Welcome to our guide on pay stub information. From your gross pay to your deductions, your pay stub is a concise and accurate reflection of your financial journey.

At Check Stub Maker, we understand the importance of clarity and accuracy when it comes to deciphering pay stubs.

That’s why our pay stub generator is designed to assist you in creating and reading your pay stubs with precision and ease.

We’ll delve into the intricacies of what pay stub information comprises and why it’s essential for every employee to gain a comprehensive overview of their overall earnings.

What this article covers:

What Is a Pay Stub and What Should It Include?

A pay stub, also known as a paycheck stub or income statement, is a document provided by employers to their employees each pay period.

As per our expertise, it contains crucial particulars regarding compensation and deductions.

Table: Elements Of A Pay Stub

| Element | Description | Example |

| Gross Wages |

|

|

| Deductions |

|

|

| Contributions |

|

|

| Net Pay |

|

|

| Garnishments |

|

|

| Paid Time Off (PTO) |

|

|

| Pay Period |

|

|

| Pay Rate |

|

|

| Contact Information |

|

|

1. Gross Wages

Gross wages represent your total earnings before anything is debited, such as taxes or retirement contributions.

At Check Stub Maker, we ensure these figures are prominently displayed on our online paystub record, providing a clear breakdown of your income.

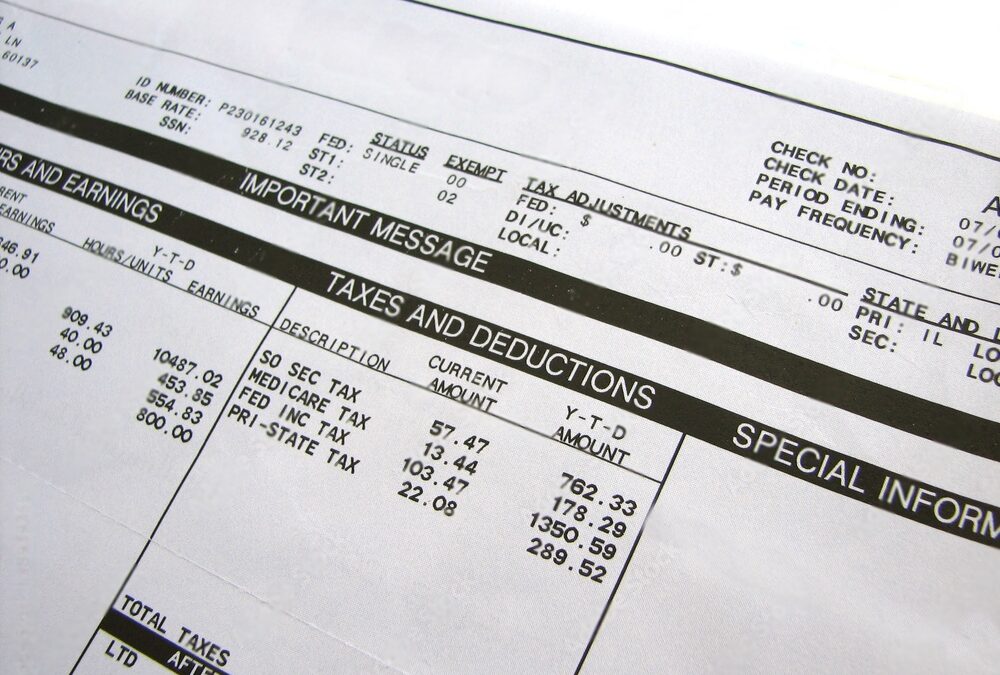

2. Deductions

Deductions are amounts subtracted from your gross wages for taxes, insurance, and retirement plans, such as:

- federal and state taxes

- Social Security

- Medicare

- health insurance

- 401(k) contributions

We meticulously organize these debited items as well as allowances on paystub, ensuring employees are always aware of what’s being deducted and why.

3. Contributions

Contributions are payments made by employers towards employee benefits, such as:

- life insurance

- retirement plans

With us at Check Stub Maker, these contributions are clearly reflected on your pay stubs, showing the value added to a compensation package that goes beyond just your gross wages.

4. Net Pay

Net pay is the amount an employee takes home after all deductions, such as taxes and benefits, are subtracted from gross wages.

