What You Can Do If You Work Wont Give You Your Paystubs

If your employer recently paid you with a personal check without an accompanying pay stub, you might be wondering what you can do if you work wont give you your paystubs.

Oct 31, 2023Wondering ‘What counts as a pay stub'? A pay stub is more than just numbers; it's a vital record showcasing your earnings and deductions.

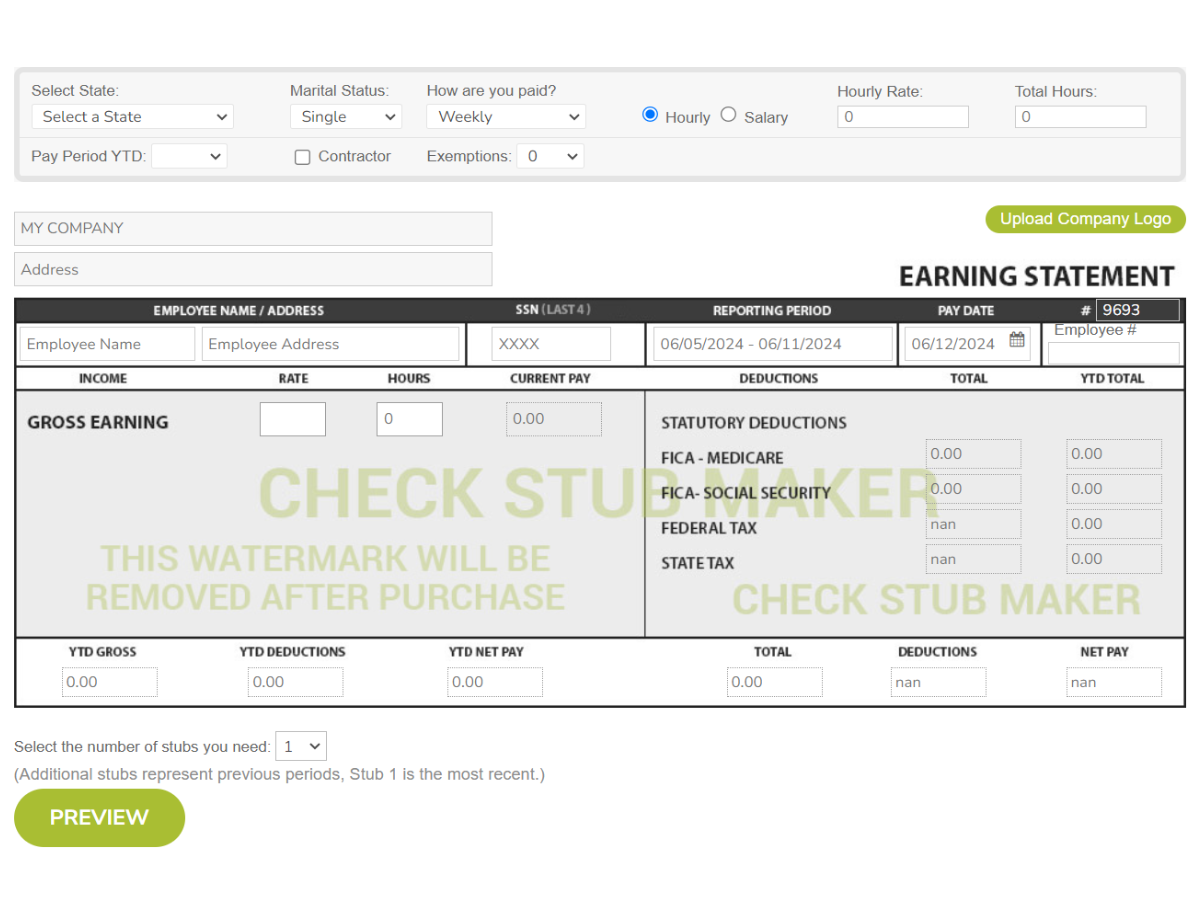

Wondering ‘What counts as a pay stub'? A pay stub is more than just numbers; it's a vital record showcasing your earnings and deductions. In this guide, we at Check Stub Maker will reveal the critical components of pay stubs, including gross wages, deductions, employer contributions, and net pay as well as the crucial role that pay stubs play in financial transactions. Plus, we'll show you how our pay stub creator simplifies the process of payroll documentation, ensuring accuracy and efficiency in every paycheck. Let's dive in! What this article covers:

