Check Stubs Meaning

Have you ever wondered about the ‘check stubs meaning' in your payroll documents?

Oct 04, 2024Welcome to our guide on pay stub information. From your gross pay to your deductions, your pay stub is a concise and accurate reflection of your financial journey.

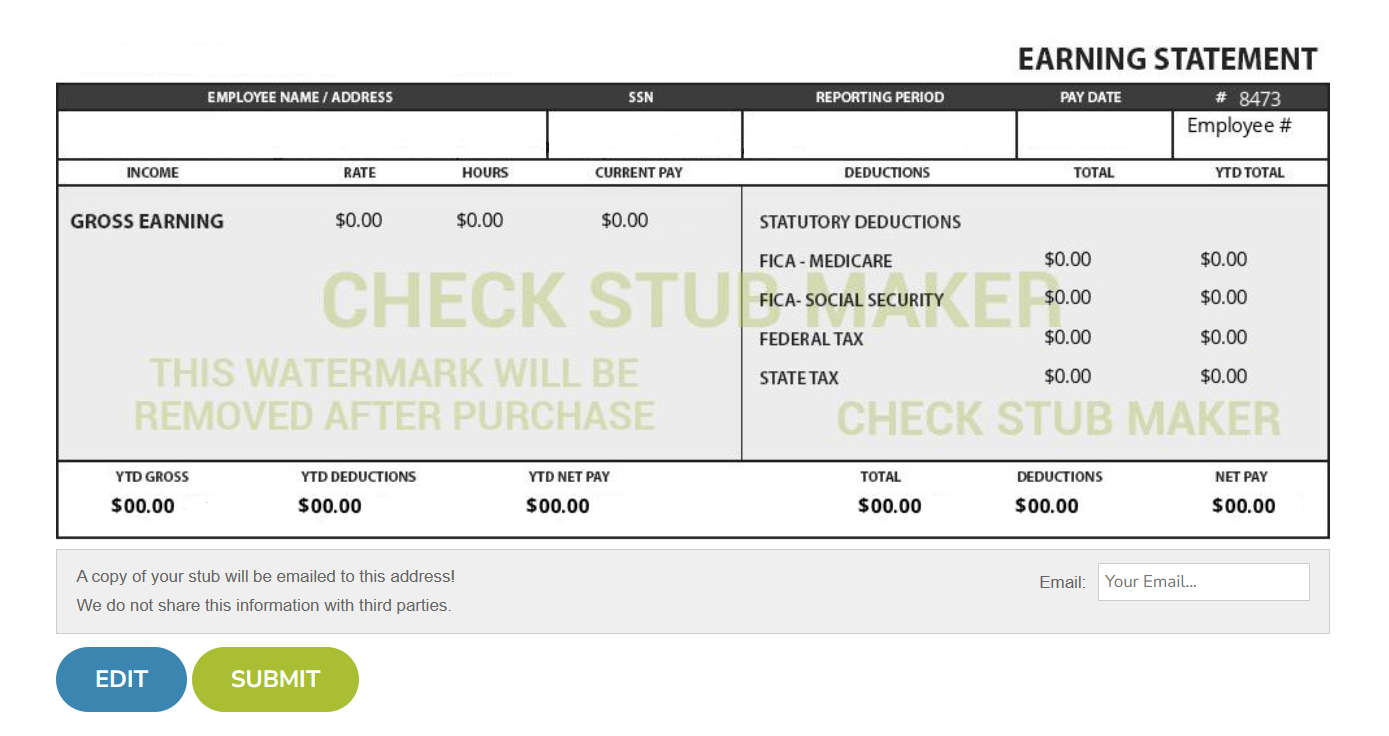

Welcome to our guide on pay stub information. From your gross pay to your deductions, your pay stub is a concise and accurate reflection of your financial journey. At Check Stub Maker , we understand the importance of clarity and accuracy when it comes to deciphering pay stubs. That's why our pay stub generator is designed to assist you in creating and reading your pay stubs with precision and ease. We'll delve into the intricacies of what pay stub information comprises and why it's essential for every employee to gain a comprehensive overview of their overall earnings. What this article covers:

A pay stub, also known as a paycheck stub or income statement, is a document provided by employers to their employees each pay period. As per our expertise, it contains crucial particulars regarding compensation and deductions. Table: Elements Of A Pay Stub

ElementDescriptionExampleGross Wages- Total income before any deductions.

