The Basics of Cost Savings

!The Basics of Cost Savingshttps://checkstubmaker.com/wp-content/uploads/2019/12/cost-savings-300x200.jpg Are you wondering how to cut expenses for your busi...

Dec 05, 2019Are you aware of the hidden treasures in your payroll documents? Let's delve into a crucial aspect: a retirement account that is sometimes a deduction on a paystub.

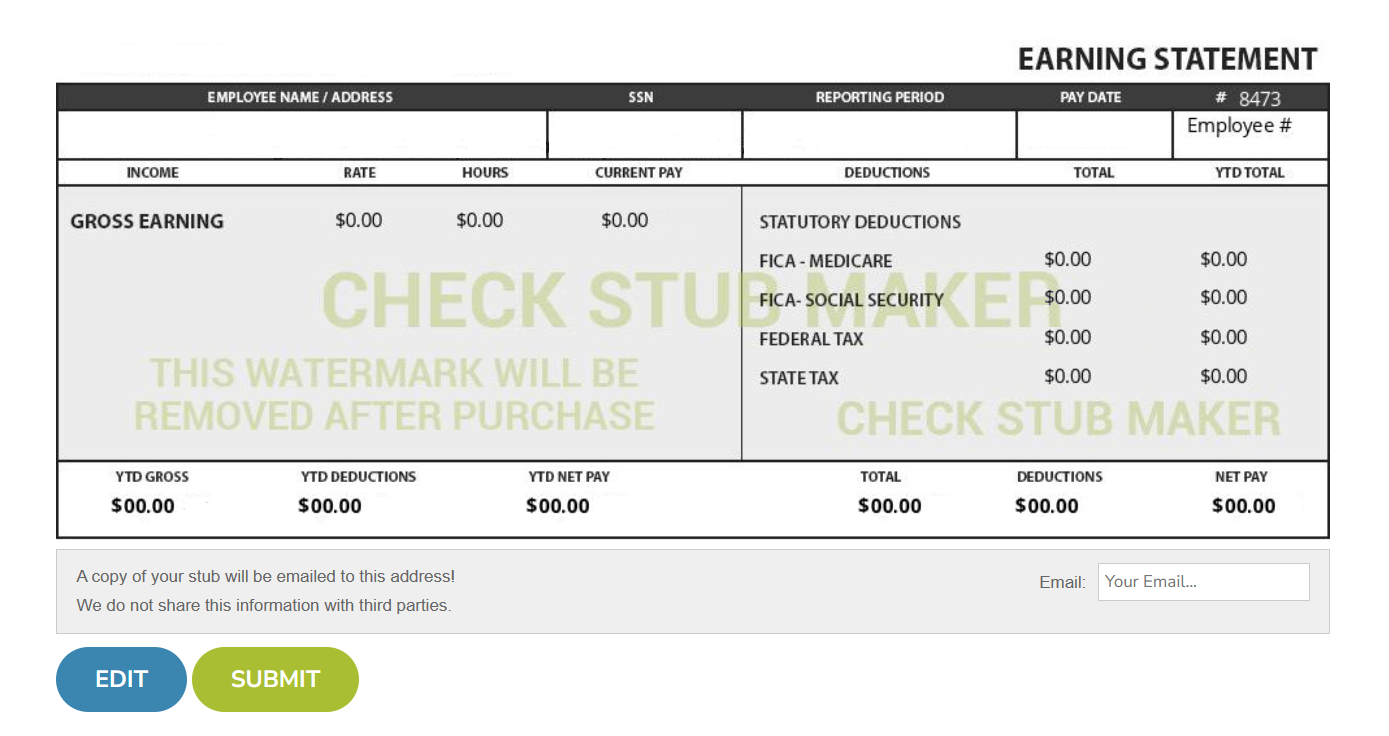

Are you aware of the hidden treasures in your payroll documents? Let's delve into a crucial aspect: a retirement account that is sometimes a deduction on a paystub. Accounts like pensions and IRAs are typically a workers comp deduction on paystub that pave the path to economic security in your golden years. Yet, recognizing them on your paystub isn't always straightforward. At Check Stub Maker , we specialize in interpreting payroll intricacies. As per our expertise, our pay stub generator unravels retirement account deductions, ensuring you can decode them effortlessly to secure your financial future. In our upcoming article, we'll uncover various deductible retirement account types, shedding light on their significance and impact on your financial journey. What this article covers:

If you're wondering, ‘ Which deduction from your paystub is paid back later ?', we'll look at some common examples of deductible retirement funds. Table: Retirement Funds You Can Claim Deductions On

Deductible Retirement FundsDescriptionExamplesRetirement Annuity Funds- Offer tax benefits

