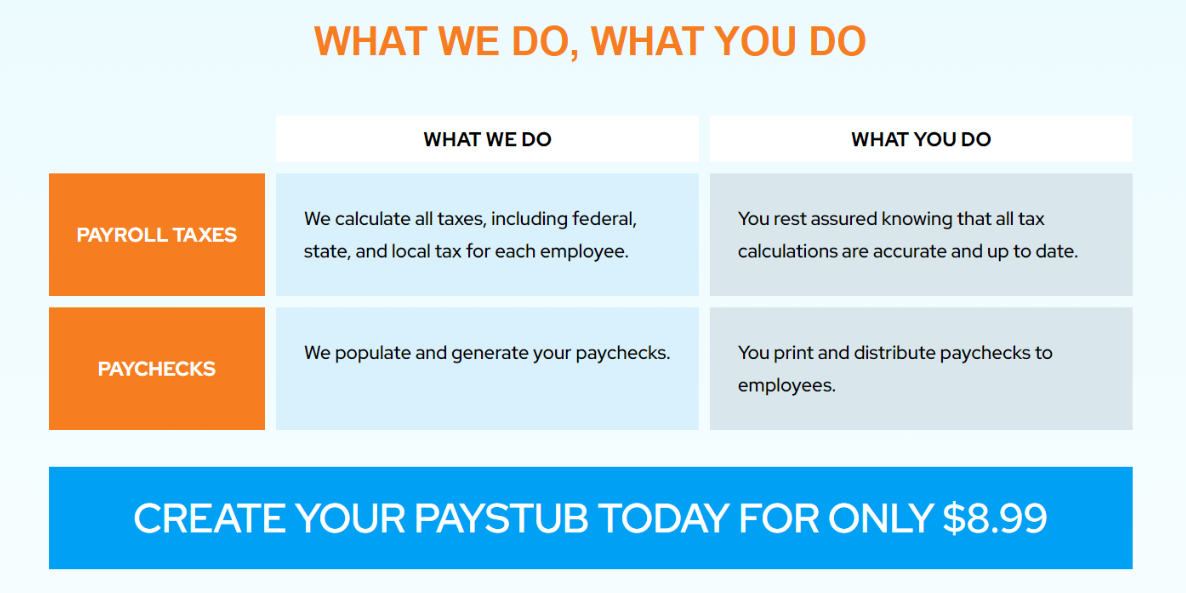

In addition to ongoing communication, employers must also distribute annual notices that summarize each employee's contributions and the current status of their accounts. Our team at Check Stub Maker discovered through using this product that our paystub generator can assist employers with keeping precise records of contributions and deductions. This makes it easier to meet these reporting requirements.

It's crucial for employers to adhere to the terms outlined in the 403(b) plan's written program. This includes enforcing contribution limits, overseeing distributions, and ensuring that the plan remains in compliance with IRS regulations. Regular audits and reviews of the 403(b) plan should be consistently conducted to aid with its compliant operation and alignment with both the written program and IRS guidelines. Any deviations from the plan's terms must be recorded and corrected promptly. Employers should also consult with legal and financial advisors to keep the plan up-to-date with any changes in regulations. That way, all parties with a vested interest can benefit fully from the plan's intended advantages.

Employers are required to deposit employee contributions into the 403(b) plan promptly. This is usually done within five business days following the pay period. Timely deposits are pivotal for maintaining the tax-sheltered status of the plan and ensuring that employees' retirement savings are invested as intended. In order to guarantee timely deposits, we recommend that employers establish a reliable process for transferring contributions from payroll to the plan's custodian to avoid penalties and the potential loss of tax benefits.

Through our practical knowledge, we at Check Stub Maker found that a TSA's main advantage is the ability to offer pre-tax contributions. This subsequently results in reduced taxable earnings and taxes being deferred on your salary. This allows your annuity contributions to grow over time without being taxed until they're withdrawn, which is often during retirement. TSAs also include the possibility of employers matching contributions, which can significantly boost an employee's retirement savings. However, there are some disadvantages to consider. For instance, withdrawals made before the age of 59½ may incur a 10% early withdrawal penalty in addition to ordinary income tax. Furthermore, the investment options within a TSA plan can sometimes be more limited compared to other conventional retirement plans, depending on the provider. It's important for employees to weigh these pros and cons when deciding whether a TSA is the right choice for their retirement strategy in the future.

TSAs are specifically intended for employees of public schools, certain non-profits, and religious organizations. In contrast, 401(k) plans are generally offered by private-sector employers and are more widely available. Another key difference lies in the investment options between the two. TSAs may supply fewer investment choices compared to 401(k) plans, which is dependent on the plan provider. With that said, both types of plans offer the benefit of tax-deferred growth. This allows employees to build their retirement savings without being taxed on the salary until they withdraw the funds.

