What is Form 8832 and How Do I File it?

If your LLC is looking to change your default tax classification, then the IRS requires you to fill out a Form 8832. Here’s everything you need to know about...

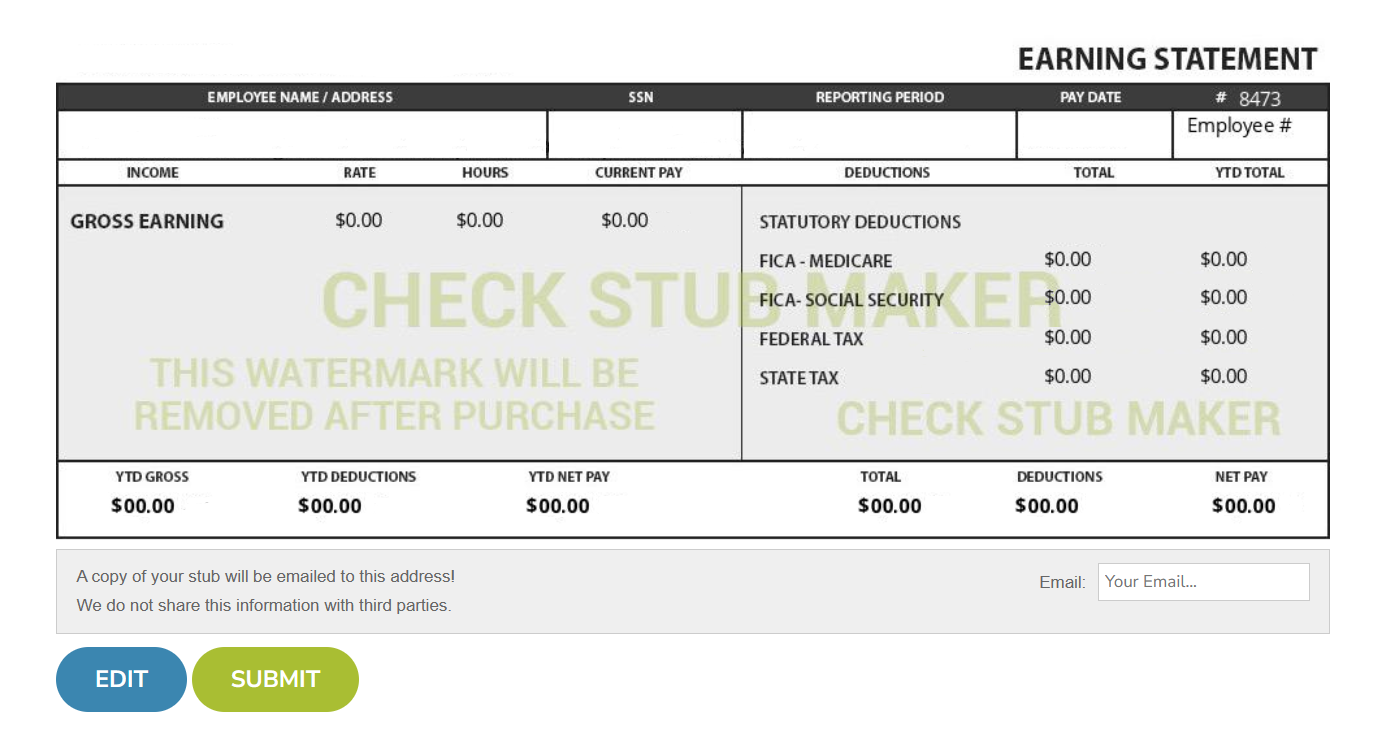

Nov 13, 2020At Check Stub Maker, we understand the significance of pay stub deductions in managing finances effectively.

At Check Stub Maker , we understand the significance of pay stub deductions in managing finances effectively. If you're wondering, ‘ What are deductions on pay stub ?', they encompass taxes, insurance, and contributions, playing a pivotal role in reflecting your earnings. Tracking them efficiently ensures financial clarity for both employers and employees. Our expertise lies in simplifying this process. With our user-friendly pay stub creator , you can effortlessly comprehend your deductions every step of the way. In our upcoming article, we'll delve into the intricacies of various deductions that typically appear on pay stubs and how to calculate them using our digital platform. Let's get started! What this article covers:

Payroll deductions refer to the amounts withheld from an employee's paycheck by their employer to cover various costs, including:

As per our expertise, these deductions are essential for ensuring compliance with tax regulations and facilitating enrollment for numerous workplace benefits. Understanding payroll deductions is also crucial for employees to accurately assess their take-home pay and plan their finances accordingly. At Check Stub Maker, we recognize the importance of clarity in payroll deductions. Our analysis revealed that our pay stub generator allows employees to comprehend and track their deductions effortlessly. Now, you can ensure accuracy in your finances and make informed decisions about your spending and saving habits using our digital platform.