Deductions- Amounts subtracted from gross wages for taxes, benefits, etc.

Contributions- Payments made by employers towards employee benefits.

Net Pay- Amount an employee takes home after all deductions.

Garnishments- Court-ordered deductions for debts.

Paid Time Off (PTO)- Accrued vacation, sick days, and personal time.

Pay Period- The timeframe over which earnings are calculated.

Pay Rate- The amount an employee earns.

Contact Information- Information for both the employer and employee.

Gross wages represent your total earnings before anything is debited, such as taxes or retirement contributions. At Check Stub Maker, we ensure these figures are prominently displayed on our online paystub record , providing a clear breakdown of your income.

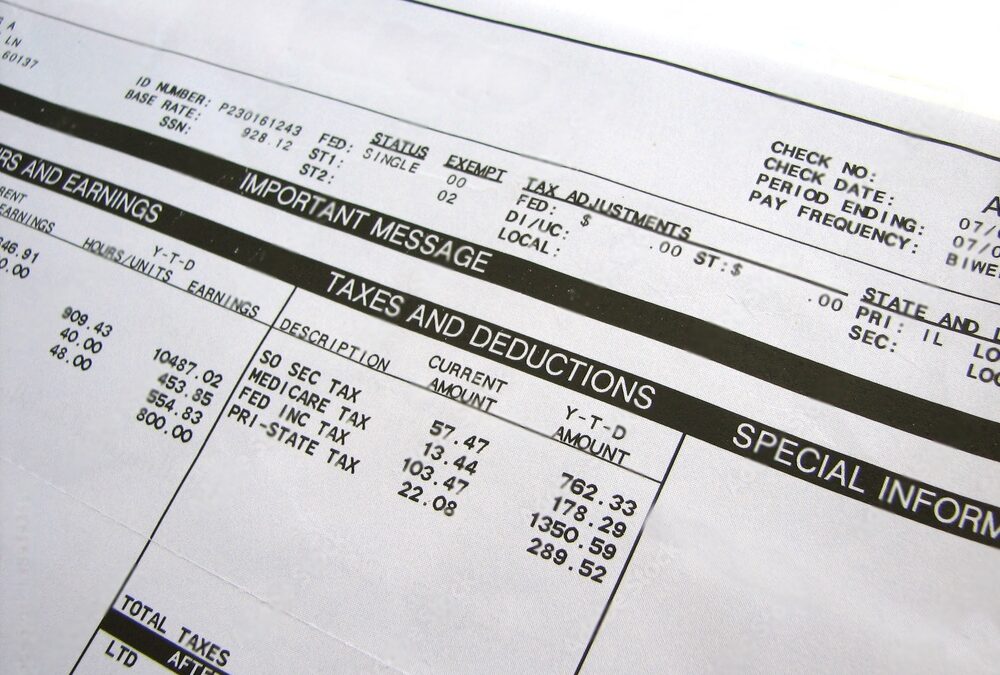

Deductions are amounts subtracted from your gross wages for taxes, insurance, and retirement plans, such as:

We meticulously organize these debited items as well as allowances on paystub , ensuring employees are always aware of what's being deducted and why.

Contributions are payments made by employers towards employee benefits, such as:

With us at Check Stub Maker, these contributions are clearly reflected on your pay stubs, showing the value added to a compensation package that goes beyond just your gross wages.

Net pay is the amount an employee takes home after all deductions, such as taxes and benefits, are subtracted from gross wages. After trying out this product, our paystub maker automatically calculates net pay by subtracting all specified compensation and everything else debited from your gross earnings. This final figure is prominently displayed on pay stubs, providing you with a clear understanding of your take-home pay after taxes.

