When you’re dismissed from your employement, one of the critical questions that might come to mind is, “How long from being let go from a job do they keep a record of pay stubs?”

The answer varies depending on several factors, including state laws and company policies. Understanding this is crucial, especially when you need these records for future employment or financial purposes.

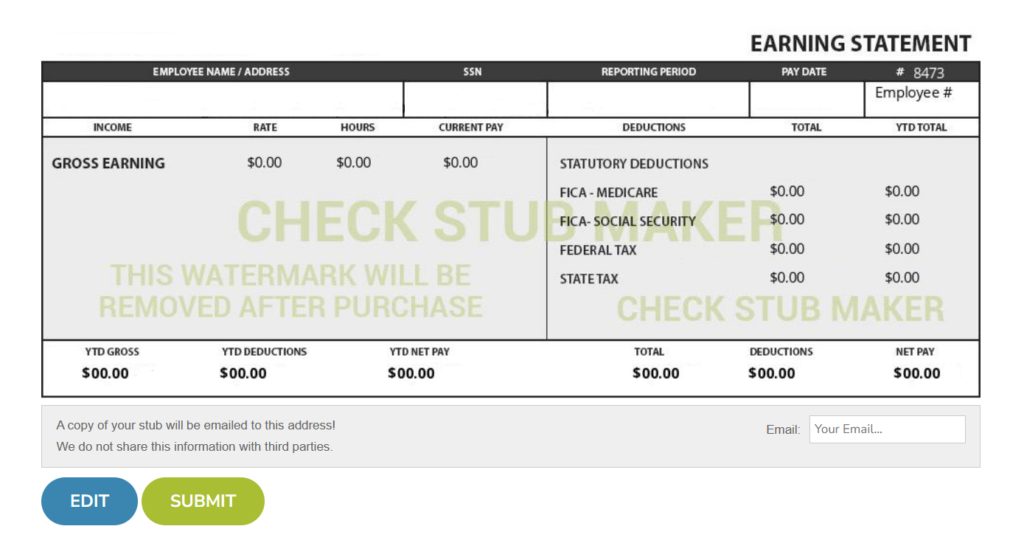

In this guide, we at Check Stub Maker will explore recordkeeping requirements for employers as stipulated by federal and state laws and offer alternative payroll retention options like our trusted pay stub generator.

Let’s dive in!

What this article covers:

- How Long Do You Have to Keep Payroll Records?

- How Should You Store Payroll Records?

- Payroll Records FAQs

How Long Do You Have to Keep Payroll Records?

Employers are generally required to maintain payroll records for specific periods to comply with federal and state regulations.

Let’s take a closer look at these specific retention periods.

Table: Retention Requirements For Payroll Records

| Payroll Examples | Retention Duration | Legislation or Governing Institution |

| wagesjob evaluationstermination documents | Up to 1 year | Equal Employment Opportunity Commission (EEOC) Fair Labor Standards Act (FLSA) |

| wage rate tablestime cardspiece rate tickets | Up to 2 years | Department of Labor (DOL) |

| payroll recordscollective bargaining agreementssalespurchase records | Up to 3 years | Department of Labor (DOL) |

| tax returnsworksheetsother tax filing documents | Up to 4 years | Internal Revenue Service (IRS) |

| retirement and pension plans | Up to 6 years | Employee Retirement Income Security Act (ERISA) |

Records That Should Be Kept For One Year

According to the Equal Employment Opportunity Commission (EEOC), employers must keep payroll records for at least one year after the termination of employment.

If an employee is terminated involuntarily, the employer must retain their payroll records from the date of termination.

Our findings show that this includes records related to:

- wages

- job evaluations

- termination documents

These records are crucial for demonstrating compliance with the Fair Labor Standards Act (FLSA) and other employment laws.

If you’re wondering how long to keep copies of paystubs, our pay stub creator shows evidence of your earnings for a year and beyond. That way, you can stay compliant with federal laws, even after your employment is terminated.

Records That Should Be Kept For Two Years

Records that should be kept for two years include:

- wage rate tables

- time cards

- piece rate tickets

Based on our first-hand experience, these documents are vital for verifying the accuracy of wage computations.

Records That Should Be Kept For Three Years

According to the Department of Labor, employers are required to keep payroll records, collective bargaining agreements, sales, and purchase records for at least three years. These records are essential for proving compliance with various labor laws.

Records That Should Be Kept For Four Years

The IRS stipulates that tax-related records should be retained between 3-7 years.

Our research indicates that this includes records of:

- tax returns

- worksheets

- any other documents related to filing taxes

Records That Should Be Kept For Six Years

According to the Employee Retirement Income Security Act (ERISA), records related to retirement and pension plans should be kept for six years.

