Is It Illegal to Keep Check Stubs From the Employee When They Have Direct Deposit?

Ever wondered, "Is it illegal to keep check stubs from the employee when they have direct deposit?"

Oct 31, 2023When you receive a paystub p, it's packed with important financial information, but understanding all the details can be a challenge. One common question is, "What does advice date mean on a pay stub?"

When you receive a paystub p , it's packed with important financial information, but understanding all the details can be a challenge. One common question is, "What does advice date mean on a pay stub?" We at Check Stub Maker will help you understand your paystubs better by ensuring that every piece of information, including the advice date, is clear and understandable with our digital paystub maker . In this blog post, we'll explore what the term ‘advice date' means on your pay stub and why it's important for your financial tracking. Let's dive in! What this article covers:

The advice date on a pay stub signifies when your paycheck was officially issued, aligning with the specific pay period you've worked. This could be weekly, bi-weekly, or monthly, depending on your employer's payroll schedule (something we happen to know a lot about at Check Stub Maker). Our research indicates that understanding the advice date on your paystub is vital for three key reasons:

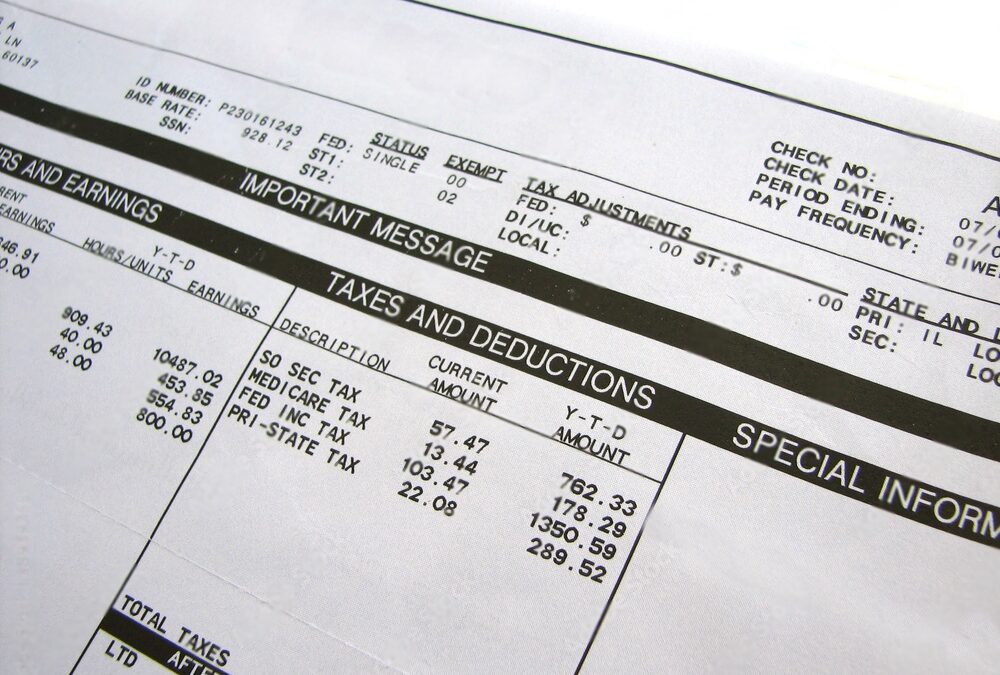

As it stands, the advice date is a cornerstone in managing your personal finances effectively and avoiding clerical errors related to dates wrong on pay stub . In the realm of pay stubs, the term 'advice' refers to the document itself. Payment advice is essentially another name for a pay stub. Whether it's called ‘check advice', ‘direct deposit advice', or simply a ‘pay stub', the purpose remains the same. These documents are designed to provide comprehensive information about your earnings (including your overtime on pay stub ) and deductions. Drawing from our experience in payroll, we found that this level of detail is crucial, as it allows you to confirm that you have received the correct compensation for your work. At Check Stub Maker, we understand the importance of accuracy and clarity in these documents and strive to ensure that the check stubs we create meet these standards.

The advice number on your pay stub is crucial for distinguishing each paycheck or pay stub you receive. It can differ based on the method of payment. For instance, direct deposit advice numbers typically start with '9', while check stub advice numbers usually begin with '3'. This number serves as a reference for your payment advice that extends beyond the normal paystub date range . If you receive a physical check, the advice number will correspond to the check number. If you're using direct deposit, the advice number will be listed separately. Our investigation at Check Stub Maker demonstrated that this number isn't just a formality; it's a vital tool for making inquiries or resolving any issues that might arise with your payment.

Your pay stub's advance date shows when your employer made an advance payment that was distinct from your regular period end date on paystub , which we've found is just as important as the advice date and number on your paystub. Based on our first-hand experience with paystubs, knowing where to find the advance date is particularly relevant if you're an employee who received a portion of your wages earlier, perhaps due to specific arrangements like earned wages access programs or for unique circumstances such as emergency payouts. Additionally, it may be important for reconciling your total earnings because it can help you distinguish between regular and advanced payments in your paystub advice, providing a clear picture of your financial earnings over a given period. Keeping an eye on the advance date helps in accurately tracking your income flow. When you make paystubs with Check Stub Maker, we help ensure that you're always aware of the amounts you receive ahead of time, which aids in better financial planning and budgeting on your part. Should you you run into any issues, you can make use of the advice number on your paystub to make inquiries related to your advance payment and date.

In this blog post, we've explored specific aspects of a paystub for office , such as the meaning of the advice date, the advice number, and the significance of the advance date. At Check Stub Maker, we pride ourselves on offering user-friendly, accurate, and reliable payroll services. Whether you're an employer or an employee, we invite you to create pay stubs containing the correct payroll advice for a hassle-free experience. So, take our sage advice now and start creating accurate pay stubs with Check Stub Maker to simplify your payroll process once and for all! If you want to learn more, why not check out these articles below:

Ever wondered, "Is it illegal to keep check stubs from the employee when they have direct deposit?"

Oct 31, 2023

!61 Ways to Save Money in a Small Businesshttps://checkstubmaker.com/wp-content/uploads/2020/05/61-ways-to-save-money-300x200.jpg Saving money in a business ...

May 27, 2020

Talk of digital transformation seems to be everywhere these days, but what does it mean to go digital? When you want to watch a movie, you can do it online. ...

Jun 20, 2017