Unlock the secrets of efficient payroll management with pay stub records—your mechanism to achieving streamlined payment tracking for both employers and employees.

Drawing from our experience, they’re comprehensive snapshots of earnings, deductions, and contributions, crucial for tax purposes and loan applications, and ensure fair labor practices.

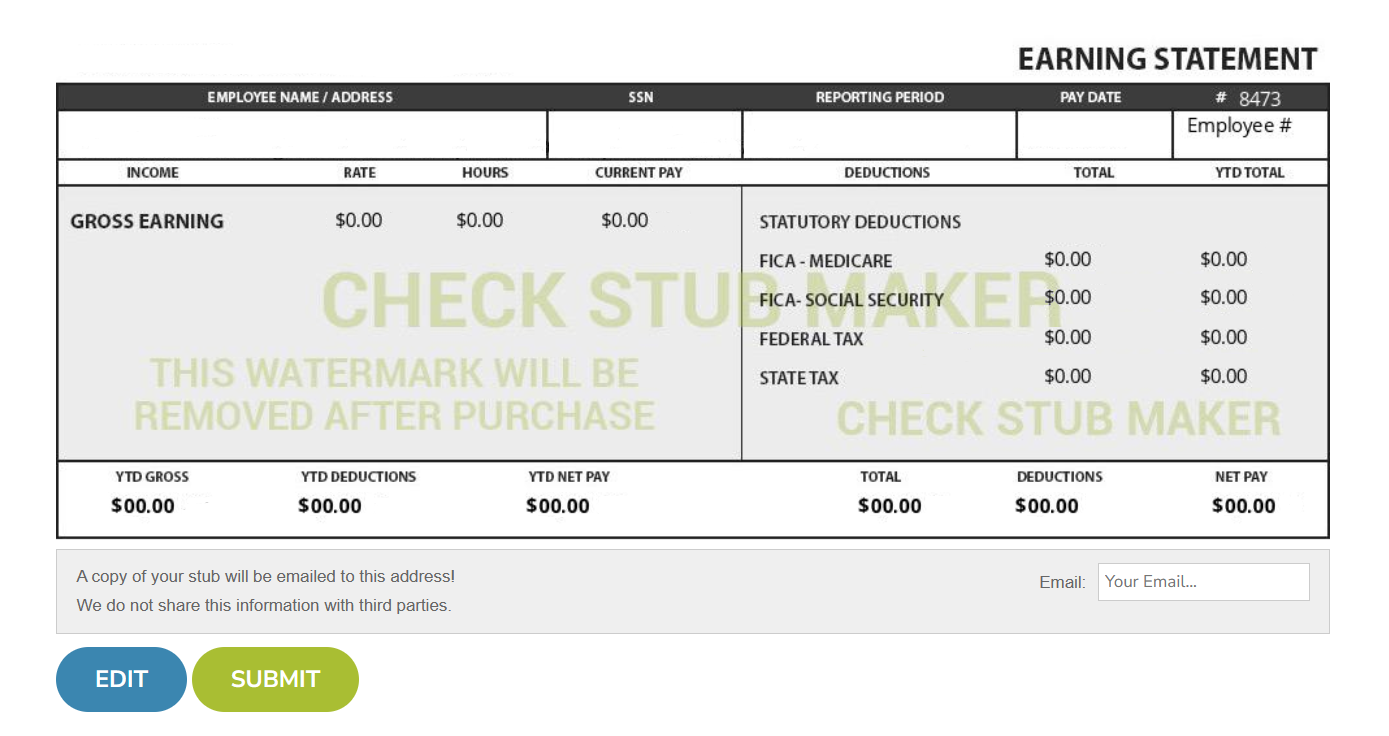

At Check Stub Maker, we offer a seamless pay stub creator to ensure accuracy and concurrence with your financial documentation.

This article will dive deep into the world of pay stub records, from their definition and vital components to their significance and best practices for storage.

What this article covers:

- What Are Payroll Records?

- How to Manage and Store Payroll Records

- Why Should Employers Keep Payroll Records?

- Payroll Records FAQ

What Are Payroll Records?

Meticulous payroll records consist of comprehensive documents that detail every aspect of an employee’s pay history, including their:

- wages

- deductions

- hours worked

As per our expertise, they serve as a vital tool for both employers and employees.

What Should Be Included In A Payroll Record?

Aside from earnings and deductions, a payroll record should also include document allowances on paystub and any exemption on pay stub; together, these factors directly impact the calculation of taxes and net pay.

At Check Stub Maker, our pay stub generator meticulously captures all these elements, ensuring that every payroll document is meticulous and legally compliant.

How Long Should Employers Keep Payroll Records?

The duration can vary by jurisdiction, but a general rule of thumb is to maintain payroll records for at least three to six years according to the IRS.

Our research indicates that this period allows for adequate time in case of audits, wage disputes, or tax inquiries.

It’s essential for employers to stay informed about the specific requirements in their state to ensure full adherence.

By leveraging our expertise and tools at Check Stub Maker, businesses can ensure their payment records are accurate, comprehensive, and securely stored.