Individuals can claim deductions on their contributions

Deductible from taxable income, reducing the overall tax liability

Monthly payments made to a private pension plan

Provident Funds- Similar to retirement annuity funds

Also qualify for tax deductions

Gives people immediate tax relief

Reduces taxable income and incentivizes retirement savings

Contributions made through salary deductions

Employer matches a portion of the contribution

Pensions- Eligible for tax deductions

Offers significant tax advantages

Provides immediate tax relief

Contributions made by an employer and employee to a company-sponsored pension plan

May include defined benefit or distinct contribution plans

Retirement annuity funds offer tax advantages, allowing people to claim deductions on their contributions. Contributions made to these funds are deductible from taxable income, reducing the overall tax liability. Our research indicates that this incentivizes people to save for retirement while enjoying immediate tax relief. At Check Stub Maker, we can assist in identifying these deductions on pay stubs , ensuring you maximize your tax benefits and retirement savings.

Contributions to provident funds also qualify for tax deductions, providing people with immediate tax relief. Provident funds function similarly to retirement annuity funds, allowing older people to save for retirement while reducing their taxable income. When we tried this product, we discovered that our paystub maker helps you quickly identify these deductions on your pay stubs, ensuring accurate record-keeping and maximizing your tax benefits.

Pension contributions are eligible for tax deductions, offering significant tax perks. Employers often deduct pension from employees' salaries before calculating their taxable income, which provides immediate tax relief. With Check Stub Maker's assistance, you can easily identify pension deductions on your pay stubs, ensuring compliance with tax regulations and optimizing retirement savings.

If you're wondering, ‘ Which deduction on a pay stub is optional ?', an Individual Retirement Arrangement (IRA) is a voluntary tax deduction which appears as a specific line item in pay stubs. It indicates the optional amount withheld from the employee's paycheck for retirement savings. Through our practical knowledge, this deduction is typically listed under the deductions section, alongside other pre-tax contributions. With our paystubs , we ensure that IRA deductions are accurately reflected, providing employees with a clear view of their retirement savings at all times. By partnering with us, you can easily track your IRA earnings and foster financial security for years to come.

A common deduction on a person's pay stub is an IRA, and there are several types with specific rules related to contributions and tax deductions. Table: Different Types Of IRAs And Their Rules

IRA TypeDescriptionRulesTraditional- Allows pre-tax income contributions, reducing taxable income

Contributions grow tax-deferred

Contributions may be tax-deductible

Subject to income limits

Withdrawals subject to ordinary income tax rates and penalties for early withdrawals

Roth- Contributions made with after-tax dollars

Enables tax-free withdrawals during retirement

Withdrawals of contributions (not earnings) can be tax-free and penalty-free

Income limits

SEP- Designed for entrepreneurs and small business owners

Offers higher contribution limits

Tax-deductible

Investments grow tax-deferred

Limits are higher than Traditional and Roth IRAs

Simple- Available to small businesses with fewer than 100 employees

A Traditional IRA allows people to make tax-deductible contributions, reducing their taxable income for the year. They grow tax-deferred until withdrawal during retirement. Withdrawals are subject to ordinary income tax rates, and penalties may apply if they're made before the age of 60.

Roth IRA contributions are made with after-tax dollars, allowing for tax-free withdrawals during retirement. Individuals can withdraw contributions (not earnings) at any time without penalties. Based on our first-hand experience, there are income limitations for contributing to a Roth IRA, and these earnings can be withdrawn tax-free and penalty-free.

A Simplified Employee Pension (SEP) IRA is designed for self-employed people and small business owners. Contributions are tax-deductible, and investments grow tax-deferred until withdrawal. Unlike traditional and Roth IRAs, SEP limits are higher, making it an attractive option for entrepreneurs or employees with higher income levels.

A Savings Incentive Match Plan for Employees (SIMPLE) IRA is available to small businesses with 100 employees or less. Employees can contribute a portion of their salary, and employers must make either a matching contribution or a non-elective contribution. Based on our first-hand experience, these are tax-deferred until withdrawal, and early withdrawals may incur penalties. At Check Stub Maker , we're committed to helping you consistently keep track of your IRA account. After trying out this product, the built-in-calculator in our pay stub creator assists you with accurately recording your contributions time and time again.

Required Minimum Distributions (RMDs) are mandatory withdrawals from retirement accounts, such as Traditional IRAs, starting at the age of 72. RMDs are calculated based on life expectancy and account balance. They're subject to ordinary income tax rates and contribute to an individual's taxable income. Based on our observations, failure to extract the required amount results in significant penalties. At Check Stub Maker, we ensure that our customers understand these withdrawals. Our platform educates users on payroll rules and assists in financial planning for retirement.