Payroll deductions work by withholding specific amounts from an employee's paycheck to cover various expenses such as taxes, insurance premiums, retirement contributions, and other benefits. Drawing from our experience, these deductions are determined by factors like the:

The deducted amounts are then listed on the employee's pay stub, providing a detailed breakdown of where their money is allocated. That's why we're committed to creating clarity in our check stubs , so you can understand your deductions better, learn how to change withholding on paystub , and manage your finances effectively.

Pretax deductions are amounts withheld from an employee's paycheck before taxes are calculated. These deductions can include contributions to retirement plans, health insurance premiums, and flexible spending accounts (FSAs). By deducting these amounts before taxes, employees may lower their taxable income, potentially reducing their overall tax liability. This can lead to significant savings over time. At Check Stub Maker, we ensure that paycheck stubs display pretax deductions, helping you understand how these deductions impact your take-home pay and tax obligations every year.

Let's look at the most common types of statutory deductions on pay stubs. Table: Statutory Deductions

Statutory DeductionsDescriptionExampleFICA Taxes- Federal Insurance Contributions Act taxes fund Social Security and Medicare

Federal Income Tax- Compulsory deduction imposed by the federal government based on income level, filing status, and W-4 allowances

State And Local Taxes- Mandatory deductions levied by state and local governments

Social Security- Funds the federal Social Security program, with contributions from both employees and employers

Medicare- Funds the federal Medicare program

Provides healthcare coverage to eligible individuals

Employee and employer make contributions of 1.45% each (2.9% in total)

No income limit

A common deduction on a person's pay stub would be the Federal Insurance Contributions Act taxes, or FICA, for short. They're mandatory deductions from employees' paychecks that fund Social Security and Medicare programs. FICA taxes are divided into two parts:

Social Security tax is levied at a flat rate on income up to a certain threshold (about $168,600), while Medicare tax is assessed at a flat rate on all earned income.

A FIT deduction on paystub is compulsory and imposed by the federal government on employees' earnings. The amount withheld for federal income taxes depends on several factors, including your:

Based on our observations, employers use withholding tables provided by the IRS to determine the appropriate amount to withhold.

State and local taxes are mandatory deductions levied by state and local governments on employees' wages. These taxes and the amount withheld vary depending on the employee's location and the applicable tax rates set by state and local authorities.

Social Security tax is a type of pay stub of workmen compensation deduction that funds the federal government's Social Security program. It's levied on employees' earnings up to a specified annual income limit. Our investigation demonstrated that the current Social Security tax rate is set at 6.2% for employees, with employers matching this contribution, making the total amount 12.4%.

Medicare tax is a compulsory deduction that funds the federal government's Medicare program, which gives medical assistance to eligible individuals, such as:

A medicare deduction on paystub is levied at a flat rate on all earned income, and has no income limit. The current Medicare tax rate is 1.45% for employees; employers match with an equal contribution, which comes to 2.9% overall. These statutory deductions are essential components of employees' paychecks, ensuring funding for vital government programs such as Social Security and Medicare. At Check Stub Maker, we provide clear and detailed pay stubs that reflect these statutory deductions, helping you understand your financial obligations and plan accordingly.

Wage garnishments are court-ordered deductions from an employee's paycheck to satisfy debts such as:

Our practical knowledge shows that these deductions occur after taxes are calculated and withheld, impacting the employee's net pay. Garnishments are typically a fixed percentage of the employee's disposable income that are subject to legal limits. They can significantly affect an employee's take-home pay and economic stability. We at Check Stub Maker ensure accurate calculation and documentation of wage garnishments on our paystubs , helping employers and employees navigate these deductions consistently and efficiently.