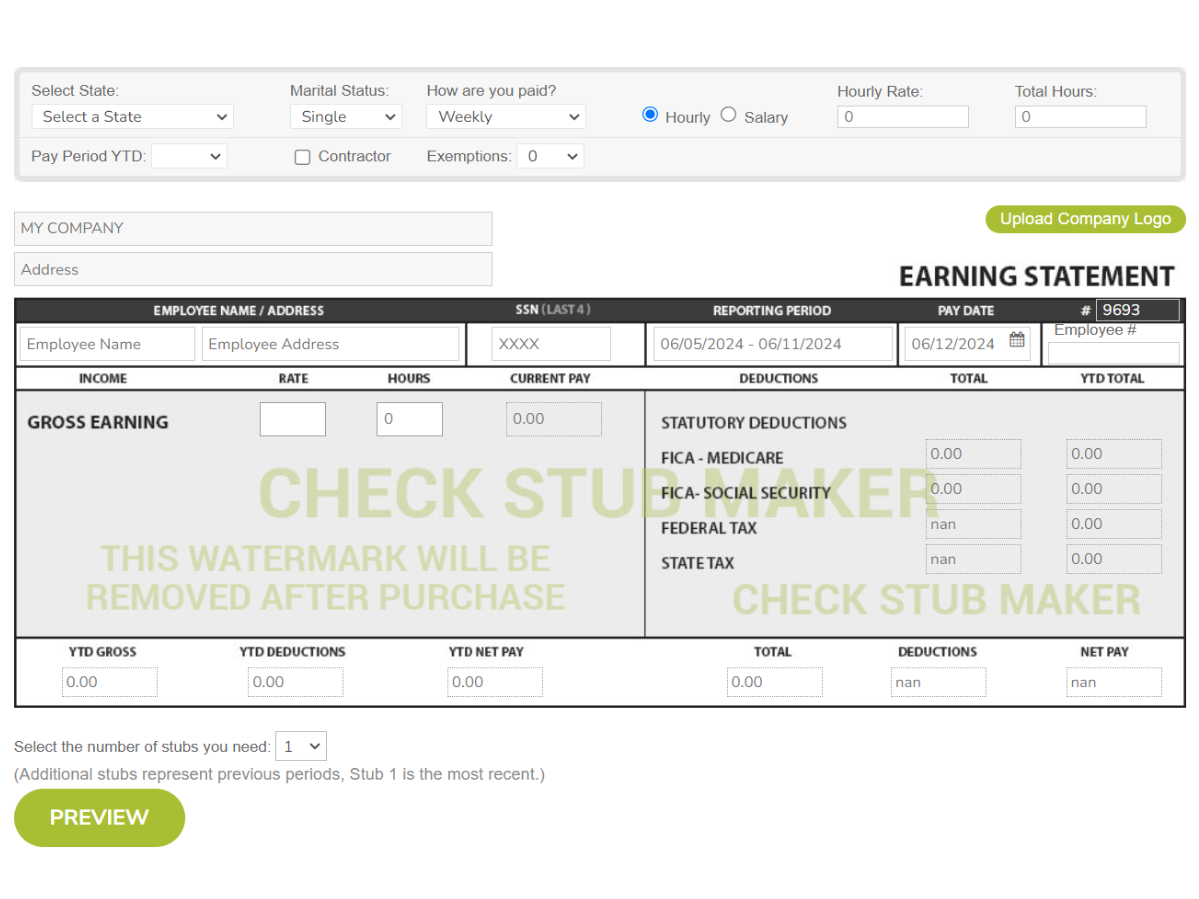

In this guide, we discovered that an annuity on a check stub typically refers to contributions made to a tax-sheltered annuity plan, or ‘TSA' for short, such as a 403(b). At Check Stub Maker , we understand the importance of accurate payroll management, including handling contributions to various annuities. If you're looking for an easy way to generate professional pay stubs that clearly show all your deductions and contributions, we invite you to try our user-friendly pay stub generator . With our easy and affordable digital solutions, your employees will have clear, detailed records of their earnings and retirement savings contributions in a matter of minutes. If you want to learn more, why not check out these articles below:

In the realm of payroll, it's imperative that you understand the significance of the 'fit deduction on paystub' for both employers and employees.

Mar 25, 2024

Is a pay stub a check? This is a common question many employees ask when trying to decipher their money-related paperwork. At Check Stub Maker, we're here to clear up any confusion.

Oct 04, 2024

With springtime comes spring cleaning. As you tackle disorder and perform deep cleaning, you might come across important papers. You might even keep them ins...

Apr 20, 2017