Understanding Your Check Stub

Every two weeks you get your paycheck and each one is immediately put into your bank and dispersed to all the various bills without much thought to your chec...

Jan 17, 2017Boldly simplify your finances with our expert guide on how to calculate pay stub with tips and to it.

Boldly simplify your finances with our expert guide on how to calculate pay stub with tips and to it.

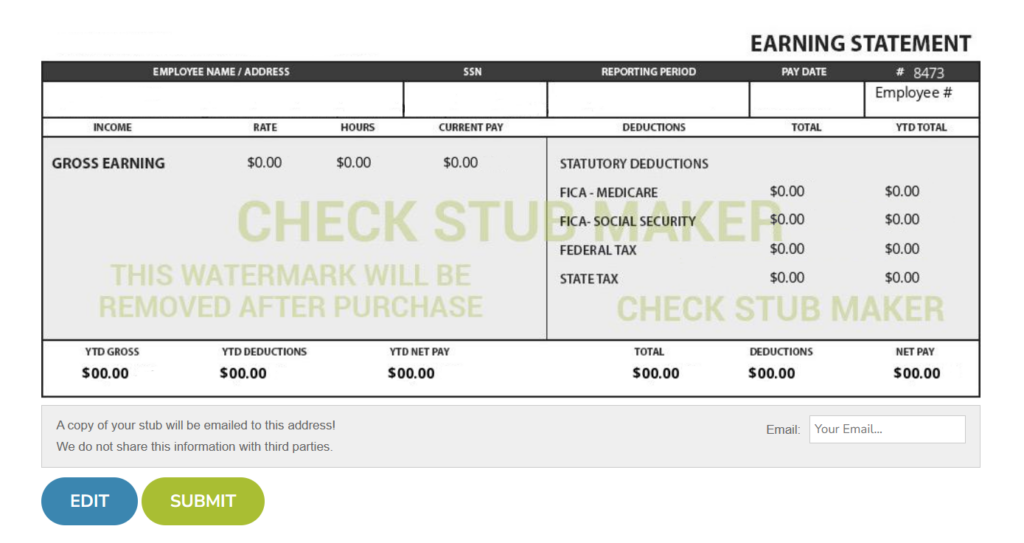

At Check Stub Maker , we understand the nuances of payroll management, especially for employees who get paid in tips.

In this blog post, you'll discover how to accurately calculate payments for tipped employees. Expect detailed steps on adding dates, state-specific information, and tip rates, all aimed at helping you generate precise pay stubs with our user-friendly pay stub generator .

Let's dive into the specifics of generating a complete and compliant pay stub for your tipped employees.

What this article covers:

Here’s how you can calculate payroll for your employees who get paid through tips.

Drawing from our experience, adding the correct date and state at the beginning ensures compliance with local laws.

This initial step sets the foundation for accurate pay stub calculations. Every state has its own minimum wage laws and tax requirements, which can affect how much an employee should be paid.

For instance, some states like Washington have a higher minimum cash wage for tipped employees, which is set at $16.28.

Conversely, other states such as Colorado and Federal might occasionally use the federal baseline instead, which amounts to a minimum wage of more than $30 in monthly tips according to the Department of Labor.

Employers must be aware of these details to avoid penalties to provide proper wage reporting.

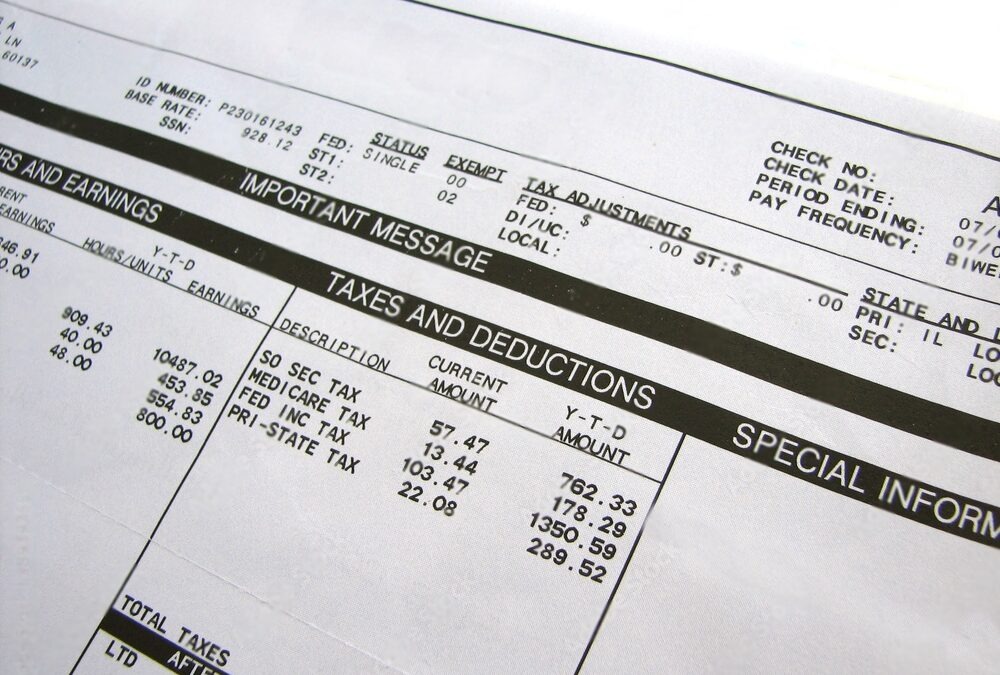

Our findings at Check Stub Maker show that accurately recording the tip rate or fixed amount received by employees helps with deciphering an employee’s precise gross pay calculations.

