What Does PTO Stand for on a Pay Stub?

Have you ever glanced at your pay stub and wondered, "What does PTO stand for on a pay stub?" Well, you're not alone!

Aug 28, 2024In today's dynamic business landscape, understanding how to provide a partner with a pay stub for a guaranteed payment is crucial.

In today's dynamic business landscape, understanding how to provide a partner with a pay stub for a guaranteed payment is crucial. These payments represent fixed amounts that are paid to partners, irrespective of the partnership's profitability. This is done to ensure stability and trust within this important business relationship. Based on our first-hand experience, they highlight the partner's value, offering transparency and security in financial dealings. In this article, we at Check Stub Maker will delve into the processes of providing a partner with a pay stub for a guaranteed payment, elucidating its purpose and its myriad of advantages. What this article covers:

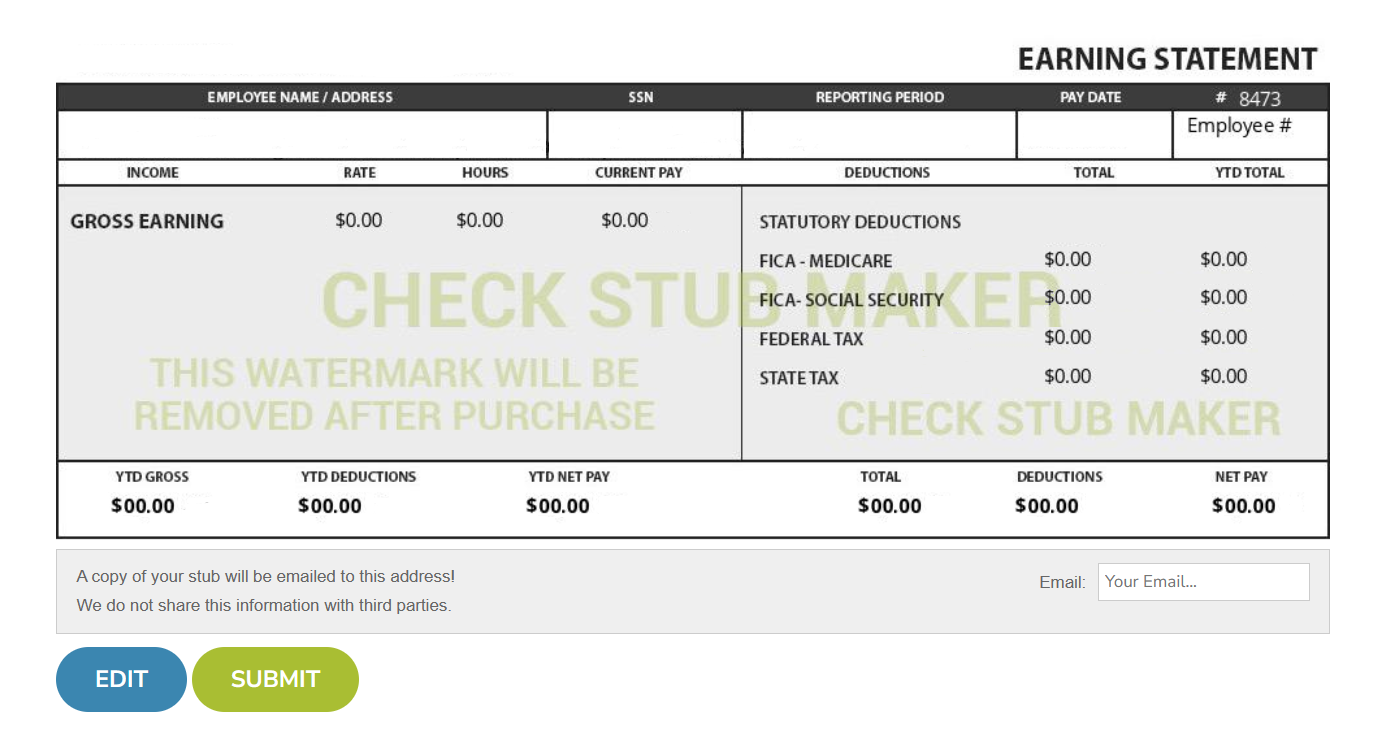

Generating the requisite standard pay stub sections for a partnership guaranteed payment is straightforward with us. Our pay stub generator ensures that each guaranteed payment is accurately reflected and compliant with financial standards. Here's what you need to get started:

Our service simplifies the creation of pay stubs for guaranteed payments, a critical aspect of partnership financial management.

