What Is FITW on My Paystub?

Welcome to Check Stub Maker, your trusted source for all things paystub! Ever looked at your paystub and wondered, "What is FITW on my paystub?" Well, you're...

Aug 14, 2023Wondering "If I dont see Medicare deductions on my paystub, what could they be combined with?" Medicare deductions are crucial contributions toward healthcare costs in retirement.

Wondering "If I dont see Medicare deductions on my paystub, what could they be combined with?" Medicare deductions are crucial contributions toward healthcare costs in retirement. While it's an essential component of many paychecks, your Medicare deduction on paystub might not always be categorized separately on financial documents. Drawing from our experience, employers often merge Medicare and Social Security withholdings instead of listing them as different deductions. This can make it tricky to decipher when examining your pay stubs and other related paperwork. At Check Stub Maker , we specialize in simplifying the payroll process. Our pay stub creator ensures clarity in your earnings breakdown, including your Medicare deductions. In this article, we'll explore how Medicare tax withholding works and shed light on employer responsibilities in this context. What this article covers:

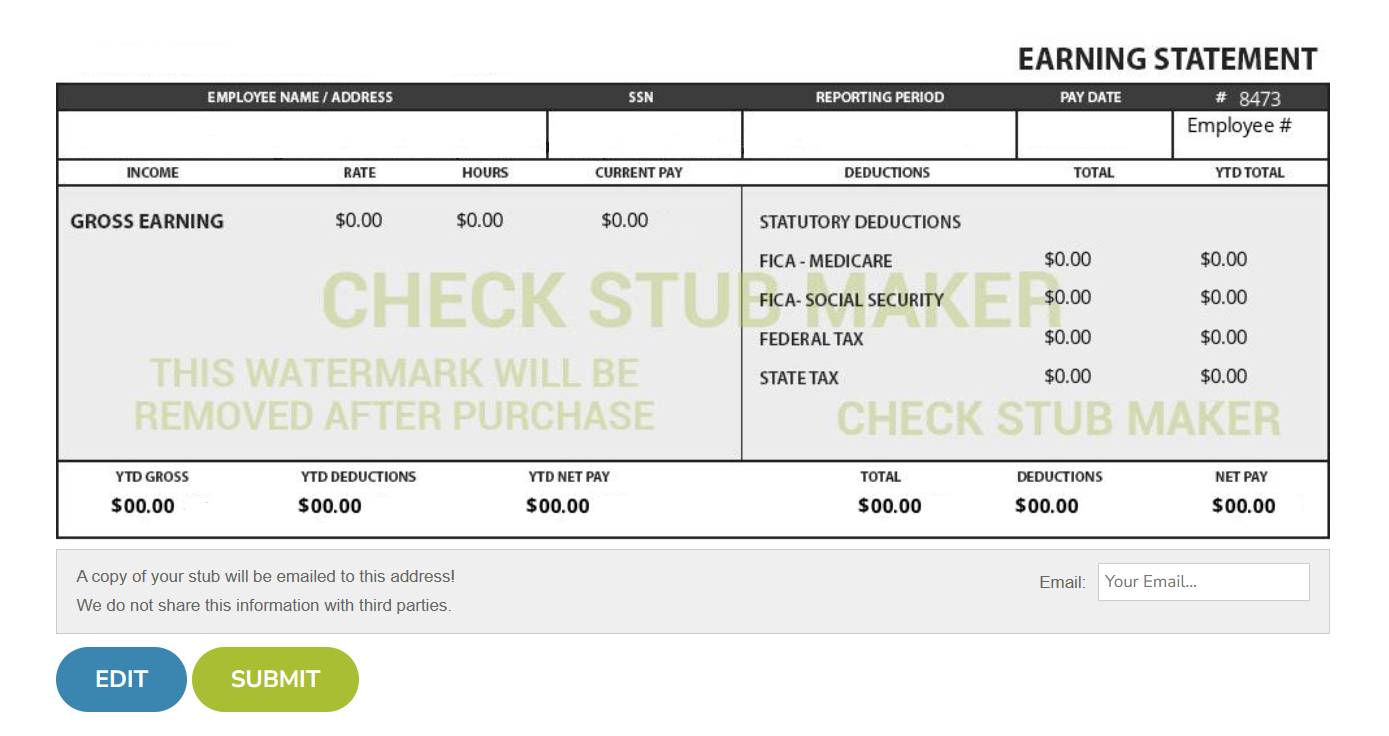

As per our expertise, if Medicare deductions aren't visible on your paystub, they might be merged with Social Security taxes as a whole instead of being listed as separate sub-sections. Though they contribute to the same federal programs, employers typically do this to streamline reporting, which aligns with common payroll practices. At Check Stub Maker, we simplify this process, providing standard pay stub sections payroll accounting layouts for easy comprehension so you can better understand this method of tax deduction reporting.

If your employer fails to withhold Medicare taxes altogether, it could lead to serious consequences for them and employees:

As an employee, you cannot opt out of Medicare tax withholding if your employer is required to withhold it. However, certain exemptions may apply to specific types of employment, such as certain government officials who have a government pension plan or religious organizations.

Like your voluntary deductions on paystub , if you notice a Medicare deduction on your paycheck, it signifies that a portion of your earnings is being withheld to fund Medicare. Our findings at Check Stub Maker show that this deduction ensures your contribution toward the federal health insurance program and receipt of future medical benefits under the Medicare program .

When you create pay stubs with us at Check Stub Maker, look for a line item labeled "Medicare" or "FICA Medicare”, which should display the amount deducted for Medicare taxes by your employer. This section of your pay stub will indicate whether the requisite tax contribution for Medicare stipulated by the Social Security Administration (SSA) has been shared in equal measure by you and your employer, which is usually:

