Pay Stubs

Pay Stubs for business ownersWe are entering a new age in which pay stubs are becoming more available to users online. It is safe to say the demand for onlin...

Jul 01, 2015When you start a new job, one of the most anticipated moments is receiving your first pay stub. But how long does it take for a job to send your pay stub?

When you start a new job, one of the most anticipated moments is receiving your first pay stub. But how long does it take for a job to send your pay stub? Generally speaking, it takes employers approximately takes 1-2 days to send pay stubs if they're using automated payroll processing systems; it sometimes takes longer with manual payroll processes. At Check Stub Maker, we understand the importance receiving of timely and accurate pay stubs. Our pay stub generator is designed to streamline this process, ensuring you get your pay stubs promptly and without any hassle. In this blog post, we'll evaluate the payroll process in greater detail and provide our expert insights on when employees can expect to receive their pay stubs from their employers. Let's get started! What this article covers:

Drawing from our experience, it usually takes 1-2 days to process payroll, then another 2-3 days for those funds to reach an employee's bank account. Let's look in greater detail at how payroll processing works in a typical payroll cycle.

Our findings show that a typical payroll cycle can be:

The frequency of these cycles often depends on the employer's policy and the regulations of the state in which the business operates. For instance, if you get paid bi-weekly, some states like Alaska and New Mexico require employers to provide paychecks and subsequent check stubs for employees on a bi-weekly basis. Understanding these cycles is crucial as they directly influence when you'll receive your pay stub.

Based on our observations, issues such as bank holidays, processing errors, or delays in time reporting can affect when employers issue pay stubs to employees. With that said, this is usually done unintentionally and most companies strive to maintain a consistent payroll schedule to ensure that their employees are paid on time.

Through our practical knowledge, payroll processing involves tracking time, calculating wages, deducting taxes, and issuing payments to employees.

The first step in payroll processing involves tracking time and attendance. This is crucial for calculating the correct amount of pay, especially for hourly employees. Time tracking methods vary, from traditional time clocks to advanced digital solutions.

After time tracking, the next step is reviewing and approving the recorded time. This process is vital to ensure accuracy in payroll. Managers or supervisors typically oversee this step, verifying the hours worked before forwarding them for payroll processing.

Calculating wages and deductions is a complex process, involving various factors like gross pay, taxes, and other deductions. At Check Stub Maker, we're firm believers in helping you create pay stubs that consistently reflect your true earnings and deductions.

Once the calculations are complete, the payroll is either submitted for processing or disbursed directly to employees. This step marks the transition from processing to actual payment, as employees eagerly await their earnings.

Paying taxes is an integral part of payroll processing. As per our expertise, employers are responsible for withholding the correct tax amounts and ensuring they're paid to the relevant authorities in a timely manner. This step is crucial for compliance with tax laws and regulations mandated by the IRS.

Finally, retaining records is essential for both employers and employees. These records serve as proof of income and employment, and are necessary for future references, such as loan applications or tax filings. Employers must keep these records accurate and accessible so employees know how long to retain pay stubs . The time it takes for a job to send your pay stub depends on the payroll processing cycle and the efficiency of the payroll system in place. At Check Stub Maker, we aim to simplify this process with our efficient paystub generator , ensuring you receive your pay stubs promptly and accurately.

If you're wondering how to store paystubs , an automated system like ours here at Check Stub Maker has several advantages. From streamlining your payroll processes, we can help you create unique pay stub templates which you can store on any electronic device.

One of the most significant advantages of our automated payroll processing system is the considerable amount of time it saves. Manual payroll processes can be time-consuming, involving extensive data entry and calculations. Our automation streamlines these processes, allowing for quick and efficient handling of payroll tasks. After trying out this product, the efficiency of our paystub maker not only benefits the payroll process as a whole; it also ensures that employees receive their payments and pay stubs without unnecessary delays.

