What Is FITW on My Paystub?

Welcome to Check Stub Maker, your trusted source for all things paystub! Ever looked at your paystub and wondered, "What is FITW on my paystub?" Well, you're...

Aug 14, 2023When it comes to managing payroll records, one critical question often arises: "How long do you have to hold physical employee paystubs for?"

When it comes to managing payroll records, one critical question often arises: "How long do you have to hold physical employee paystubs for?" Generally speaking, employers need to retain employee records for up to four years or more as stipulated by the IRS and similar government institutions. In this article, we'll delve into the specific requirements set by various federal and state legislation regarding the retention of payroll records by employers. Let's dig in! What this article covers:

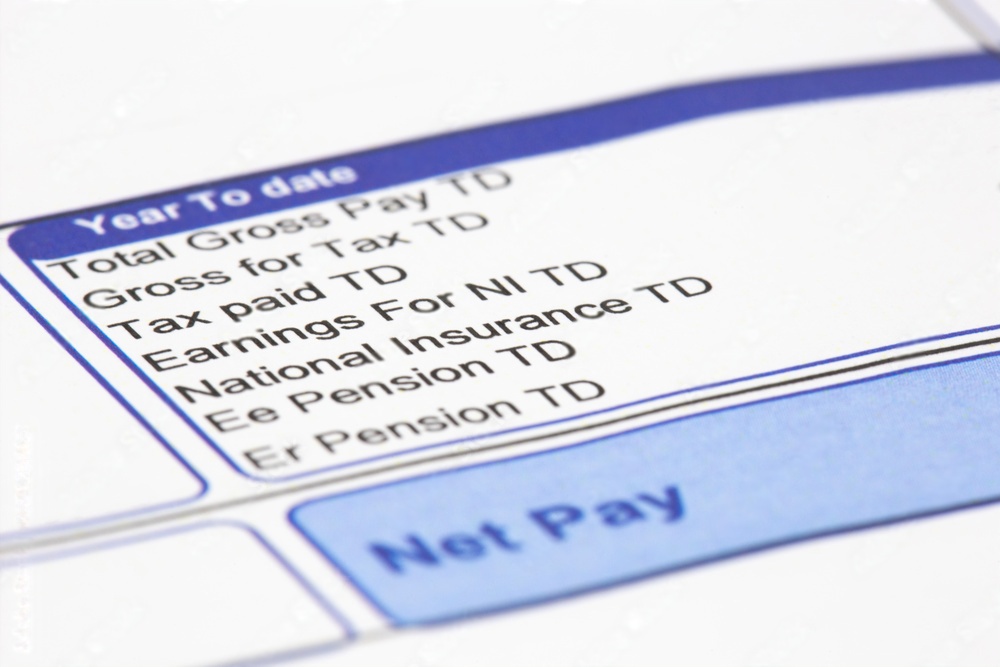

The Internal Revenue Service (IRS) has specific guidelines for the retention of employment tax records (physical or digital). Based on our observations, employers are required to keep all records of employment taxes for at least four years after filing the 4th quarter for the year. These records include the:

This duration ensures that the information is available for IRS review if needed. It's crucial for employers to maintain these records in an organized manner, and our pay stub generator at Check Stub Maker can be an invaluable tool in achieving this.

Regarding its payroll retention requirements , the Fair Labor Standards Act (FLSA) mandates that employers keep the following documents for at least three years:

Moreover, it stipulates that the following documents related to wage computations should be kept for at least two years:

If you're wondering why pay stub record retention is necessary, it and other financial documentation ensure compliance with the FLSA's standards on minimum wage, overtime, and child labor. After trying out this product, Check Stub Maker's paystub maker can help you manage these records efficiently and accurately.

The length of time for employee record-keeping (paper or electronic) varies according to legal requirements for specific financial and personal documents. Table: Retention Requirements For Financial And Personal Documents

Document TypeRetention DurationLegislation or Governing InstitutionI-9 FilesUp to 3 yearsU.S. Citizenship and Immigration ServicesBackground ChecksUp to a yearEmployment Offers And ContractsUp to 3 yearsMedical RecordsUp to 3 yearsFamily Medical Leave Act (FMLA)Payroll RecordsUp to 3 yearsFair Labor Standards Act (FLSA)Employee Tax RecordsUp to 4 yearsInternal Revenue Service (IRS)Health And Safety RecordsUp to 5 yearsOccupational Safety and Health Administration (OSHA)### I-9 Files

According to U.S. Citizenship and Immigration Services , employers must retain Form I-9 for either three years after the date of hire or one year after the date of termination, whichever is later. This ensures compliance with legal requirements for verifying the identity and employment authorization of individuals hired for employment in the United States.

The Fair Credit Reporting Act (FCRA) doesn't specify the exact duration of retaining background check records. With that said, the retention length varies based on:

Our investigation demonstrated that, employers usually only keep background checks for a year after said employees have left their employment.

Employment offers and contracts contain critical information about the terms of employment. These documents should be kept for a minimum of three years after an employee's termination, as they can be vital in the event of disputes or legal claims. At Check Stub Maker, we can help you make paystubs that correctly reflect your earnings as per your employment contract in these scenarios.

According to the Family Medical Leave Act (FMLA) , medical records, including workers' compensation claims or medical leaves, should be kept them for a minimum of three years after termination of employment.

Payroll records, which include details about wages, hours worked, and deductions, should be kept for at least three years following termination of employment. Our research indicates that this duration aligns with the requirements set by the Fair Labor Standards Act (FLSA) .

The IRS mandates that employers must retain employee tax records , such as W-2s and tax withholding information for at least four years after the filing date or the date the taxes were paid, whichever is later. With our trusted payroll solutions here at Check Stub Maker, you can create pay stubs that reflect pertinent financial information that's recorded in your tax forms.

According to the Occupational Safety and Health Administration (OSHA), health and safety records , including those related to workplace injuries and occupational illnesses, should be kept for at least five years. This retention should follow the end of the calendar year that these records cover. Drawing from our experience, this retention period helps in monitoring workplace safety and compliance with regulations, which is beneficial in future legal disputes.

While legal requirements provide a minimum retention period, it may be prudent to keep payroll records for a longer duration. Based on our first-hand experience, this practice can be beneficial in the following scenarios:

At Check Stub Maker, we recommend a cautious approach to payroll recordkeeping. We can ensure that financial documents like your paystubs are available if needed beyond the minimum required timeframe.

In this article, we've answered the critical question: 'How long do you have to hold physical employee paystubs for?' From the IRS and FLSA requirements to specific legislation for various types of employee records post-termination, maintaining organized and accessible records is essential for any business. At Check Stub Maker, we offer user-friendly solutions to streamline your payroll processes with paystubs and time . Whether you're looking to generate accurate paystubs or seeking advice on record retention on various financial documents, we're here to help. So, what are you waiting for? Try Check Stub Maker now and experience the ease of managing your payroll records efficiently for years to come. If you want to learn more, why not check out these articles below:

Welcome to Check Stub Maker, your trusted source for all things paystub! Ever looked at your paystub and wondered, "What is FITW on my paystub?" Well, you're...

Aug 14, 2023

At Check Stub Maker, we've spent years delving into the nitty-gritty of payroll processing and documentation. We know that understanding the paystub meaning ...

Aug 14, 2023

Have you ever wondered, "Can a bank locate a lost deposited check using the check stub?" It's a common concern, and fortunately, the answer is rooted in a bank asking for paystub and how they meticulously track each transaction.

Apr 24, 2024