Next, we'll look at examples of common voluntary deductions on paystub . Table: Voluntary Deductions

Voluntary DeductionsDescriptionExamplesHealth Insurance- Voluntary payments made by employees to cover healthcare costs

Group-Term Life Insurance- Employee contributions towards life insurance coverage provided by an employer

Retirement Plans- Employees make contributions to retirement plans

Flexible Spending Accounts (FSA)- Pre-tax funds set aside by employees for eligible medical or dependent care costs

Job-Related Expenses- Voluntary deductions for expenses incurred for work-related purposes

Health insurance deductions are voluntary payments made by employees to cover their healthcare costs. These deductions typically contribute to premiums for medical, dental, and vision coverage. They provide financial security by offsetting medical costs for employees and their dependents. At Check Stub Maker, we provide succinct documentation of health insurance deductions on pay stubs, helping you track your healthcare plans effectively and understand your coverage.

Group-term life insurance deductions involve voluntary contributions towards life insurance coverage provided by an employer. These deductions offer monetary protection to employees' beneficiaries in case of death. Based on our first-hand experience, the premium amount is calculated according to factors such as:

We assist employers and employees in accurately reflecting group-term life insurance deductions on their pay stubs, ensuring transparency and understanding of coverage details throughout.

Retirement plan deductions entail voluntary contributions to retirement savings, such as a 401(k) or IRA on paystub . These deductions help employees save for their future monetary security by investing a portion of their income. These deductions may be pre-tax or post-tax, ultimately affecting the taxable income and eventual retirement savings. After trying it out, our paystub maker includes precise calculations of retirement plan deductions, empowering you to monitor your savings progress any time you like.

Flexible spending account (FSA) deductions allow employees to set aside pre-tax funds for eligible medical or dependent care expenses. These deductions reduce taxable income and provide tax benefits for employees. FSAs offer flexibility in managing healthcare and childcare costs, enhancing financial planning and budgeting. At Check Stub Maker, we facilitate efficient reporting of FSA deductions on our pay stubs, ensuring that employees are always aware of their available funds and able to utilize them effectively.

Job-related expense deductions involve voluntary contributions towards costs incurred for work-related purposes, such as:

These deductions may vary based on job requirements and employee agreements. By detailing job-related deductions on pay stubs, we at Check Stub Maker can assist you with carefully tracking your expenses and understanding your monetary obligations every step of the way.

With Check Stub Maker's intuitive payroll platform, you can effortlessly create pay stubs , calculate deductions, and ensure financial transparency. Here's how to get started:

By utilizing our paystub creator , you can streamline your payroll processes, minimize errors, and ensure the receipt of accurate compensation for your tax deductions.

Payroll deductions are typically reported on paystubs like ours at Check Stub Maker, which provide a detailed breakdown of earnings and deductions for each pay period. These deductions may include taxes, insurance premiums, retirement contributions, and other withholdings.

Incorrect payroll deductions may occur due to errors in calculation, misclassification of employees, or unlawful deductions. Examples include:

Through our trial and error, we discovered that incorrect deductions can lead to legal issues and employee dissatisfaction, which can negatively impact workplace morale.

The Long-Term Disability (LTD) deduction on paychecks refers to premiums deducted to long-term disability insurance coverage. LTD insurance provides income replacement benefits to employees who are unable to work due to a qualifying disability for an extended period (usually more than six months). The deduction amount varies based on factors such as the:

LTD deductions help employees mitigate financial risks associated with long-term disabilities and ensure economic stability during challenging times.

In our exploration of pay stub deductions, we've decoded the intricacies of different deductions found on pay stubs, empowering you to calculate them with precision. Try our paystub creator today and experience the convenience firsthand. With us at Check Stub Maker , managing deductions becomes a breeze. So, what are you waiting for? Start optimizing your payroll process now! If you want to learn more, why not check out these articles below:

If your LLC is looking to change your default tax classification, then the IRS requires you to fill out a Form 8832. Here’s everything you need to know about...

Nov 13, 2020

Starting a new small business can be very exciting and lucrative if done correctly. However, it can certainly be stressful at times due to all your new respo...

Aug 11, 2022

The phrase "paystub missing for the days I am suing my employer" resonates with many employees who have faced payroll discrepancies, such as missing paystubs when the company wont release paystubs, or paystubs reflecting incorrect amounts on them.

Oct 31, 2023