Manual payroll processing is prone to human error, which can lead to significant issues like incorrect pay stubs or tax filings. Our automated payroll system greatly reduces these errors. By automating calculations and data entry, the risk of mistakes is minimized, ensuring accuracy whenever you create paystubs with us. At Check Stub Maker, we're all about accuracy maintaining trust and transparency between employers and employees with our payroll processes.

Another advantage of using an automated system like ours is the ease of customization. Every business has unique payroll needs, and an automated system can be tailored to meet these specific requirements. Whether it's adjusting for different pay cycles, or incorporating various deductions and benefits, our pay stub creator can handle these with ease. This flexibility ensures that the payroll process aligns perfectly with a company's operational needs.

In this article, we've explored the question, 'How long does it take for a job to send your pay stub?' and delved into the intricacies of payroll processing. We've seen that the time frame can vary, but with tools like our paystub creator , this process can be significantly expedited. At Check Stub Maker, we don't just save you time and help you reduce errors but we also offer easy, customizable templates to fit your specific payroll needs. So, don't wait – visit Check Stub Maker today and experience the speed and efficiency of our digital payroll solutions in record time! If you want to learn more, why not check out these articles below:

Pay Stubs for business ownersWe are entering a new age in which pay stubs are becoming more available to users online. It is safe to say the demand for onlin...

Jul 01, 2015

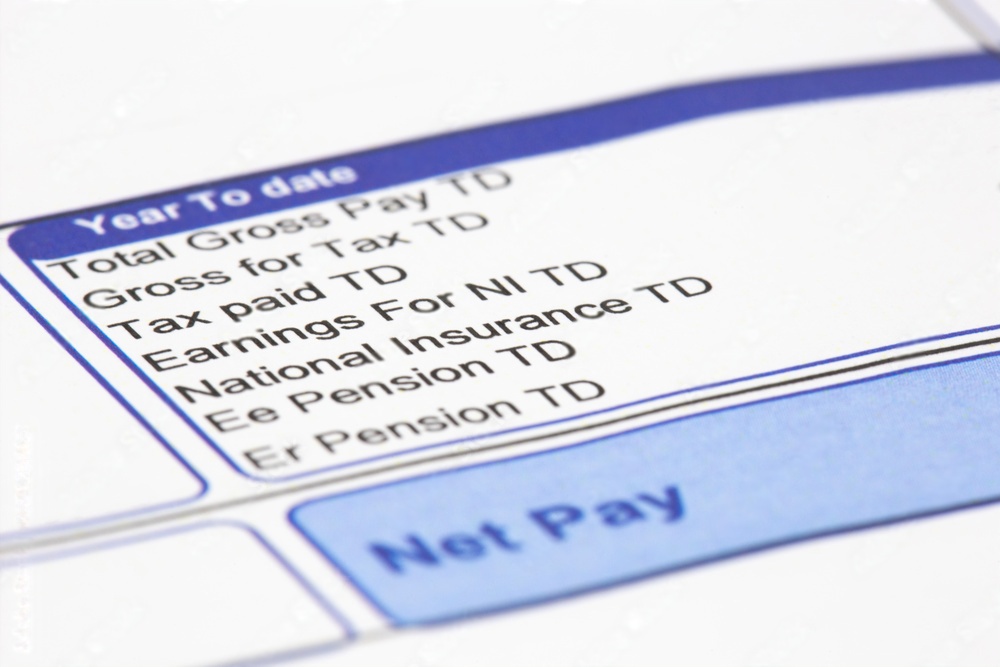

!YTD Meaning for Individuals and Small Businesseshttps://checkstubmaker.com/wp-content/uploads/2020/03/ytd-meaning-300x200.jpg YTD means "Year To Date." It s...

Mar 19, 2020

At Check Stub Maker, we've spent years delving into the nitty-gritty of payroll processing and documentation. We know that understanding the paystub meaning ...

Aug 14, 2023