A Payroll Deduction Plan is a system where employers withhold a portion of an employee's salary to cover various expenses or contributions, such as taxes, retirement savings, insurance premiums, or other perks. This method streamlines financial transactions and ensures timely payments for both employees and employers.

Employees begin by agreeing to specific deductions, often outlined during onboarding or enrollment periods by their employer. From there, employers deduct the agreed-upon amount from the employee's paycheck before disbursing wages. Drawing from our experience, deductions can be allocated to several purposes and occur consistently per pay period. This ensures regular contributions towards personalized financial goals.

Our investigation demonstrated that there are four types of payroll deduction plans:

By offering payroll deduction plans, employers empower their employees to manage their finances efficiently while facilitating seamless transactions. Our platform at Check Stub Maker ensures accurate documentation of these deductions for clear financial records reflected in our check stubs .

The process for setting up Payroll Deduction IRAs for your employees involves several steps:

To establish Payroll Deduction IRAs, it's essential to begin by ensuring clarity in the enrollment and contribution process. This includes communicating the availability of IRA deductions to employees and obtaining written consent from those interested. Additionally, assisting employees in selecting suitable IRA options, such as Traditional or Roth IRAs based on their financial goals and circumstances, is crucial. Our investigation at Check Stub Maker demonstrated that documenting the terms of the IRA deduction agreement, including the frequency and amount of contributions, is necessary to ensure compliance with IRS regulations.

Once the IRA payroll deduction agreements are in place, the deduction process needs to be streamlined. This involves integrating IRA deductions into the regular payroll process to ensure seamless and timely contributions. After putting it to the test, payroll software like our check stubs maker can automate IRA deductions from employees' paychecks according to the agreed-upon terms, providing necessary clarity on retirement plans. It's essential to consistently maintain accurate records of IRA deductions, including contribution amounts and dates, for transparency and compliance purposes.

Maintaining neutrality and transparency is paramount while facilitating IRA payroll deductions. This means refraining from providing financial advice to employees regarding IRA investment decisions to avoid conflicts of interest. Moreover, ensuring equal access to IRA payroll deductions for all eligible employees without discrimination is fundamental. Additionally, staying updated on IRS regulations and compliance requirements for IRAs is necessary to ensure that these deductions align with legal standards and employee interests. By following these steps, employers empower employees to save for retirement through payroll deductions while ensuring compliance, transparency, and neutrality in the process. At Check Stub Maker, we're committed to facilitating smooth and efficient IRA payroll deduction setups for both small businesses and entrepreneurs.

Employees must be at least 18 years old and earn taxable compensation to qualify for payroll deduction IRAs. Eligibility typically extends to employees in this age bracket and higher who meet certain criteria set by their employers. However, specific eligibility requirements may vary depending on the employer's policies and the IRA plan's terms.

As of 2024, the IRS stipulates that individuals under 50 years old can contribute up to $6,000 per year to a Payroll Deduction IRA. Conversely, those aged 50 and above have a catch-up contribution option of an additional $1,000, making their total limit $7,000.

Payroll Deduction IRAs are considered employer-sponsored retirement plans. Although they're not as comprehensive as traditional 401(k) plans, they provide a convenient option for employees to save for retirement through automatic payroll deductions. When you make paystubs with us at Check Stub Maker, you're able to keep track of your retirement savings any time, any place.

A Payroll Deduction IRA offers several advantages for both employers and employees:

Despite its numerous incentives, a Payroll Deduction IRA may have some drawbacks:

In wrapping up, we've uncovered the mystery behind 'a retirement account that is sometimes a deduction on a paystub.' From retirement annuity funds to IRAs, we've explored various options that may appear as deductions on paystub. Ready to simplify your payroll? Look no further than us at Check Stub Maker ! With our user-friendly platform, creating accurate pay stubs and tracking your retirement benefits is a breeze. Visit us now and let's streamline your payroll process effortlessly with our pay stub creator ! If you want to learn more, why not check out these articles below:

!The Basics of Cost Savingshttps://checkstubmaker.com/wp-content/uploads/2019/12/cost-savings-300x200.jpg Are you wondering how to cut expenses for your busi...

Dec 05, 2019

When it comes to managing payroll records, one critical question often arises: "How long do you have to hold physical employee paystubs for?"

Jan 30, 2024

Ever glanced at your pay stub and wondered, “What does retro mean on a pay stub?” If so, you're not alone. Pay stubs can seem like they're written in a different language, with a host of numbers and technical terms that might seem mystifying.

Aug 31, 2023