After trying out this product, our paystub maker automatically calculates net pay by subtracting all specified compensation and everything else debited from your gross earnings.

This final figure is prominently displayed on pay stubs, providing you with a clear understanding of your take-home pay after taxes.

5. Garnishments

Garnishments are court-ordered deductions taken from an employee’s wages for debts such as:

- child support

- alimony

- unpaid taxes

This visibility helps you appreciate the full extent of debts in all aspects of your personal life.

6. Paid Time Off (PTO)

Paid Time Off (PTO) encompasses vacation, sick days, and personal time that you’re entitled to take while still receiving pay.

PTO balances are meticulously tracked and updated on your pay stubs, showing information such as:

- accrued time

- used hours

- remaining balance

Through our practical knowledge, this ensures you consistently understand your PTO status.

7. Pay Period

The pay period is the timeframe over which your earnings are calculated, which can occur:

- weekly

- bi-weekly

- monthly

At Check Stub Maker, we clearly indicate the pay period on each of our pay stubs, ensuring that employees are aware of the specific dates their wages cover.

Based on our observations, this can help you better track your work and income over time.

8. Pay Rate

The pay rate is the amount an employee earns per:

- per hour

- per day

- on a salary basis

This allows you to understand how your wages are calculated in case any discrepancies should occur in the future.

9. Contact Information

Contact information on pay stubs includes the employer’s and employee’s:

- name

- physical address

- phone number or email

This detail not only aids in record-keeping but also ensures that any queries regarding your pay stubs can be dealt with promptly and efficiently.

Understanding these components of a pay stub is crucial for managing your personal finances and ensuring accuracy in payroll processing.

After putting it to the test, our pay stub creator simplifies this process with its user-friendly interface and accurate calculations, allowing you to generate detailed pay stubs effortlessly.