The retention period for payroll records depends on the type of record and the applicable federal and state laws.

Both employers and employees should be aware of these requirements to ensure compliance and readiness for any future needs. For employees, especially those who have been let go from their job, having access to accurate pay stubs is crucial.

This is where our services at Check Stub Maker come in, offering a reliable and easy-to-use paystub generator to meet your needs, even during periods of unemployment.

How Should You Store Payroll Records?

At Check Stub Maker, we understand the importance of secure and accessible record-keeping, particularly your check stubs.

Here are some effective methods for storing payroll records.

Digital

The digital storage of payroll records is becoming increasingly popular due to its convenience and space-saving benefits. Digital files should be backed up regularly and protected with robust cybersecurity measures.

After trying out this product, our digital solutions at Check Stub Maker offer you an added layer of security and accessibility, allowing you to access your paystubs online while being safeguarded against data loss.

Software

Using payroll software can streamline the record-keeping process significantly. These systems not only help in generating payroll records but also in storing them efficiently.

Payroll software often comes with features like automatic backups and encryption. This ensures that your records are not only well-organized but also secure from unauthorized access.

At Check Stub Maker, our paystub maker is user-friendly and customizable, allowing you to input your payroll information securely and accurately.

Paper Files

Traditional paper files are used for record-keeping, particularly by employers with a smaller workforce. When storing physical documents, it’s essential to have a secure, organized system.

If you go down the paper route, we recommend utilizing a locked filing cabinet in a controlled environment to prevent damage from environmental factors like moisture or fire.

Labeling and systematic organization are key to ensuring that records can be easily retrieved when needed.

Payroll Records FAQs

Let’s look at some common questions related to storing important financial documentation.

How Long Does The IRS Require You To Retain Payroll Records?

The IRS mandates that employers keep payroll records for at least three years and longer after the due date for the tax return on which the payroll information is reported.

Our investigation demonstrated that this requirement is crucial for tax purposes and to answer any potential queries from the IRS.

How Long Should Employers Keep Form W-2?

As stipulated by the IRS, employers are required to keep copies of Form W-2 for at least four years after their last completed tax filing.

Based on our observations, this is important for verifying your income tax, social security, and Medicare tax withholdings.

For added insurance, create pay stubs with us at Check Stub Maker to accurately reflect your earnings and deductions just in time for tax season.

Which Payroll Record Items Are Employers Required to Keep?

Employers must retain the following financial documentation related to their employees’:

- names

- addresses

- occupation

- wages earned

- hours worked

- deductions

- dates of payment

How Long Do You Keep Records Used To Calculate Wages?

Records used to calculate wages, such as time cards and piece rate tickets, should be kept for at least two years. This duration is essential for verifying the accuracy of wage calculations and compliance with labor laws.

If you want to know how to store paystubs, you can easily store and keep track of your calculated wages using our paystub creator, which is designed for accuracy and longevity.

Conclusion

In answering the question, ‘How long from being let go from a job do they keep a record of pay stubs?’, we’ve evaluated the various durations for which different types of payroll records should be retained. This is particularly useful to know in the context of unemployment.

From one year for basic payroll records to up to six years for certain tax-related documents, it’s clear that maintaining these records is vital for both legal compliance and personal reference.

Whether you’re an employer looking to streamline your payroll process or an individual needing accurate pay stubs post-employment, we’re here to assist.

So why not give our services a try? Explore Check Stub Maker now and experience the ease and reliability of managing your payroll records in minutes!

If you want to learn more, why not check out these articles below:

- How Long Should You Keep Pay Stubs Before Shredding?

- How Long Does It Take for a Job to Send Your Pay Stub?

- Why Would a Company Running a Background Check Require a W2 or Pay Stubs?

- When Showing Your Pay Stubs to an Employer Do You Block Out Any Information?

- Can I View My Paystubs Online After I Am No Longer Employed?

- How Can I View My Pay Stub Before My First Paycheck?

- How Do I Get My Address Changed on My Check Stubs?

- Why Is It Important to Review the Information on a Paycheck Stub?

- Pay Stub Employment Verification

- Employee Paid Correctly But Pay Stub Shows Incorrect Pay Period

- How Can Employee Correct the Pay Stub If the Employer Ran It Wrong?

- Employer Asking for Pay Stub But I Got Paid in Cash

- Employer Not Giving Pay Stubs

- Does an Employer Have to Provide a Pay Stub?

- What If Your Employer Doesn’t Give You a Pay Stub?