Knowing how to calculate Medicare wages from paystub plays a crucial role here, ensuring all contributions are correctly calculated.

Tips can significantly impact the calculation of Medicare wages because they contribute to the total earnings from which Medicare taxes are deducted.

That’s why employers need to check that all tip income is reported accurately to avoid discrepancies in Medicare and other tax-related contributions.

### 3. Fill In Tipped Employee's General Information

### 3. Fill In Tipped Employee's General Information

Based on our observations, your general employee information aids in seamless payroll processing.

This includes your:

Accurate data entry is critical for legal compliance and for the accurate calculation of taxes and benefits, particularly when you know how to use a Social Security wages from paystub calculator .

Calculating the gross pay needs to include all earnings, including:

Together, this forms the basis for most tax calculations and benefit contributions.

Our research indicates that by understanding related components like how to fill in a W2 using a paystub and the like, employers can better prepare for year-end tax reporting by calculating their tipped earnings precisely.

Year-to-date calculations give both the employer and employee a clear picture of earnings over the year.

Through our practical knowledge at Check Stub Maker, we've simplified this step with our user-friendly paystub maker , helping our users manage their finances effectively.

This total is crucial for understanding overall income and for preparing for tax filing. It's also useful for employees who need to verify their total earnings for loan applications or for personal budgeting.

Choosing the correct pay frequency is critical, whether it’s:

The pay frequency affects how taxes are calculated and withheld, as well as how employees budget their personal finances.

Our investigation demonstrated that setting this correctly aligns the payroll process with company policy when you create check stubs with us.

Adding exemptions accurately is essential for compliance and accurate net pay calculations.

The following exemptions can directly affect the amount of tax withheld from each paycheck:

### 8. Add All Federal Tax Information

### 8. Add All Federal Tax Information

This involves correctly applying IRS tax tables and withholding rates based on the employee’s filing status and allowances claimed on their W-4 form.

As per our expertise, this is a pivotal step in payroll processing. This is where learning how to calculate withholding from paystub can ensure precision.

Through our trial and error at Check Stub Maker, we discovered that each state has different tax brackets and requirements, which need to be accurately represented to maintain compliance and guarantee correct payroll calculations.

Keep in mind that state taxes can vary, and accurate data entry here prevents costly mistakes. Knowing how to estimate AGI from paystub can be integral in this step.

Local tax requirements must also be considered for a comprehensive pay stub. This is crucial for certain geographical areas.

Some localities require additional taxes or have specific filing requirements, and these must be accurately calculated to avoid fines and ensure public service funding.

Voluntary deductions can include a wide range of benefits such as:

Employers should ensure that nsure deductions are made pre-tax or post-tax correctly to provide tax advantages.

At Check Stub Maker, we guarantee that proper handling of these check stub deductions not only provides compliance with legal requirements but also offers employees control over their financial planning and benefits.

### 12. Select 'Print A Report'

### 12. Select 'Print A Report'

Although optional, printing a report can provide a physical record for both employer and employee.

This can be useful for both auditing purposes and for employees who need to keep track of historical data for personal recordkeeping.

Additionally, the option to print detailed reports can make it easier for employees to manage their personal employment documentation, fostering transparency and trust in the payroll process.

At Check Stub Maker, our user-friendly digital interface allows you to download and store your newly made paystubs within minutes, giving you peace of mind that your financial paperwork is secure.

After putting it to the test, we found that this is particularly beneficial during audits or disputes over wage calculations that can often go back several years.

Finally, generating the pay stub is a culmination of all the detailed steps taken.

Based on our first-hand experience, this final step is simplified using our user-friendly paystub generator . This process finalizes the payroll cycle so that all calculations are accurate and employees receive documentation for their earnings and deductions.

The ability to generate and distribute pay stubs efficiently not only streamlines the administrative workload but also increases transparency and trust between employers and employees who receive their wages through tips.

Conclusion

ConclusionCalculating pay stubs for tipped employees doesn’t have to be daunting.

By following the steps outlined in this blog post, from adding basic employee information to generating the final pay stub, you can streamline your employee payments effectively.

Now, here’s a hot tip for you: try our digital solution to experience first-hand how easy and efficient financial management can be.

Visit us now at Check Stub Maker to explore our pay stub creator and save time and money on your payroll needs.

If you want to learn more, why not check out these articles below:

Every two weeks you get your paycheck and each one is immediately put into your bank and dispersed to all the various bills without much thought to your chec...

Jan 17, 2017

Are you looking through your financial records and wondering, "What is a pay stub?" Simply put, pay stubs are physical or digital documents that accompany your paycheck, offering a detailed breakdown of your earnings and deductions for a specific pay period.

Oct 04, 2023

When you're looking to get a credit card, lenders closely scrutinize your pay stub, but ‘what is looked at on pay stub when applying for a credit card'?

Apr 24, 2024