Guaranteed payments are a cornerstone in the architecture of business partnerships, acting as a stabilizing force in monetary arrangements in this professional relationship. These payments are fixed amounts distributed to partners. Our findings show that this ensures the receipt of compensation regardless of the surplus gained by the partnership. This financial mechanism is designed to provide partners with a steady income stream, reflecting their contribution and commitment to the business's success.

The primary purpose of guaranteed payments is to acknowledge and reward the active involvement of partners in the business's operations. Guaranteed payments have several key functions, such as:

At Check Stub Maker, we understand the importance of accurately reflecting these payments in payroll documents. Our pay stub generator clarifies the process of creating a professional and precise online paystub record for guaranteed payments, ensuring transparency and compliance with financial regulations between partners.

Guaranteed payments are considered earned income for the partners, which is subject to self-employment taxes. Our research indicates that guaranteed payments compensate for services rendered to the partnership, which is often likened to traditional earnings for an employee.

When the partnership's fiscal year differs from the partner's tax year, which typically falls within the calendar year, it can potentially cause errors in tax reporting. The key is to report these wages in the tax year they're received. This ensures compliance with tax regulations and aids in accurate financial planning. Partners must include these payments on their personal tax returns, regardless of the partnership's fiscal year. At Check Stub Maker, our paystub generator is designed to help partners navigate the complexities of guaranteed payments so that every payroll step is taken with clarity and compliance in mind.

Guaranteed payments offer several benefits such as ensuring partners receive compensation for their contributions to the partnership, regardless of its profitability. This stability is crucial for partners relying on the business as a primary source of earnings and accomplishes several things:

Drawing from our experience, guaranteed payments are included in the partner's income and are subject to taxes. These payments are considered as an income because they compensate individuals for services rendered to the partnership. As such, they must be reported on the partner's tax return, contributing to their taxable earnings for the year. With us at Check Stub Maker, you can create pay stubs that accurately calculate every aspect of the money earned from your partnership to better facilitate guaranteed payments during tax season.

The primary difference between guaranteed payments and distributions lies in their purpose and how they're taxed. Guaranteed payments are fixed amounts paid to partners for their services. As per our expertise, this is similar to receiving a traditional salary, and is treated as an expense by the partnership. Distributions, on the other hand, are profit shares given to partners based on the partnership agreement and the business's overall lucrativeness. While guaranteed payments are subject to taxes, distributions aren;t, reflecting their nature as profit sharing rather than as compensation for services.

An owner's draw and a salary represent two distinct methods of compensating business owners. An owner's draw is a withdrawal of business earnings by the owner for personal use, which is common in sole proprietorships and partnerships. Our findings show that it isn't subject to immediate taxation as payroll but affects the owner's capital account. Conversely, a salary is a fixed regular payment to an employee or executive. This includes business owners in corporations, and is subject to payroll taxes and withholding. The choice between an owner's draw and a salary depends on the business structure and tax implications, with each method offering distinct advantages for cash flow and tax planning. For instance, an owner's draw allows partners to pay themselves as much as they like from their business equity (including profits and losses) without committing to a typical 40-hour work week. This flexibility of payment, however, requires more tax estimates on the owner's part, which is usually done on a quarterly basis. In contrast, a salary is commonly provided according to a set schedule (weekly, bi-weekly or monthly) and hourly rate agreed on by the employer and employee. With that said, it means that pay periods are more often in tandem with tax season, which requires less financial planning than with an owner's draw. At Check Stub Maker, we provide the tools and resources to navigate the complexities of various types of payments made to business partners.

In this article, we've explored how to provide a partner with a pay stub for a guaranteed payment. We've also delved into their significance, and the streamlined undertaking of creating accurate pay stubs for these distinct transactions. At Check Stub Maker, we're here to simplify your business needs with our dynamic paystub maker , ensuring every step is as smooth as possible. Ready to make your payroll management easier? Try our services at Check Stub Maker today by keeping the conversation light, but the transactions precise between business partners. If you want to learn more, why not check out these articles below:

Have you ever glanced at your pay stub and wondered, "What does PTO stand for on a pay stub?" Well, you're not alone!

Aug 28, 2024

Have you ever wondered, "What does TRS stand for on paystub?" Let's clear that up right away.

Aug 28, 2024

When an employee parts ways with their employer, they might receive severance pay as a financial farewell gesture.

Apr 24, 2024