1.45% (deducted from employee's paycheck) + 1.45% (employer's contribution) = 2.9%Additionally, you can cross-check these pay stub deductions with your annual W-2 form, which should reflect the total Medicare taxes withheld by your employer throughout the year for extra clarity.

What is an example of a mandatory deduction on a pay stub ? Medicare tax is a mandatory deduction which you pay to fund the Medicare program. This fund provides health insurance benefits primarily to:

Our investigation demonstrated that it helps sustain Medicare's financial stability by ensuring a consistent revenue stream for healthcare services and vital medications.

A common deduction on a person's pay stub would be Medicare, which funds a portion of the Medicare insurance program. It covers essential healthcare services such as:

This tax ensures that taxpayers who contribute during their working years can access affordable healthcare assistance upon reaching the age of eligibility or facing qualifying disabilities. Drawing from our experience at Check Stub Maker, it supports the sustainability and expansion of Medicare to meet the healthcare needs of an aging population and people with debilitating conditions.

The Additional Medicare Tax targets high-income earners, providing additional revenue to fund Medicare's services. People with higher earnings contribute more to the Medicare program through this tax (which is set at 0.9%), ensuring equitable financing and support for healthcare services. The Additional Medicare Tax helps maintain Medicare's financial stability and enhances its capacity to provide quality healthcare benefits to all eligible beneficiaries. After trying out this product, our paystub maker helps you quickly make payroll documents and customize them to show all your Social Security tax deductions separately and comprehensively.

If you're wondering why you don't see Medicare deductions on your paystub, they could be merged with other Social Security taxes. While this is perfectly aligned with common financial practices, we always recommend that you communicate openly with your employer to ensure that you're both aware of your tax responsibilities in this context. With us at Check Stub Maker , our user-friendly paystub generator helps you streamline your earnings effortlessly, including all of your tax deductions, for your peace of mind. Visit our website now and take the hassle out of payroll deductions! If you want to learn more, why not check out these articles below:

Welcome to Check Stub Maker, your trusted source for all things paystub! Ever looked at your paystub and wondered, "What is FITW on my paystub?" Well, you're...

Aug 14, 2023

When it comes to a prospective employer wanting to check your paystubhttps://checkstubmaker.com/how-can-i-view-my-pay-stub-before-my-first-paycheck/ , you mi...

Jan 30, 2024

As tax season approaches, are you wondering, ‘Why would you want to claim an exemption on your pay stub?'

Jul 02, 2024