Garnishments are court-ordered deductions taken from an employee's wages for debts such as:

This visibility helps you appreciate the full extent of debts in all aspects of your personal life.

Paid Time Off (PTO) encompasses vacation, sick days, and personal time that you're entitled to take while still receiving pay. PTO balances are meticulously tracked and updated on your pay stubs, showing information such as:

Through our practical knowledge, this ensures you consistently understand your PTO status.

The pay period is the timeframe over which your earnings are calculated, which can occur:

At Check Stub Maker, we clearly indicate the pay period on each of our pay stubs, ensuring that employees are aware of the specific dates their wages cover. Based on our observations, this can help you better track your work and income over time.

The pay rate is the amount an employee earns per:

This allows you to understand how your wages are calculated in case any discrepancies should occur in the future.

Contact information on pay stubs includes the employer's and employee's:

This detail not only aids in record-keeping but also ensures that any queries regarding your pay stubs can be dealt with promptly and efficiently. Understanding these components of a pay stub is crucial for managing your personal finances and ensuring accuracy in payroll processing. After putting it to the test, our pay stub creator simplifies this process with its user-friendly interface and accurate calculations, allowing you to generate detailed pay stubs effortlessly.

Here's what a typical pay stub looks like in practice: Employee Information: Name: John Doe Address: 1234 Maple Street, Anytown, USA Employee ID: 56789 Position: Marketing Coordinator Employer Information: Company Name: ABC Corporation Address: 9876 Oak Avenue, Anytown, USA Phone: (555) 123-4567 Email: company@abc-corporation.com Pay Period: Start Date: 01/01/2024 End Date: 01/15/2024 Earnings: Pay Rate: $25.00 per hour Hours Worked: 80 Gross Pay: $2,000.00 Deductions: Federal Tax: $300.00 State Tax: $100.00 Social Security: $124.00 Medicare: $29.00 Health Insurance: $75.00 401(k) Contribution (5%): $100.00 Total Deductions: $728.00 Year-to-Date Totals: Gross Pay: $2,000.00 Total Deductions: $728.00 Net Pay: $1,272.00 Contributions By Employer: Employer 401(k) Contribution: $100.00 Health Insurance Contribution: $200.00 PTO Balance: Total Accrued: 40 hours Used: 8 hours Remaining: 32 hours This pay stub example provides a clear breakdown of John Doe's earnings for the pay period, including his gross wages, specific deductions, net pay, and compensation by the employer, as well as the PTO balance.

A pay stub isn't the same as a paycheck. Based on our first-hand experience, a paycheck is the actual payment you receive. Conversely, paystubs like ours at Check Stub Maker outline your wages, deductions, taxes, and other pertinent details related to compensation.

Hourly workers typically receive pay stubs along with their paychecks. Pay stubs are essential for both employers and employees to maintain accurate records of wages earned, taxes withheld, and deductions made.

In this article, we've explored what 'pay stub information' means and the various details that pay stubs usually contain. From gross wages to deductions and contributions, pay stubs provide valuable insights into an employee's compensation. Understanding pay stubs is essential for employees to manage their financial transactions and ensure transparency in an employer's business' payroll processes. With our user-friendly paystub creator , you can generate comprehensive pay stubs effortlessly, guaranteeing clarity and accuracy in your financial records. So, what are you waiting for? Try Check Stub Maker today and experience the convenience of creating professional pay stubs with all the payroll information you need at your fingertips. If you want to learn more, why not check out these articles below:

Have you ever wondered about the ‘check stubs meaning' in your payroll documents?

Oct 04, 2024

In the realm of entrepreneurial ventures, showcasing a paystub for self-employed can be a tad more intricate than it is for regular employees.

Nov 01, 2023

Are you working in the Education industry and wondering, ‘How can I get a copy of my pay stub if I am a teacher?'

Jul 02, 2024