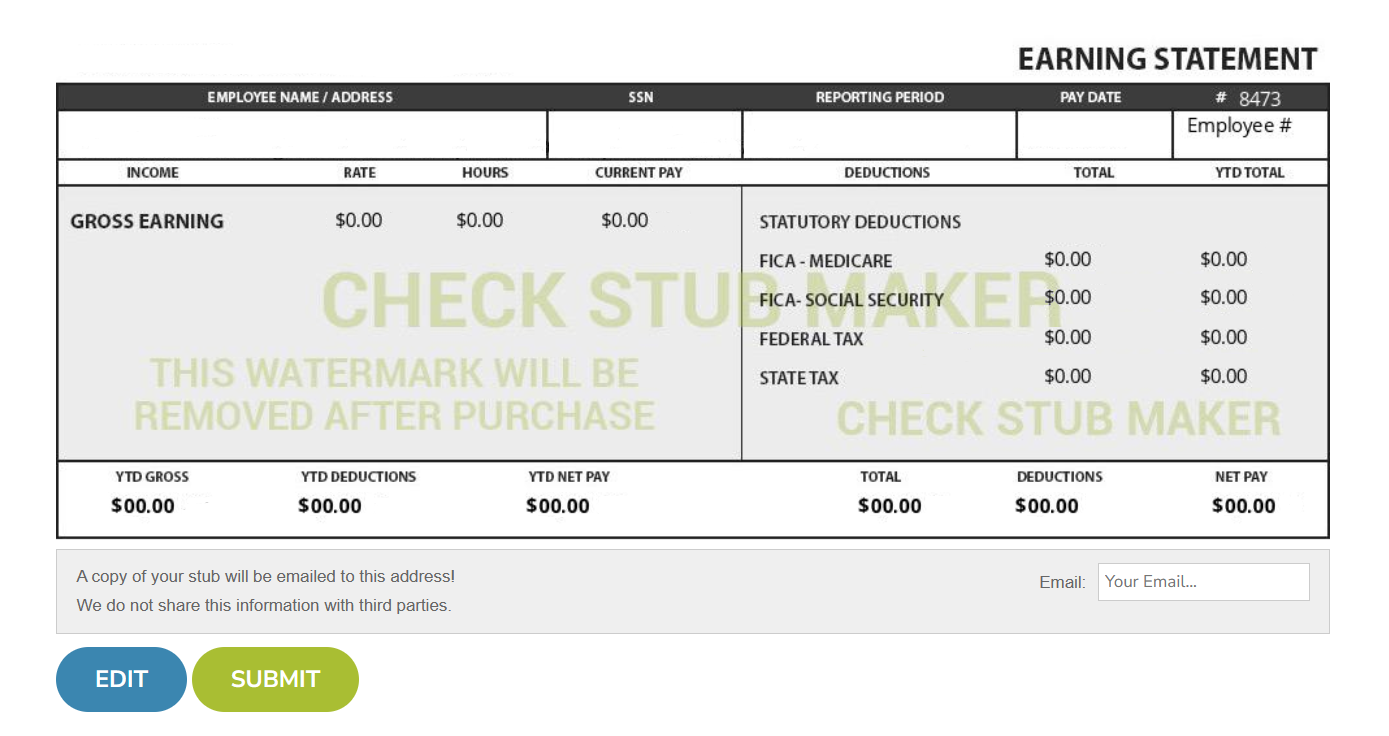

Pay Stub Example

Here’s what a typical pay stub looks like in practice:

Employee Information:

Name: John Doe

Address: 1234 Maple Street, Anytown, USA

Employee ID: 56789

Position: Marketing Coordinator

Employer Information:

Company Name: ABC Corporation

Address: 9876 Oak Avenue, Anytown, USA

Phone: (555) 123-4567

Email: [email protected]

Pay Period:

Start Date: 01/01/2024

End Date: 01/15/2024

Earnings:

Pay Rate: $25.00 per hour

Hours Worked: 80

Gross Pay: $2,000.00

Deductions:

Federal Tax: $300.00

State Tax: $100.00

Social Security: $124.00

Medicare: $29.00

Health Insurance: $75.00

401(k) Contribution (5%): $100.00

Total Deductions: $728.00

Year-to-Date Totals:

Gross Pay: $2,000.00

Total Deductions: $728.00

Net Pay: $1,272.00

Contributions By Employer:

Employer 401(k) Contribution: $100.00

Health Insurance Contribution: $200.00

PTO Balance:

Total Accrued: 40 hours

Used: 8 hours

Remaining: 32 hours

This pay stub example provides a clear breakdown of John Doe’s earnings for the pay period, including his gross wages, specific deductions, net pay, and compensation by the employer, as well as the PTO balance.

Pay Stub FAQ

Is A Pay Stub The Same As A Paycheck?

A pay stub isn’t the same as a paycheck. Based on our first-hand experience, a paycheck is the actual payment you receive.

Conversely, paystubs like ours at Check Stub Maker outline your wages, deductions, taxes, and other pertinent details related to compensation.

Do Hourly Workers Get Pay Stubs?

Hourly workers typically receive pay stubs along with their paychecks. Pay stubs are essential for both employers and employees to maintain accurate records of wages earned, taxes withheld, and deductions made.

Conclusion

In this article, we’ve explored what ‘pay stub information’ means and the various details that pay stubs usually contain.

From gross wages to deductions and contributions, pay stubs provide valuable insights into an employee’s compensation.

Understanding pay stubs is essential for employees to manage their financial transactions and ensure transparency in an employer’s business’ payroll processes.

With our user-friendly paystub creator, you can generate comprehensive pay stubs effortlessly, guaranteeing clarity and accuracy in your financial records.

So, what are you waiting for? Try Check Stub Maker today and experience the convenience of creating professional pay stubs with all the payroll information you need at your fingertips.

If you want to learn more, why not check out these articles below:

- Exemptions on a Pay Stub

- Pay Stubs and Bank Statements

- How to Generate a Pay Stub for a Partnership Guaranteed Payment

- Why Would a Company Running a Background Check Require a W2 or Pay Stubs?

- When Showing Your Pay Stubs to an Employer Do You Block Out Any Information?

- Can I View My Paystubs Online After I Am No Longer Employed?

- How Can I View My Pay Stub Before My First Paycheck?

- How Do I Get My Address Changed on My Check Stubs?

- Why Is It Important to Review the Information on a Paycheck Stub?

- How Long Should You Keep Pay Stubs Before Shredding?

- How Long Does It Take for a Job to Send Your Pay Stub?

- How Long From Being Let Go From a Job Do They Keep a Record of Pay Stubs?

- How Long Do You Have to Hold Physical Employee Paystubs?

- How Long Does a Business Have to Keep Check Stubs?

- View My Check Stubs Online