A Guide to Small Business Accounting

!A Guide to Small Business Accountinghttps://checkstubmaker.com/wp-content/uploads/2019/11/small-business-accounting-300x200.jpg If you have owned a business...

Nov 03, 2019Wondering ‘how to read paystub'? While payroll templates may vary, pay stubs usually include similar information and key sections such as employee details, earnings, deductions, and net pay.

Wondering ‘how to read paystub'? While payroll templates may vary, pay stubs usually include similar information and key sections such as employee details, earnings, deductions, and net pay. At Check Stub Maker , we simplify this process with our user-friendly pay stub generator , making it quick and easy to comprehend your pay stub. In this blog post, we'll explore typical sections of this important payroll document to help you become well-versed in understanding your salary pay stub check . Dive in with us and master your pay stubs effortlessly!

In order to correctly read your pay stub, it's important to verify personal details, check gross earnings, review tax and deduction amounts, and confirm that your net pay matches each section for accuracy. Let's walk through each section to help you interpret your pay stub with confidence. Example: How To Read Pay Stub Information --------------------------------- PAY STUB --------------------------------- Employee Information: Name: John Doe Social Security Number: XXX-XX-1234 Address: 123 Main St, Springfield, IL 62701 Employee ID: JD123456 ----------------------------------------------------------------------------- Employer Information: Company Name: ABC Corp Address: 456 Business Rd, Springfield, IL 62701 Department/Division: Sales ----------------------------------------------------------------------------- Federal Tax Withholding: Single, 0 allowances State Tax Withholding: IL ----------------------------------------------------------------------------- Hours And Earnings: Regular Hours: 160 Overtime Hours: 10 Holiday Hours: 8 Gross Earnings: $4,000.00 ----------------------------------------------------------------------------- Taxes: Federal Income Tax: $400.00 State Income Tax: $200.00 Social Security Tax: $248.00 Medicare Tax: $58.00 ----------------------------------------------------------------------------- Before Tax Deductions: Health Insurance: $150.00 Retirement Contributions: $200.00 ----------------------------------------------------------------------------- Employer Paid Benefits: Health Insurance Contribution: $150.00 Retirement Plan Contribution: $200.00 ----------------------------------------------------------------------------- Summary Numbers: Total Earnings: $4,000.00 Total Deductions: $1,256.00 Net Pay: $2,744.00 ----------------------------------------------------------------------------- Leave Balances: Vacation: 10 hours Sick Leave: 5 hours Personal Days: 3 days -----------------------------------------------------------------------------

This section contains personal data such as your name, address, and employee ID. After putting it to the test, our paycheck stub maker reduces errors in employee details, ensuring your personal information is always correct.

In this section, you'll find data related to your employer, including the:

Having accurate employer info aids in tax and legal compliance to enable smooth payroll processing.

This section outlines your federal and state tax withholdings, reflecting your tax status. We at Check Stub Maker recommend verifying the withholding amounts by comparing them with your W-4 form from the IRS to check that these figures are correct. This is especially important for a ‘ pay stub federal withholding single ' scenario when you need to apply for a tax-exempt status as an individual filer without a spouse or dependents.

This box outlines the hours you've worked overall, including your:

It also shows your gross earnings before any deductions are applied. At Check Stub Maker, our check stub generating tool automatically enables accurate calculation of hours and earnings, consistently providing you with precise payroll data.

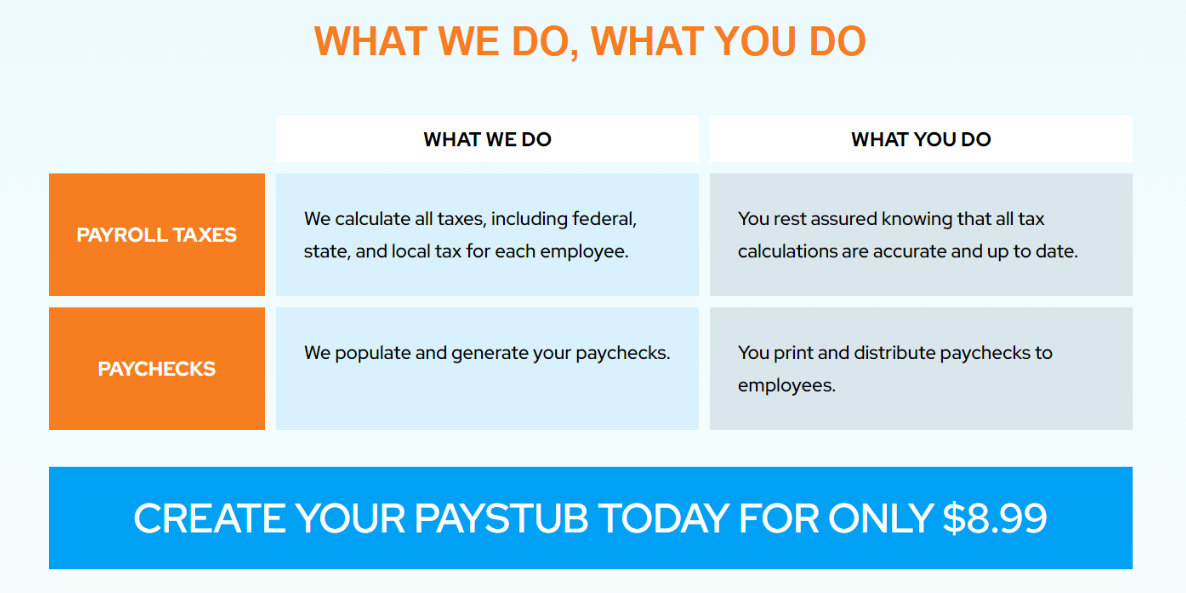

In this section, all taxes withheld, including federal, state, and local taxes, are listed. It's important to verify these amounts against your tax brackets and filing status to help you avoid issues with under or over-withholding when tax season arrives.

This section includes your pre-tax benefits such as:

Drawing from our experience, pre-tax deductions can affect your net pay by significantly reducing your taxable income.

This section covers contributions from your employer, such as health insurance and retirement plans. These benefits aren't deducted from your salary but are a crucial part of your overall compensation. Monitoring these benefits for accuracy ensures you consistently receive the correct compensation from your company.

This box summarizes your total earnings, total deductions, and net pay, providing a quick overview. By making use of our paystub maker , you can generate accurate summary numbers which are vital for clear financial tracking and budgeting.

This section tracks your accrued leave, including your:

Based on our first-hand experience, accurate leave balances help in planning time off efficiently, ensuring you can take your well-deserved breaks without any issues. By understanding each section of your pay stub, you can avoid potential issues and better manage your finances. At Check Stub Maker, we're committed to making this process simple and error-free with our reliable pay stub generator .

In this blog post, we explored ‘how to read paystub' correctly to better understand your income. With our pay stub creator , we help small businesses and self-employed individuals create precise pay stubs to make better sense of their earnings. So, if you're ready for simple yet detailed payroll, try out Check Stub Maker today and experience the ease and accuracy of pay stub generation in a matter of minutes! Did our blog meet your needs? You might also find our other guides helpful:

!A Guide to Small Business Accountinghttps://checkstubmaker.com/wp-content/uploads/2019/11/small-business-accounting-300x200.jpg If you have owned a business...

Nov 03, 2019

Navigating the world of payroll documentation can sometimes be daunting, especially when you need to know how to get two months of pay stubs for financial scenarios such as renting a new apartment or securing a bank loan.

Dec 06, 2023

Wondering how to get paystubs from a job if you get paper checks?

Aug 28, 2024