A paycheck refers to the actual payment received by an employee, whether in physical or digital form. Conversely, a pay stub provides a detailed breakdown of that payment's components, including earnings, deductions, and contributions. As per our expertise at Check Stub Maker, pay stubs generated through our platform comprehensively outline a person's payroll information. With our paystub generator , we empower you to navigate your finances with confidence.

A pay stub is a critical document that offers employees transparency regarding their professional compensation. If you want to know how to read paystub , it typically includes general information such as:

### General Information

### General Information

Through our practical knowledge, pay stubs are written pay statements. They typically display details taken from paychecks during each pay period.

Gross wages represent an employee's total earnings before deductions or contributions. This amount reflects either a person's base salary or hourly rate.

Deductions encompass withholdings from an employee's paycheck, including:

Exemptions on paystub is related to deductions and withholdings in this context. They help employers and employees keep track of their tax-related obligations.

Employer contributions refer to any contributions made by the employer on behalf of the employee, such as healthcare benefits or retirement annuities.

Net pay, or take-home pay, is the amount an employee receives after deductions and contributions have been subtracted by the employer from their gross wages. It represents the actual amount deposited into the employee's bank account after taxes.

Our investigation demonstrated that the most crucial aspect of a pay stub is the net pay. This figure represents the actual amount an employee takes home after deductions and taxes. Employees frequently prioritize net pay as it provides a clear indication of their monetary standing. By prominently displaying net pay on our paystubs , we at Check Stub Maker ensure that you can easily understand your take-home earnings for better monetary planning.

It's essential to retain your pay stubs for record-keeping and documentation purposes, as mandated by the Fair Labor Standards Act (FLSA) . By keeping pay stubs organized, you can simplify tax filing processes and provide a reliable means of income verification. At Check Stub Maker, we understand the importance of pay stubs in maintaining financial records. Therefore, we encourage our users to create pay stubs with us, then securely store and organize them to ensure compliance with state and national regulations.

Our research indicates that keeping employee pay stubs for a minimum of one year is standard practice, which is primarily done for tax purposes. At Check Stub Maker, we advise you to retain your pay stubs for longer durations to play it safe though. This is generally because payroll paperwork is also vital for loan applications, rental agreements, and budgetary planning.

If your pay stubs are unavailable, you can request copies from your employer or utilize alternative paperwork, such as bank statements or tax records. Alternatively, Check Stub Maker offers a convenient solution. After trying out this product, our intuitive paystub generator allows you to recreate your pay stubs quickly and accurately. All you have to do is input your relevant information, and our digital service does the rest, providing you with reliable pay stubs in a matter of minutes.

In this guide, we explored the importance of pay stubs, discovering how they provide transparency and financial management in employee compensation. Understanding their purpose and significance can empower you to accomplish effective financial planning. So, what are you waiting for? Hassle-free payroll services are just one click away with our intuitive paystub creator at Check Stub Maker ! Did our blog meet your needs? You might also find our other guides helpful:

If your employer recently paid you with a personal check without an accompanying pay stub, you might be wondering what you can do if you work wont give you your paystubs.

Oct 31, 2023

Modern paystubs are powerful tools that revolutionize the way small businesses manage payroll. At Check Stub Maker, we've done a lot of research into how mod...

Aug 14, 2023

If you're pondering over how to access pay stubs if you're not a Best Buy employee anymore, there's no need to scratch your head in confusion anymore.

Oct 31, 2023