How to Manage and Store Payroll Records

Employers and employees can choose from several methods to store payroll records effectively.

Self-Storage

Self-storage involves keeping physical or digital pay stub records on-premises.

For physical documents, we recommend using locked filing cabinets in a secure, accessible location to protect against unauthorized entry and environmental damage.

Alternatively, you can keep digital financial paperwork on company servers or secure cloud storage solutions. With us at Check Stub Maker, you can create check stubs in minutes that are ready for online storage.

Ensure your pay stub data is encrypted, backed up regularly, and can only be retrieved by authorized personnel.

Based on our observations, regular audits can also help maintain organization and compliance for both types of self-storage.

Offsite Storage

Offsite storage is an option for physical records to reduce the risk of loss due to disasters like fire or flood. Trusted third-party companies specialize in document storage, offering secure, climate-controlled environments.

This method is particularly useful for archiving older paperwork that isn’t needed daily but must be retained for legal reasons.

Always make sure that the chosen service provides adequate security measures and quick access for you when needed.

Payroll Software

Payroll software is a modern solution that simplifies the creation, management, and storage of important financial records.

Services like ours at Check Stub Maker can help you generate accurate paystubs easily, ensuring adherence with tax laws and labor regulations.

Payroll software can also integrate with other HR systems, streamlining payment processes and reducing the risk of errors.

Choosing the right storage method depends on the company’s:

- size

- budget

- specific needs

Why Should Employers Keep Payroll Records?

Maintaining accurate pay stub information is a critical component of a business’s operations for several reasons.

1. To Stay Organized And Help Employees

Keeping detailed payroll records helps employers stay organized and manage their workforce more effectively.

Based on our first-hand experience, it ensures that employees are paid accurately and on time, records reflecting elements like their:

- hours worked

- overtime

- bonuses

- deductions

This transparency helps in building trust with employees, as they can retrieve their payroll information for personal financial planning, loan applications, or to verify accuracy.

It also simplifies the process of answering any queries employees might have about their pay or tax withholdings.

2. To Avoid Legal Issues

Accurate records can protect a business from legal disputes.

In cases where an employee might challenge the fairness of their pay, overtime, or leave, detailed paperwork provides tangible evidence to support the employer’s practices.

This documentation can be crucial in defending against claims of unpaid wages or non-compliance with labor laws mandated by the Department of Labor.

3. To Keep Compliant With State Guidelines

Each state may have its own set of rules regarding payroll record-keeping.

These can include specifics on:

- what needs to be documented

- how they should be stored

- the duration for keeping them

By adhering to these guidelines, employers avoid penalties and ensure they’re in good standing with state labor departments.

State-specific compliance is particularly important for businesses operating in multiple jurisdictions, as recordkeeping requirements can vary significantly.

Payroll Records FAQ

How Do I Create A Payroll Record?

Creating a payroll record is straightforward with our services at Check Stub Maker.

We have found from using this product that our paystub generator allows you to input employee details, pay rates, hours worked, and deductions. Our system then calculates the net pay and generates a detailed pay stub for you.

This serves as an efficient payroll record, documenting all necessary information for both the employer and employee.

Who Should Be Allowed To See Employee Records?

Viewing employee payment records should be limited to safeguard privacy and confidentiality.

Through our practical knowledge, people who can examine this paperwork typically include the:

- employer

- employee

- specific personnel such as HR managers or payroll administrators

In some cases, external parties like auditors or legal representatives may need access under specific circumstances.

It’s crucial to ensure that any retrieval of documents is concurrent with privacy laws and company policies.

Do I Need Payroll For One Employee?

Even if you have just one employee, it’s essential to maintain proper payroll records. This ensures adherence with tax laws and labor regulations, regardless of your business’s size.

Conclusion

In navigating the world of pay stub records, we’ve uncovered their undeniable benefits, pivotal importance, and savvy storage solutions for both employers and employees.

This paperwork is the backbone of transparent and compliant payment processes.

Now that you’re equipped with this knowledge, why not take the next step?

At Check Stub Maker, we can help you keep your payroll records up-to-date with our paystub maker, so you can focus on what you do best—running your business.

If you want to learn more, why not check out these articles below:

- Pay Stubs and Bank Statements

- Employee’s Get a Pay Stub What Does a Partner Get for Guaranteed Payments

- Why Is It Important to Review the Information on a Paycheck Stub?

- Pay Stub Employment Verification

- Employee Medicare on Pay Stub

- How Long Should You Keep Pay Stubs Before Shredding?

- How Long Does It Take for a Job to Send Your Pay Stub?

- How Long From Being Let Go From a Job Do They Keep a Record of Pay Stubs?

- How Long Do You Have to Hold Physical Employee Paystubs?

- How Long Does a Business Have to Keep Check Stubs?

- What You Can Do If You Work Wont Give You Your Paystubs

- If My Pay Stub Says Vacation Time Do They Have to Give It to Me?

- How to Access Pay Stubs If Your Not a Best Buy Employee Anymore

- Letter From Employer Verifying No Pay Stub for Work Week

- Why You Should Always Ask for a Pay Stub